Capital One no longer offers personal loans, but a variety of other banks, credit unions, and online lenders do. Personal loans can serve a variety of purposes, including helping with a large purchase, covering home renovation costs, or consolidating credit card debt. Most personal loans are unsecured, meaning you don’t have to attach collateral to them and worry about losing your home or car if you can’t repay the loan.

If you’re interested in borrowing a personal loan, read on for our recommended alternatives to Capital One personal loans for the funding you need.

Table of Contents

Alternatives to Capital One personal loans

You can’t get a new personal loan from Capital One, but we’ve researched excellent options to choose from.

You can check out our resource on the best personal loans to see our top choices (including options for consumers with good, fair, and bad credit), or compare the alternatives below. Click the lender’s name in the table to find out more about its personal loan.

| Company | Editorial rating | Best for |

| SoFi® | 5.0 out of 5 | Best for good credit |

| LightStream | 4.8 out of 5 | Best for excellent credit |

| Upgrade | 4.9 out of 5 | Best for fair credit |

| Upstart | 4.8 out of 5 | Best for thin (little to no) credit |

| Credible | 5.0 out of 5 | Best marketplace |

SoFi – Best for good credit

- Fixed rates (APR): 8.99% – 29.99%1

- Loan amounts: $1,000 – $100,000

- Credit score: 680

SoFi lets you see your rates without hurting your credit score—and, if approved, get your funds as soon as the same day. SoFi also offers zero-fee options, or you can pay a one-time fee for a lower interest rate. See our full review here.

- Credit score category: Good

- Soft credit pull to check rates? Yes

- Deposit time: Same day

- Origination fee: 0%, but can pay an optional origination fee of 0% to 6% to access lower rates

- Discounts: 0.25% for autopay, 0.25% for direct deposit

- Repayment terms: 12 – 84 months

LightStream – Best for excellent credit

- Rates (APR): 7.49% – 25.49%

- Loan amounts: $5,000 – $100,000

- Credit score: 660

LightStream offers personal loans for borrowers with good credit scores, allowing this online lender to offer competitive rates, no fees, and lengthy repayment terms up to 12 years. You can get your loan funded as soon as the same day.

One downside of LightStream is that it doesn’t give you the option of prequalifying for a personal loan online. You must submit a full application to see your loan offers. For that reason, we recommend this lender for borrowers who know they have excellent credit and are confident they’ll be approved for a personal loan.

- Credit score category: Excellent, good

- Soft credit pull to check rates? Not available

- Deposit time: As soon as the same day

- Origination fee: 0%

- Discounts: 0.50% autopay

- Repayment terms: 24 – 144 months

Upgrade – Best for fair credit

- Rates (APR): 8.49% – 35.99%

- Loan amounts: $1,000 – $50,000

- Credit score: 560

Upgrade is an online lender that provides competitive personal loans to borrowers with bad or fair credit. It offers useful benefits such as personalized loan recommendations and free credit health tools to its customers.

The lender has a short-term hardship assistance program. It offers secured and unsecured loans and lets borrowers apply jointly. If you have less-than-stellar credit or need a smaller loan, Upgrade is worth exploring.

- Credit score category: Fair, bad

- Soft credit pull to check rates? Yes

- Deposit time: As soon as the next day

- Origination fee: 1.85% – 9.99%

- Repayment terms: 24 – 84 months

Upstart – Best for thin credit

- Rates (APR): 6.40% – 35.99%

- Loan amounts: $1,000 – $50,000

- Credit score: 300+

Upstart is an online lending platform that partners with banks to provide personal loans you can use for almost anything.

Upstart’s lending model considers education, employment, and other variables when determining eligibility rather than relying on credit scores alone. It will consider applicants with credit scores of 300 or higher, as well as applicants who don’t have enough of a credit history to generate a score.

- Credit score category: Fair, bad

- Soft credit pull to check rates? Yes

- Deposit time: As fast as one business day

- Origination fee: 9% – 12%

- Repayment terms: 36 or 60 months

Credible – Best marketplace

- Rates (APR): 5.20% – 35.99%

- Loan amounts: $600 – $200,000

- Credit score: Varies by lender, but typically 550+

Credible is a lending marketplace that lets you check your prequalified rates with multiple lenders1. If you qualify, you may see offers from Credible’s partner lenders, which include Upstart, LightStream, Discover, SoFi, Avant, and others.

This rate check only involves a soft credit pull so that it won’t harm your credit score.

- Credit score category: Poor, fair, good

- Soft credit pull to check rates? Yes

- Deposit time: Varies by lender

- Origination fee: 0% – 12%

- Discounts: Some lenders offer autopay or loyalty discounts

- Repayment terms: 12 – 84 months

Other options for finding personal loans

If you’re looking for a personal loan and are disappointed to find that Capital One doesn’t offer them, don’t worry—you have plenty of options. You can find personal loans from a variety of banks, online lenders, credit unions, and peer-to-peer lenders.

Here’s a closer look at each type of lender. Click the option in the table to find out more about it.

| Credit score category | Pros | Cons | |

| Bank loans | Typically not disclosed, but may require good credit | May have an option for in-person banking May qualify for a loyalty discount if you’re already a customer | Funding can take longer Credit requirements may be more stringent |

| Online loans | Poor, fair, good | Fast funding Some lenders use alternative lending models and accept lower credit scores | Require due diligence to avoid predatory internet loans |

| Credit union loans | Fair, good | Rates won’t exceed 18% May have lower fees | Must be credit union member to borrow |

| Peer-to-peer loans | Fair, good | May have less stringent credit requirements Fast funding | May have higher fees and rates |

Bank loans

Many banks offer these loans. Banks often don’t disclose their minimum credit requirements, but they may use a traditional lending model that prefers a good score of 670 or higher.

Borrowing from a bank could be ideal if you want the option to visit a branch in person. Most banks also offer online applications. You might also qualify for an interest rate discount if you’re already a banking customer.

Online loans

Online loans may be a solid fit if you’re looking for a streamlined application process and fast funding. Some online lenders can fund your loan the day your application is approved. Plus, many give you the chance to prequalify online, so you can check your rates with no commitment or impact on your credit score.

Some online lenders use alternative lending models, making it easier for borrowers with weak or thin credit to qualify for a loan.

But remember: Predatory lenders exist on the internet, especially those that promise no-credit-check loans. Do your due diligence to ensure you’re borrowing from a reputable lender.

Credit union loans

Many credit unions offer personal loans, but you must become a member to borrow. Membership requirements may be based on where you work or live, but some credit unions, such as PenFed Credit Union, are open to anyone. Rates and fees will vary by credit union, but your rate won’t exceed 18%, based on a National Credit Union Administration Board rule.

Peer-to-peer loans

Peer-to-peer loans are different from other loans. Instead of borrowing from a financial institution, you’ll borrow from an individual investor. The credit requirements for a peer-to-peer loan can be more flexible than those on a bank loan. However, the rates and fees may be higher than you’d find from other lenders.

Specific types of personal loans

As you search for a personal loan, you may see personal loans for specific purposes. Types of personal loans include:

- Home improvement loans: You can find personal loans designated for home improvement costs. Some lenders get even more specific—LightStream, for instance, offers landscaping, solar, swimming pools, and remodel loans.

- Debt consolidation loans: You may also explore personal loans for debt consolidation, which could save you money if you can qualify for a better rate. Some lenders will pay off your creditors for you, and others will disburse the funds to you.

- Medical loans: You can also find personal loans to pay off medical bills.

- Wedding loans: Some lenders provide personal loans to help you finance the cost of a wedding.

- Adoption loans: Personal loans for family planning include adoption and fertility loans.

- Travel loans: You may discover travel loans, but be cautious about taking on debt for nonessential expenses.

- Secured personal loans: Some lenders offer secured personal loans, which require you to back them with collateral. Secured personal loans can have lower credit score requirements, but you risk losing your asset if you can’t make payments.

Keep in mind that you can use a general personal loan for almost any purpose, even if it’s not labeled as one of these loan types. There may be a few restricted uses, depending on your lender.

For instance, some lenders say you can’t use a personal loan for gambling, investing, higher education, or business expenses.

Find personal loans by credit score

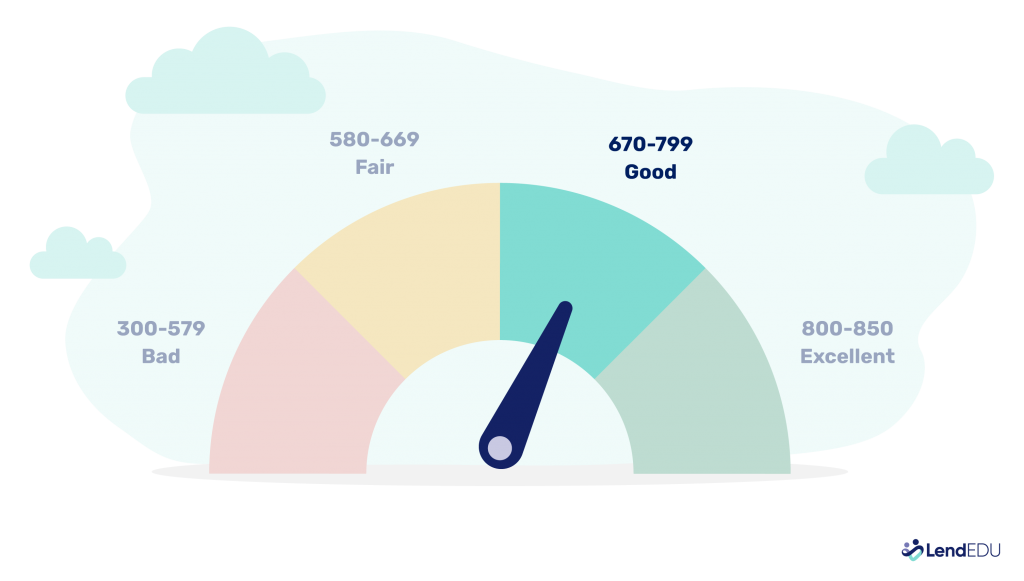

A key factor in finding the right personal loan for you is your credit score. Most personal loans are unsecured, so lenders rely on your credit to assess your risk as a borrower. A good credit score indicates you’re likely to repay your loan on time, and a poor or thin credit score appears riskier to a lender.

Borrowers with good or excellent scores will qualify for the lowest rates. Borrowers with weaker scores may end up with a rate on the higher end of a lender’s range (or not qualify at all). Plus, loans for weak credit tend to come with higher fees, such as origination and late fees.

Several lenders cater to various types of scores, so shop around to find a lender that’s the best match for your financial profile. To narrow down your options, check out our resources for:

What loans does Capital One offer?

Capital One no longer offers personal loans, but it provides other financing options, including auto loans, business loans and lines of credit, and commercial lending products.

- Auto loans: Through the Auto Navigator program, Capital One helps you find a car loan, as well as browse cars from thousands of dealers nationwide. Along with new and used car financing, Capital One also provides auto loan refinancing.

- Small business loans and lines of credit: Capital One offers a variety of financing options for small businesses, including real estate term loans, medical practice loans, equipment loans, business credit cards, and business lines of credit. You can also apply for a Small Business Administration (SBA) loan through Capital One.

- Commercial lending: Capital One has a variety of commercial financing solutions, including real estate, asset-based lending, and more.

Recap of Capital One personal loan alternatives

Capital One may not provide personal loans anymore, but you still have several options for borrowing money. Consider our top picks for personal loan lenders below that offer competitive interest rates, fast funding, and a streamlined online application.

Before you choose a loan, take time to compare offers from multiple lenders. Because many lenders let you prequalify for personal loans, you can check your rates without dinging your credit score.

Along with a low rate, look for a loan with few (or no) fees, flexible repayment terms, and a monthly payment that works for your budget. By putting in this legwork upfront, you can find a personal loan with the lowest cost of borrowing.

| Lender | Minimum credit score | |

| SoFi | 680 | View rates |

| LightStream | 660 | View rates |

| Upgrade | 560 | View rates |

| Upstart | 300 | View rates |

| Credible | Varies by lender | View rates |

About our contributors

-

Written by Rebecca Safier

Written by Rebecca SafierRebecca Safier is a personal finance writer with years of experience writing about student loans, personal loans, budgeting, and related topics. She is certified as a student loan counselor through the National Association of Certified Credit Counselors.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.