Student loan interest is the extra cost you pay for borrowing money, and it adds up over time. Most student loans use simple interest, meaning you only pay interest on the original amount borrowed. However, some private lenders use compound interest, where unpaid interest gets added to your balance, increasing costs over time.

Understanding how interest accrues and how to calculate it can help you take control of your loans and save money. Whether you’re starting repayment or looking to pay less, this guide on how student loan interest works makes it easy to understand.

Table of Contents

How does student loan interest work?

Interest is the cost of borrowing money. Student loan servicers and lenders charge interest to help offset their expenses and reduce the risk of lending money to borrowers. Interest rates are expressed as a percentage of your principal balance.

Student loan interest rates vary based on whether you borrow a federal or private student loan:

- Federal undergraduate student loans have a fixed 6.53% interest rate (if disbursed on or after July 1, 2024, and before July 1, 2025).

- Federal graduate and parent loans have slightly higher rates, at 7.05% and 8.05%, respectively.

- Private student loan lenders set their rates from around 4.5% to 18%.

Here’s a sampling of undergraduate student loan rates from our top-rated lenders:

| Lender | Rates |

| College Ave | 3.47% – 17.99% |

| Sallie Mae | 3.49% – 14.71% |

| Earnest | 3.69% – 16.85% |

| SoFi | 3.54% – 15.99% w/ autopay |

Private student loan rates may be expressed as an annual percentage rate, or APR. This is a broader loan cost than just your interest rate. APR includes interest and the annual cost of any fees associated with borrowing.

While federal student loans have fixed rates, private student loan rates can be fixed or variable. Fixed rates won’t fluctuate, but variable rates can change depending on market conditions. When your rate changes, your monthly payment will change along with it.

Here are some of the pros and cons of fixed vs. variable-rate loans.

| Fixed rate | Variable rate |

| ✅ Rate won’t increase over time | ✅ Rate and payments could decrease depending on the market |

| ✅ Payments remain the same over time | ✅ Initial rate could be lower than fixed option |

| 🅧 Rate could be higher than variable option | 🅧 Rate may increase over time |

| 🅧 Rate won’t ever decrease | 🅧 Payments aren’t as predictable |

No matter which type of loan you borrow for school, it’s important to understand your terms.

Review the promissory note your lender provides to understand how interest is calculated, how it accrues, and whether you have a grace period while you’re in school and shortly after graduation.

How is student loan interest calculated?

Lenders can apply either a simple or compound interest formula to your loan.

Simple interest is calculated only on the original loan amount, so you pay the same amount of interest throughout the life of the loan. Compound interest is calculated on both the original amount and any interest that has already been added, meaning you end up paying interest on your interest over time. This is why simple interest is more beneficial overall.

Federal and many private student loans use simple interest, though some private lenders may use a compound interest formula.

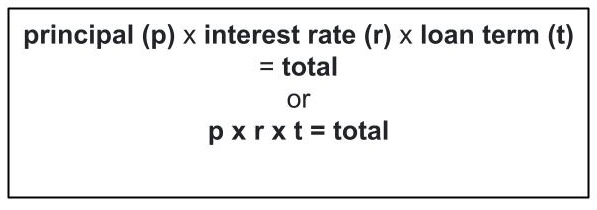

Simple interest is calculated as follows:

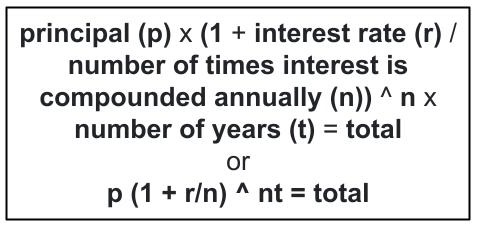

Compound interest is more complex to calculate:

Essentially, the interest in the first year is added to the outstanding balance. The following year, the interest is calculated based on that new balance. This continues throughout the loan’s duration.

How to calculate your student loan interest

Since most student loans use simple interest, let’s use that as an example to show how you can calculate the interest costs on your student loan. Imagine your student loan has the following details:

| Detail | Amount |

| Principal | $10,000 |

| Interest rate | 7.5% |

| Loan term | 10 years |

Now, apply the simple interest formula:

📌 principal (p) × interest rate (r) × loan term (t) = total interest

📌 10,000 × 0.075 × 10 = $7,500

So, in this example, you’d pay $7,500 in total interest over the life of the loan. That means your total repayment amount (principal + interest) would be $17,500.

How does interest accrue on student loans?

Loans can also accrue interest differently. Some loans accrue interest monthly, while others accrue it daily. Federal student loans are daily interest loans, as are many private student loans.

Except for Direct Subsidized and certain older student loans, interest on federal student loans accrues while you’re in school, during the grace period following graduation, and generally during periods of deferment. Interest accrues on all federal loans in forbearance.

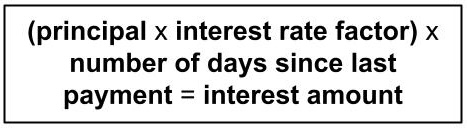

If you’re curious about calculating your monthly or daily interest, you first need to determine your interest rate factor, which equals your yearly interest date divided by the number of days in the year. For simplicity’s sake, let’s use the principal and rate from our example above:

| Detail | Amount |

| Principal | $10,000 |

| Rate | 7.5% |

So, in this case, our interest rate factor would be:

📌 .075 / 365 = 0.00021 (or 0.021%)

To calculate your total daily interest, you’ll use this formula:

If it’s been 30 days since your last payment, your formulate would look like this:

📌 (10,000 x 0.00021) x 30 = 63

You accrued $63 in total monthly interest and $2.10 per day.

Are student loans compound interest?

Most student loans use a simple interest formula, but not all. When interest compounds, any unpaid interest in a statement period is added to your principal balance.

In the next statement period, you pay interest on your initial principal plus the amount of unpaid interest added to that balance. Compounding interest can increase your interest costs over time.

How often are student loans compounded?

Federal student loan interest doesn’t typically compound, though it can capitalize, which is similar to compounding.

If you don’t make interest payments on your unsubsidized federal loans while in school, during your grace period after graduation, or while in deferment, any interest you accrue in those time frames will be capitalized.

When interest on your federal student loans capitalizes, the accrued interest is added to your principal balance. So, if you accrue $250 interest on a $7,500 loan while in deferment, your new principal balance will be $7,750.

Is student loan interest monthly or yearly?

Federal student loans accrue interest daily, not monthly or yearly. The interest structure of private student loans can vary depending on your lender. Some may accrue interest daily, while others might accrue it monthly or annually.

How to pay off interest on student loans

Here are some steps to pay off interest on your student loans more quickly.

Prioritize your highest-rate loan

Consider prioritizing your loans by interest rate to pay off your interest faster. Once you’re making the minimum payments on each loan, allocate any remaining funds to the loan with the highest interest rate. Doing so can help reduce your overall interest costs.

| Payoff order | Loan | Balance | Interest rate |

| 1 | B | $10,000 | 7.80% |

| 2 | C | $3,000 | 6.50% |

| 3 | A | $5,000 | 4.99% |

Make extra payments

Making extra payments is another great way to help reduce your interest costs over time. You might consider making two monthly payments or paying a lump sum toward your interest if you have a windfall. For example, you could use a portion of your tax return to pay off your student loan interest.

If you make two monthly payments, here’s what that might look like. For the purposes of our example, you have a $10,000 loan with a 7.8% rate and a monthly payment of around $120.

If you made two payments each month of $120, you would pay off your loan in four years instead of 10 and save $2,700 on interest:

| Current | Pay 2x/mo. | Savings | |

| Repay. length | 10 years | 4 years | 6 years |

| Interest paid | $4,433 | $1,700 | $2,733 |

| Total cost | $14,433 | $11,700 | $2,733 |

Since student loans are amortized, extra payments will increase the speed with which you repay your overall loan.

Refinance

If you have a high-rate student loan, you could also refinance if you’re eligible. Just be mindful that refinancing a federal student loan with a private lender can mean forfeiting certain benefits, like student loan forgiveness or income-driven repayment.

Still, refinancing could make sense if you have private loans or you can get a significantly lower rate.

Let’s say you have a $10,000 student loan with an 8% interest rate, and you refinance to a loan with a 5% interest rate. Here’s a look at your potential savings:

| Current | After refi. | Savings | |

| Monthly payment | $121 | $106 | $15/mo. |

| Term length | 10 yrs | 10 yrs | 0 mo. |

| Total interest | $4,559 | $2,728 | $1,831 |

| Total cost | $14,559 | $12,728 | $1,831 |

FAQ

How often does interest accrue on student loans?

Interest on student loans typically accrues daily. This means the lender calculates your interest by multiplying your outstanding principal balance by the daily interest rate.

The daily interest rate is often your annual interest rate divided by the number of days in a year. The result is how much interest charges add to your loan debt daily.

How does interest on student loans work?

Student loan interest is essentially a cost for borrowing money, usually expressed as a percentage of the amount (principal) you’ve borrowed. This interest accumulates over time, growing the overall cost of your loan.

You can slow the growth by paying more than your minimum required payment. The extra money will go toward the outstanding principal, reducing the amount of money the interest is calculated on.

Can I avoid paying interest on student loans?

Avoiding interest on student loans entirely is difficult, but you can minimize how much you’ll pay for the loan’s life. Enrolling in an automatic payment plan can sometimes earn you a small interest rate reduction.

If you can, paying more than the minimum payment can reduce the principal faster and lower the total interest paid. Another option, if you qualify, is to refinance your student loans at a lower interest rate, which could decrease the total interest you’ll pay over time.

About our contributors

-

Written by Jess Ullrich

Written by Jess UllrichJess is a personal finance writer who's been creating online content since 2009. She specializes in banking, investing, tax relief, and loans. She is a former financial editor at two popular online publications.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.