At LendEDU, we publish well-researched educational resources that help millions of people navigate the (often boring, yet extremely important) financial decisions that we all have to make along life’s journey. For us, educated financial decisions begin and end with us caring about helping people.

Message From Our Editorial Team

Our consumer guides are written by in-house experts, all of whom have years of experience educating consumers about finance. Before we publish, our research and advice is thoroughly reviewed, fact-checked, and revised by a curated panel of certified professionals to ensure accuracy and completeness.

Our Editorial Team's Accreditations & Certifications

- Certified Financial Planner (CFP)

- Certified Public Accountant (CPA)

- Chartered Alternative Investment Analyst (CAIA)

- Certified Investment Management Analyst (CIMA)

- Accredited Investment Fiduciary (AIF)

- Chartered Financial Consultant (CHFC)

- Accredited Asset Management Specialist (AAMS)

- Accredited Financial Counselor (AFC)

- Certified Educator in Personal Finance (CEPF)

- Retirement Income Certified Professional (RICP)

- Wealth Management Certified Professional (WMCP)

- Licensed Insurance Agent (LIA)

Help You Manage Debt Responsibly

Compounding interest is an extremely powerful force—especially over long periods of time. It can help grow your savings account significantly without adding more into it. Unfortunately, the compounding that most Americans experience is in reverse. Debts increase further each year, so people can never seem to catch up on interest payments. They get trapped underneath an ever-growing mountain of debt.

Life is expensive. There are many reasons to borrow money. At LendEDU, we realize that we cannot fix debt in America, but we are passionate about helping people use debt more responsibly.

We strive to empower you to borrow less, and to only borrow from the most reputable lenders. This way, you can pay off debt sooner and let the power of compounding interest start working for you, as opposed to against you.

Have Debt

16,000,000 Educated

Financial Decisions

LendEDU was created in 2014 because there were no excellent resources to compare lenders. Which is the best lender? How much will this loan cost me? These are hard questions for the average person to answer on their own. Since then, we're proud to say that we've helped over 16 million confused borrowers become informed consumers.

What Makes The Content That LendEDU Publishes Different

Expert Approved: Before we publish many of our guides, our team of experienced editors goes the extra mile by working with accredited experts to verify the accuracy and maximize the helpfulness of the information.

Editor's Awards: Our editors use detailed criteria, which vary based on the type of product, to determine how to rate companies. After considering a multitude of factors, editors figure out which companies are best for different people.

Editorial Ratings: Our team evaluates each company that we publish a review about and determines a 1-to-5-star rating, where 5 stars is excellent and 1 star is poor.

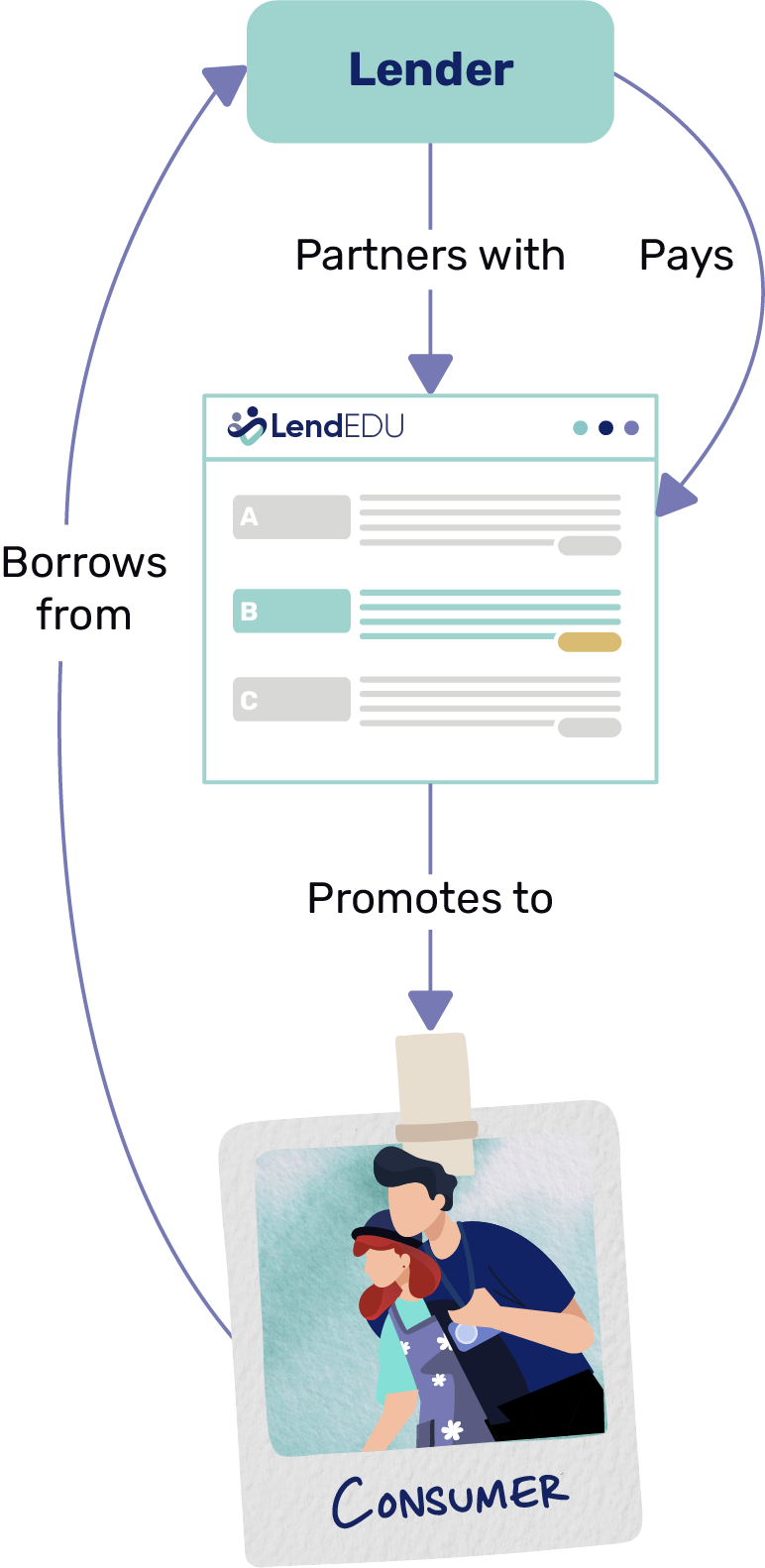

How LendEDU Makes Money

LendEDU is a for-profit company that works hard to ensure that the companies we review are reputable, offer good products, and treat their customers fairly.

Similar to other online financial education companies, LendEDU is compensated by some of the companies seen on our website when readers click to, apply for, or take out a financial product.

Compensation from our advertising partners allows us to pay our team of editors and comes at no cost to readers. This may impact where products appear on our site (including, for example, which cards are shown on pages and the order in which partners appear in tables), but companies can’t pay us to guarantee favorable reviews or ratings.

Join Our Team

LendEDU has been in business since 2014, yet working at LendEDU still feels like working at a well-resourced startup as opposed to a large corporation. For us, being small, keeping weekly meetings to a minimum, and having everyone work closely with one another are all features that help us maximize job satisfaction and deliver a best-in-class online experience for consumers.

Are we currently hiring? Yes, we always look for self-motivated professionals we enjoy spending time with to join our team. If this describes you, then reach out to tell us more about yourself.

Get in Touch

Suite 600, Charlotte NC, 28246

Frequently Asked Questions

Is LendEDU a non-profit?

No, LendEDU is a for-profit company.

Why should I use LendEDU?

LendEDU does the legwork in researching financial products so you don't have to. From our roundups of the best lenders and companies, to our informational guides that walk you through confusing topics, we have thousands of posts that cover a wide range of topics.

Is LendEDU a lender?

No, LendEDU is not a lender. We are a financial education company that conducts in-depth research on financial products and services to help our readers make the best decisions.

What does LendEDU help with?

LendEDU has published content about a wide (and growing) variety of financial products including student loans, personal loans, mortgages, home equity loans, auto loans, tax products, and more.

How is LendEDU different from other financial education sites?

We dig deep into the special circumstances that our readers may be facing when making financial decisions. Whether you're concerned about the impact of your current credit score, lack of cosigner, or your debt-to-income ratio, we consider all the details that make a difference and steer you to the best options for you.