A college degree can fast-track you to a job with a higher salary, but like most things in life, you must spend money to make money. And when it comes to college, you might have to spend a lot of money. According to the Education Data Initiative’s report published in December 2024, the average cost of a single year of college in the United States is $38,270.

But that doesn’t mean you must give up hope on a college education.

In case you’ve exhausted your federal financial aid, school aid package, and scholarship opportunities, and are currently in need of funding for school, here’s our list of top-rated private student loan lenders: Best Private Student Loans in 2026: Reviewed and Ranked.

Below, we’ll explore how to pay for college with no money (and maybe without even taking on debt).

| Company | Rates (APR) | Rating (0-5) |

|---|---|---|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

3.29% – 15.99% fixed-rate APR w/ autopay included |

|

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

Table of Contents

- 1. Apply for financial aid

- 2. Seek scholarships and grants

- 3. Consider work-study programs

- 4. Explore community college options

- 5. Leverage employer tuition assistance

- 6. Use military benefits

- 7. Examine income-share agreements (ISAs)

- 8. Consider online learning platforms

- 9. Investigate tuition-free colleges

- 10. Look into international study options

1. Apply for financial aid

The number one way to pay for college with no money is to apply for financial aid. While it’s not guaranteed you’ll get a full ride, it’s the official process for obtaining need-based aid. (Schools may supplement your need-based aid with merit-based scholarships, depending on your academic resume.)

Start by filling out the FAFSA (Free Application for Federal Student Aid), then wait to see what kind of aid you get offered by each school. And don’t wait too long—each year, there’s a FAFSA deadline you’ll need to meet to qualify for aid. Common types of financial aid from schools include:

- Grants

- Scholarships

- Work-study programs

- Federal Direct Loans

In addition to federal loans, you can apply for private student loans to fill the gap. This allows you to attend college without spending a dime now—and you’ll repay any loans once you graduate and, theoretically, have a job with income to cover the payment.

2. Seek scholarships and grants

One of the core components of your financial aid package is the Pell Grant—money you don’t have to pay back, awarded to you based on your family’s financial need. Similarly, colleges and universities may award specific scholarships to help reduce the cost of school for you, often based on your academic or athletic record.

But the financial aid letter is only the start. Outside organizations may also award scholarships and private grants, either based on your academic performance or affiliation with a specific group or community, including:

- Organizations in your field of study

- Religious organizations

- Community groups

- Ethnic-based organizations

- Your parents’ employer (or your employer, if you already have a job)

You can use websites such as CareerOneStop and Fastweb to search for scholarships online or contact your school’s financial aid office for further assistance. Here are some unique college scholarships to start your search.

3. Consider work-study programs

Your financial aid package might also include employment through a federal work-study program. These are part-time jobs available to undergraduate and graduate students with greater financial need.

Jobs could be on or off campus and ideally related to the major you declare—which can give you real-world experience in your chosen field well before you graduate. These jobs are also designed to be flexible with your class schedule.

Generally, you’ll earn the federal minimum wage in a work-study program, but this can vary depending on the type of job. The money goes to you, not directly to the school, to cover tuition—but the idea is that you’ll use this money to pay for college.

It’s possible you can find a better-paying job elsewhere, but it may be less flexible with your schedule. On top of that, you should tread lightly with any kind of work during school: You should prioritize your grades above all else. Working too much could impact your academics, socialization, and physical and mental health.

4. Explore community college options

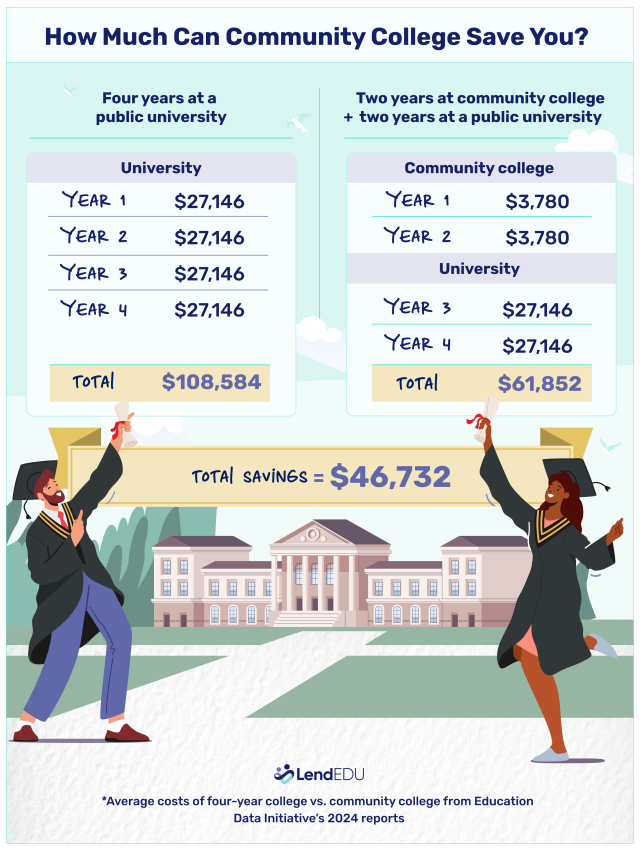

Unfortunately, community college isn’t free, so you’ll technically need to spend money to attend. However, the average cost of community college in 2024 was roughly $1,890 per semester, according to the Education Data Initiative—dramatically lower than the average annual cost of college at a four-year institution, $27,146.

Many students opt to save money by knocking out their general education credits at a community college and then switching to a four-year school to finish their degree.

While attending community college for your general education credits isn’t a true strategy to pay for college with no money, the more flexible schedule could allow you to explore a part-time job while going to school, meaning you’ll potentially have the money to cover the cost of school—and then some.

You can still finance community college despite the lower price tag. Here are the best student loans for community college this year.

5. Leverage employer tuition assistance

Already have a job? See if your employer offers tuition assistance. This is a popular benefit; 46% of employers offer it, according to the Society for Human Resource Management’s 2024 Employee Benefits study.

How the programs work varies by employer: Some may bankroll your education upfront; others may reimburse you upon course completion. Companies may also only offer tuition assistance if you’re enrolled in a program relevant to your role; some may limit how much aid they offer per year, and some may require you to pay back the tuition if you leave the company within a stated time period.

Here are some companies that currently offer tuition assistance, many to both full- and part-time employees:

- Amazon

- AT&T

- Chipotle

- JetBlue

- Starbucks

- Target

- T-Mobile

- UPS

- Walmart

6. Use military benefits

You can also rely on the U.S. military to help pay for college, as long as you’re part of a military branch. How much the military covers depends on your branch and status:

- Active-duty members can get up to $4,500 a year.

- Eligible service members, veterans, and family members can get assistance through the GI Bill.

- Reservists can also get assistance, as well as students who participate in ROTC programs or attend a military academy.

7. Examine income-share agreements (ISAs)

Income-share agreements (ISAs) were once considered an innovative alternative to student loans, but they’ve become less common in recent years. The Consumer Financial Protection Bureau (CFPB) has scrutinized them for deceptive practices, such as misrepresenting the nature of the agreements and failing to provide required disclosures.

Consequently, fewer schools now offer ISAs, but some programs still exist. An income-share agreement is a contract in which a student receives funding from a university or private lender to pay for school. Instead of making fixed payments like a traditional student loan, the borrower agrees to repay a percentage of their future income for a set number of years after graduation. The repayment amount varies based on earnings—if you earn more, you pay more, and if you earn less, your payments decrease.

Unlike student loans, ISAs typically don’t require a credit check, making them an option for students who lack strong credit or a cosigner. Eligibility is often based on academic performance and field of study, with lenders prioritizing degrees expected to lead to higher salaries.

While ISAs can provide access to funding for those who don’t qualify for traditional loans, it’s important to carefully review the repayment terms—some agreements may result in higher overall costs compared to federal or private student loans.

8. Consider online learning platforms

Who says you have to go to college to go to college? Accredited online degree programs are a practical alternative to in-person education at traditional colleges and universities — and they’re cheaper, too. The Education Data Initiative found getting an online degree saves you $30,545 over four years.

And that doesn’t include other savings, such as gas, parking, and rent (if living with parents). While you’ll still technically need some money to pay for an online degree, it’s much more affordable—and you’ll have more free time to work a part-time job or side hustle during college to pay for your degree.

If you’re not seeking a degree but just want to expand your knowledge, you can also find free online courses in various subjects. Some of the country’s most famous schools offer such free courses, including:

- Harvard

- Massachusetts Institute of Technology (MIT)

- Brown University

9. Investigate tuition-free colleges

Across more than 30 states, there are several colleges and universities—some even Ivy League—offering tuition-free degrees, according to Best Colleges. Of course, tuition isn’t free for everyone. Often, these programs are available to students from low-income families; in fact, multiple Ivy League schools offer free tuition to students whose families make under a specific threshold (assuming you can get accepted into the school), including:

Depending on the school, there may also be free tuition opportunities for students pursuing a degree in a field currently experiencing a labor shortage, as well as Native American students.

10. Look into international study options

Some countries allow international students, including those from the United States, to study for free. Germany and Iceland are two of the most notable countries, though you may encounter other fees and a higher cost of living to attend—not to mention a language barrier.

Other countries may not offer free tuition to international students, but many in Europe, like the Nordic countries, do offer much more affordable education.

When helping someone with a very tight budget plan to attend college, we would likely do a few things:

- We would start by re-aligning assets to help improve need-based financial aid.

- Further, if we can work with a student early enough, we encourage them to participate in school activities and improve their grades so they have a better chance of getting scholarships and grants from colleges.

- It is also important to consider the cost of paying student loans so the student can decide if it makes sense to pursue.

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Michael Menninger, CFP®

Reviewed by Michael Menninger, CFP®Michael Menninger, CFP®, is the founder and president of Menninger & Associates Financial Planning. He provides his clients with financial products and services, always keeping their individual needs foremost in mind.