Refinancing student loans is like leveling up your finances. It lets you cash in on the progress you’ve made with your credit score, income, and other debts to lock in a better interest rate or more favorable terms.

An impressive credit score can help you secure a student loan refinance, but refinancing can lower your credit score. Let’s take a look at why this happens, whether the sacrifice is worth it, and how you can limit the impact refinancing has on your credit score.

Table of Contents

How refinancing student loans affects your credit score

When you refinance a student loan, the lender will run a hard inquiry on your credit report. Each hard inquiry can cause up to a five-point drop in your credit score, affecting your score for about a year.

When you complete a refinance, the old loan is closed, and a new loan appears on your credit report. This affects the average age of your credit accounts, which constitutes 15% of your credit score.

We’ll explain this further below.

Hard credit check

Lenders use information from your credit report, including whether you pay bills on time and how much credit you’re using, to determine whether you meet their lending criteria and how responsible you are as a borrower. They use the information on your credit report to determine the interest rate and terms they offer.

During a hard credit check—a credit inquiry—a lender requests a copy of your credit report from a credit bureau to determine whether you’re a suitable candidate for a loan.

The credit bureaus then mark the request on your credit report. Hard inquiries show that you’re looking for a loan, and each hard inquiry can cause your credit score to decrease by up to five points.

Multiple hard inquiries in a short period can signify that you rely on credit to fund your lifestyle.

“Instead of hard credit checks when you’re shopping for a student loan, check with lenders that offer prequalification, so it’s only a soft inquiry.”

Rod Griffin, Senior director of public education and advocacy, Experian

Close old loans

When you refinance a student loan, your old loan is closed, and a new loan is opened in its place. Griffin said closing old accounts can cause a minor ding in your credit score, but this will go away over time.

Open a new loan

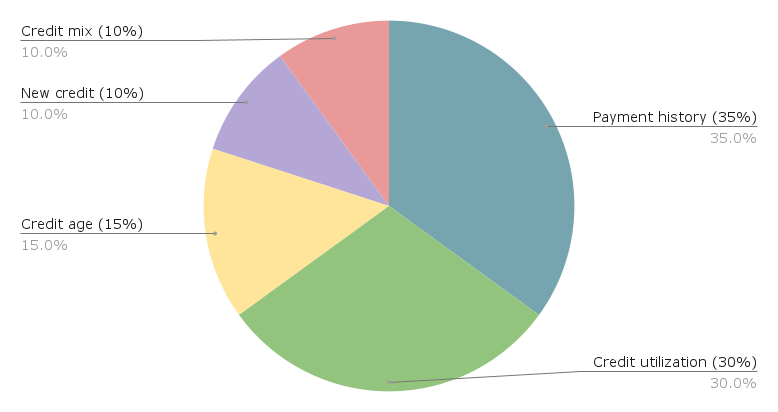

The age of all your credit accounts is compiled into the average age, which makes up 15% of your credit score. The older the average age, the better your credit score. Lenders like to see a long credit history because it shows that you can be a responsible borrower over an extended period.

Also, any time you open a new account, you must prove you can make payments on time every month. Once you’ve done this for a few months, the credit bureaus will see that you’re a responsible borrower.

Payment history is the largest component of your credit score. The best way to maintain a good credit score is to pay your bills on time.

How to limit the impact of refinancing on your credit

Refinancing can mean saving hundreds or even thousands in interest over the life of a loan. Even if your credit score drops by a few points, it will often bounce back. You can minimize the effect of refinancing on your credit report while reaping the rewards of refinancing.

1) Prequalify before submitting a full application

Before you complete a loan application, prequalify with different lenders. Prequalifying means lenders don’t run a full credit check and instead compile enough information to give you an interest rate estimate. Prequalifying only counts as a soft credit check and won’t affect your credit score.

They may appear on your credit report, but credit bureaus don’t include soft inquiries when calculating your credit score. After you prequalify, choose the lenders with the best terms, and complete a formal application.

>> Read more: Best student loan refinance companies

2) Make sure you can meet your repayment obligations on the new refinance loan

When you choose to refinance student loans, compare the different repayment terms. Most lenders offer terms ranging from five to 20 years, with lower interest rates for shorter terms and higher rates for longer terms. Choose a monthly payment you’re comfortable with.

3) Continue repaying your old student loans until the refinance is complete

Refinancing can take a few weeks to process, depending on the lender. In the meantime, keep making payments with your current lender. Missing a payment can have a huge impact on your credit score.

Once the refinance is complete, note the new due date on your calendar. If possible, set up automatic payments to ensure you don’t miss a payment on your new loan. Most student loan servicers provide an interest rate discount when you sign up for autopay, so you’ll save money too.

Does the credit impact of refinancing benefit you in the long run?

You don’t need a perfect credit score to access the best interest rates and loan terms. You should also expect your credit score to fluctuate over time. However, if you pay on time and keep your overall credit use low, your score will remain high.

If you plan to apply for a mortgage at some point, refinancing your student loans could increase the amount you qualify for.

Debt-to-income ratio (DTI) is crucial for mortgage approval.

Total monthly debt payments / Monthly gross income

Here’s an example calculation.

- Current situation:

- Monthly student loan payment: $400

- Annual gross income: $45,000

- Monthly gross income: $3,750 ($45,000 / 12)

- DTI: $400 / $3,750 = 10.67%

Max DTI for most lenders: 45%

- This includes future mortgage payments.

- $3,750 x 45% = $1,687.50

- Current maximum monthly mortgage: $1,287.50 ($1,687.50 – $400)

Impact of refinancing your student loan

- New student loan payment: $325

- New maximum monthly mortgage: $1,362.50 ($1,687.50 – $325)

By refinancing your student loans to a lower monthly payment, you could qualify for a higher mortgage amount.

When refinancing your student loans may hurt you

In some cases, refinancing your student loans could cost you more money and end up harming you financially.

Read below to see when you should avoid refinancing.

If you’re taking out a mortgage or personal loan

If you’re planning to apply for a mortgage or personal loan, you should avoid doing anything that will affect your credit score, such as refinancing your student loans. Refinancing can cause a slight drop in your score, and that drop could result in a higher interest rate on your new loan.

This may have a small impact if you’re taking out a personal or auto loan, but it can have a much bigger effect if you’re taking out a mortgage or other large loan. Griffin says you should wait three to 12 months after refinancing your student loans to apply for a mortgage. This will provide ample time for your credit score to bounce back.

If you’re interested in taking out a mortgage now, wait until after you’ve closed on the home to refinance your student loans.

However, if you have an excellent credit score and refinance your student loans, the impact may be small enough that delaying taking out a mortgage is unnecessary. Be sure to check your credit score after refinancing to see whether you should wait a few months before applying for a mortgage.

If you need access to federal student loan protections

If you refinance your federal loans, they will become private loans. Federal student loans come with certain benefits that don’t exist with private student loans. If you decide to refinance these loans, you will lose access to the benefits listed below with no way to undo the decision.

Here are the benefits you give up by refinancing federal student loans:

- Income-driven repayment plans: Your payments are based on your income and family size. If you stick with an income-driven repayment plan for 20 or 25 years, you may have the rest of your loan balance forgiven.

- Loan forgiveness programs: The federal government offers loan forgiveness programs only available for federal loans. The Public Service Loan Forgiveness (PSLF) program offers loan forgiveness to borrowers after 10 years of making payments and working for a qualifying nonprofit or government organization. If you are a teacher, social worker, or healthcare worker, you may qualify for PSLF.

- More deferment and forbearance options: Federal student loans provide more deferment options, including deferred interest for some borrowers. For example, the federal government suspended interest on student loans when the COVID-19 pandemic started, and many private lenders offered six to 12 months of deferment with interest still accruing. If you lose your job, the deferment and forbearance options of your federal loans can make a massive difference for your financial health.

If you’ve used any of these benefits in the past or you think you might in the future, avoid refinancing. And if you’re eligible for loan forgiveness, you may save more by sticking with your federal loans.

>> Read more: Should you refinance your student loans?

About our contributors

-

Written by Zina Kumok

Written by Zina KumokZina Kumok is a personal finance writer dedicated to explaining complex financial topics so real people can understand them. As a former newspaper reporter, she has covered everything from murder trials to the Final Four.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.