Our take: SoFi personal loans are a top choice for borrowers with good credit who want a fast, all‑digital process and no‑fee options. You can borrow up to $100,000, check your rate without hurting your credit, and even add a cosigner to qualify for better terms.

Keep in mind the $5,000 minimum loan amount, the online‑only service, and the fact that SoFi’s best rates are reserved for well‑qualified applicants.

Personal Loans

- No-fee options

- Borrow up to $100,000

- Cosigner options

- Member perks

- Fast funding

- Interest rate discounts

- Available only for good credit

- $5,000 minimum

- No physical branches

| Fixed rates (APR) | 8.99% – 29.99% with all discounts* |

| Loan amounts | $5,000 – $100,000 |

| Term lengths | 2 – 7 years |

| Min. credit score | 660 |

I recently got approved for a personal loan from SoFi, so I’m writing this review fresh from experience. As a veteran financial writer, I’ve researched many financial companies, but I have only used a few for my personal finances. SoFi is one of them. SoFi earns a great editorial rating from LendEDU and is our best personal loan for those with good credit, so it was at the top of my list.

In this SoFi Personal Loans Review, I’ll share the history of SoFi, the types of personal loans it offers, the benefits, drawbacks, and several genuine customer reviews (including my own). I’ll also share several alternatives for you to consider, so that you can decide which personal loan company is best for you.

About SoFi

SoFi stands for Social Finance, and the company had small beginnings. In 2011, a few Stanford University classmates created SoFi to help students refinance federal and private student loans. The company grew rapidly and soon offered multiple types of lending products, including mortgages and personal loans.

By 2020, SoFi had 1 million members, which grew to 10 million by the end of 2024. Now, it’s a publicly traded company and, as of June 2022, a national bank that offers checking and savings accounts.

How do SoFi personal loans work?

The process to get a personal loan with SoFi is quick and painless. Here’s how it works:

Personal loans made easy online

You complete the entire SoFi personal loans process online. After you set up an account with SoFi, select the type of loan you want. SoFi asks you to choose from a list of personal loan uses, which include Debt Consolidation, Home Improvement, Family Planning, Travel, and Weddings.

You can prequalify for a loan to check your rate, which does not affect your credit. SoFi will give you several loan options if you qualify, with varying terms and monthly payments. Once you choose one, SoFi conducts a hard pull and checks your credit as part of the approval process.

Low fixed rates

The rates and terms that SoFi offers vary from 8.99% – 29.99% (with all discounts1). SoFi explains in an educational article that the purpose of your loan can affect your interest rate you get. However, SoFi does not expressly state whether that applies to specific personal loans it offers.

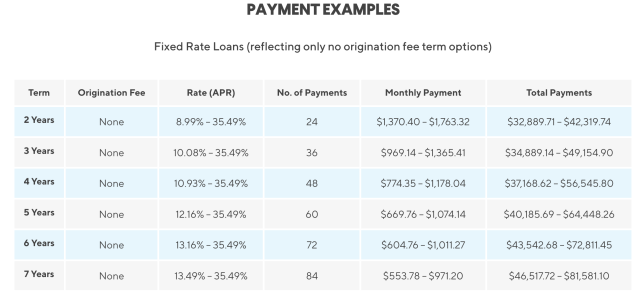

In SoFi’s payment example chart, the shorter the term, the lower your interest rate can be:

No fees required

You won’t need to pay an origination fee with a SoFi personal loan. However, it offers a lower interest rate if you elect to pay an origination fee.

I chose the no-fee option. (That’s one of the reasons I selected SoFi as my lender.) Review your options carefully before choosing a loan so you don’t accidentally select an origination fee if you don’t want one.

Fast funding

SoFi has super fast funding. Once you provide your loan documentation and get approved, you can have your funds as fast as the next business day.

Pros and cons

Here are several benefits and drawbacks to getting a personal loan with SoFi.

Pros

-

No-fee options

SoFi doesn’t charge fees, unless you specifically choose to pay an origination fee to lower your interest rate.

-

Borrow up to $100,000

SoFi has a higher personal loan maximum than many competitors.

-

Cosigner options

SoFi allows cosigners, which can help you access more competitive interest rates.

-

Member perks

SoFi offers several benefits, including financial planning services, events, credit monitoring, and a net worth tracker.

-

Fast funding

You can get your funds as fast as the next business day.

-

Interest rate discounts

SoFi offers discounts for enrolling in autopay and for allowing the bank to pay your creditors directly if you’re consolidating debt.

Cons

-

Available only for good credit

Typically, you must have a credit score of 660 or above to qualify for a SoFi personal loan

-

$5,000 minimum

The minimum loan amount required is higher than other lenders.

-

No physical branches

SoFi is an online-only lender. If in-person communication is important to you, you won’t get that with SoFi.

Customer reviews

| Source | Customer rating | Number of reviews |

| Trustpilot | 4.2/5 | 10K+ |

| Better Business Bureau (BBB) | 1.28/5 | 355 |

| 2.4/5 | 188 |

SoFi reviewers on Trustpilot highlight how quick and easy the application process was. One reviewer said SoFi is “unbelievably fast.”

SoFi is not BBB-accredited, but it earns an A+ rating for the platform. However, customer reviews on BBB and Google skew lower (but are far fewer in number).

Many negative reviews mention poor customer service and issues with SoFi’s checking accounts. I don’t have a SoFi checking account, so I can only comment on the personal loan application process, which was speedy. It was faster to verify my identity and get approved for a personal loan than it was to change my last name in SoFi’s system.

As of September 2025, SoFi customers have filed 2,361 total BBB complaints in the last three years and closed 744 complaints in the last 12 months.

Contact SoFi

Visit SoFi’s Contact Us page to access the Live Chat feature. At first, you’ll talk with a virtual assistant that connects you to an agent during business hours.

Business hours for personal loan support are Monday through Thursday, 5 a.m. to 7 pm. Pacific time, and Friday to Sunday, 5 a.m. to 5 p.m. Pacific.

You can also call to speak with an agent about personal loans at 855–456-7634.

Alternatives

Here’s how SoFi stacks up against three of our other picks for the best personal loans:

SoFi vs. Upstart

Upstart uses AI to determine borrower eligibility, resulting in more approvals for buyers with a limited credit history. It might be a better option if you don’t have good credit. Upstart does, however, charge origination fees.

SoFi vs. Upgrade

Upgrade is a lending option for borrowers who have a minimum credit score of 580 and might be unable to be approved by other lenders for a personal loan. The drawback is that it has up to a 9.99% origination fee.

SoFi vs. LightStream

SoFi and LightStream both cater to borrowers with good credit. LightStream offers longer terms for some types of personal loans, such as home improvement loans, and has a lower starting rate (6.99% APR).

See our full list of reviewed personal loan companies.

How to apply

Here’s how to take out a personal loan with SoFi.

- Start your online application. Visit SoFi’s website and complete a short form using your computer, phone, or tablet.

- Prequalify in less than two minutes. SoFi will perform a soft credit check to show your potential rates and terms without affecting your credit score.

- Review your loan offer. If you’re prequalified, you’ll see your estimated rate, term, and loan amount. You can proceed if you like what you see.

- Submit your full application. Choose your offer and provide any required documentation to move forward with approval.

- Get help if needed. Loan consultants are available to guide you through the process and answer any questions.

- Sign electronically and receive your funds. Once approved, sign your loan documents online. Funds are typically deposited directly into your bank account.

How we rated SoFi

We designed LendEDU’s editorial rating system to help readers find companies that offer the best personal loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared SoFi to several personal loan lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Company | Best for… | Rating (0-5) |

|---|---|---|

|

Best for Good Credit |

|

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- SoFi, Our Story

- SoFi, Does Loan Purpose Matter?

- SoFi, Compare Rates and Terms

- Better Business Bureau, SoFi

- Trustpilot, SoFi

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.