If you’ve ever stared at your student loan statement and wondered whether there’s a smarter, faster, or more affordable way to pay it off, you’re not alone.

Maybe you’ve heard about refinancing and how it could lower your interest rate or help you drop a cosigner. Maybe you’re hoping it could finally make those monthly payments feel a little less suffocating.

But refinancing isn’t a one-size-fits-all solution. Whether it’s the right move for you depends on a mix of factors: your credit score, income, type of loans, and where you are in your repayment journey. And for every “yes, you can refinance,” there’s a “well, it depends.”

In this guide, we’ll unpack exactly what lenders look for, when refinancing is (and isn’t) possible, and how to weigh the pros and cons before you make the leap.

Table of Contents

Eligibility requirements

You must meet specific eligibility criteria to refinance your student loans. Each lender has its unique requirements, but here are several factors to consider:

Credit score

Your credit score plays a vital role in eligibility. Lenders’ credit requirements vary, but we’ve collected those from four of our top lenders:

| Lender | Min. credit score | How does minimum compare? |

|---|---|---|

| SoFi® | 650 | Standard |

| Earnest | 650 | Standard |

| ELFI | 680 and at least 36 months of credit history | Stringent |

| Nelnet Bank | 650 | Standard |

Income

Lenders look for stable income to ensure you can manage payments. Your chosen lender might want a consistent employment history or a steady income from your business. Many lenders we’ve researched don’t disclose a minimum income requirement.

Self-employed borrowers can struggle providing this income verification. Find out more about refinancing if you’re self-employed below.

Degree

Did you graduate? Some lenders may only refinance loans for graduates, while others might be more flexible. Read more about refinancing without a degree below.

Loan type

It will help to know whether your loans are from the U.S. government (via a federal loan servicer) or a private lender. If you’re unsure who owns your loans or what type you have, review your account statements or contact your servicer.

Can you refinance private student loans?

Refinancing private student loans tends to be more straightforward. Various lenders offer this service, and the decision often depends on factors including your credit score, income, and degree status.

Can you refinance federal student loans?

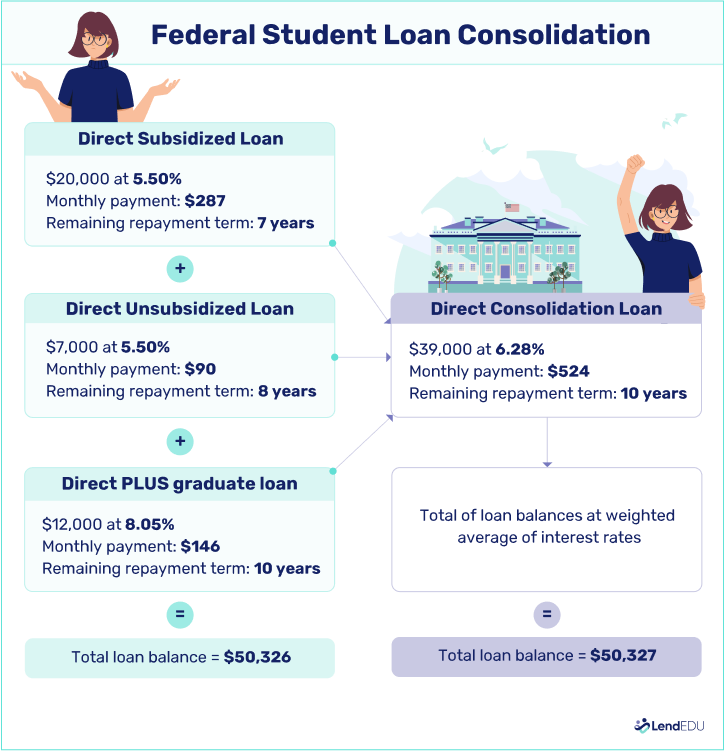

Federal student loans can be more complex to refinance. Instead of refinancing with a private lender, you might consider a Direct Consolidation Loan, which combines multiple federal loans into one.

It’s crucial to understand refinancing federal loans with a private lender could lead to losing federal benefits, such as eligibility for income-driven repayment plans, Public Service Loan Forgiveness, and deferment or forbearance options.

Because you lose federal protections and benefits, I only recommend refinancing federal loans into private ones if you have stable income, six months’ worth of expenses saved in an emergency fund, and interest rates are favorable.

Citizenship and residence

- Citizenship status: Many lenders require U.S. citizenship or permanent residency.

- State of residence: Lending laws vary by state, and several lenders are only available in select states, so your location may influence eligibility.

When you can and can’t refinance

Whether you should refinance depends on your personal financial situation, goals, and loan type. Understanding these factors can guide your decision.

| Scenario | Can you refinance? |

|---|---|

| After consolidation | Yes |

| After bankruptcy | Possibly, with conditions |

| Before you graduate | Possibly, with conditions |

| Without a degree | Possibly, with conditions |

| You have federal student loans | With caution |

| After you’ve already refinanced | Yes |

| You have defaulted student loans | Unlikely |

| When self-employed | Yes, with stable income |

| With bad credit | Possibly, with cosigner |

| You don’t have a cosigner | Possibly, depending your credit and the lender |

After consolidation

Can you refinance? Yes.

Yes, you can refinance after consolidating your student loans—i.e., rolling them all into one loan. It may lead to better terms and rates, but be aware you stand to lose federal benefits if you refinance a federal Direct Consolidation Loan with a private lender.

After bankruptcy

Can you refinance? Possible with conditions.

Refinancing after bankruptcy might be challenging but not impossible. Many lenders are cautious about borrowers with past bankruptcy; even those that permit refinancing may enforce strict requirements.

You’ll likely need a robust recent payment history, or you may have to wait several years after the bankruptcy is finalized. Adding a cosigner to your refinance loan could increase your chances of approval.

Before you graduate

Can you refinance? Possible with conditions.

If interest rates decrease or you desire a more manageable monthly payment while transitioning into the workforce, you might consider refinancing your loans. Many lenders prefer graduates, but some might refinance your loans before graduating if you meet certain requirements.

This is often more prevalent with private loans because most federal loans don’t require repayment until at least six months post-graduation.

Without a degree

Can you refinance? Possible with conditions.

Many lenders require an associate, bachelor’s, or master’s degree to refinance, but it isn’t a universal requirement.

Refinancing without a degree is possible with certain lenders if you meet other eligibility criteria. Citizens Bank, PNC, and Discover are willing to refinance student loans for borrowers who didn’t graduate.

With federal loans

Can you refinance? Yes, with caution.

Refinancing federal student loans requires careful consideration because it will lead to losing federal benefits. If you’re in a stable financial position with no anticipated changes and have a solid credit score that qualifies you for the most favorable rates, refinancing could be a viable way to save money.

But if your income is inconsistent or job security is a concern, refinancing federal student loans may be unwise. We don’t recommend refinancing if you might want to use student loan forgiveness programs or extended repayment options.

After you’ve already refinanced

Can you refinance? Yes

Yes, you can refinance student loans multiple times and as often as you wish. If interest rates have declined since your last refinance, this can help you save a substantial amount over the long term.

Refinancing again might also be sensible if you aim to reduce your monthly payment, settle your loan earlier, or relieve a cosigner from the loan obligation.

After defaulting on student loans

Can you refinance? Unlikely

Most lenders are unwilling to refinance defaulted student loans because it indicates you’re a high-risk borrower, suggesting you might not repay the money. Also, the default has likely lowered your credit score, which could prevent you from qualifying for the loan.

Self-employed

Can you refinance? Yes, with stable income

Self-employed borrowers can refinance if they demonstrate stable income and meet other lender requirements. It might be more challenging if your income is erratic or difficult to verify.

Your credit report is vital in determining eligibility as a self-employed borrower, so ensure it’s in good shape before applying. In some situations, you may need a cosigner.W

With bad credit

Can you refinance? Possible with cosigner

Refinancing with bad credit might be challenging, but a cosigner could increase your chances. You don’t need perfect credit; however, a lower score might lead to higher interest rates. Credit score criteria can differ among lenders, so it’s wise to explore various options if your credit is less than ideal.

No cosigner

Can you refinance? Yes

The need for a cosigner hinges on your credit score and the lender’s requirements. If your credit is not up to par, or you’re aiming for the lowest interest rate, a cosigner might be prudent.

But you might not need a cosigner if your credit score is satisfactory and you’re content with the loan terms offered.

Not understanding the full picture—such as fees and the impact of a longer term, which increases the interest paid over time—and refinancing from federal to private loans without considering the features federal loans offer if you experience job loss or a decrease in income are all common mistakes borrowers make.

You can avoid these pitfalls by carefully making the decision to refinance—not making it in haste without doing research and talking with the lenders and trusted advisors.

Pros and cons of refinancing

Considering refinancing your student loans now that you’ve confirmed you might be eligible? It’s essential to weigh the potential benefits against the possible drawbacks. Here’s a breakdown to help you make an informed decision.

Pros

-

Lower interest rates

You might secure a lower rate, saving you money over the life of the loan.

-

Change in loan term

Adjusting the term might align better with your financial goals.

-

Consolidation of loans

Combining multiple loans into one can simplify your payments.

Cons

-

Loss of federal loan protections

Refinancing federal loans with a private lender could mean losing benefits, such as income-driven repayment plans.

-

Potential costs and fees

Some lenders might charge fees for refinancing, increasing your overall costs.

-

Impact on credit score

The process might lower your credit score by a few points due to the credit check involved.

About our contributors

-

Written by Kristen Barrett, MAT

Written by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.