Our take: Cash App Borrow offers fast access to small loans with a simple 5% flat fee and no credit check, making it convenient for short-term needs. But eligibility is inconsistent, and frequent borrowing can get expensive fast.

Short-term loan

- Instant access to funds if you’re eligible

- No credit check and no impact on your credit score

- Transparent terms, including a clear flat fee

- Not all Cash App users can access Borrow, and eligibility isn’t always clear

- If you have enabled autopay and your Cash App balance runs out, the app may withdraw money from your linked bank account, potentially creating an overdraft

- 5% for a four-week loan is relatively high APR

| Loan amount | $20 – $400 |

| Availability | Select users in eligible states |

| Repayment term | 4 weeks (lump sum or installments) |

| Cost | 5% flat fee (no interest if on time) |

| How to qualify | Based on state, Cash Card usage, direct deposit, and account history |

Cash App Borrow is a tool that lets eligible users take out short-term, small loans directly through Cash App. In this Cash App Borrow review, we’ll break down how it works, who qualifies, and whether it’s worth trying. Spoiler alert: It’s fine for the occasional shortfall, but we’d caution against over-relying on it.

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Table of Contents

- How Cash App Borrow works

- Eligibility requirements

- How much can you borrow?

- Repayment terms

- Fees and interest

- How to access the Borrow feature

- Is the Borrow feature available everywhere?

- Pros and cons

- Who could benefit from Cash App Borrow?

- Other Cash App features

- Alternatives to Cash App Borrow

- Is Borrow worth it?

How Cash App Borrow works

This in-app lending option can give you access to instant, short-term personal loans issued through Cash App’s banking partner, Square Financial Services (SFS). Block is the parent company of both Cash App and SFS.

Borrowing through Cash App requires no credit check and thus won’t affect your credit score. The loans come with a 5% flat fee and are usually subject to repayment within four weeks. In case of a late repayment, Cash App may automatically pull funds from your account balance or any incoming deposits.

Check out our full Cash App review.

Eligibility requirements

Eligibility requirements for Cash App Borrow are unclear. According to some users on Reddit, the Borrow feature doesn’t show up on their app interface even though they “have been using Cash App for years,” whereas for others, it has unlocked within months.

When we reached out to Cash App, a service rep told us that “there isn’t a solid ‘the customer does this and it automatically unlocks’ type of eligibility.” Nevertheless, you’re likelier to be able to access Borrow if you:

- Use Cash App regularly

- Have an established history of direct deposits into the app

Cash App added that it “continue(s) to work to allow more customers to use the product.”

How much can you borrow?

If you have access to this loan option, you can typically take out somewhere from $20 to $400. The exact amount depends on your account history. Overall, this feature is designed for minor, temporary cash flow gaps as an alternative to predatory payday loans.

Repayment terms

The standard repayment term for Cash App Borrow is four weeks. You can also repay earlier in part or in full anytime.

Failing to repay the loan on time could trigger penalties like late fees. The app may also remove the Borrow feature from your interface and, in some cases, send the debt to collections.

Fees and interest

Cash App charges a 5% flat fee on loans. Any late payments will cost you an extra 1.25% a week on the outstanding amount.

For example, if you borrow $100, you’ll need to repay $105. If you’re a week late in repaying, the amount you owe increases by 1.25%. And 1.25% of $105 is $1.31, so you’d owe $106.31.

How to access the Borrow feature

To see whether you have access to Cash App Borrow, navigate to Banking → Borrow within the app. If you qualify for an in-app loan, the option will show up automatically. If you can’t see the feature, you might not be eligible for Borrow yet.

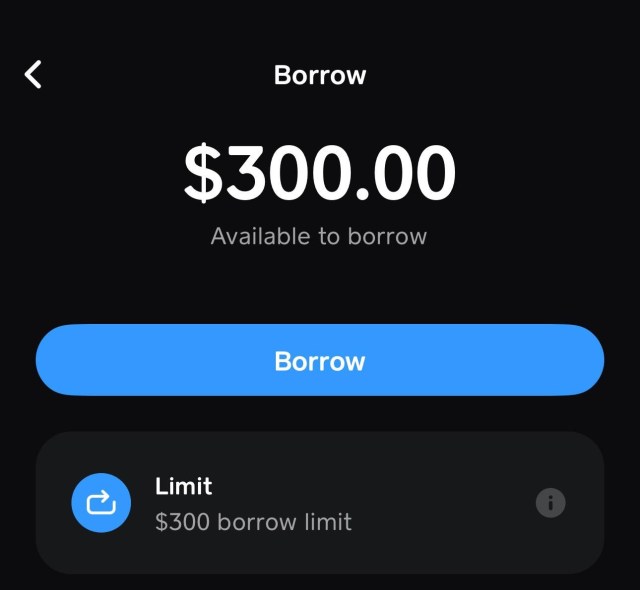

Once you tap Borrow, you will see something like this:

Don’t have access to Borrow yet? Check out these Cash Advance Apps That Work With Cash App.

Is the Borrow feature available everywhere?

According to the Cash App Borrow loan agreement, “Loans are not available in all states.” However, a service rep informed us that “The Borrow feature is widely available in all U.S. states, but not to all U.S. residents.”

We realize this is confusing. The easiest way to confirm your eligibility for Borrow is to look for the feature within your app interface.

Pros and cons

Pros

-

Instant access to funds if you’re eligible

-

No credit check and no impact on your credit score

-

Transparent terms, e.g., a clear flat fee

Cons

-

Not all Cash App users can access Borrow, and eligibility isn’t always clear

-

If you have enabled autopay and your Cash App balance runs out, the app may withdraw money from your linked bank account, potentially creating an overdraft

-

5% for a 4-week loan is relatively expensive when you consider it in APR terms

To elaborate on the last point, annual percentagerate (APR) is calculated as:

(Fee / Loan amount) x (52 / Number of weeks to repay loan) x 100

At a 5% fee, this would be 65% APR.

0.05 × (52/4) = 0.05 × 13 = 0.65

That’s much more affordable than payday loans, which average an APR of about 400%, but still expensive compared to mainstream loans and credit lines, where you may expect 8% to 36% APR, depending on your credit history and income.

Who could benefit from Cash App Borrow?

Cash App Borrow can be helpful if you:

- Use it as an occasional, short-term cash stopgap

- Are confident you can repay the loan on time

- Are a responsible borrower with healthy money management habits

- May not qualify for traditional credit

On the other hand, Borrow isn’t the best option if:

- You need long-term credit

- You struggle to maintain balanced cash flow

- You find yourself borrowing repeatedly and depleting your monthly income

Other Cash App features

Besides Borrow, Cash App works as an all-in-one peer-to-peer cash transfer service and banking app with a user-friendly interface. You can use it for:

- Instant money transfers

- Building up and managing savings

- Direct deposits

- Investing in stocks

- Bitcoin transactions

Alternatives to Cash App Borrow

If you aren’t eligible for Borrow or want to explore other quick funding options, consider a cash advance. Unlike Borrow, which offers a small short-term loan, these apps can provide early access to a portion of your paycheck.

Here’s how Cash App Borrow stacks up against three of our top-rated cash advance apps:

Max. advance

$400

$1,000

$400

$500

Instant fee

None

5% flat fee regardless of transfer time 5% flat fee regardless of transfer time$2.99

Subscription

Included in $8/month fee1.5% of amount for external card; $0 to Dave account

Delivery speed

Several days

Transfer to an external bank account can take a few hours to a few days, depending on your bank’s processing speedMinutes with instant or 1 to 3 days for standard

Instant

Minutes with instant or 1 to 3 days for standard

Cash App Borrow vs. EarnIn

With EarnIn, you can borrow up to $300 per day (capped at $1,000 per pay period) against your upcoming paycheck. The app runs no credit checks and charges no interest or mandatory fees, but instant transfers will cost you from $2.99 to $5.99.

Unlike Cash App Borrow, which sets a four-week repayment period, EarnIn automatically deducts your advance on payday. Borrowers need to provide employment verification and a linked bank account.

Cash App Borrow vs. Tilt

Tilt offers both cash advances (up to $400) and a line of credit (up to $1,000). Unlike Cash App Borrow, Tilt doesn’t attach a fee to the advance itself. Instead, it charges a flat $8 monthly fee, which covers instant delivery.

Cash App Borrow vs. Dave

Dave lets you access up to $500 with no credit checks or interest. The monthly membership to unlock this option costs up to $5. The app doesn’t charge a fee on the advance itself, which is its main advantage compared to Cash App Borrow.

Is Borrow worth it?

Cash App Borrow can be a handy solution for occasional cash shortages. However, repeated borrowing may get expensive. Strategic budgeting and saving up for a rainy day can help avoid becoming dependent on short-term loans. If you must borrow, compare several microloans and cash advance options to make sure you’re getting a fair deal.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

About our contributors

-

Written by Anna Twitto

Written by Anna TwittoAnna Twitto is a money management writer passionate about financial freedom and security. Anna loves sharing tips and strategies for smart personal finance choices, saving money, and getting and staying out of debt.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.