If you’re looking into companies to buy gold from, you’ll find a long list of gold dealers offering bullion for IRA accounts or home storage.

Our top-rated gold IRA companies (which also sell physical gold investments) are listed here: Top Gold IRA Companies of 2025. These are all reputable gold dealers.

- Up to $15,000 in free silver on qualified accounts

- 100% satisfaction guarantee, 7-day full refund

- Lowest price guarantee & no buy-back fees

- Complimentary shipping insurance

- Invest in a gold IRA with as littile as $5,000

- Easy online account setup

- Detailed guidance for beginners

- Up to $10,000 in free silver on qualified purchases

- 100% tax-free and penalty-free IRA rollover

- Price Protection Program for large purchases

- 24-hour account setup

- Fees waived for accounts over $100,000

But maybe you’re looking for physical gold for something other than an IRA, for example, for your home storage or a collection. In this case, we’re talking vintage bullion, rare and collectible coins, and special edition and proof sets.

When you’re buying physical gold, you want a dealer that won’t skimp on details gold IRA investors might not care about as much, like mintage, condition grading, and live pricing. These details are sometimes sparse on the gold IRA company sites.

So what’s the best place to buy physical gold online? What are the best dealers? Based on our research, the following six companies are among the most trusted gold and silver coin dealers on the market.

| Company | Best for… | |

|---|---|---|

|

Purchasing with crypto |

|

|

Diverse product selection |

|

|

Monthly purchase plan, beginner investors |

|

|

Global storage options, secure delivery |

|

|

Low premiums over spot price |

|

|

Fast, discreet shipping |

|

Table of Contents

Best gold dealers

Best for bulk discounts: JM Bullion

Why we picked it

JM Bullion is one of the biggest names in the precious metals industry, known for its competitive prices and excellent product variety. Founded in 2011, the company offers both IRA-eligible bullion and collectibles.

- Wide selection of precious metal products

- Transparent pricing

- Discounts on check/wire purchases

- Helpful educational resources

- Some reports of poor service

- Numerous unresolved complaints with the BBB

| Inventory | Gold, silver, platinum, palladium, rare metals |

| Shipping | Free over $199 |

| Storage | 6-month free storage offer with TDS Vaults |

| Returns | Within 5 business days of delivery |

| Delivery protection | Shipping insurance, discreet packaging |

| Purchase minimum? | Only when paying with bank wire or Klarna |

| Years in business | 14 |

| Customer ratings | Good |

| Other offerings | Precious metals IRA |

Diverse product selection: American Precious Metals Exchange (APMEX)

Why we picked it

In business since 2000, APMEX is a well-known and trusted gold dealer. Investors appreciate the company’s precious metal product variety and generous rewards for loyal buyers.

- Live prices

- Bonuses, rewards, and loyalty program

- Live customer support

- Portfolio tool for monitoring investments

- Low Trustpilot score

- Premiums may be high

| Inventory | Gold, silver, platinum, palladium |

| Shipping | Free for orders over $199 |

| Storage | Allocated and segregated storage with Citadel Global Depository Services |

| Returns | Within 7 days of delivery |

| Delivery protection | Tracking, full insurance |

| Purchase minimum? | No |

| Years in business | 25 |

| Customer ratings | Mixed |

| Other offerings | IRA, collectibles |

Best monthly purchase plan: Money Metals Exchange

Why we picked it

Money Metals Exchange is a popular gold distributor offering all-in-one solutions for investors. Besides a wide-ranging inventory, the dealer also provides affordable and secure proprietary storage.

- On-site world-class depository

- Varied product catalog

- Attractive monthly purchase plan

- Referral program

- Limited reviews and mixed client feedback

| Inventory | Gold, silver, platinum, palladium, others |

| Shipping | Free from $199 |

| Storage | Money Metals Depository |

| Returns | Within 3 business days of delivery, at company’s discretion, not including shipping and handling fees |

| Delivery protection | Insured shipments, signature requirement for high-value orders |

| Purchase minimum? | None |

| Years in business | 15 |

| Customer ratings | Fair |

| Other offerings | IRA, loans |

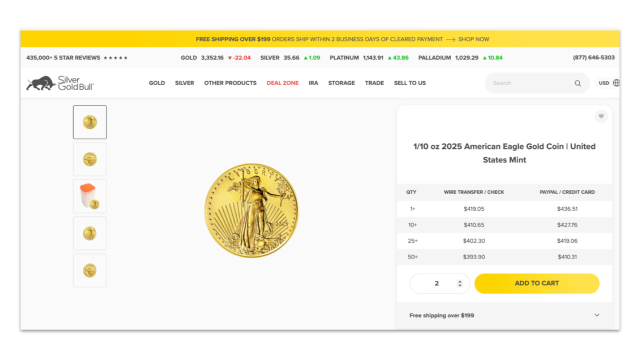

Most secure delivery: Silver Gold Bull

Why we picked it

Silver Gold Bull is one of the best online gold dealers, known for its impressive product catalog and commitment to client satisfaction. The dealer offers a price match guarantee, including shipping and fees.

- Outstanding selection of bullion and collectibles

- Secure shipping and insurance

- Price match policy

- Stellar reviews

- Many listings appear “out of stock” or lack images

| Inventory | Gold, silver, platinum |

| Shipping | Free for orders over $199 |

| Storage | Allocated and segregated storage in four countries |

| Returns | Must contact team within 2 business days from delivery |

| Delivery protection | Shipping insurance, signature upon delivery, discreet packaging |

| Purchase minimum? | None except if you pay using PayPal Later or wire transfer |

| Years in business | 16 |

| Customer ratings | Outstanding |

| Other offerings | IRA, collectibles |

Best for low premiums: SD Bullion

Why we picked it

SD Bullion lists a solid variety of gold and silver products at competitive prices, complete with a price match guarantee. The company also offers fast IRA setup and secure storage.

- 3-in-1: Gold seller, IRA dealer, and storage provider

- Price match guarantee

- Proprietary safe storage

- Multiple payment options

- Live chat appears on website but says “unavailable”

- Some customers report issues with shipping

| Inventory | Gold, silver, platinum |

| Shipping | Free for orders over $199 |

| Storage | Segregated storage in the dealer’s own depository |

| Returns | Within 3 business days of delivery |

| Delivery protection | Full insurance, signature requirement, plain packaging |

Best for discreet shipping: Buy Gold and Silver Coins (BGASC)

Why we picked it

BGASC is one of the most reputable gold dealers out there, with consistently high ratings, secure shipping, and quality service. However, it doesn’t offer IRA or storage solutions, so you must provide these yourself.

- Next-day shipping

- Private and secure transactions

- No order minimum

- No IRA options

- No storage solutions

| Inventory | Gold, silver, platinum, palladium |

| Shipping | Free on orders over $199 |

| Storage | No partner depositories |

| Returns | Within 5 business days of delivery, shipping costs not covered |

| Delivery protection | Shipping insurance, discreet packaging, required signature for orders over $1,000 |

| Purchase minimum? | None |

| Years in business | 13 |

| Customer ratings | Excellent |

| Other offerings | Collectibles |

What are the most reputable gold dealers?

When you’re looking to buy gold or silver, especially for long-term investment in a precious metals IRA, you want to make sure you’re purchasing from a trustworthy seller. All the companies we listed are established gold dealers with a long-standing reputation and an A+ BBB score, but their online rankings vary.

Gold dealers with excellent Trustpilot scores

Of the six gold sellers we highlighted, Silver Gold Bull has the best Trustpilot rating: 4.8 based on around 4,000 reviews. This review, praising the company for “great price” and “fast shipping,” appears typical among the dealer’s clients.

BGASC, too, has an excellent Trustpilot average of 4.5, based on around 8,000 reviews. Clients appreciate the dealer’s competitive prices and excellent service: For example, Steve says, “With BGASC, I have received the best pricing … Always have received my order quickly.”

Companies with mixed reviews

APMEX and Money Metals perform less well on Trustpilot. Money Metals has an average rating of 3.4 (based on 130 ratings), with some reviews citing issues like “unresponsive customer support” and products that arrived “in terrible shape.” However, other clients are happy with “the prices, the quality, delivery speed, and customer service experience.”

APMEX’s Trustpilot rating seems surprisingly low for such a widely used, long-established company. It has a 1.6 score, but the displayed reviews are overwhelmingly positive. This discrepancy might be due to Trustpilot’s rating system, which could give more influence to some reviews or penalize companies that fail to address negative feedback.

What to check before you buy

Although online ratings and reviews can help you figure out whether a bullion seller is reliable, you should also do your research. Read the fine print on the company’s fee structure, returns policy, insurance, and storage offers. Compare prices and service terms to confirm you’re getting a good deal.

As a CFP®, I don’t directly help clients choose which companies to work with, but I advise finding reputable dealers with good reviews and not just going with the group you hear on the news or radio.

Find a dealer that provides a clean and relatively simple purchasing process while charging minimal fees, as this impacts the long-term benefit of purchasing the physical metal.

Which are the most trusted gold and silver coin dealers?

While all the companies we reviewed offer a solid selection of gold and silver coins, APMEX stands out thanks to its vast inventory. APMEX lists an astonishing variety of coins, from popular choices like American Eagles and Maple Leafs to international coins like Austrian Philharmonics, Mexican Libertads, Krugerrands, and more.

It also carries vintage bullion, rare and collectible coins, special edition and proof sets, and other offers for those interested in coins beyond their metal value. Each product comes with a detailed description, precise specifications, condition grading, live price, and a guarantee of matching the quality of the displayed image.

When looking for the best gold coin dealers, pay attention to details like variety, transparency, markups, and return or exchange policies. A trusted seller will clearly state whether a product is standard bullion or a collectible coin. They should share mintage details, coin grade, and other relevant information, and answer any questions promptly when you reach out about a listing.

Reputable dealers often provide guides and educational resources that help you make the right decision when choosing coins, such as information on which coins are suitable for holding in a gold or silver IRA.

Which companies are best for bullion bars and bulk orders?

If you’re mainly interested in investment-grade gold and silver, the best bullion companies on our list are SD Bullion and JM Bullion.

Unlike some other dealers that also offer numismatic coins and other collectibles, SD Bullion focuses on investment metals, including large gold and silver bars (up to 1 kilogram for gold and 1,000 ounces for silver). Many investors, especially those who opt to buy large quantities, choose SD Bullion for low premiums and bulk discounts.

JM Bullion is another excellent choice for buying high-purity precious metals. It features an excellent product selection at competitive prices, delivers metals in fully insured, discreetly packed shipments, and is well-known for its strong customer service. JM Bullion also runs weekly sales at prices of up to 65% off the premium—a great opportunity to snag an attractive deal.

While researching bullion dealers, look for companies with transparent pricing that specifies the premium. Browse the product selection to make sure you’re buying metal products from reputable sources like the U.S. Mint. Study the dealer’s shipping, insurance, and return policies, and find out whether the company offers a buyback program in case you need to sell your metals.

How do I know what the best company to buy gold from is?

When shopping for gold or silver bullion, choose established dealers that offer competitive prices, strong service, fast, secure shipping, and good communication.

Pricing and fees

You’ll want to get as much metal as possible for your money, but the lowest price per ounce isn’t always the best deal. Look at total costs, including shipping and handling, and avoid vague pricing. All the companies we reviewed, for example, offer free shipping from $199. This is the industry standard, so anything above that indicates you could get a better deal elsewhere.

Also check out the seller’s special offers, like bulk discounts, flash sales, and IRA signup bonuses.

Product selection

Some precious metal dealers offer rare and collectible coins in addition to bullion, while others focus solely on investment-grade coins, bars, and rounds. However, at a minimum, an established company should offer rounds, bars of various sizes, and a selection of popular legal tender coins.

Honesty

Trustworthy sellers won’t spam you or resort to high-pressure sales tactics. They’ll be upfront about the pros and cons of investing in gold, premiums, and any extra fees. If you ask a question or have a complaint, a representative should help you resolve your issue quickly and efficiently.

Extra services (IRA and storage)

If you’re buying bullion, you may also plan to set up a gold IRA or need a secure storage solution for your precious metals. Many top-rated gold dealers help you open an IRA account and provide guides that explain how a gold IRA works. Some offer attractive deals, like a period with no storage fees.

Remember that the investment threshold for a gold IRA is often higher than the minimum order amount for a home delivery.

Reputation

Look at dealers’ online reviews. What do clients say about their product quality, shipping, service, and prices? Obviously, experiences may differ, and feedback is often subjective, but multiple reviews pointing to an ongoing issue, like an unreliable buyback policy, could be a red flag.

How to start working with a gold distributor

Once you choose a gold dealer that suits you in terms of product selection, pricing, shipping, and service, the process is fairly straightforward. This is what you can expect when working with online bullion sellers.

1. Set up an account

Gold dealers usually ask you to set up an account before you place your first order. You’ll need to provide basic details like your name, email, and address. Your account is where you track your orders, set preferences, and access deals.

2. Choose products

Browse the dealer’s listings. You’ll usually be able to search by category, like metal, product type (e.g., coins or bars), mint, or even region (U.S., U.K., Canada, etc). Take your time reading product descriptions and the fee structure, especially if you’re a first-time buyer.

3. Select a payment method

Gold dealers usually accept various payment methods, including wire transfers, PayPal, credit cards, and even cryptocurrency. Many offer better deals for wire or check payments.

4. Place your order

Add the selected products to your cart. Your price at checkout usually depends on the metal’s current spot price. Make sure you understand the seller’s insurance policy and shipping terms, like delivery times and signature-on-delivery requirement.

5. Track the order

Once you place the order, the dealer will provide you with tracking information so you can monitor your shipment. Sellers typically offer full shipping insurance and send precious metals in discreet packaging. Most also ask you to receive the shipment personally and provide a signature upon delivery, especially for high-value orders.

6. Check your package

Make sure the package is intact and the product count and condition match what you ordered. If you notice any issues, like signs of tampering with the packaging, missing items, or products that have arrived not as advertised (like scratched or dented coins when you paid for uncirculated), contact customer service immediately.

Three facts to be aware of when you’re considering buying gold:

- Premium to purchase

- Discount to sell in the future

- Cost associated with the storage of the physical coins or bullion (e.g., safe or safe-deposit box and insurance coverage).

At the end of the day, minimizing these costs affects the benefits of holding physical metal rather than purchasing a liquid holding that you can change over time.

How we chose the best online gold dealers in 2025

Since 2020, LendEDU has evaluated gold dealers to help readers find the best precious metal IRAs and inventories for direct purchase. Our latest analysis reviewed 24 data points from 31 dealers, with 744 data points collected from each. This information is gathered from company websites, public disclosures, customer reviews, and direct communication with company representatives.

These data points are organized into broader categories, which our editorial team weighs and scores based on their relative importance to readers. These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

Gold dealers we evaluated

- Advantage Gold

- All American Assets

- American Bullion

- American Hartford Gold

- American Precious Metals Exchange (APMEX)

- Anthem Gold Group

- Augusta Precious Metals

- Birch Gold Group

- Eagles Capital

- Goldco

- Gold Alliance

- Goldline

- iTrustCapital

- JM Bullion

- Lear Capital

- Monetary Gold

- Noble Gold

- OneGold

- Orion Metal Exchange

- Oxford Gold Group

- Patriot Gold Group

- Preserve Gold

- Priority Gold

- RC Bullion

- Red Rock Secured

- Rosland Capital

- Silver Gold Bull

Recap of the best online gold dealers

| Company | Best for… | Customer reviews | |

|---|---|---|---|

|

Purchasing with crypto | Good |

|

|

Diverse product selection | Mixed |

|

|

Monthly purchase plan, beginner investors | Fair |

|

|

Global storage options, secure delivery | Outstanding |

|

|

Low premiums over spot price | Great |

|

|

Fast, discreet shipping | Excellent |

|

About our contributors

-

Written by Anna Twitto

Written by Anna TwittoAnna Twitto is a money management writer passionate about financial freedom and security. Anna loves sharing tips and strategies for smart personal finance choices, saving money, and getting and staying out of debt.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.