Gen Z’s average credit score just dropped to 676, the lowest of any generation, and a big slide from the national average of 715. It’s not because Gen Z is bad with money. (You’re not!) It’s because the math has changed.

Rising prices, student loan payments, and stricter credit rules are making it harder to build a solid score from scratch. And with debit cards and “buy now, pay later” apps dominating, many young adults aren’t getting credit for the money moves they are making.

Here’s what’s really going on with Gen Z credit scores in 2026 (and how to turn things around).

Table of Contents

Average credit score by generation

According to FICO’s 2025 Credit Insights Report, Gen Z’s average credit score is 676. That’s plummeted from last year and far below the national average of 715. It’s also the steepest decline of any generation in five years.

Here’s how the generations stack up:

Why Gen Z credit scores are sliding

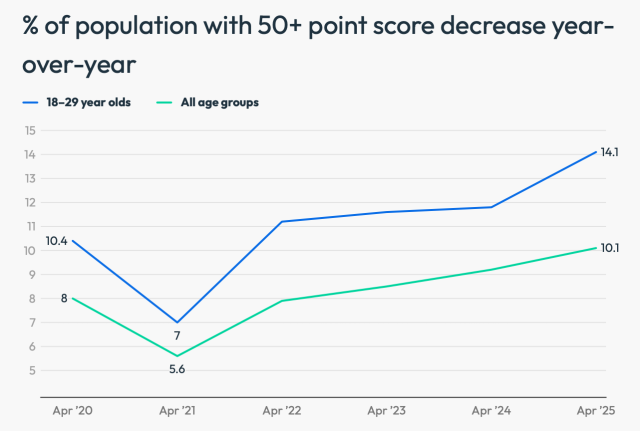

Around 14.1% of Gen Z borrowers experienced a decline of 50 points or more in their score this year. That substantial drop shows that many young adults could be feeling the squeeze.

This “squeeze” is a result of several financial stresses.

1. Smaller savings cushion to fall back on

A top reason many Gen Zers have experienced a drop in credit is simply having less cash to fall back on than other generations.

According to PYMNTS data:

- Gen Z has roughly $5,948 in savings

- Millennials have about $8,594

- Gen X has around $9,313

Even with this cushion, rising prices have 40% of savers “extremely concerned” about how one $2,000 emergency could damage their savings. Throw in the fact that the average household has about 4.6% of their income leftover for savings each month, and it’s clear to see why. Most young savers are still walking a financial tightrope.

And with the average household saving just 4.6% of their income (roughly $153 a month on a $40,000 salary), there’s not much wiggle room to recover when something unexpected hits.

2. Less access to credit

It’s harder than ever for Gen Z to get started. After the Credit CARD Act of 2009, banks stopped handing out easy credit on college campuses. This was a major win overall, but it also shut off one of the simplest ways to build credit early.

Now, beginner credit cards are tougher to qualify for, and most big banks are focused on high-end cards for wealthier customers. That leaves younger borrowers with limited choices, higher fees, or secured cards that require cash deposits up front.

Many Gen Zers end up using debit cards or buy now, pay later apps instead of credit cards. But those don’t help build a credit history.

3. Student loans and rising costs

When student loan payments resumed in 2023, it couldn’t have come at a worse time. Everyday expenses were already climbing, and for many young borrowers, something had to give. If you’re stuck choosing between groceries and your student loan bill, and you miss a single payment, your score can drop by 49 points or more.

Nearly 70% of Gen Z adults say rising prices are their biggest daily challenge, compared with 39% of baby boomers.

4. Credit confusion (and anxiety)

A USAA study found that nearly half of Gen Z doesn’t fully understand how credit scores work, and one in five has never checked their score.

Honestly, this hesitation makes sense. If you’re scared, checking your score can feel like peeking at a bad grade you can’t change. So you may put it off. And the longer you avoid it, the scarier it can feel.

But here’s the reality: Not knowing your credit score can make your anxiety worse. The best way to ease your fear is to actually look at your score and figure out what’s really going on. Once you see the number, you can start improving it instead of imagining the worst.

Small moves to help you build credit

Good credit isn’t built overnight. It’s built through small, steady habits that show lenders you can handle money responsibly. Here’s where to start:

Use a credit builder app

Credit builder apps are for people who have little or no credit history. You essentially open a small savings-style account with a bank and make tiny monthly payments into it, like $25 or $50. Each payment gets reported to the credit bureaus, so you build credit history over time.

Once you finish, you get back the money you paid (minus any fees), so it’s like saving and building credit at once.

Make every payment on time

Your payment history makes up the biggest chunk of your credit score, and even one missed bill can tank it fast. Set up automatic payments (autopay) for as many bills as you can. If autopay isn’t an option, set up reminders on your phone.

Keep balances low

Try to use less than 30% of your available credit at any time. If your card limit is $1,000, aim to stay under $300. High balances make lenders nervous because it looks like you’re stretched thin. Paying down balances before your statement closes can help your score move in the right direction.

Ask to be an authorized user

If you have a parent, sibling, or trusted friend with a good credit score, ask if they’ll add you to their card. Their positive history (on-time payments and low balances) can give your score a jumpstart.

Get credit for the bills you already pay

Rent, utilities, and streaming services don’t usually count toward credit. But tools like Experian Boost or rent-reporting apps can change that.

Check your score often

Did you know you can download your credit reports for free at AnnualCreditReport.com? You can also use the Credit Karma app to keep an eye on your scores. (It’s what I personally use when I don’t feel like pulling reports.)

Recommended readings

- How to Improve Your Credit Score in 3 Months (and Beyond)

- College Grads Face 4.8% Unemployment — Higher Than the National Average

- 0.25%: What the Fed’s Rate Cut Means for Your Savings

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- FICO, FICO Score Credit Insights

- Experian, What Is the Average Credit Score in the U.S.?

- Bureau of Economic Analysis, Personal Savings Rate

- U.S. Department of Education, U.S. Department of Education Begins Federal Student Loan Collections

- New York Times, Gen Z Wants to Build Credit. It Has Few Options.

- PYMNTS, Gen Z Credit Scores Plunge as Cost of Living Rises

- Businesswire, Nearly Half of Gen Z Doesn’t Know What Affects Their Credit Score

- AnnualCreditReport, Request Your Free Credit Reports

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.