Personal Loans

- Installment loans and lines of credit have triple-digit interest rates

- Limited geographic availability

- Available to borrowers with poor or no credit

| Rates (APR) | 208.00% – 459.00% |

| Loan amounts | $200 – $2,500 |

| Repayment terms | Up to 18 months |

MoneyKey offers fast access to short-term loans, but its high interest rates make it an expensive option for borrowers. With rates well above the 36% maximum we recommend, it’s important to consider the total cost and explore other options first. If you decide to proceed with MoneyKey, have a solid repayment plan to avoid financial strain.

Table of Contents

About MoneyKey installment loans

MoneyKey offers installment loans in seven states: Delaware, Idaho, Mississippi, Missouri, Texas, Utah, and Wisconsin.

| Term | Details |

| Fixed rates (APR) | 208% – 459% |

| Loan amounts | $200 – $2,500 |

| Repayment periods | Up to 18 months |

These loans give you a lump sum of money upfront, which you pay back in fixed monthly installments over a set period. The specific terms and rates MoneyKey offers depend on your state.

The interest rates on these loans are sky-high, especially when compared to many banks or other online lenders, and they can vary based on your state, credit, and repayment plan.

If you need to borrow a small amount—$500 or less—without a credit check, consider one of our top-rated cash advance apps instead of MoneyKey.

MoneyKey line of credit

| Term | Details |

| Fixed rates (APR) | 279% to 399% |

| Loan amounts | $200 – $3,500 |

Personal lines of credit can be an appealing alternative to applying for a new loan every time you need extra cash. A line of credit is a more flexible solution that gives you access to a set amount, and you can withdraw funds whenever you need them. As you pay down your balance, more credit becomes available, so it’s like having cash on standby for emergencies or unexpected expenses.

MoneyKey offers two types of lines of credit: its own line of credit, available in Kansas and Tennessee, and the CC Flow Line of Credit, which is provided by Capital Community Bank in partnership with MoneyKey and is available in 14 states. (See the full list below.)

Your interest rate and credit limit will depend on your state, credit score, and other factors, but MoneyKey’s rates are much higher than those for credit cards or most other personal lines of credit.

If approved, you can draw funds up to your limit whenever needed, with charges only applied to the amount you borrow. You can also repay at any time without penalties, giving you control over your borrowing and repayment schedule.

States where MoneyKey’s CC Flow Line of Credit is available

- Alabama

- Alaska

- Arizona

- Arkansas

- Florida

- Hawaii

- Indiana

- Kentucky

- Louisiana

- Michigan

- Montana

- Ohio

- Oklahoma

- Wyoming

Who’s eligible for a personal loan or line of credit from MoneyKey?

To qualify for an online loan through MoneyKey, you must meet the following requirements:

- Be of legal age in your state.

- Be a U.S. citizen or permanent resident.

- Reside in a state where MoneyKey products are available.

- Have an active bank account.

- Maintain a regular source of income.

- Provide a valid contact number and an active email address.

MoneyKey pros and cons

Consider the risks and benefits of a MoneyKey loan before you proceed.

Pros

-

Borrowers with bad credit are eligible

-

Get your money fast

-

User-friendly website

-

Many users report that customer service was helpful

Cons

-

High interest rates can make for an expensive loan and a difficult repayment

-

Some borrowers say it is hard to access their accounts

-

Some users claim customer service was poor after they received their loans

-

Limited state availability

MoneyKey customer reviews

We checked several sources to determine consumers’ experiences with MoneyKey.

| Source | Customer rating | Number of reviews |

| Trustpilot | 4.5/5 | 4,141 |

| Better Business Bureau | 2.16/5 | 67 |

| 4.4/5 | 359 |

Customer reviews of MoneyKey reveal mixed feedback across various platforms. Many users express satisfaction with the company’s services, as reflected in higher ratings on Trustpilot and Google, which suggests that a good number of customers have had positive experiences, particularly appreciating the fast and convenient loan process.

However, feedback on the Better Business Bureau site points to areas of concern, with some customers highlighting issues that may affect the overall experience. This mixed reception suggests that while MoneyKey works well for some, others have faced challenges, underscoring the importance of considering various factors before choosing this lender.

How to apply for a personal loan with MoneyKey

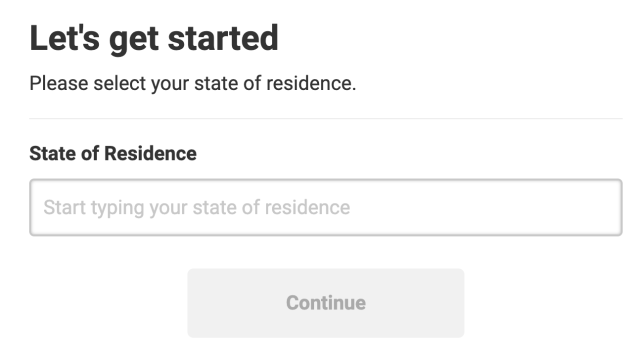

- To apply for a personal loan with MoneyKey, you must first indicate your state of residence on the website.

- MoneyKey will then display the loan types you’re eligible for, such as the CC Flow Line of Credit, an installment loan, or MoneyKey’s own line of credit.

- Once you’ve selected the appropriate loan type, you’ll need to enter your email address. By providing your email, you consent to receive account information and marketing communications from MoneyKey and CC Flow throughout the lifecycle of your account, from origination to closure, in line with its privacy policies.

- After this, you’ll create a MoneyKey account to apply. You’ll be asked to provide personal information, such as your name, address, Social Security number, income details, and employment information.

- Once you’ve filled in all the required details and submitted your application, MoneyKey will review it to determine whether you meet its eligibility criteria.

- If approved, you could receive your loan funds as early as the next business day.

Does MoneyKey have a customer service team?

MoneyKey provides multiple ways to get in touch with its customer service team:

- Text: Send a text message to 1-866-255-1668. Standard rates apply.

- Email: Contact the team at [email protected].

- Phone: Speak with an agent by calling 1-866-255-1668.

- Mail: Send your inquiries or feedback to 1000 N West Street, Suite 1200, Wilmington, DE 19801.

MoneyKey’s team is available:

- Monday – Friday: 8 a.m. – 9 p.m. Eastern

- Saturday and Sunday: 10 a.m. – 6 p.m. Eastern

- Holiday hours: 10 a.m. – 6 p.m. Eastern

If you have suggestions or feedback about your experience, MoneyKey encourages you to use its feedback form to share your thoughts.

Alternatives to MoneyKey

If you’re looking for alternatives to MoneyKey, several cash advance apps and personal loans cater to various financial needs, including those with less-than-perfect credit. Here are several top-rated options.

Cash advance apps

These alternatives are likely to offer more flexibility, lower costs, or better terms than MoneyKey.

| Company | Best for… | Cash advance amounts | Rating (0-5) |

|---|---|---|---|

|

Best Overall | Up to $300/day; Up to $1,000/pay period |

|

|

Best Early Payment Benefit | Up to $500 |

|

|

Best Overdraft Reimbursement | $10 – $300 |

|

Personal loans

If you want to borrow a higher amount, these personal loan lenders offer higher amounts, and you may qualify with poor or little to no credit.

| Company | Min. credit score | Loan amounts | Rating (0-5) |

|---|---|---|---|

|

300 | $1,000 – $75,000 |

|

|

560 | $1,000 – $50,000 |

|

|

None | $2,000 – $36,500 |

|

FAQ

Does MoneyKey offer payday loans?

No, MoneyKey no longer offers payday loans, but we generally don’t recommend them due to their high interest rates and fees. If you need quick access to cash before your next paycheck, consider exploring our top-rated cash advance apps, which can be a more cost-effective and flexible solution.

What types of personal loans does MoneyKey offer?

MoneyKey offers installment loans and lines of credit, depending on your state of residence. Installment loans provide a lump sum amount with a fixed repayment schedule, while lines of credit allow you to draw funds up to a certain limit as needed. Both loan types have different terms, rates, and eligibility criteria.

How fast can I get approved for a loan with MoneyKey?

MoneyKey offers a quick and convenient online application process. Depending on when you apply and the approval process, you can often get approved within minutes, and funds may be deposited into your bank account as soon as the same business day.

Are any fees associated with MoneyKey personal loans?

MoneyKey does not charge application or origination fees for its personal loans. However, interest rates and other finance charges can be much higher than those with traditional lenders. Be sure to review the full terms and conditions of your loan agreement to understand the total cost.

How we rated MoneyKey

We designed LendEDU’s editorial rating system to help readers find companies that offer the best personal loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared MoneyKey to several personal loan lenders and marketplaces, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating, recapped below.

| Product | Our rating |

| MoneyKey personal loan | 3.6/5 |

About our contributors

-

Written by Jeff Gitlen, CEPF®

Written by Jeff Gitlen, CEPF®Jeff Gitlen, CEPF®, is the director of growth at LendEDU. He graduated from the Alfred Lerner College of Business and Economics at the University of Delaware.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.