Finding a personal loan with a low income is possible if you know where to look. Lenders assess your income alongside other factors, such as monthly expenses and debt, to ensure you can manage the loan.

While eligibility varies by lender, stable income is key. This guide will show you the best options for low-income personal loans and how to improve your chances of approval.

| Company | Min. Income? | Credit Profile | Rating (0-5) |

|---|---|---|---|

|

|

No | All |

|

|

Not Disclosed | Good Credit |

|

|

Not Disclosed | Fair or Bad Credit |

|

|

Yes ($12,000) | Bad Credit |

|

|

Yes ($1,200/mo.) | Bad Credit |

|

|

Not Disclosed | Good Credit |

|

|

Not Disclosed | Good Credit |

|

|

Not Disclosed | Good Credit |

|

|

Not Disclosed | Good Credit |

|

|

Not Disclosed | Fair Credit |

|

Table of Contents

Personal loans for low income

Lenders evaluate your income alongside other factors, such as your debt-to-income ratio (DTI) and credit scorer, when considering you for a loan. Even if your income is low, you could qualify for a loan if your DTI is within the lender’s limits.

Below, we’ve grouped lenders into two categories:

Personal loans for good credit and low income

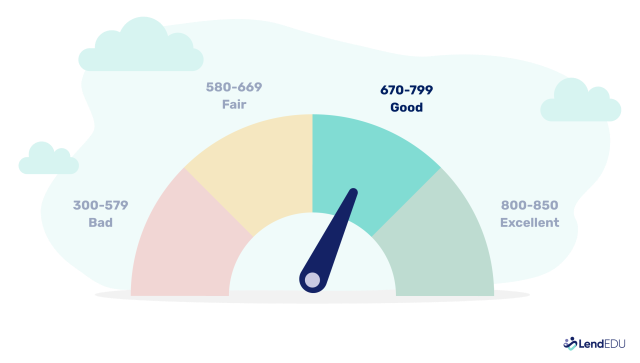

A good credit score is the best way to keep loan payments affordable, and it can also result in a lower interest rate. Credit scores often fall into one of four categories: bad, fair, good, or excellent.

FICO credit scores range from 300 to 850:

Your maximum loan amount may be limited based on income and other debts, but a good credit score could qualify you for better rates.

Here’s more about each of our top picks for borrowers with good credit and a low income.

Credible

About Credible

Credible is an excellent choice because of its free online marketplace. Credible allows you to submit one application and compare offers from multiple lenders.

Credible’s platform also caters to a diverse range of credit profiles, making it a great option for those with bad to excellent credit. The ability to view customized loan options based on your financial background makes Credible a standout choice.

- Compare prequalified rates from multiple lenders

- No application or origination fees

- Checking your rate doesn’t affect your credit score

- Only shows offers from its partners

| Rates (APR) | 6.99% – 35.99% |

| Loan amounts | $600 – $200,000 |

| Repayment terms | 1 – 10 years |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: Varies by lender

- Minimum income: Varies by lender

- States: All 50 states and D.C.

SoFi

About SoFi

SoFi is an online lender offering personal loans up to $100,000. In addition to fast approval and no fees, you can get a 0.25% interest rate reduction when you sign up for autopay.

- Funds available as soon as the same day

- Pays off credit card issuers and adds a 0.25% rate discount

- Check your rate without affecting your credit in 60 seconds

- A high minimum loan requirement of $5,000

| Fixed rates (APR) | 8.99% – 29.99% with all discounts |

| Loan amounts | $5,000 – $100,000 |

| Repayment terms | 2 – 7 years |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: 650

- Minimum income: Not disclosed

- States: All 50 states and D.C.

- Other requirements:

- Must be a U.S. citizen, permanent resident, or visa holder (J-1, H-1B, E-2, O-1, or TN)

- At least 18 years old

- Employed, have sufficient income from other sources, or have received an offer of employment to start within the next 90 days

Happy Money

About Happy Money

Happy Money offers an unsecured personal loan called the “Payoff Loan.” Happy Money’s Payoff Loans can help you consolidate and pay down credit card debt.

Depending on your preference, you can ask Happy Money to pay your creditors or deposit your loan in your checking or savings account. Happy Money designed its loans to pay off credit card debt.

- Choose your terms, payoff date, and monthly payment

- Happy Money pays off credit card companies

- Check your rate without affecting your credit

- High minimum loan balance of $5,000

- Must use funds to pay off credit card debt

| Rates (APR) | 12.45% – 17.99% |

| Loan amounts | $5,000 – $40,000 |

| Repayment terms | 2 – 5 years |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: 640

- Minimum income: Not disclosed

- States: All 50 states and D.C.

- Other requirements:

- No delinquencies on your credit report

LightStream

About LightStream

LightStream offers competitive rates on its personal loans and loan amounts of up to $100,000. Depending on your loan type, you could choose a loan term of up to 12 years.

With LightStream’s Rate Beat Program, if you find a better rate on an unsecured personal loan from another lender, LightStream will beat it by 0.10 percentage points. LightStream also caps its rates much lower than most other personal loan lenders.

However, you should be confident in your credit score and income before applying because LightStream doesn’t allow you to prequalify. You must apply with a hard inquiry on your credit report to know whether you’re approved.

- Offers multiple loans customized to different uses

- No application, origination, or prepayment fees

- May reduce your rate by 0.10 percentage points if you find a lower rate elsewhere

- Checking your rate requires a hard credit check

| Rates (APR) | 7.49% – 25.49% |

| Loan amounts | $5,000 – $100,000 |

| Repayment terms | 2 – 12 years |

Eligibility requirements

- Soft credit check: No

- Minimum credit score: 660

- Minimum income: Not disclosed

- States: All 50 states and D.C.

- Other requirements:

- Few to no delinquencies in your payment history

- Stable and sufficient income

- A variety of financial accounts, all in good standing

Best Egg

About Best Egg

Best Egg offers unsecured and secured personal loans up to $50,000. Its secured loans are available to homeowners. Your home doesn’t secure the loan; items in your home do, including light fixtures, cabinets, and vanities.

According to Best Egg, qualifying homeowners can take out a secured loan in 24 hours without completing additional paperwork. Whether you opt for an unsecured or secured loan, Best Egg lets you check your rates online without affecting your credit score.

- You could qualify for lower rates than with an unsecured loan

- Funds are available in as little as 24 hours

- Check your rate without affecting your credit

- Requires you to secure your loan with personal items in your home

- An origination fee of 0.99% to 9.99%

| Rates (APR) | 7.80% – 35.99% |

| Loan amounts | $1,000 – $50,000 |

| Repayment terms | 3 – 5 years |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: 600

- Minimum income: Not disclosed

- States: All 50 states and D.C.

- Other requirements:

- Must be a U.S. citizen living in the U.S. or a permanent resident living in the U.S.

- Must be of legal age (varies by state)

- Must have a valid checking account, email, and physical address (no P.O. boxes)

Achieve

About Achieve

Achieve personal loans are best for borrowers with good to excellent credit, offering loan amounts up to $50,000. The application process includes a soft credit pull, so pre-approval won’t affect your credit score.

However, if you have excellent credit, make note of Achieve’s origination fees of 1.99% to 6.99%, which are added to the monthly loan payments. Several of the lenders mentioned above don’t assess origination fees.

Achieve isn’t available in every state, so check your eligibility if you live in a restricted area. It’s a solid option if you meet the minimum credit score of 620 and have a stable income. Achieve doesn’t disclose a minimum income, but its maximum loan amount is 40% of your annual income. So if your income is $12,500, the eligible loan amount would be $5,000.

| Rates (APR) | 8.99% — 35.99% |

| Loan amounts | $5,000 — $50,000 |

| Repayment terms | 24 — 60 months |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: 620

- Minimum income: Not disclosed

- States: All 50 states and D.C.

- Other requirements:

- Must be a U.S. citizen or legal permanent resident

Personal loans for bad credit and low income

These lenders are our top choices for borrowers with fair or bad credit.

Upgrade

About Upgrade

Upgrade is a solid choice for fair-credit and some poor-credit borrowers. Upgrade will fund personal loans starting at $1,000, which could appeal if you’re seeking a low loan amount. Upgrade can fund your loan within one business day of verifying your application.

However, all Upgrade personal loans have a one-time origination fee between 1.85% and 9.99% of the amount borrowed, representing the cost to underwrite the loan. This cost factors into your overall annual percentage rate (APR), reflecting fees and interest rates.

- Review multiple loan options to choose your best terms

- Funds are available in as little as one day

- Accepts joint applications

- Check your rate without affecting your credit

- Charges an origination fee of 1.85% to 9.99%

| Rates (APR) | 8.49% – 35.99% |

| Loan amounts | $1,000 – $50,000 |

| Repayment terms | 2 – 7 years |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: 580

- Minimum income: Not disclosed

- States: All 50 states and D.C.

- Other requirements:

- Must be a U.S. citizen, permanent resident, or in the U.S. on a valid visa

- Must be 18+ years old (19+ in Alabama and other select states)

- Must be able to provide verifiable bank info and have a valid email

Upstart

About Upstart

Upstart accepts borrowers with credit scores of 300—the lowest possible. Upstart offers prequalification online, so you can check your rates without affecting your credit score.

Upstart uses an artificial intelligence-powered alternative lending model to determine whether you qualify for a loan, relying on various factors to assess your finances and make an approval decision.

Upstart charges an origination fee for your personal loan, between 9% and 12% of the amount borrowed.

- Funds can be available as soon as the next day

- Check your rate without affecting your credit in 5 minutes

- Charges an origination fee of up to 12%

| Rates (APR) | 7.80% – 35.99% |

| Loan amounts | $1,000 – $75,000 |

| Repayment terms | 3 – 5 years |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: None

- Minimum income: $12,000

- States: All 50 states and D.C.

- Other requirements:

- Must have a verifiable name, date of birth, and Social Security number

- Must be 18+ years of age

- Must have a job (or job offer or verifiable source of regular income), valid email address, and U.S. address

- Must meet minimum credit underwriting requirements (that is, an established credit history); if no credit history, borrowers must be enrolled in a degree program (associate, bachelor’s, or more advanced) at an accredited school

- Must have a valid bank account

Avant

About Avant

Avant offers personal loans to borrowers with less-than-perfect credit, making it a strong option for those with credit scores as low as 580. Loan amounts range from $2,000 to $35,000, with repayment terms of 12 to 60 months.

While Avant provides quick funding—often within one business day—it charges an administration fee of up to 9.99%. The straightforward application process and mobile app for loan management add to its convenience, but be mindful of the fees when calculating the total cost.

| Rates (APR) | 9.95% – 35.99% |

| Loan amounts | $2,000 – $35,000 |

| Repayment | 12 – 60 months |

Eligibility requirements

- Minimum credit score: 580

- Minimum income: $1,200 per month

- States: 43 states and Washington, D.C.*

- Other requirements:

- Must be a U.S. citizen or legal resident

- Income verification

- Must be 18+ years

**Not available in Hawaii, Iowa, Maine, Massachusetts, New York, Vermont, and West Virginia

Rocket Loans

About Rocket Loans

Rocket Loans offers a fully online personal loan application process, with funds available as soon as the same business day. You can secure loans ranging from $2,000 to $45,000.

However, Rocket Loans has only two repayment term options—36 or 60 months—and charges an origination fee of up to 9%. An autopay discount is available, providing added convenience for those looking to reduce their rates.

| Rates (APR) | 9.116% – 29.99% |

| Loan amounts | $2,000 – $45,000 |

| Repayment | 36 or 60 months |

Eligibility requirements

- Soft credit check: Yes

- Minimum credit score: Mid-600s

- Minimum income: Not disclosed

- States: Not available in Iowa, Nevada, or West Virginia

- Other requirements:

- Must be a U.S. citizen or permanent resident

- Income verification

- Must be 18+ years

If you’re considering a personal loan, I recommend being diligent about making the monthly payment on time and building a budget that works for you to save money for future emergencies and needs instead of borrowing. And of course, always contact the lender if your monthly payment will be delayed or a financial hardship has occurred.

Erin Kinkade, CFP®

Alternatives to personal loans when you have low income

Consider one of these alternatives if you discover you can’t qualify for a personal loan based on your income. Be sure to weigh the pros and cons before making your decision.

- Side hustle: Instead of borrowing, consider finding a way to earn more to cover your cash flow needs. You’ll find no shortage of side hustle ideas, which can help you boost your income on a schedule that works for you.

- Credit card: If you have a low income, consider applying for a credit card instead of a personal loan. The interest rates tend to be higher, and your credit limit may start low. But you might find it easier to get extra financing by choosing a credit card instead of an installment loan.

- Cash advance app: When you have a more minor, short-term financial need, consider using a cash advance app. Loan amounts are much smaller, often maxing out around $500. Instead of interest, you’ll pay a funding fee and potentially a monthly fee for using the service.

- Retirement loan: It’s possible to borrow from your 401(k) if you have one, but this has several drawbacks. For instance, if you don’t repay the loan on time, you’ll owe income tax and an early withdrawal penalty on the funds. You also might need to repay the loan immediately if you leave your job. The loan reduces your retirement account balance, which could reduce the account’s growth.

FAQ

What is considered low income?

Low income is typically defined based on household size and geographic area. For example, a one-person household earning under $22,000 annually is often considered low income by federal standards. However, this threshold increases with family size and varies depending on local cost of living.

What credit score do I need to qualify for a personal loan with a low income?

Most lenders require at least a fair credit score, typically around 580, for borrowers with low income. Exceptions include marketplaces, such as Credible, and Upstart, whose minimum credit score requirement is 300—the lowest possible. However, having a higher credit score can improve your chances of approval and help you secure better interest rates and loan terms.

Are there no-fee low-income personal loans?

Several lenders may offer personal loans without origination fees, particularly if you have good credit. If you have good to excellent credit, consider SoFi and LightStream for no-fee loans. Be sure to review the loan’s terms to understand all potential costs.

How we selected the best low-income personal loans

Since 2017, LendEDU has evaluated personal loan companies to help readers find the best personal loans. Our latest analysis reviewed 1,029 data points from 49 lenders and financial institutions, with 21 data points collected from each. This information is gathered from company websites, online applications, public disclosures, customer reviews, and direct communication with company representatives.

These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

| Company | Min. Income? | Credit Profile | Rating (0-5) |

|---|---|---|---|

|

|

No | All |

|

|

Not disclosed | Good Credit |

|

|

Not disclosed | Fair or Bad Credit |

|

|

Yes ($12,000) | Bad Credit |

|

|

Not disclosed | Good Credit |

|

|

Not disclosed | Good Credit |

|

|

Not disclosed | Good Credit |

|

|

Not disclosed | Good Credit |

|

|

Yes ($1,200/mo.) | Bad Credit |

|

|

Not disclosed | Fair Credit |

|

About our contributors

-

Written by Lauren Ward

Written by Lauren WardLauren Ward is a personal finance writer who regularly covers topics like mortgages, real estate, tax relief, home equity, business loans, and investing.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.