You may already know that a HELOC allows you to borrow against your home’s equity, but how does that actually work? Essentially, a HELOC is a flexible credit line anchored to your property’s value. You can use it to renovate your home or cover miscellaneous ongoing costs. Here, we’ll recap the HELOC process so you can have a thorough understanding of how it works.

Table of Contents

How a HELOC works step by step

A HELOC doesn’t work like a traditional lump-sum loan. Instead, it unfolds in stages—from applying and accessing funds, to repaying and eventually closing out the line. Here’s what each step typically looks like in practice:

1. Applying for a HELOC

Before applying for a HELOC, you should estimate how much you can borrow. This depends on the home equity you own: your home’s current value minus the amount you must still repay on your mortgage.

Typically, HELOC lenders allow you to borrow 85% of your home’s appraised value minus your mortgage balance, provided you hold at least 20% of your property’s equity.

For instance, if your home is worth $500,000 and you owe $200,000 on your mortgage, you could borrow:

$500,000 x 0.85 = $425,000

$425,000 – $200,000 = $225,000

Lenders usually approve borrowers with a credit score of at least 620. You may qualify for better rates if your credit score is 700 or higher.

Prequalifying for a HELOC won’t affect your credit score, so make sure you shop around and compare lenders. Once you submit your application, the provider will review your credit and income. Some will also stipulate an in-person appraisal of your property, especially for large amounts. Figure requires appraisals for HELOCs over $400K.

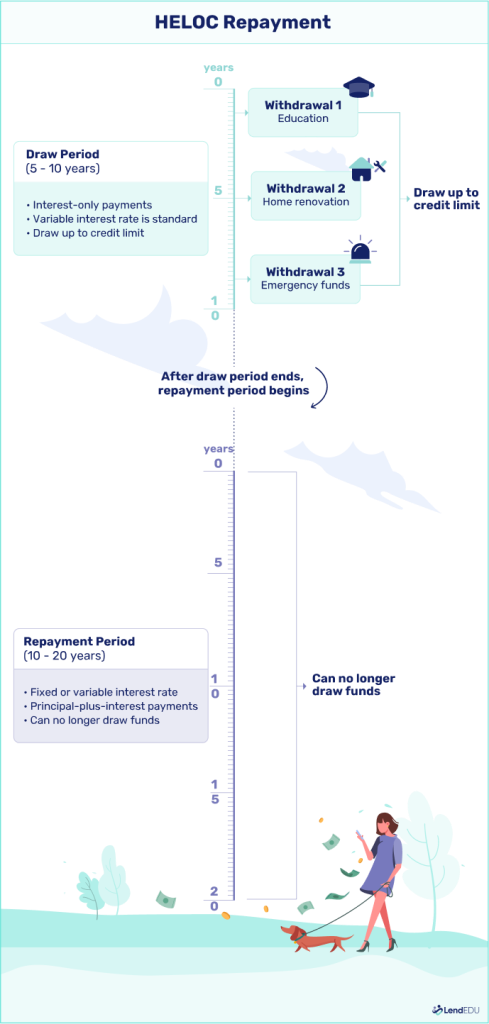

2. Using HELOC funds during the draw period

Once the lender approves your application, you can access the HELOC funds in several ways. Many lenders provide a credit card that works like a regular debit or credit card, but you can also withdraw via checks, online or phone transfers, or even cash.

During a HELOC’s draw period (usually around 10 years), you can tap into the funds as needed. HELOCs can cover a wide range of expenses—home improvements, education, medical bills, starting a business, or even buying another property. Just remember: your home backs the line of credit, so it’s important to borrow responsibly.

Remember that with a HELOC, you’re taking out a lien against your home. This isn’t to be used like a credit card for everyday purchases. Prioritize spending on things that will add value.

How does a HELOC payment work during the draw period?

While you’re drawing funds, most lenders only require minimum monthly payments. These may be:

- Interest-only payments: Lower upfront, but your balance doesn’t shrink. You’ll still owe the full amount borrowed once the draw period ends.

- Principal + interest payments: Higher monthly cost, but your balance decreases over time.

Your payment type depends on your lender’s terms and what you choose at origination.

How does interest work on a HELOC?

Most HELOCs have variable interest rates that move with the prime rate. This means your monthly payments can rise or fall over time.

Some lenders also offer ways to stabilize payments:

- Fixed-rate HELOCs that mimic a home equity loan: e.g., Figure’s “fixed-rate HELOC,” which requires a full draw upfront, then repayment at a fixed rate. If you repay and later redraw, new funds get a fresh fixed rate.

- Variable-rate HELOCs with conversion options: e.g., locking in fixed rates for certain withdrawals, while keeping the rest variable.

- Introductory fixed rates that revert to variable: e.g., FourLeaf offers a 6.49% APR for the first year, then shifts to a 7.50% variable APR.

3. HELOC repayment

Once the draw period ends, your HELOC enters the repayment period, which usually lasts 10 to 20 years.

How do you pay back a HELOC?

During repayment:

- No new borrowing: You can’t access more funds.

- Principal + interest payments: Your outstanding balance is converted into monthly payments that cover both principal and interest. These are typically higher than draw-period payments, especially if you were paying interest-only before.

- Amortization schedule: In most cases, the loan is structured so that your balance is gradually paid down to zero by the end of the repayment term.

Some HELOCs, however, include a balloon feature. Instead of amortizing, the full remaining balance is due in a lump sum when the draw period ends. For example, if you borrowed $50,000 and only made interest payments, you’d still owe the full $50,000 at once.

If the higher amortizing payments or a balloon payoff feels overwhelming, you may be able to refinance—either into a new HELOC or a fixed-rate home equity loan with more manageable terms. A qualified financial advisor can help you choose the best way to pay off your HELOC.

Before opening a HELOC, review your current income and existing expenses to ensure paying off the HELOC isn’t going to put you in an uncomfortable position. You may be able to afford the payments on the HELOC now, however, will you have funds left over to actually enjoy your income? It’s a balancing act between what you can afford and what is going to be comfortable for you.

4. Closing out a HELOC

Once you’ve paid your HELOC balance, you can close the line of credit. Make sure to ask the lender for a close-out letter to confirm the credit line is closed and there’s no longer a lien on your home. Some lenders, like Chase, automatically send a lien release to the county recorder within 30 days of repayment. Double-check this step if you’re selling your home, since any active lien could hinder the sale process.

If you need continued access to HELOC funds, you may be able to extend or renew the line of credit before it expires. Check with your lender beforehand to find out whether your plan allows renewals.

You can also start from scratch and apply for a new HELOC—if your home equity has grown or your credit has improved, this could unlock better borrowing terms. However, keep in mind that a new HELOC also comes with separate application and closing fees.

Example of how a HELOC works

Tom and Sarah are homeowners in Boston with $180,000 in home equity and $250,000 left on their mortgage. They want to:

- Upgrade their outdated HVAC system

- Remodel their kitchen

- Consolidate $15,000 of high-interest debt

Instead of taking out personal loans at 13% to 15% APR, they qualify for a $75,000 HELOC at a 7% variable rate.

How they use it:

- $15,000 to pay off credit card debt, cutting hundreds of dollars in monthly interest

- $10,000 for an HVAC upgrade and home insulation

- $30,000 for a kitchen remodel and new flooring

How they repay it:

- During the first few years, they make interest-only payments of about $300 per month

- Later, they begin paying extra toward principal

- At the end of the draw period, they owe $20,000

- Their HELOC lets them choose between:

- A balloon payment, or

- A 10-year repayment schedule (120 monthly payments)

They choose the repayment schedule, spreading the balance into manageable monthly payments.

Bottom line: By using a HELOC, Tom and Sarah eliminated high-interest debt and improved their home’s value—without creating financial stress.

Should you use a HELOC?

A HELOC can be a flexible, convenient way to access your home equity for planned expenses or debt consolidation. Just keep in mind that the line eventually transitions from borrowing to repayment, so it’s important to have a plan for how you’ll manage those future payments.

Thinking ahead—whether that means budgeting for higher costs or considering a refinance—can help you use a HELOC confidently without putting your home at risk.

Read more about the pros and cons of HELOCs to help you decide. If you’re ready to get started, check out our top HELOC lender recommendations.

About our contributors

-

Written by Anna Twitto

Written by Anna TwittoAnna Twitto is a money management writer passionate about financial freedom and security. Anna loves sharing tips and strategies for smart personal finance choices, saving money, and getting and staying out of debt.

-

Reviewed by Crystal Rau, CFP®, CRPC®, AAMS®

Reviewed by Crystal Rau, CFP®, CRPC®, AAMS®Crystal Rau, CFP®, CRPC®, AAMS®, is a Certified Financial Planner based in Midland, Texas. She is the founder of Beyond Balanced Financial Planning, a fee-only registered investment advisor that helps young professionals and families balance living their ideal lives with being good stewards of their finances.