Getting denied a student loan can feel like a major setback—but it doesn’t have to end your college plans. Whether the issue is credit, paperwork, or eligibility, there’s usually a fix. This guide breaks down why loan applications get denied and what you can do next, including federal, private, and alternative funding options.

Table of Contents

FAFSA denied for federal student loans

Federal student loans are usually the best place to start when paying for college. They offer fixed interest rates, income-driven repayment plans, and potential forgiveness options.

But if your FAFSA was denied or you were told you don’t qualify for loans, it can be confusing and stressful. Don’t worry—you might just need to make a few corrections or clear up some paperwork. Here’s what could be going on and how to fix it.

Can FAFSA deny you?

Not exactly. The FAFSA (Free Application for Federal Student Aid) itself doesn’t approve or deny anything—it’s a form used to figure out your eligibility for federal loans, grants, and work-study programs. But after you submit the FAFSA, you could still be denied federal aid based on your situation or a mistake in your application.

So if you’ve been told you’re not eligible for federal loans, you’re not alone—and there’s often a way forward.

Why would FAFSA be denied?

There are two main reasons you might be denied federal student loans: you don’t meet the eligibility requirements or something went wrong in the application process.

Common eligibility issues

You may not qualify for federal student loans if:

- You’re not a U.S. citizen or eligible non-citizen

- You don’t have a valid Social Security number

- You’re not enrolled at least half-time in an eligible degree or certificate program

- You’re not making satisfactory academic progress (such as a low GPA or incomplete coursework)

- You’re in default on a previous federal loan or owe a refund on a grant

- You’re currently incarcerated, which generally disqualifies you from federal loans

- You’re applying for a PLUS loan and have an adverse credit history (e.g., recent bankruptcy, default, foreclosure, collections, etc.)

Application problems

Even if you meet all the eligibility rules, your aid can still be delayed or denied if:

- You left part of the FAFSA blank

- You entered incorrect information, like a mismatched name or Social Security number

- You forgot to sign the application (electronically or physically)

- You missed your school’s FAFSA deadline

- You were selected for verification and didn’t submit the required documents (like tax forms)

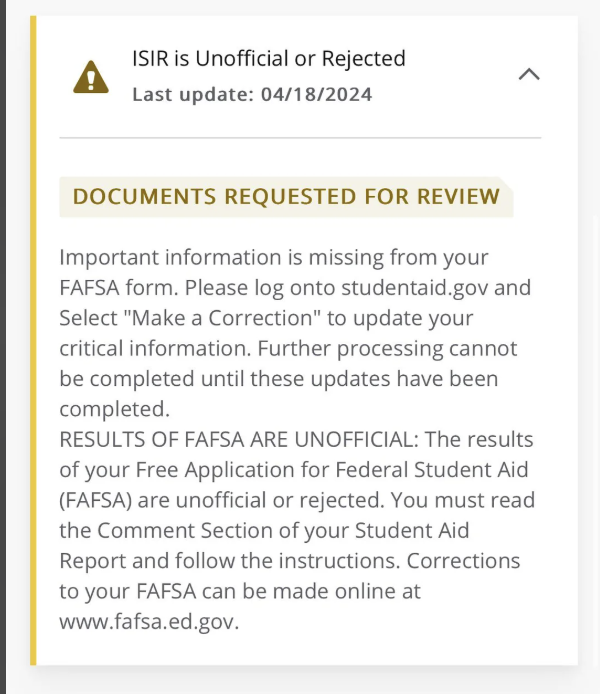

Here are some examples of how this might look when you log in to view the status of your FAFSA.

The good news is, these are all fixable issues, and you have the ability to correct or edit your FAFSA—but you’ll need to act quickly, especially if classes are about to start.

What to do if you were denied financial aid

The next step depends on why your federal aid was denied. Some issues can be resolved quickly—others may take time. Here’s how to respond depending on the situation:

| Reason for denial | Possible solution |

| Loan in default | Apply for student loan consolidation or rehabilitation |

| Citizenship issue | Work toward becoming an eligible non-citizen or permanent resident |

| Incarcerated | Explore federal grants or education programs available while incarcerated |

| PLUS loan denied for credit reasons | Get an endorser or document extenuating circumstances |

| Not meeting academic standards | Ask about academic plans or appeal options at your school |

| FAFSA incomplete or incorrect | Log back in and fix any errors, or refile completely if needed |

| Missing verification documents | Submit your paperwork promptly and follow up with your financial aid office |

If you’re not able to resolve the issue right away—or you still don’t qualify for federal loans—you might consider private student loans as a backup option.

Private loans come from banks, credit unions, and online lenders. They’re credit-based, so you may need a cosigner if you don’t have a strong credit history or steady income yet. Interest rates can be higher than federal loans, and repayment options are typically less flexible—but they can be a helpful tool when federal aid isn’t available.

Before applying, compare lenders carefully and make sure you understand the terms. The table below show our top recommendations for private student loan lenders. If you’re adding a cosigner, talk honestly about the risks and responsibilities for both of you.

| Company | Rates (APR) | Rating (0-5) |

|---|---|---|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

3.29% – 15.99% fixed-rate APR w/ autopay included |

|

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

Parent PLUS loan denial

The Parent PLUS loan can be a useful way to help cover your child’s college costs—but it isn’t guaranteed. Unlike most federal student loans, PLUS loans involve a credit check, and certain issues in your credit history can result in a denial.

Can your Parent PLUS loan application be denied?

Yes. The Department of Education may deny your Parent PLUS loan application if your credit report shows signs of financial trouble, even if your income is high or you’ve never missed a student loan payment before.

Reasons for Parent PLUS loan denial

Denials typically happen because of what the Department of Education defines as adverse credit history. This includes:

- One or more accounts that are 90+ days delinquent

- Accounts that have been charged off or sent to collections

- Defaults on previous loans

- A bankruptcy, repossession, or foreclosure in the last five years

- Wage garnishments or tax liens

Any one of these may be enough to disqualify your application.

What to do if you were denied a Parent PLUS loan

A denial doesn’t mean you’re out of options. Here are four possible ways to move forward:

1. Apply with an endorser

You can reapply with an endorser—someone with good credit who agrees to take responsibility for the loan if you don’t repay it. This is similar to using a cosigner on a private loan. The endorser can’t be the student the loan is for, but it could be another family member.

2. Appeal the denial

If your credit issues were due to circumstances beyond your control—such as a job loss or medical emergency—you can submit an appeal and provide documentation. If approved, you’ll also need to complete PLUS loan counseling before funds are released.

3. Explore private student loans

Private student loans are available through banks, credit unions, and online lenders. These loans often require a cosigner with strong credit, especially if the student borrower doesn’t have an income. If you’re not eligible for a Parent PLUS loan, this can be a viable alternative, particularly if you or another trusted adult can cosign.

4. Consider a home equity option

If you own a home, a home equity loan or home equity line of credit (HELOC) may be worth considering. These products typically offer lower interest rates than unsecured loans, and some borrowers prefer them for large education expenses. Just be cautious—your home is the collateral, so repayment should be carefully planned.

Denied private student loans

Private student loans are offered by private lenders with varying eligibility requirements. If your application was denied, it can be frustrating—but it doesn’t mean you’re out of options. Understanding the reason behind the denial is the first step toward fixing it.

Can you get denied for private student loans?

Yes. Private lenders review your credit history, income, debt load, and other financial factors before approving a student loan. If you—or your cosigner—don’t meet their criteria, the lender can deny your application.

Each lender sets its own rules, so being denied by one doesn’t mean you’ll be denied by all.

Why your application was denied

Credit is often the main hurdle for students applying for private loans, but it’s not the only reason an application might be rejected. Here are some common factors:

- Income: Lenders want to see that the borrower or cosigner has enough income to afford the loan payments. If there’s no income or it’s too low, the application may be denied.

- Employment history: A short or inconsistent work history—especially if you’re applying without a cosigner—can work against you.

- Debt-to-income (DTI) ratio: If a large portion of your income already goes to existing debt, that could be a red flag for lenders.

- Credit history: Limited or poor credit, missed payments, or high credit card balances can all lead to denial.

- Other factors: Some lenders consider your field of study, school, or residency status. Not all private lenders work with international students, DACA recipients, or students attending non-accredited programs.

If you applied with a cosigner, keep in mind that their credit and financial profile are reviewed too. If they don’t meet the lender’s requirements, you could still be denied. you may need to find another creditworthy cosigner.

You were denied a private student loan—now what?

There are two main ways to strengthen your private student loan application to avoid future denials:

Add a cosigner with a strong credit history

A creditworthy cosigner can significantly improve your approval odds. Lenders want to see a solid credit score, stable income, and low debt. If your current cosigner wasn’t approved, you may need to apply with someone who better meets those standards.

Just remember: cosigning is a serious financial commitment. If you miss payments, your cosigner becomes responsible—and their credit could be damaged too.

Improve your credit score

Whether or not you use a cosigner, building your credit can help now and in the long run. Here are some practical ways to do that:

- Make on-time payments on any credit accounts you already have.

- Check your credit reports and dispute any errors you find.

- Pay down existing debts, especially credit cards with high balances.

- Consider a secured credit card to build credit if you don’t have much history.

Every private lender is a little different. Once you’ve taken steps to strengthen your application, compare your options and focus on lenders that align with your financial profile.

What to do if you can’t get approved for a student loan

You still have options if you’ve applied for federal and private student loans and been denied both. Some of the avenues you might explore include:

- Scholarships: Scholarships can provide free money for school. Some are merit-based; others are need-based. You can search for scholarships online or visit your school’s financial aid office to see if any school-specific options are available.

- Grants: Like scholarships, grants give you free money to pay for school. In most cases, grants are need-based rather than merit-based. You can apply for federal Pell Grants by completing the FAFSA, searching online, or contacting your school’s financial aid office for other grant opportunities.

- Work study: Work-study programs allow you to earn money to pay for school in exchange for working in an approved setting. You can apply for federal work-study by completing the FAFSA.

You’re not limited to just one of these funding sources. The more scholarships, grants, and work-study opportunities you apply for, the more money you can obtain for school.

How to get approved for a student loan: Top tips

If you know that you’ll need student loans to pay for college, you can take steps now to better prepare for

- Understand what type of loans you’re applying for. That can help you take preemptive actions to raise your approval odds, such as improving your credit score or getting federal loans out of default.

- Start with federal loans first. Federal loans offer benefits that private student loans don’t, including income-driven repayment options and the possibility for loan forgiveness.

- Submit the FAFSA each year to get the maximum federal aid possible. If you don’t fill out the FAFSA, your school will assume you don’t have federal financial aid for that school year.

Along those lines, your best resource for finding financial aid may be your school. Your financial aid office can give you more specific information about different funding options, how to apply, and what to do if federal student loans aren’t available.

You can still take part-time classes if you need extra time to address any issues keeping you from getting approved for student loans. You may need to pay for those classes out of pocket if you don’t qualify for aid yet. But that can be a good way to keep your education on track until you become eligible for loans.

Read more: How Student Loans Work

FAQ

Can you be denied a student loan because of bad credit?

Yes—but it depends on the type of loan. Federal student loans (except for Parent PLUS and Grad PLUS loans) don’t require a credit check, so bad credit usually won’t disqualify you. However, private student loans and PLUS loans do look at credit. If your credit history shows defaults, collections, or other red flags, you may be denied unless you apply with a qualified cosigner or appeal the decision.

What disqualifies you from student loans?

Common reasons for federal loan disqualification include:

- Not being a U.S. citizen or eligible non-citizen

- Not being enrolled at least half-time in an eligible program

- Defaulting on previous federal student loans

- Not making satisfactory academic progress

- Failing to complete the FAFSA or required documentation

For private loans, disqualification is more often tied to credit score, income, debt-to-income ratio, or lack of a strong cosigner.

If I get denied for a student loan, can I apply again?

Yes. You can reapply anytime, especially after fixing the issue that caused the denial. For federal loans, that might mean correcting your FAFSA or resolving a loan default. For private loans, you might try again with a different cosigner or after improving your credit. Just make sure you understand the reason for the denial before submitting a new application.

Does a denied loan hurt your credit?

The denial itself doesn’t impact your credit—but the hard credit inquiry that happens when you apply may cause a small, temporary dip in your credit score. If you’re shopping around for private loans, try to submit all applications within a short window (typically 14–45 days) to limit the effect of multiple inquiries.

Who can you contact if your loan application is turned down?

Start with your school’s financial aid office—they can explain why your federal aid or FAFSA-based loan was denied and help you figure out your next steps. If you were denied a private student loan, contact the lender directly to ask for details about the decision and whether you can reapply with a cosigner or updated information. You can also speak with a nonprofit credit counselor or college access advisor for additional guidance.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.