Home equity lines of credit (HELOCs) are popular with homeowners, and for good reason: You can borrow money as you need it at lower rates than credit cards offer, and you might even be able to deduct the interest on your taxes if you use the cash to boost your home’s value.

But HELOCs aren’t right for everyone. They require a greater degree of money management skills because HELOCs are more complicated than traditional loans. It’s easy to borrow too much, something you’ll want to avoid since your house is on the line.

If you’re clear on your goals and financial abilities, though, a well-chosen HELOC can be the perfect fit for many borrowing needs. We’ll walk you through what to consider.

Table of Contents

1. How is it structured?

Having a clear idea of why you need a HELOC and what you’ll spend it on is extra-important, considering how much they can vary among lenders. Finding the right HELOC might mean wading past several options before you find one that aligns with your borrowing and repayment needs.

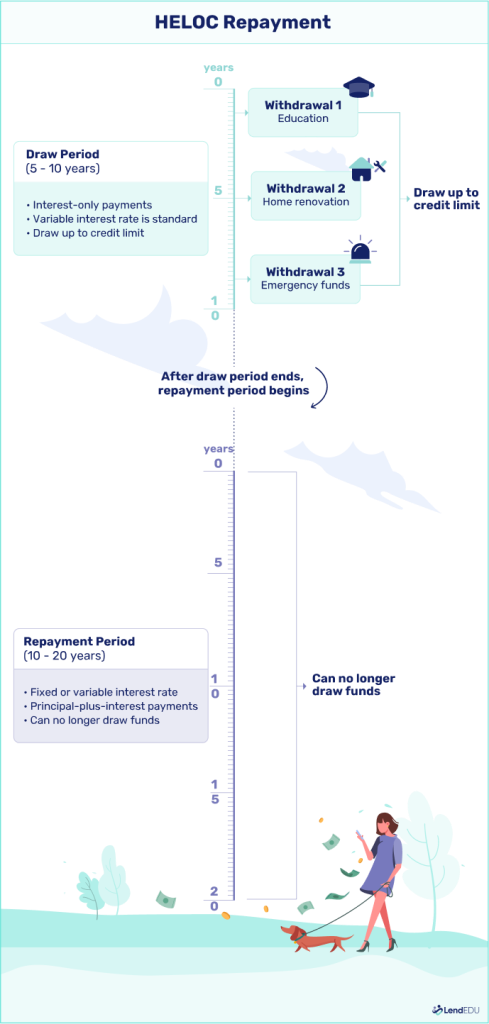

Most traditional HELOCs follow a standard model: you can borrow money during a 10-year draw period and repay any outstanding amounts during a 20-year repayment period.

But many lenders add extras, such as a HELOC loan option that allows you to create mini-loans within your HELOC. You’ll begin repaying these immediately, often at fixed rates. That might be more useful if you occasionally have larger projects, for example, but you don’t want to run up your HELOC balance too much.

We’ll take a look at how different lenders compare for each of these questions, starting with HELOC structure:

| Company | Draw period | Repayment period | Rating (0-5) |

|---|---|---|---|

|

|

2 – 5 years | 5, 10, 15, or 30 years |

|

|

5 years | 5, 10, 15, or 30 years |

|

|

10 years | 20 years |

|

|

10 years | 20 years |

|

|

10 years | 20 years |

|

2. How much can I borrow?

I explain to clients that HELOC borrowing power isn’t based on the total equity in their home. Instead, lenders use a loan-to-value calculation to determine how much can be borrowed, and each lender may set different lending limits.

Another factor to consider is how much you can borrow. Your credit score, income, and other details often play a role here, but an even bigger factor is your lender’s combined loan-to-value ratio (CLTV) limits.

Your CLTV is essentially the percentage of your home’s value tied up by home debts, such as your mortgage and potential HELOC. You can calculate your current LTV by dividing your mortgage balance by your home’s estimated value.

For example, if you owe a $100,000 mortgage on a $400,000 home, your LTV—right now—is 25% ($100,000 / $400,000). If your lender allows a combined LTV up to 85%, you could borrow up to 60% of your home’s value in additional financing ($240,000 in this example).

Lenders that allow higher CLTVs can typically offer you a larger HELOC limit than a lender with a smaller CLTV limit. The downside is that you’re more at risk of ending up underwater on your home debts because it creates less of a buffer in case your home value falls.

| Company | Max CLTV | Max HELOC limits | Rating (0-5) |

|---|---|---|---|

|

|

85% | $750K |

|

|

89% | $400K |

|

|

85% | $1M |

|

|

95% | $500K |

|

3. What are the costs?

All the lender variations in how HELOCs are structured can lead to a wide range of HELOC costs. Most HELOCs charge variable interest rates on your outstanding balances, which can increase or decrease your financing costs over time. But from here, the fees you’ll pay diverge more.

To set up your line of credit, most lenders will charge various HELOC closing costs (which are paid out of pocket when you close on the loan) or fees, some of which are deducted from your available line of credit. A HELOC is a type of second mortgage, which means paying many of the same closing costs as your first mortgage. Some lenders allow you to roll these costs into your HELOC balance, but that means paying extra interest.

I emphasize the importance of borrowing only what you need, which helps keep costs down.

With a HELOC, typical expenses may include an appraisal, title, and possible closing costs, along with interest and, eventually, principal payments during the repayment period. The costs will vary depending on location and the lender, which is why it is important to shop lenders.

Once your HELOC is open, you’ll likely have other fees to think about. Some lenders charge annual fees, for example, or fees for making specific types of draws against your account.

| Company | Closing costs | Other fees | Rating (0-5) |

|---|---|---|---|

|

|

$0 | Orig. fee up to 4.99% |

|

|

$0 | 4.90% first-draw fee |

|

|

$0 | None |

|

|

$0 | $50 annual fee; $15 fixed-rate option setup fee |

|

4. How is my home value assessed?

To calculate your HELOC credit limit, your lender needs an accurate assessment of your home’s value.

Lenders used to do this by ordering a full appraisal of your home from a walk-through inspector, which could add hundreds of dollars onto your closing costs. That’s the most accurate assessment method today, and lenders sometimes still require it. But more lenders have shifted to easier routes.

On the opposite end of the spectrum, many online-only lenders are accepting home value estimates from automated valuation models (AVMs), like the ones used by Zillow and Redfin. These are quick and easy to do, but can be less accurate than other methods.

Some lenders offer hybrid or drive-by appraisals, where an inspector looks up your home online and then checks the exterior to make sure it matches up. If you’ve done exterior work on your property recently, this can be a good way to account for those upgrades in your home’s value.

| Company | Appraisal method | What else to know | Rating (0-5) |

|---|---|---|---|

|

|

AVM | Best overall HELOC |

|

|

AVM | Best customer reviews |

|

|

Full in-person appraisal required for $400K+ HELOC | Best credit union |

|

5. How do the rates work?

We’ve covered how lenders may charge variable rates that can affect your borrowing costs—and thus your monthly payments. So it’s important to know whether and how your HELOC interest rates can change over time.

Lenders set different rules for how your interest rates work:

- Margin: How much your lender adds onto the current index rate, based on your creditworthiness.

- Index rate: Lenders often use the Wall Street Journal Prime Rate as the starting point for calculating your own interest rate.

- Step adjustment (variable rates only): How much your interest rate can change with each adjustment.

- Upper and lower caps (variable rates only): How high—or low—your interest rates can theoretically go.

- Adjustment frequency (variable rates only): How often your lender recalculates your rates, potentially causing your payment to change.

Lenders don’t usually disclose this information until you receive the final loan agreement to sign. But it’s important to take note of these details, so you know exactly how your payments can change and can ensure they’ll be affordable in the future.

| Company | Rates (APR) | Fixed or variable? | Rating (0-5) |

|---|---|---|---|

|

|

6.70% – 14.65% | Fixed |

|

|

6.99% – 15.49% | Fixed |

|

|

12-month intro rate starting at 6.49% for VantageScores of 720 and up, w/ post-intro rates starting at 7.75% | Fixed for 12-month intro period, then variable |

|

|

9.50%+ | Both are available |

|

I don’t usually get into the technical details of how HELOC rates are calculated, but I do talk with clients about the current interest rate environment and explain that HELOCs often carry higher rates than traditional mortgages.

We also review the differences between fixed (limited availability) and variable rates to decide which option best fits their budget, financial situation, and the outlook for future interest rates.

6. Are there any minimum draw requirements?

People often take out HELOCs as a sort of emergency fund. It’s comforting to know that, at any moment, you already have preapproved access to a large credit line if something happens. Many people leave their HELOC untouched for years at a time.

Lenders, on the other hand, want you to actually use your credit line, so they can charge you interest and make money off the deal. Many lenders impose minimum draw requirements, either at the start of your HELOC or with each withdrawal you take.

But unless your lender assesses penalties or prohibits it, you can repay the excess funds you don’t actually need right away.

| Company | Initial draw | Additional draws | Rating (0-5) |

|---|---|---|---|

|

|

Full amount (minus fees) drawn at origination | $500 |

|

|

Full amount (minus fees) drawn at origination | No min. specified |

|

|

$25,000 (required for low intro rate) | $10K min (for fixed rate) |

|

|

None required | $5K min (for fixed rate) |

|

7. Can I afford the maximum potential payment?

One of the most important questions is whether you can afford your HELOC payments, especially as they change. Unlike a traditional loan, your HELOC payments will fluctuate as your rate changes, as you draw and repay funds, and when you shift from the draw to repayment periods.

The last thing you want is to lose your home because you can’t make the payments anymore. Life happens, and it’s not uncommon to borrow more than you planned, to lose your job, or for variable interest rates to rise.

You can get a good handle on your maximum potential loan costs by using a HELOC payment calculator and entering your maximum credit limit and interest rate. Chances are you won’t ever owe that much, but knowing how high your payments can get might help you plan your HELOC journey better.

Take a look, for example, at how the monthly payment changes under different HELOC balance and interest rate scenarios:

| Repayment period balance | Interest rate | Term length | Monthly payment |

| $45,000 | 8% | 20 years | $376 |

| $45,000 | 18% | 20 years | $694 |

| $90,000 | 8% | 20 years | $753 |

| $90,000 | 18% | 20 years | $1,389 |

8. How do I draw funds?

Lenders offer a range of options for withdrawing your HELOC funds, including bank deposits, paper checks, or even HELOC credit cards. This can be important if you have specific uses in mind.

If you’re often tempted to overspend, for example, it might be worth avoiding a HELOC credit card. The implications of falling behind on your HELOC payments (i.e., foreclosure) are worse than falling behind on credit card payments.

Most lenders allow you to have the funds deposited right into your bank account, which can be a good choice for larger and more infrequent borrowing needs, like home renovation projects.

| Company | Draw methods | Rating (0-5) |

|---|---|---|

|

|

Direct deposit |

|

|

Direct deposit |

|

|

Direct deposit, paper checks, or visit branch |

|

About our contributors

-

Written by Lindsay VanSomeren

Written by Lindsay VanSomerenLindsay VanSomeren is a personal finance writer living in Suquamish, Washington. She's passionate about helping people manage their money better so that they can live the life they want. In her spare time, she enjoys outdoor adventures, reading, and learning new languages and hobbies.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.