Managing multiple student loans with different rates and due dates can be a hassle. A Direct Consolidation Loan lets you roll your federal loans into one, simplifying repayment with a single monthly payment and fixed interest rate.

Offered by the Department of Education, a Direct Consolidation Loan won’t lower your rate, but it can make payments easier and unlock access to income-driven plans or loan forgiveness. If you’re looking for a way to streamline your loans, keep reading to see how it works and when it might be a smart move.

Table of Contents

- What is a Direct Consolidation loan?

- How is my Direct Consolidation Loan interest rate calculated?

- How long does a Direct Loan Consolidation take to repay?

- Who services Direct Consolidation Loans?

- Who is eligible for a Direct Consolidation Loan?

- Is a federal Direct Consolidation loan a wise idea?

- How to apply for a Direct Consolidation Loan

- Are federal student loan consolidation and student loan refinancing the same?

- FAQ

What is a Direct Consolidation loan?

A Direct Consolidation Loan is a federal loan program from the U.S. Department of Education that allows borrowers to combine multiple federal student loans into a single loan with a fixed interest rate.

This simplifies the loan management process by offering a single monthly payment and extending the repayment period.

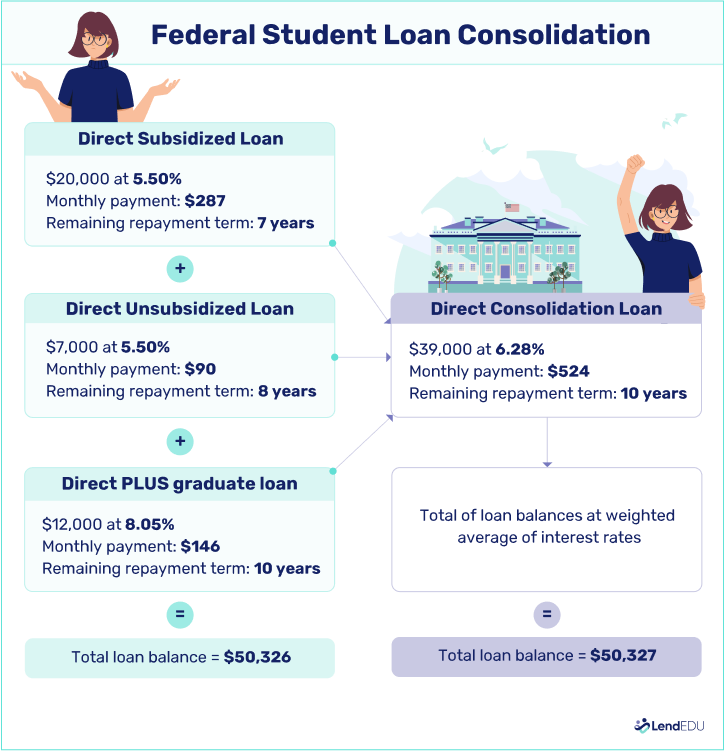

A federal Direct Consolidation Loan doesn’t reduce the interest rate but bases your new rate on the weighted average of your loans rounded up to the nearest 0.125%.

Unlike private loans for students, which you can consolidate through any number of private lenders, federal borrowers who want to maintain the federal government’s benefits must consolidate loans through the Direct Consolidation Loan (not a private loan).

This loan option is available to most borrowers, including those with PLUS loans, Federal Perkins Loans, and Health Education Assistance Loans. If you want to consolidate your federal student loans, remember:

- New fixed rate: When consolidating loans through the Direct Consolidation Loan, the new fixed rate is based on the “weighted average of the existing loan rates … rounded up to the nearest one-eighth of one percent.”

- Simplified loan repayment: Once federal loans are consolidated, repayment will consist of a single monthly payment made to a single loan servicer—assuming you consolidate all your federal loans.

- Lower payments: The Direct Consolidation Loan allows borrowers access to a lower payment by extending the repayment terms to a maximum of 30 years. Remember: Extended repayment terms and lower payments often result in more interest paid over the 30-year term.

- Additional loan repayment plans: The federal government has created numerous repayment plans, many of which are income-driven. This includes the Income-Based Repayment Plan (IBR), the Saving on a Valuable Education (SAVE) plan, and the Income Contingent Repayment Plan (ICR).

- Public Service Loan Forgiveness (PSLF): Some borrowers may find loan consolidation results in access to the Public Service Loan Forgiveness plan. Under this plan, full-time government and not-for-profit employees may be eligible for loan forgiveness after 120 qualifying monthly payments.

Many IDR plans decrease the repayment burden by basing monthly payments on a percentage of the borrower’s discretionary income (10% to 20%, based on the plan). These plans also typically offer loan forgiveness after 20 to 25 years of eligible payments.

How is my Direct Consolidation Loan interest rate calculated?

The interest rate for your Direct Consolidation loan is set based on the weighted average of the consolidated loans, rounded up to the nearest 0.125% (one-eighth of one percent). Your rate will be fixed for the entire loan term and will never change.

You can see an example of a federal student loan consolidation, including the interest rates and payments before and after consolidation, in the following image:

How long does a Direct Loan Consolidation take to repay?

The repayment term for a federal Direct Consolidation Loan can range from 10 to 30 years. How long it takes to repay your loan will vary depending on your loan balance. The larger the loan balance, the longer the repayment term you’re offered.

For example, if you owe more than $60,000 in federal student loans, you may be able to get a repayment term as long as 30 years. You’ll need to repay balances of less than $7,500 in 10 years at most.

If you want to repay your loan faster than your repayment term, you can do so without paying a prepayment penalty. Prepayments generally don’t count as qualifying payments for loan forgiveness programs, so keep this in mind if you’re interested in forgiveness.

Who services Direct Consolidation Loans?

All federal student loans, including Direct Consolidation Loans, are serviced by a company assigned to your account by the U.S. Department of Education. Your loan servicer will contact you once your account is assigned to it. The servicer is also listed in your Federal Student Aid account.

Your federal student loan account may be assigned to one of the following loan servicers by the U.S. Department of Education:

- EdFinancial

- MOHELA

- Aidvantage

- Nelnet

- ECSI

- Default Resolution Group

- CRI

You can log in to your Federal Student Aid account to view your loan servicer. You can also contact the Federal Student Aid Information Center by calling 1–800–433–3243 if you need additional assistance.

Who is eligible for a Direct Consolidation Loan?

Most federal student loans qualify for consolidation if they are in repayment or a grace period. However, there are some restrictions on which loans can be included and how they can be combined.

Eligible loans

You can consolidate the following federal student loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans (for graduate or professional students)

- Direct PLUS Loans (for parents): Parents can consolidate their own loans, but they cannot combine them with their child’s federal loans.

- Federal Perkins Loans

- FFEL Program Loans (Subsidized, Unsubsidized, and PLUS)

- Federal Nursing Loans

- Health Education Assistance Loans (HEAL)

Loans that cannot be consolidated

- Private student loans: Only federal loans qualify for a Direct Consolidation Loan.

- Spousal loans: Married couples cannot consolidate their federal loans together.

Special cases

- Previously consolidated loans: If you already consolidated your loans (including FFEL Consolidation Loans), you may still be eligible for a new consolidation under certain conditions.

- Loans in default: You must either:

- Agree to an income-driven repayment plan (IBR, SAVE, PAYE, or ICR), or

- Make three consecutive, full, on-time monthly payments.

Is a federal Direct Consolidation loan a wise idea?

Considering the pros and cons is crucial as you evaluate whether federal student loan consolidation is right for you.

Pros

-

Single, possibly lower, monthly payment

-

Increased access to income-based repayment and loan forgiveness programs

-

Continued access to federal student loan benefits

Cons

-

Interest rate won’t decrease but will be your loans’ weighted average (rounded up)

-

Repayment term may be longer, resulting in higher total loan costs

-

Loan consolidation may cause you to lose credit for progress toward loan forgiveness

Because consolidation often means repayment is extended, which often lowers monthly payments, you may find you’ll make more payments and pay more interest.

Consolidation through the Direct Consolidation Loan may result in losing borrower benefits and repayment options, including principal rebates, interest rate discounts, and loan forgiveness benefits associated with your federal loans. This applies in particular to borrowers who have already enrolled in income-driven repayment plans or a forgiveness plan because consolidation “resets the clock,” extending repayment.

If you’re looking for simplicity and don’t want to lose federal loan benefits, I would recommend federal loan consolidation. Over the long term, you may pay more in interest if you don’t prepay the loan before the term ends. However, if you can extend the loan terms and subsequently lower your monthly payment, it can free up funds to build emergency savings and begin saving for retirement.

As time goes on, you may increase your income and apply more toward the consolidated loan, allowing you to pay it off earlier. This lowers the interest you pay. You may also experience a hardship, so the consolidation offers relief.

Consider the interest rate of the loan, the benefits the federal loans provide, and whether you have the need and the option for loan forgiveness. The long-term financial impact depends on each individual’s goals, and it’s wise to consult a financial professional or trusted family or friend when making this decision.

How to apply for a Direct Consolidation Loan

To apply for a Direct Consolidation Loan, visit the StudentAid website, where you can complete and submit the online application. You can also print, complete, and mail the application if you prefer.

To complete the form, be ready to provide:

- Basic borrower information (such as your name, address, and Social Security number) and your verified FSA ID

- Two references (adults who don’t live with you and have known you for three years or more)

- Loans you want to consolidate (including the name of the servicer or loan holder, account number, and estimated payoff amount). Get this information when you log in to your Federal Student Aid account.

- Income information if you want to repay under an income-driven repayment plan

- The end date of loans in grace periods if you want to delay the consolidation until the grace period ends

The Direct Consolidation Loan can make repayment more manageable by offering a single monthly payment and access to income-driven repayment programs. However, federal student loan consolidation may not be suitable for everyone.

If you have questions about the Direct Consolidation Loan, visit the U.S. Department of Education’s Federal Student Aid website, or contact the Student Loan Support Center at 1-800-557-7394.

Are federal student loan consolidation and student loan refinancing the same?

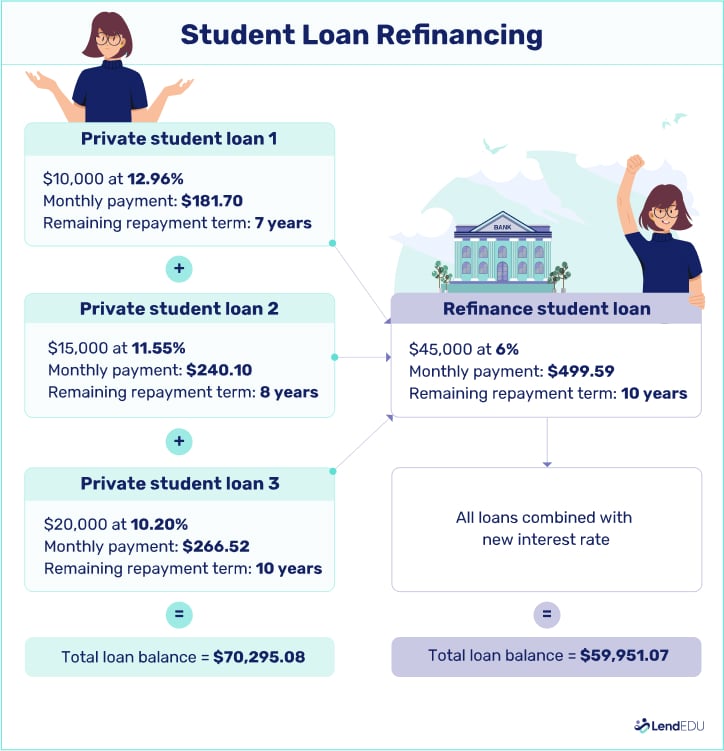

You can “consolidate” private student loans and federal education loans—together in some cases—but be aware of the differences:

| Federal consolidation | Private refinancing | |

| Eligible loans | Most federal student loans | Private or federal student loans |

| Credit check? | ❌ | ✅ (Varies by lender; often requires good credit and sufficient income) |

| Interest rate | Weighted average of current loans, rounded up | Lower rate is possible |

| Amounts | Outstanding balance | Outstanding balance |

| Federal benefits available? | ✅ | ❌ |

As the name suggests, private student loan consolidation or refinancing is a loan consolidation with a private lender. Eligibility requirements, rates, and loan terms vary by lender. Federal loan consolidation is only for federal student loans.

You can consolidate most federal student loans with a federal consolidation loan. The exception is a parent’s Direct PLUS loan. Married couples can’t jointly consolidate their federal student loans.

Most private lenders allow borrowers to consolidate private and federal student loans into a new loan, but we advise doing so with caution. You’ll lose federal benefits with private refinancing (e.g., loan forgiveness). Avoid private refinancing if there’s any chance you’ll need these federal benefits.

Eligibility, rates, and terms often depend on the borrower’s credit score, income, and total loan amount. Getting a lower rate with a private student loan is possible, especially if your finances or market conditions have improved since you got your loans. Check out the example below:

The rates and terms vary by lender, so if you’re considering a private consolidation loan, shop around and contact individual lenders for lender-specific information.

The government sets eligibility, rates, and terms, regardless of the loan servicer (e.g., MOHELA, Aidvantage, or Edfinancial). Federal student loans don’t have credit requirements. Anyone with eligible federal student loans qualifies.

The rate for federal student loans is the weighted average of all consolidated loans, rounded up to the nearest 0.125%. So you can’t get a lower rate with a federal student loan consolidation, but it will simplify the payment process because you’ll only have one loan to repay.

FAQ

Are Direct Consolidation Loans eligible for forgiveness?

Yes, but only under specific conditions. A Direct Consolidation Loan itself doesn’t provide automatic forgiveness, but it can make you eligible for forgiveness programs that you wouldn’t qualify for otherwise. For example:

- Public Service Loan Forgiveness (PSLF): If you consolidate FFEL or Perkins Loans, they can become eligible for PSLF, but you’ll need to restart the 120-payment count.

- Income-Driven Repayment (IDR) Forgiveness: Consolidating can help if you have older loans that wouldn’t otherwise qualify for IDR plans. However, consolidation restarts the clock on forgiveness under an IDR plan.

How does a Direct consolidation Loan work for Parent PLUS loans?

Parents who took out Direct PLUS Loans can consolidate them into a Direct Consolidation Loan, but there are some key rules:

- Parent PLUS Loans cannot be combined with the student’s federal loans. Parents can only consolidate their own loans.

- Only one income-driven repayment (IDR) plan is available. Once consolidated, Parent PLUS Loans are only eligible for ICR—they cannot be repaid under SAVE, PAYE, or IBR.

- Consolidation can make Parent PLUS Loans eligible for PSLF. If the parent borrower works for a qualifying employer, they may qualify for forgiveness after 120 payments under ICR.

How long does it take to get a Federal Direct Consolidation Loan?

The process usually takes 30 to 60 days from application to disbursement, but it can take longer in some cases. During this time:

- Your loan servicer processes your application and verifies eligibility.

- Your existing loans are paid off, and the new Direct Consolidation Loan is created.

- If you request to delay processing until the end of your grace period, this can extend the timeline.

If you’re consolidating to qualify for PSLF or an IDR plan, be sure to continue making payments while your application is processed to avoid delays.

About our contributors

-

Written by Megan Hanna, CFE, MBA, DBA

Written by Megan Hanna, CFE, MBA, DBADr. Megan Hanna is a finance writer with more than 20 years of experience in finance, accounting, and banking. She spent 13 years in commercial banking in roles of increasing responsibility related to lending. She also teaches college classes about finance and accounting.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.