Table of Contents

How are student loans calculated?

Your loan servicer calculates your repayment plan using a few core factors:

- The amount you borrowed: This is the principal amount. The higher the principal amount, the higher your monthly payments are likely to be.

- The repayment term: Federal loans have a standard repayment term of 10 years, but private loan repayment periods may run from 10 to 15 years. Refinancing student loans can extend the payment period (and impact your student loan repayment plan).

- The interest rate: Federal student loans have fixed interest rates; private loans may have fixed or variable interest rates. With the latter, your payment amount can fluctuate over time as interest rates go up or down.

Note that some types of student loans accrue interest while you’re in school and during grace periods after graduation; this is called interest capitalization. Once repayments start, you’ll not only have to pay interest on the principal (what you borrowed) but also interest on the interest already accrued unless you have paid it off prior.

How are monthly payments calculated?

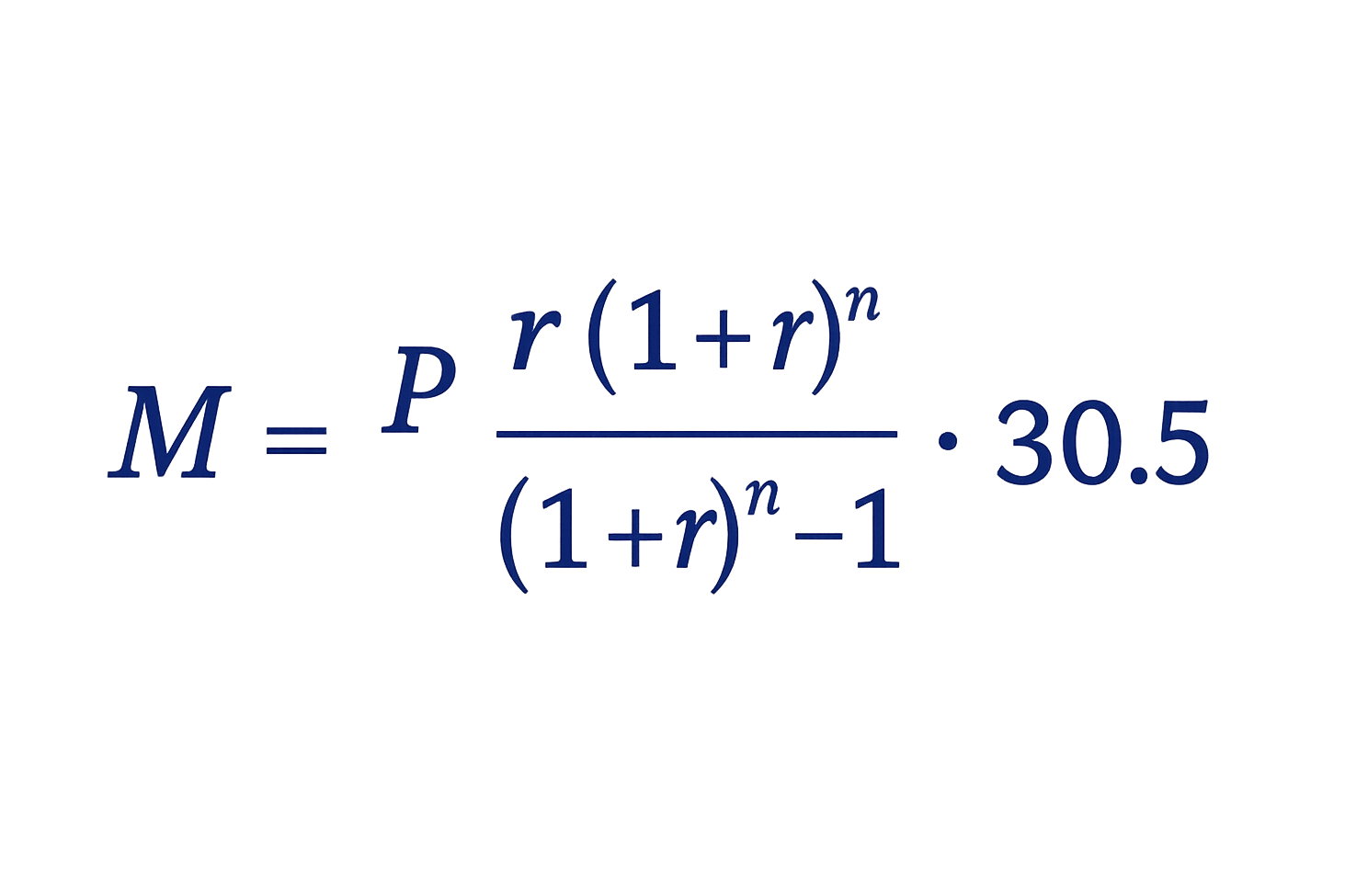

In general, loan servicers will calculate your monthly payments by using the following formula:

Where:

- M is the monthly payment

- P is the principal loan amount

- r is the daily simple interest rate (annual interest rate divided by 365.25*)

- n is the total number of days during the repayment period*

- 30.5 is, rounded, the average number of days in a month

*For simplicity, we assume 365.25 days a year to account for leap years.

For instance, if you borrowed $50,000 and have 10 years to pay it off (120 payments), at a daily simple interest rate of 7%, you would calculate your minimum monthly student loan payment (M) as follows:

M = $50,000 * .07/365.25 * (1 + .07/365.25)^3652.5 / ((1 + .07/365.25)^3652.5 – 1) * (30.5)

M = $580.60 (rounded)

That means, assuming the interest rate is fixed at 7% for the entire 10 years, you’ll pay a total of $69,672 on your $50,000 student loan.

How is the principal calculated?

The principal balance of your student loan is the amount you borrowed. In a straightforward scenario, you would borrow one single amount via one single loan to fund your entire education, but in reality, you likely have several smaller loans with different principal balances.

Let’s look at two examples to show you how much of a difference the size of the principal (P) makes on your monthly student loan payment, one in which you borrowed $50,000 and one in which you borrowed $100,000. We’ll hold other variables (interest rate, loan term) constant.

$50,000 student loan

M = $50,000 * .07/365.25 * (1 + .07/365.25)^3652.5 / ((1 + .07/365.25)^3652.5 – 1) * (30.5)

The monthly loan payment is $580.60 (rounded) on a $50,000 loan.

$100,000 student loan

M = $100,000 * .07/365.25 * (1 + .07/365.25)^3652.5 / ((1 + .07/365.25)^3652.5 – 1) * (30.5)

The monthly loan payment is $1,161.21 (rounded) on a $100,000 loan.

How is my student loan interest calculated?

Student loan interest depends on whether you have a federal or private student loan.

- Federal student loan interest rates are always fixed, and you’ll lock into an interest rate set by the federal government depending on the date of your first disbursement.

- Private student loans can have fixed or variable interest rates, and the rates aren’t set by the federal government. These rates can vary and often go higher than federal loan interest rates.

All federal student loans use a simple interest calculation, as do most private student loans. If your private loan uses compound interest, you’ll pay more (and the formula here won’t apply).

But how does your interest rate actually work in a student loan payment calculator? You’re given an annual interest rate, but student loan interest accrues daily. That’s why our formula divides the interest rate by 365 (or, technically, 365.25 to accommodate leap years).

If student loans accrued interest monthly, like many mortgages and car loans, instead of daily, you’d spend a little less over the life of the loan. The two examples below show the difference between a loan that accrues interest (r) daily and one that accrues interest monthly. We’ll assume a $100,000 loan, a 7% interest rate, and a 10-year repayment term.

Example of daily accruing interest

M = $100,000 * .07/365.25 * (1 + .07/365.25)^3652.5 / ((1 + .07/365.25)^3652.5 – 1) * (30.5)

M = $1,161.21

The monthly loan payment is $1,161.21 (rounded) with daily accruing interest. Over 10 years, the total loan cost is $139,345.20.

Example of monthly accruing interest

M = $100,000 * .07/12 * (1 + .07/12)^120 / ((1 + .07/12)^120 – 1)

M = $1,161.08

The monthly loan payment is $1,161.08 (rounded) with monthly accruing interest. Over 10 years, the total loan cost is $139,329.60.

How is my amortization schedule calculated?

The standard repayment plan for student loans follows an amortization schedule, much like a mortgage. The amortization schedule ensures that your monthly payment remains the same over the repayment period (n).

However, your initial payments will be more heavily weighted toward interest, with only a small amount of the payment going to the principal. Over time, more of your monthly payment will go toward the principal and less to interest. Why?

Because in the first month, you’re paying interest on the total principal amount and just a little toward the principal. In the second month, you’re paying interest on that slightly reduced principal amount. Each subsequent month, the interest is calculated on a lower principal balance.

Our takeaways: What is the best student loan repayment plan?

The best student loan repayment plan is one that works for you. The faster you pay off your loans, the less you’ll pay in interest—but you also need to be realistic about what you can afford each month.

Some strategies to consider:

- Start paying in school: If you have disposable income while in school, you can make prepayments on your student loan, which will lower your principal balance—and thus your monthly payments—once the actual repayment period begins.

- Make extra principal payments: If you have room in your budget, pay additional funds toward your principal each month. This will help you pay off your loan sooner (and thus pay less in interest).

- Switch to income-driven repayment: The federal government has a number of income-driven repayment programs that can reduce your monthly payment amount—in some cases to $0 a month—if you qualify. This may extend repayment to 20 or even 25 years, so it’s possible you’ll pay more in interest over time.

- Consider eligibility for loan forgiveness: There are certain scenarios where your federal loans could be forgiven. For instance, if you maintain a public service job and make 120 qualifying monthly payments, certain federal loans can be forgiven.

- Refinance carefully: Refinancing your loans to a better interest rate and/or longer loan term can help ease the burden of student loan payments. However, keep in mind that refinancing a federal loan into a private loan makes you ineligible for federal loan forgiveness.

About our contributors

-

Written by Timothy Moore, CFEI®

Written by Timothy Moore, CFEI®Timothy Moore is a Certified Financial Education Instructor (CFEI®) specializing in bank accounts, student loans, taxes, and insurance. His passion is helping readers navigate life on a tight budget.

-

Reviewed by Catherine Valega, CFP®, CAIA®

Reviewed by Catherine Valega, CFP®, CAIA®Catherine Valega, CFP®, CAIA®, founded Green Bee Advisory LLC to help women, philanthropists, investors, and small businesses build, manage, and preserve their financial resources. She's been practicing financial planning for more than 20 years.