Our take: Wells Fargo personal loans offer competitive rates and no fees, but they’re only available to customers with at least a 12-month relationship. Unless you already bank with Wells Fargo and have good credit, we recommend comparing offers from higher-rated lenders, such as SoFi (best for good credit) or Upgrade (best for fair credit).

Personal Loans

- Relationship discount

- No fees

- Same-day credit decision

- Only for current Wells Fargo customers

- No joint loan option

- Limited customer service hours

| Fixed rates (APR) | 6.74% – 23.99% |

| Loan amounts | $3,000 – $100,000 |

| Term lengths | 1 – 7 years |

| Minimum credit score | None |

Wells Fargo personal loans are a great option for borrowers with good credit and a long-standing relationship with the bank. No fees are associated with these loans, the repayment terms are flexible, and you can benefit from a 0.25% relationship discount.

But you must be a customer for at least 12 months before you can apply for a personal loan. So it’s not the best option if you need quick funding and don’t already have an account. Here’s how to figure out when Wells Fargo is the right fit and when it makes sense to consider SoFi, Upgrade, or another top-rated personal loan.

How Wells Fargo personal loans work

| Term | Details |

| Minimum credit score | None |

| Minimum income | None |

| Fixed rates (APR) | 6.74% – 23.99% with discount |

| Rate discounts | 0.25% relationship discount |

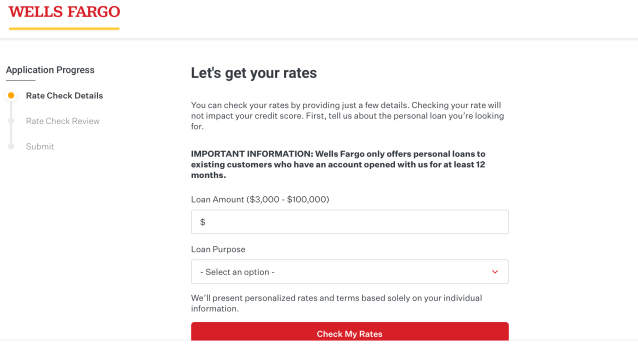

| Loan amounts | $3,000 – $100,000 |

| Repayment period | 12 –84 months |

| Fees | None |

| Unique features | Same-day funding |

Eligibility requirements

The Wells Fargo personal loan credit requirements are fairly standard. The biggest difference between this bank and other lenders is that there’s no minimum credit score or income requirement. Instead, your eligibility depends on a combination of your application, credit history, and relationship with the bank.

However, higher scores are generally needed to qualify for the lowest rates. Upgrade might be a better option if you have fair credit, but Wells Fargo is a solid choice if your credit is good and you already have a Wells Fargo bank account.

Rates and fees

The personal loan fixed interest rates are competitive. The current range is comparable to the national average. Wells Fargo is a strong choice for budget-conscious borrowers who meet the qualification requirements.

Unique features

Wells Fargo offers a generous 0.25% Relationship Discount, which helps keep fixed interest rates low. The advertised rates include the discount, and you must have a Wells Fargo checking account with automatic payments from it to qualify.

Other personal loan companies, such as SoFi and Navy Federal, offer discounts, but many don’t.

Pros and cons

Pros

-

Relationship discount

The bank’s 0.25% relationship discount makes the lowest loan rate quite competitive. As long as you have a qualifying Wells Fargo checking account and set up automatic payments, you qualify for the discount.

-

No fees

Wells Fargo charges absolutely no fees: no origination fees, no closing fees, and no prepayment penalties.

-

Same-day credit decision

Most applicants receive a decision on the day they apply. Plus, 96% of customers get funds the same day they sign for their loan.

Cons

-

Must already be a Wells Fargo customer

You’ll need a Wells Fargo account for at least 12 months before you can qualify for a personal loan.

-

No joint loan option

You can’t apply for a loan with another applicant, which might be a deal breaker for some borrowers.

-

Limited customer service hours

Customer service for loans has isn’t available on weekends.

Customer reviews

Wells Fargo has a history of regulatory issues, and reviews for the bank tend to be negative. Customers report that the loan approval process can be long and confusing.

But here’s the deal: The negative reviews might be irrelevant if you’re already a customer and are happy with your experience. You can likely expect similar service when you apply for a Wells Fargo personal loan.

Here’s a look at Wells Fargo personal loan reviews and customer ratings.

| Source | Customer rating | Number of reviews |

| Better Business Bureau | 1.09/5 | 985 |

| Trustpilot | 1.40/5 | 542 |

| 1.40/5 | 111 |

Alternatives

Although Wells Fargo offers low rates and no fees, it’s not the best choice for everyone. Let’s take a look at how it compares to some of the best personal loan alternatives.

Wells Fargo vs. SoFi

SoFi is one of the strongest alternatives to Wells Fargo, especially if you have good credit. Both lenders offer personal loans with no required fees. However, SoFi earns much higher customer scores on Trustpilot: 4.3 out of 5 based on nearly 10,000 reviews. Customers praise its ease of use, fast funding, and transparent terms. If customer experience is a top priority for you, SoFi stands out as the better option.

Wells Fargo vs. Upgrade

Qualifying for a personal loan with fair credit can be challenging, but Upgrade‘s minimum credit score requirement of 580 makes it possible. The starting rates are higher than Wells Fargo, but it’s worth the extra expense if you don’t meet the personal loan requirements.

Wells Fargo vs. PenFed Credit Union

As the best credit union for personal loans, PenFed offers free membership, small loan amounts, and no fees. PenFed’s lowest rates are higher than Wells Fargo’s rates, but they’re still competitive. It’s a great option if you prefer working with a credit union instead of a bank.

Wells Fargo vs. LightStream

If you need the money fast, LightStream is one of the best options. The funds can be deposited into your account on the same day you apply, as long as you complete all steps before 2:30 p.m. Eastern during the week. Although Wells Fargo offers a same-day credit decision for most applicants, the funding typically takes multiple days. The only potential downside? You need good to excellent credit to qualify.

How to apply

The application process for a Wells Fargo loan is straightforward and quick. Once you apply, you can expect a decision the same day. After that, you’ll receive the funds within a few days.

Here’s an in-depth look at what to expect when you apply for a personal loan from Wells Fargo.

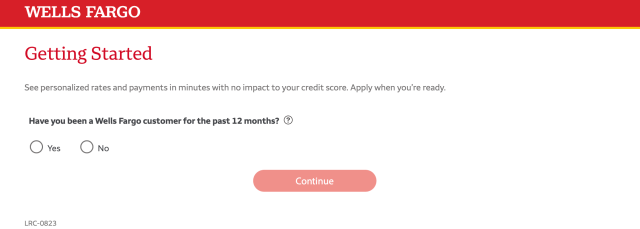

- Confirm eligibility: You need to confirm you’ve been a Wells Fargo customer for at least 12 months. After that, you can log in to your account or manually enter the information.

- Submit form: Complete the online application to check your rates. Because you’re already an account holder, the process is fast.

- Accept offer: Review the offer terms from Wells Fargo and decide whether to accept the loan.

FAQ

Are Wells Fargo personal loans worth it?

Wells Fargo personal loans are worth it if you have a good credit score and need funds for a large expense. You also need to be a customer for at least 12 months before applying, so it’s not available to everyone.

What credit score is needed for a Wells Fargo personal loan?

You don’t need to meet a minimum credit score requirement when applying for a Wells Fargo unsecured loan. The bank considers different aspects of your application, including credit history and relationship to Wells Fargo.

What is the Wells Fargo personal loan phone number?

The Wells Fargo personal loan phone number is 1-877-526-6332 for account opening, and 1-877-269-6056 for questions about an existing account.

What if I’m denied for a Wells Fargo personal loan?

If Wells Fargo denies your personal loan application, you’ll receive a decision letter that states the reason. The bank must provide the written explanation within 60 days. You can file a complaint with the Consumer Financial Protection Bureau if you think the decision is due to discrimination.

How we rated Wells Fargo

We designed LendEDU’s editorial rating system to help readers find companies that offer the best personal loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Wells Fargo to several personal loan lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating, recapped below.

| Company | What to know | Rating (0-5) |

|---|---|---|

|

Only available to current customers |

|

About our contributors

-

Written by Taylor Milam-Samuel

Written by Taylor Milam-SamuelTaylor Milam-Samuel is a personal finance writer and credentialed educator who is passionate about helping people take control of their finances and create a life they love. When she's not researching financial terms and conditions, she can be found in the classroom teaching.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.