Our take: Upstart stands out for using AI to look beyond your credit score, making it easier for borrowers with limited or no credit history to qualify. With fast approvals, low fixed rates, and a minimum score of just 300, it’s a strong option, though fees may be higher than some competitors.

Personal Loans

- Low minimum credit score requirements

- Fast approvals and funding

- Easy online application process

- AI-powered credit decisions that consider more than your FICO score

- Low fixed rates

- Also offers short-term relief loans

- Higher origination fees than many competitors

- Only 2 repayment term options

- No cosigners or joint loans

| Fixed rates (APR) | 7.80% – 35.99% |

| Loan amounts | $1,000 – $75,000 |

| Repayment terms | 3 or 5 years |

| Min. credit score | 300 (lowest possible) |

If you’re new to adulting, holding down your first job and paying for your first place, or rebuilding your finances later in life, you might have noticed that it’s challenging to get credit from traditional banks. Even if you work hard and pay your bills on time, having a thin or limited credit history prevents you from accessing many lending products.

The founders of Upstart didn’t think was fair, so they built a personal loan that uses AI to scan 2,500+ data points (you know, instead of a handful of metrics, like traditional banks). That’s resulted in Upstart approving 43% more applicants than traditional lenders, making it our pick for the best personal loan for those with limited credit.

About Upstart

Dave Girouard, the co-founder of Upstart, said he started the company when he learned that only 45% of Americans have access to quality credit products. At a congressional hearing on expanding credit access, Girouard explained that FICO scores aren’t the best way to determine whether someone is creditworthy anymore.

Instead, Upstart uses its proprietary artificial intelligence model that takes into account applicants’ employment history, education, income, and several other variables to evaluate a potential borrower’s risk of default. The result is that Upstart not only approves more borrowers but also provides much lower average annual percentage rates (APRs) than other lenders.

At the end of 2020, Upstart announced its initial public offering (IPO) and today remains a publicly traded company and a leader in the AI lending space.

How do Upstart personal loans work?

| Feature | Details |

|---|---|

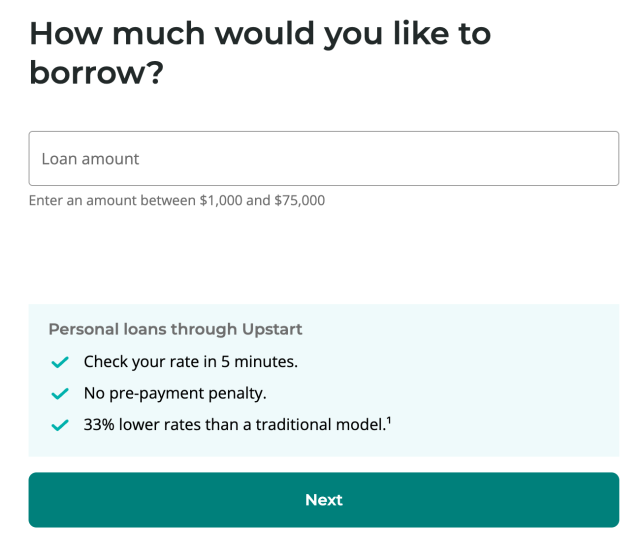

| Loan amounts | $1,000 – $75,000 |

| Fixed rates (APR) | 7.80% – 35.99% |

| Terms | 3 or 5 years |

| Minimum credit score | 300 |

| Funding time | As fast as 1 business day |

| Origination fee | Up to 12% |

Flexible loan requirements

| Requirement | Details |

|---|---|

| Citizenship | U.S. resident with SSN |

| Income | Must have job or verifiable offer within 6 months |

| Age | 18+ |

| Credit history | None required; minimum score listed is 300 (the lowest possible) |

Upstart publishes its required minimum credit score as 300, which is the lowest FICO score possible. Additionally, you need to have no recent bankruptcies within the last three years, a balanced debt-to-income ratio, verifiable income, and be a U.S. resident above the age of 18.

Upstart doesn’t allow joint applications or cosigners.

Low fixed rates

Eligible borrowers can qualify for low fixed rates starting at 7.80%. Your fixed rate won’t change for the duration of your term.

Powered by AI

Upstart’s AI software is what sets it apart. When you apply for an Upstart loan, the technology measures 2,500 variables to help determine whether you qualify. Even if you have little to no credit history, Upstart’s AI tools consider your income, education history, and more. You can check your rate in just five minutes.

How long does Upstart take to deposit funds?

Once you’re approved for an Upstart loan, you can get your money in as little as one business day, making it an excellent option for those who are facing a financial emergency.

Loan options

Upstart allows you to choose a personal loan with a three- or five-year term. There is no prepayment penalty if you decide to pay it off early.

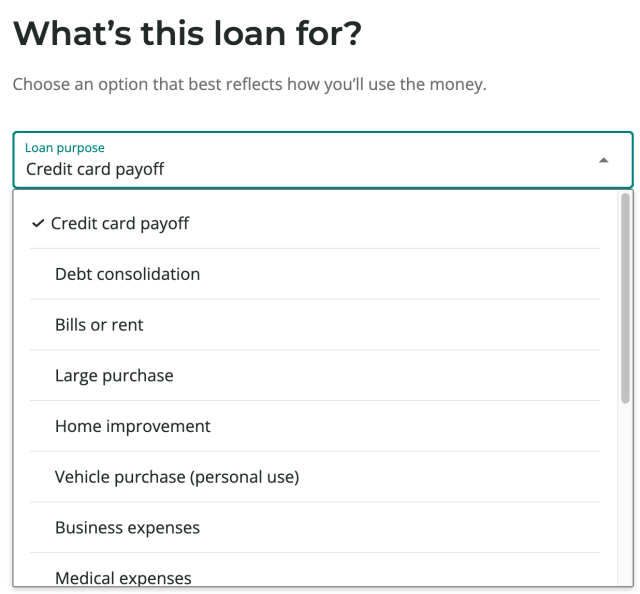

Loan uses

The benefit of an Upstart personal loan is that you can use it for a variety of purposes. Personal loans on Upstart’s website include:

- Wedding loans

- Home improvement loans

- Moving loans

- Medical loans

- Debt consolidation loans

- Credit card consolidation loans

Several Reddit users report qualifying for an Upstart personal loan at a much lower rate than their credit cards, enabling them to consolidate high-interest debt.

Short-term relief loans

In addition to its standard personal loans, Upstart offers a separate short-term relief loan designed for smaller, immediate needs. Borrowers can apply for $200 to $2,500 with repayment terms ranging from three to 18 months. These relief loans come with a fixed rate up to 36%, no interest, and no late fees or prepayment penalties—only a one-time origination fee.

This option may appeal if you’re seeking a more affordable alternative to payday loans. For example, a $1,000 relief loan repaid over 12 months would cost around $205 in total fees, compared to thousands in interest with a high-APR payday loan. While approval still requires a soft credit check and $12,000 in minimum annual income, funds can be delivered as soon as the next business day.

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Costs and fees

Upstart charges interest fees, origination fees of up to 12%, and late fees if you don’t make your payments on time.

Pros and cons of Upstart

Here are some of the benefits and drawbacks of applying for a personal loan with Upstart.

Pros

-

Low minimum credit score requirements

-

Fast approvals and funding

-

Easy online application process

-

AI-powered credit decisions that consider more than your FICO score

-

Low fixed rates

-

Short-term relief loans offer a much better alternative to payday loans

Cons

-

Higher origination fees than many competitors, especially if you have good to excellent credit

-

Only 2 repayment term options

-

No cosigners or joint loans

Is Upstart legit? Customer reviews

| Source | Customer rating | Number of reviews |

|---|---|---|

| Trustpilot | 4.9/5 | 56K |

| Better Business Bureau (BBB) | 1.25/5 | 162 |

| 4.0/5 | 170 |

Upstart generally earns positive customer reviews. It is BBB-accredited and has an A+ rating with the platform.

However, its customer ratings are lower with the BBB and Google. The number of reviews is also significantly lower.

Several customers mentioned being denied a loan or having issues with loan payments, while positive comments often commend the smooth and quick transactions. One Trustpilot rating said, “I’m so thrilled because I will be able to pay off all my credit cards within three years and save … $700 a month.”

How do I contact Upstart?

Here are the ways to contact Upstart:

- Send a message via the website (must have a login)

- Call the toll-free number: 855-438-8778 (available 6 a.m. to 5 p.m. Pacific, seven days a week)

- Email [email protected]

Upstart Alternatives

We recommend getting quotes from three to five top-rated lenders to ensure you get the best possible personal loan rate and terms for you. Here’s how Upstart compares to several others to consider if you have a thin credit history:

Upstart vs. Upgrade

To qualify for an Upgrade personal loan, you’ll need a minimum of a 580 credit score, which is higher than Upstart’s qualifications. However, Upgrade offers several other benefits, such as a high-yield savings account, credit monitoring, and other resources, which may be useful to if you’re looking for a more comprehensive banking experience, especially if your credit score is in the “fair” range (FICO 580 – 669).

Upstart vs. LendingPoint

Similar to Upstart, LendingPoint offers personal loans to borrowers with less than ideal credit, except LendingPoint typically requires a credit score of around 585 or above. One unique aspect of LendingPoint is that you may qualify for a lower interest rate after several months of on-time payments. LendingPoint only offers loans up to $36,500, so Upstart might be a better fit if you need to borrow more, or if you don’t meet LendingPoint’s credit requirements.

Upstart vs. Achieve

Achieve offers personal loans to borrowers with a minimum credit score of 620 and specializes in debt consolidation loans. Achieve’s origination fees are generally lower than Upstart’s fees, but funding can take up to 20 days to deposit. So if you need money sooner, Upstart may be the better choice.

See our complete list of reviewed personal loan companies.

How to apply for an Upstart personal loan

Applying for a personal loan from Upstart is easy, especially if you have all the requested information ready ahead of time.

- Click the green “Check your rate” button on Upstart’s homepage.

- Input the loan amount you’re requesting.

- Choose the purpose of your loan (or “My reason is not listed here”) from Upstart’s list.

- Enter the requested information on the following screens. (This includes your name, email address, birthdate, street address, whether you rent or own the property, phone number, education, income, savings, and vehicle information.)

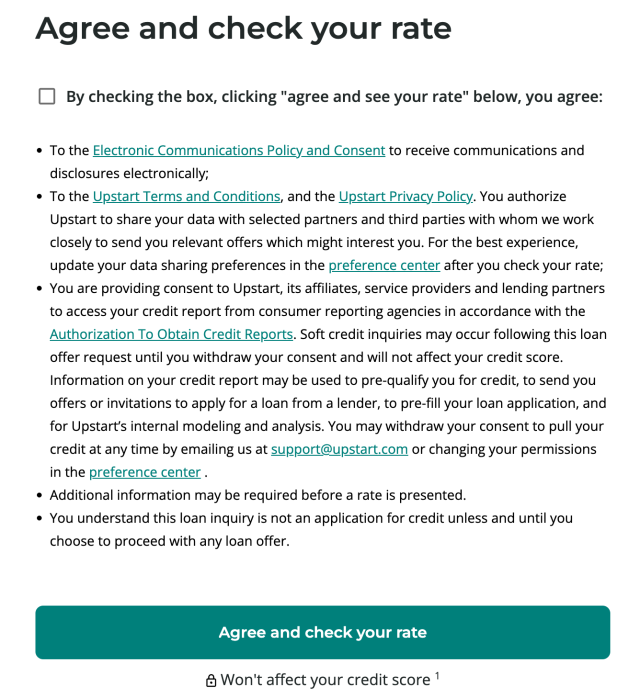

- Agree to a soft credit check (which doesn’t affect your credit score) by checking the box to proceed and clicking “Agree and check your rate.”

How we rated Upstart

We designed LendEDU’s editorial rating system to help readers find companies that offer the best personal loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Upstart to several personal loan lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Company | Best for… | Rates (APR) | Rating (0-5) |

|---|---|---|---|

|

Best for Thin Credit | 7.80% – 35.99% |

|

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Congress.gov, Testimony of Dave Girouard, CEO and Co-Founder, Upstart Network, Inc.

- FederalReserve.gov, Upstart Re: Community Reinvestment Act

- Upstart.com, Press Release: Upstart Announces Pricing of Initial Public Offering

- Upstart.com, Minimum credit requirements for loan approval

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.