When money’s tight, waiting until payday isn’t always an option. Cash advance apps let you borrow money within minutes without the interest rates or credit checks that come with traditional payday loans or credit card advances.

But not all apps are created equal. Some only give $20. Others charge hidden fees. And a few require you to sign up for a new bank account to get started.

Our editorial team personally tested these apps to verify security, instant transfer fees, and eligibility requirements to find the best options.

$0 to Dave account

Reviews of the best cash advance apps

Since 2023, LendEDU has evaluated personal finance apps to help readers find the best cash advance solutions. Our latest analysis reviewed 180 data points from 9 apps and financial institutions, with 20 data points collected from each. Here are our top recommendations.

Table of Contents

- Reviews of the best cash advance apps

- Cash advance apps that work with your existing checking account

- EarnIn: Best for Early Paycheck Access Without Fees

- Tilt: Best for Overdraft Protection and Budget Coaching

- Dave: Best for Small Advances and Side Hustle Matching

- Brigit: Great for Credit Monitoring and Building Tools

- Albert: Great for Full Financial Management

- Cleo: Great for AI Financial Assistant

- Mobile banking apps that let you borrow money

- Honorable mention apps that lend you money

- How much does it cost to borrow different amounts?

- Can cash advance apps help if you live paycheck to paycheck?

- What are some emergency fund alternatives if I can’t save right now?

- Is it bad to use cash advance apps every month?

- Are there budgeting apps that help prevent paycheck shortfalls?

- Should I use a credit builder tool instead of a cash advance app?

- When is a personal loan better than a cash advance app?

- How we selected the best cash advance apps

Cash advance apps that work with your existing checking account

These apps connect directly to your current checking account with no need to switch banks. Most offer small paycheck advances with no interest, just a flat fee or optional tip. Here are the best options in 2025.

EarnIn

Why it’s one of the best

EarnIn lets you borrow against your paycheck before payday—up to $300 per day and $1,000 per pay period. There are no mandatory fees, credit checks, or interest. Just connect to your bank, verify your income, and choose standard delivery or Lightning Speed to get your funds within minutes.

LendEDU test run results: Our best experience was with EarnIn—the tester was able to advance themselves $100, with no fees, within 8 minutes after downloading the app. (First Lightning Speed transfer is free for new users.) They were then eligible to advance an additional $150 at a time, and up to $500 total per pay period.

Details

| Max. advance | $1,000 per pay period |

| Fees | $0 for standard delivery (1–3 days); $2.99 for Lightning Speed |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Balance Shield low-balance alerts, get paid up to two days early |

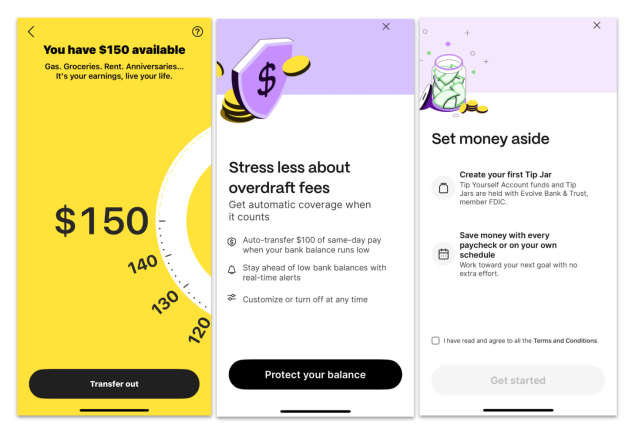

Tilt

Why it’s one of the best

Tilt (formerly Empower) gives you $10 to $400 in instant cash without interest or a credit check. You don’t need to switch banks—but you do need to pay a $8 monthly subscription after your free trial. But that $8 includes instant delivery (it’s not something you have to pay extra for). It also comes with built-in budgeting tools and the option to cancel anytime.

LendEDU test run results: We were able to advance $300 from Tilt within the first 11 minutes after download. It was close to instant, but it cost $9.00. The tester avoided paying the $8 per month subscription while on free trial. Next time they logged in (after paying for the subscription), it allowed our team member to advance $350.

Details

| Max. advance | $400 |

| Fees | $8 per month; 14-day free trial |

| Direct deposit required? | No, but helps with eligibility |

| Credit check? | No |

| Bonus features | Budget tracker, automatic savings, free trial |

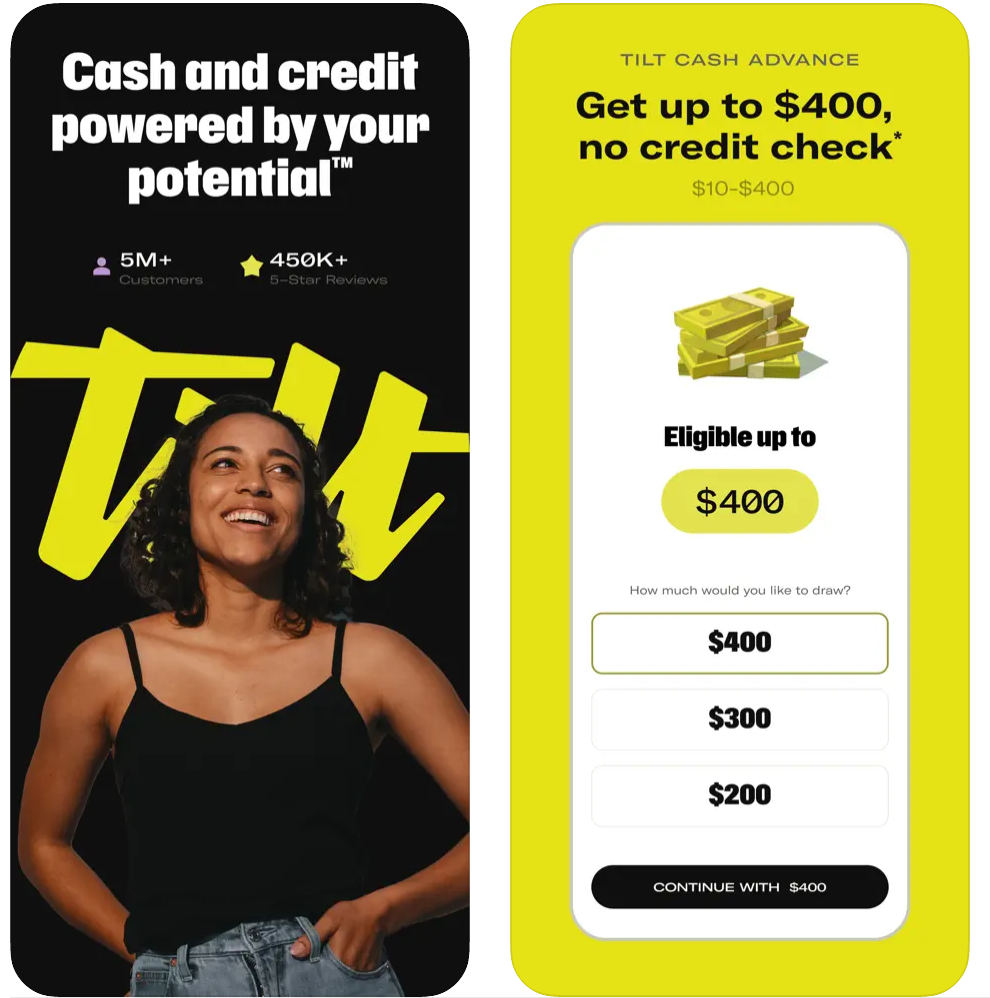

Dave

Why it’s one of the best

Dave offers up to $500 in cash advances with no interest and no credit check. There’s an optional $1/month membership, plus an instant transfer fee if you want your money right away. It also has a “Side Hustle” tool to help you find gig work.

LendEDU test run results: Our team member was eligible for an instant $400 advance with Dave after signup.

Details

| Max. advance | $500 |

| Fees | $0 for 1–3 day delivery to external bank account; 1.5% of transfer amount for 1-hour delivery to external debit card; $0 for instant delivery to Dave Checking account |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Side hustle finder, budgeting tools, Dave Spending account |

Brigit

Why it’s one of the best

Brigit lets you borrow up to $500 with no interest or tips, but you’ll need a $9.99 monthly membership to access cash advances. If Brigit sees you’re at risk of overdrafting, it can send you up to $500 automatically to cover the gap.

It also includes built-in budgeting tools, credit monitoring, and a credit-builder loan to help you improve your financial habits. Advances typically arrive within one to three business days, with an optional fee for faster delivery.

LendEDU test run results: Brigit had trouble verifying personal information, but our team member was approved for a $200 cash advance after connecting their bank account.

Details

| Max. advance | $500 |

| Fees | $9.99 monthly subscription, $0 for 1 – 3 delivery in business days, $0.99 for instant advances |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | 24-mo. credit builder installment loan; Finance Helper for budget insights; Earn and Save feature highlighting local side gigs, paid surveys, and personalized cashback offers |

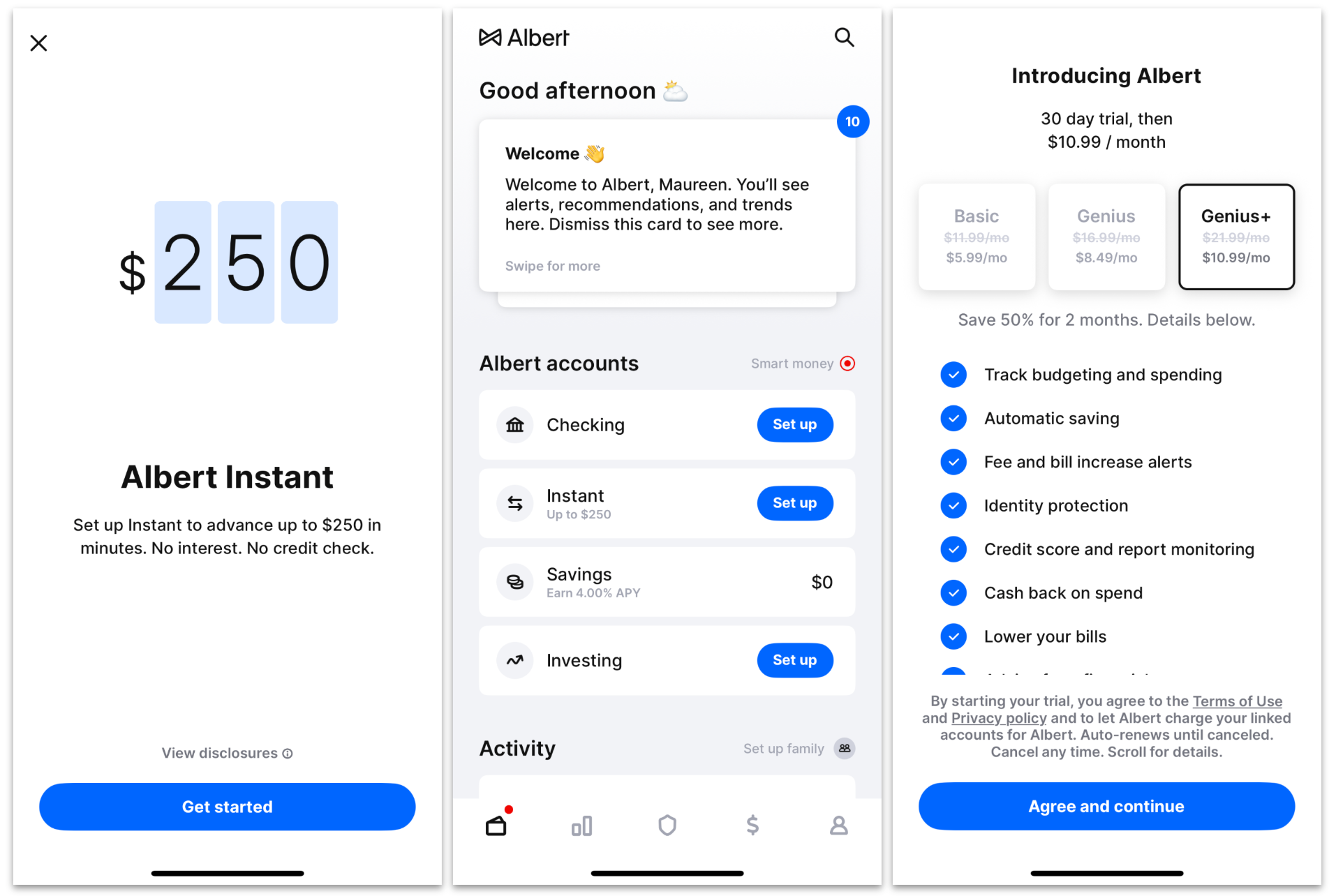

Albert

Why it’s one of the best

Albert lets you borrow up to $250 with no interest or credit check, but you’ll need a monthly membership that typically costs around $9.99 to $14.99. The app also includes automatic savings, budgeting tools, and investing support, making it a good option for those who want a full financial management app rather than just a cash advance.

Details

| Max. advance | $250 |

| Fees | $9.99/mo. for standard subscription; expedited cash advance is $4.99/advance with standard; $14.99/mo. for Genius subscription, which gives you access to cash advances within minutes for free |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Budgeting, banking, automatic savings, cash advances, guided investing, identity protection, credit monitoring, & subscription canceling |

Cleo

Why it’s one of the best

Cleo offers up to $250 in interest-free cash advances (with no credit check) alongside a full suite of AI-driven budgeting, savings and credit-building tools, making it a strong choice for users who want more than just a quick advance and are comfortable paying a monthly subscription to unlock the advance feature.

Details

| Max. advance | $250 |

| Fees | Monthly subscription for $5.99 or $14.99 per month and same-day advance from $3.99 – $9.99 |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | High-yield savings account, credit builder card, AI assistant, free money management tools |

Mobile banking apps that let you borrow money

These platforms are more than just cash advance apps—they’re full-service mobile banks. To qualify for advances, you’ll typically need to open a checking account with them and set up direct deposit. You can’t just link an existing bank account you already have.

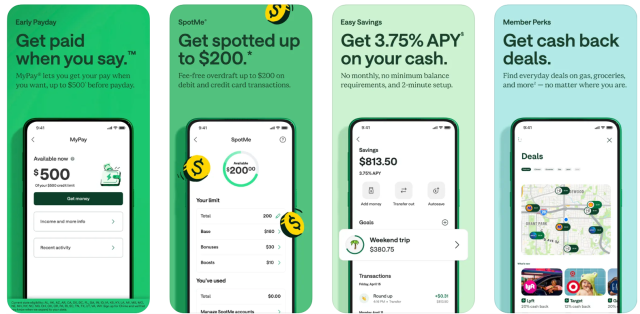

Chime

Why it’s one of the best

Chime’s SpotMe feature functions like a soft safety net. Once you get a qualifying direct deposit, Chime lets you overdraw your account by up to $200 on debit card purchases without fees.

LendEDU test run results: SpotMe worked flawlessly in testing, but it’s not great if you need actual cash in your hand—it only works on debit purchases when you overdraw.

Details

| Max. advance | $200 |

| Fees | None; option to tip |

| Direct deposit required? | Yes ($200+ in qualifying direct deposits) |

| Credit check? | No |

| Bonus features | Early payday, Credit Builder card, savings roundup |

RoarMoney by MoneyLion

Why it’s one of the best

RoarMoney is MoneyLion’s mobile banking account that pairs with Instacash—its cash advance feature. You can get an advance up to $500 by linking an external checking account with regular deposits. But to unlock the full $1,000 limit, you’ll need to open a RoarMoney account and set up direct deposit. There’s no credit check, interest, or monthly fee, and you can choose standard or instant delivery.

LendEDU test run results: In our team’s firsthand trial run, we were able to get a $100 “Turbo” speed advance for a fee of $8.99, and $250 advanced per pay period total. We got the best deal waiting 1-2 days and sending money to our new RoarMoney account (standard delivery speed is free).

A Turbo transfer of a measly $100 to RoarMoney costs $6.99 and to your external account it costs $8.99 (ouch). It informed our team member that they may eventually be approved for up to $500 worth of advances (per pay period) if eligible, with continued use of RoarMoney and transfers.

Details

| Max. advance | $500 (up to $1,000 for RoarMoney + direct deposits) |

| Fees | $0 for standard delivery (1–5 days); $0.49–$8.99 for instant |

| Direct deposit required? | Yes |

| Credit check? | No |

| Bonus features | Credit builder loan, high yield savings, personal loans |

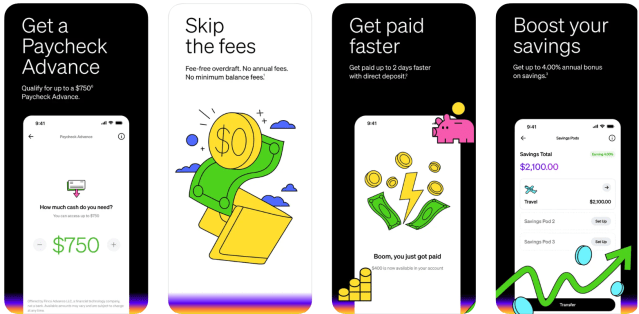

Current

Why it’s one of the best

Current offers up to $750 as a paycheck advance when you set up qualifying direct deposits. You can technically make an unlimited number of advances each month up to your maximum borrowing limit. So you can borrow exactly how much you need without fear of missing out if you need more money later on. You can also link an existing bank account with direct deposits to see if you qualify.

LendEDU test run results: We liked how easy it was to qualify after setting up a direct deposit—just $200 per month gets you access. Once eligible, you can borrow exactly what you need, multiple times a month, up to your $750 limit. The app made it clear how much was available and when repayment would happen.

Details

| Max. advance | $750 |

| Fees | $0 for standard (1-3 days); Fees apply for instant |

| Direct deposit required? | Yes (at least $200/month) |

| Credit check? | No |

| Bonus features | Savings pods, cashback, teen banking |

How much does it cost to borrow different amounts?

Cash advance apps don’t charge interest like credit cards, but that doesn’t mean borrowing is always free. Fees depend on how much you borrow, how fast you need it, and how many transfers you’ll need to reach your goal. Here’s what it typically costs to borrow common cash advance amounts—whether you’re using standard delivery or opting for instant cash.

Borrowing $10, $20, or $30

Need to cover a small gap before payday? Whether it’s a coffee, gas money, or a quick prescription, many cash advance apps offer fee-free borrowing in this range—especially if you’re willing to wait a day or two. Instant transfers usually cost a couple of bucks.

See how delivery speed and fees stack up:

Standard delivery

| App | Cost | Transfers | Speed (bus. days) |

| EarnIn | $0 | 1 | 1–3 |

| Tilt | $0 | 1 | 1–3 (trial) |

| Dave | $0 | 1 | 1–3 |

| Brigit | $9.99 membership | 1 | 1–3 |

| Albert | $9.99–$14.99 membership | 1 | 1–3 |

| Cleo | $0 (with Cleo Plus $5.99/mo) | 1 | 1–3 |

| Chime | $0 | 1 | Instant for debit purchases |

| MoneyLion | $0 | 1 | 1–3 |

| Current | $0 | 1 | 1–3 |

Instant delivery

| App | Cost | Transfers | Speed |

| EarnIn | $1.99 – $3.99 | 1 | Minutes |

| Tilt | $2.00 (trial), $10 w/sub | 1 | Minutes |

| Dave | $1.99 – $2.50 | 1 | Minutes |

| Brigit | $0.99 (plus $9.99 sub.) | 1 | Minutes |

| Albert | $4.99 (with $9.99–$14.99 sub.) | 1 | Minutes |

| Cleo | $3.99 (with Cleo Plus $5.99/mo) | 1 | Minutes |

| Chime | $0.00 | 1 | Instant for debit purchases |

| MoneyLion | $5.99 | 1 | Minutes |

| Current | Varies | 1 | Minutes |

Read our full guide to what to do if you need $10, $20, or $30 right now

Borrowing $50

Fifty dollars can make or break your week when you’re living paycheck to paycheck. This amount is available from nearly all apps in our list, often with no fees for standard delivery and modest fees for instant cash.

Here’s what it costs to borrow $50:

Standard delivery

| App | Cost | Transfers | Speed (bus. days) |

| EarnIn | $0.00 | 1 | 1–3 |

| Tilt | $0.00 | 1 | 1–3 (trial) |

| Dave | $0.00 | 1 | 1–3 |

| Brigit | $9.99 membership | 1 | 1–3 |

| Albert | $9.99–$14.99 membership | 1 | 1–3 |

| Cleo | $0 (with Cleo Plus $5.99/mo) | 1 | 1–3 |

| Chime | $0.00 | 1 | Instant for debit purchases |

| MoneyLion | $0.00 | 1 | 1–3 |

| Current | $0.00 | 1 | 1–3 |

Instant delivery

| App | Cost | Transfers | Speed |

| EarnIn | $3.99 | 1 | Minutes |

| Tilt | $2.00 (trial), $10 w/sub | 1 | Minutes |

| Dave | $2.50 | 1 | Minutes |

| Brigit | $0.99 (plus $9.99 sub.) | 1 | Minutes |

| Albert | $4.99 (with $9.99–$14.99 sub.) | 1 | Minutes |

| Cleo | $3.99 (with Cleo Plus $5.99/mo) | 1 | Minutes |

| Chime | $0.00 | 1 | Instant for debit purchases |

| MoneyLion | $5.99 | 1 | Minutes |

| Current | Varies | 1 | Minutes |

Read more about how to borrow $50 instantly with loan apps

Borrowing $100

This is one of the most popular cash advance amounts—and for good reason. It’s enough to cover a utility bill, groceries, or a tank of gas. Most apps allow $100 advances, but fees start to vary more at this level, especially for instant transfers.

Here’s what you’ll pay to get $100 quickly (or for free, if you wait):

Standard delivery

| App | Cost | Transfers | Speed (bus. days) | |

| EarnIn | $0 | 1 | 1–3 | |

| Tilt | $0 | 1 | 1–3 (during free trial) | |

| Dave | $0 | 1 | 1–3 | |

| Brigit | $9.99 membership | 1 | 1–3 | |

| Albert | $9.99–$14.99 membership | 1 | 1–3 | |

| Cleo | $0 (with Cleo Plus $5.99/mo) | 1 | 1–3 | |

| Chime | $0 | 1 | Instant for debit purchases | |

| MoneyLion | $0 | 1 | 1–3 | |

| Current | $0 | 1 | 1–3 |

Instant delivery

| App | Cost | Transfers | Speed |

| EarnIn | $0 (up to $100) | 1 | Minutes |

| Tilt | $5.00 (trial), $13 w/sub | 1 | Minutes |

| Dave | $5.00 | 1 | Minutes |

| Brigit | $0.99 (plus $9.99 sub.) | 1 | Minutes |

| Albert | $4.99 (with $9.99–$14.99 sub.) | 1 | Minutes |

| Cleo | $3.99 (with Cleo Plus $5.99/mo) | 1 | Minutes |

| Chime | $0.00 | 1 | Instant for debit purchases |

| MoneyLion | $8.99 | 1 | Minutes |

| Current | Varies | 1 | Minutes |

Borrowing $200

Two hundred dollars can be a stretch if your chosen app has a lower advance cap or charges more for fast delivery. Some services may split this across multiple transfers, so it’s worth comparing fees and speed carefully.

See how much it’ll really cost to get $200 from each app:

Standard delivery

| App | Cost | Transfers | Speed (bus. days) |

| EarnIn | $0.00 | 2 | 1–3 |

| Tilt | $0.00 | 1 | 1–3 (trial) |

| Dave | $0.00 | 1 | 1–3 |

| Brigit | $9.99 membership | 1 | 1–3 |

| Albert | $9.99–$14.99 membership | 1 | 1–3 |

| Cleo | $0 (with Cleo Plus $5.99/mo) | 1 | 1–3 |

| Chime | $0.00 | 1 | Instant for debit purchases |

| MoneyLion | $0.00 | 1 | 1–3 |

| Current | $0.00 | 1 | 1–3 |

Instant delivery

| App | Cost | Transfers | Speed |

| EarnIn | $3.99 (after first $100) | 2 | Minutes |

| Tilt | $5.00 (trial), $13 w/sub | 1 | Minutes |

| Dave | $5.00 | 1 | Minutes |

| Brigit | $0.99 (plus $9.99 sub.) | 1 | Minutes |

| Albert | $4.99 (with $9.99–$14.99 sub.) | 1 | Minutes |

| Cleo | $3.99 (with Cleo Plus $5.99/mo) | 1 | Minutes |

| Chime | $0.00 | 1 | Instant for debit purchases |

| MoneyLion | $8.99 | 1 | Minutes |

| Current | Varies | 1 | Minutes |

Borrowing $500

At this level, not all cash advance apps qualify. Some—like EarnIn—may require multiple smaller transfers to reach $500. Fees also tend to scale, especially if you opt for instant delivery.

Use the tables below to find the lowest-cost way to borrow $500:

Standard delivery

| App | Cost | Transfers | Speed (bus. days) |

| EarnIn | $0.00 | 4 | 1–3 |

| Dave | $0.00 | 1 | 1–3 |

| MoneyLion | $0.00 | 1 | 1–3 |

| Current | $0.00 | 1 | 1–3 |

Instant delivery

| App | Cost | Transfers | Speed |

| EarnIn | $15.96 | 4 | Minutes |

| Dave | $5.00 | 1 | Minutes |

| MoneyLion | $8.99 | 1 | Minutes |

| Current | Varies | 1 | Minutes |

Borrowing $1,000

At this level, MoneyLion is the only app on our list that supports borrowing up to $1,000—and that’s only if you set up a RoarMoney account and direct deposit. Standard delivery is free, but if you need funds faster, you can pay up to $8.99 for expedited access.

Here’s what it costs to borrow $1,000 with MoneyLion, based on delivery speed:

Standard delivery

| App | Cost | Transfers | Speed (bus. days) |

| MoneyLion | $0.00 | 1 | 1–3 |

Instant delivery

| App | Cost | Transfers | Speed |

| MoneyLion | $8.99 | 1 | Minutes |

Can cash advance apps help if you live paycheck to paycheck?

The best cash advance apps can help if you’re living paycheck to paycheck—but they’re more of a Band-Aid than a cure. Cash advance apps might help cover surprise bills or timing gaps between paychecks, but if you’re using them regularly, it’s worth looking into budgeting tools, credit builder apps, or ways to increase your income.

It’s important to understand how quickly the fees and costs of short-term loans can add up. Even if the loan amount or flat fee seems small, the APR when calculated over such a short period, can result in an incredibly high effective interest rate. On top of that, some lenders charge additional fees like processing, account setup, or late payment penalties. This is why cash advances should only be used in true emergencies, not as a regular way to cover income gaps or manage everyday expenses.

What are some emergency fund alternatives if I can’t save right now?

If you’re not in a position to save money, look for resources that don’t rely on your current bank balance. That could include local mutual aid groups, nonprofit lending circles, or government benefit programs to help you get back on your feet.

Is it bad to use cash advance apps every month?

It’s not ideal. Frequent use could signal that your income doesn’t cover your expenses, which can lead to long-term financial stress. Instead of relying on apps every month, consider building a budget or exploring side income options.

If you’re in an emergency and don’t have any savings to fall back on, a low-cost cash advance with little to no fees might be a helpful short-term fix. Just make sure you can pay it back by your next paycheck or when it’s due. This isn’t something to rely on regularly; it should really just be for those rare, urgent situations.

Are there budgeting apps that help prevent paycheck shortfalls?

Yes—budgeting apps like YNAB and Rocket Money can help you track bills and avoid surprises. Some even send alerts when your account is low or a large expense is coming up.

Should I use a credit builder tool instead of a cash advance app?

If your main goal is to improve your credit, yes. Tools like secured cards, credit builder loans, and credit-builder apps like Self or Kikoff can build credit over time—something most cash advance apps don’t do.

When is a personal loan better than a cash advance app?

If you need to borrow more than a few hundred dollars and can qualify, a personal loan is often a better choice. You’ll typically get a lower APR, longer repayment period, and fixed monthly payments.

How we selected the best cash advance apps

Since 2023, LendEDU has evaluated personal finance apps to help readers find the best cash advance solutions. Our latest analysis reviewed 180 data points from 12 apps and financial institutions, with 20 data points collected from each. This information is gathered from company websites, online applications, public disclosures, customer reviews, and direct communication with company representatives.

These data points are organized into broader categories, which our editorial team weights and scores based on their relative importance to readers. These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

Higher star ratings are ultimately awarded to companies that are able to advance enough money to cover common expenses without mandatory fees and delays.

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.