Our take: AmONE partners with lenders that may approve borrowers with lower credit, but it’s less transparent than other marketplaces and doesn’t disclose its lending partners upfront.

Personal Loan Marketplace

- Free to use

- Get quotes in 2 minutes

- Won’t affect your credit score (no hard pull until you choose a lender and apply)

- Compare multiple lenders in one place

- Helped 50 million people since 1999

- Partners with several lenders that offer loans to those with a thin credit history or low credit score

- Some lenders offer loans as soon as 1 day

- Not transparent about lending partners

- Customers report getting several lending phone calls

- Not a direct lender

- Some lending partners have origination fees

- Only offers comparisons of certain types of loans

| Rates (APR) | 6.99% – 35.99% |

| Loan amounts | Up to $100,000 |

| Repayment terms | Up to 7 years |

It would take way too much time (that you likely don’t have) to individually apply to multiple personal loan lenders. If you use a loan marketplace like AmONE, though, you can fill out one prequalification form and get several personal loan offers without hurting your credit score.

You will need to submit your personal information and agree to a soft credit pull, but AmONE does the heavy lifting by matching you with lenders based on your prequalification data. In this AmONE review, we’ll explain how the marketplace works, its unique features, pros, cons, and alternative marketplaces that might be better options.

AmONE marketplace features

QuinStreet, a leader in financial comparison websites, acquired AmONE in 2018 for $28.3 million, so AmONE’s business roots date back to 1999. AmONE says it specializes in matching borrowers with the best personal loans for them.

Types of loans

AmONE offers comparisons of several types of personal loans, including:

- Personal loans

- Baby/adoption costs

- Boat expenses

- Debt consolidations

- Moving and relocation costs

- Taxes

- Vacation

- Business startup loans

- Bad credit loans

- Home renovation loans

AmONE also offers to match consumers with auto loans, but not mortgages or private student loans.

Eligibility requirements

Every lender on AmONE’s marketplace will have its own personal loan eligibility requirements. Generally, lenders prefer that you have at least fair credit, a stable income history, and a low debt-to-income ratio. However, AmONE partners with lenders that accept borrowers with a less-than-perfect credit history.

Pros and cons of AmONE

Here are several benefits and drawbacks of getting a personal loan using the AmONE marketplace:

Pros

-

The service is free to use

-

Get quotes in two minutes

-

Won’t affect your credit score (no hard pull until you choose a lender and apply)

-

Compare multiple lenders in one place

-

Helped 50 million people since 1999

-

Partners with several lenders that offer loans to those with a thin credit history or low credit score

-

Some lenders offer loans as soon as 1 day

Cons

-

Not transparent about lending partners

-

Customers report getting several lending phone calls

-

Not a direct lender

-

Some lending partners charge origination fees

Is AmONE legit? Customer reviews

The thousands of AmOne reviews online on Trustpilot are mostly positive. However, AmOne is not Better Business Bureau (BBB)-accredited and shows several negative reviews:

| Source | Customer rating | Number of reviews |

| Trustpilot | 4.2/5 | 2,991 |

| BBB | 2.58/5 | 48 |

There are also several customers who’ve shared their experiences on Reddit:

While some commenters confirm that AmOne is a legitimate place to get loan offers, others report receiving spam phone calls for weeks after submitting their information.

AmONE alternatives

AmONE won’t be the best fit for everyone. We regularly update and revise our list of the best personal loan companies so you can compare your options.

Below are three well-rated marketplaces we think you should consider besides AmONE.

| Company | What to know | Benefits | |

|---|---|---|---|

|

Some partners have lenient credit requirements | Get a quote in 2 minutes |

|

|

|

Best marketplace | $200 best rate guarantee |

|

|

Works with 300+ partner lenders | Free credit score access |

|

|

Transparent, detailed privacy policy | Great customer reviews |

|

AmONE vs. Credible

Credible is our team’s choice for the best marketplace to compare personal loans, and both are free to use. We like Credible’s $200 best rate guarantee: If you close with a better rate than you prequalify for on Credible, the company will give you a $200 gift card.

AmONE vs. LendingTree

LendingTree stands out for the massive size of its partner lender network: more than 300 companies. We’re fans of LendingTree Spring, which you can sign up for for free and get credit score access and insights.

AmONE vs. Splash Financial

Splash Financial is a personal loan marketplace that earns excellent customer reviews, averaging 4.8/5 with more than 1,600 reviews on Trustpilot (in September 2025). It’s also BBB-accredited with an A+ rating from the agency.

Check out our full list of reviewed personal loan companies.

How to apply for AmONE loans

Applying to AmONE is straightforward. Here are the steps to take to apply for a personal loan using AmONE’s website.

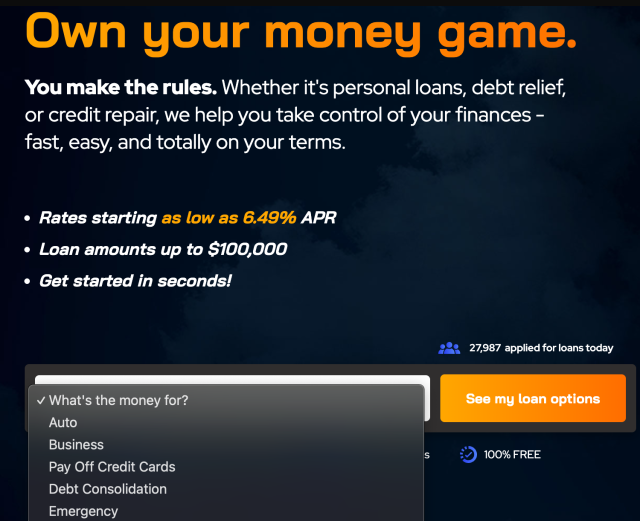

- Use the drop-down menu on AmONE’s homepage to indicate why you want to take out a loan.

- On the next screen, indicate how much you want to borrow. AmONE allows you to borrow up to $100,000.

- Select your employment status. You can choose from employed, not employed, self-employed, or other.

- Then, input your pretax income, which is your total income, including your salary, retirement funds, and benefits. You can also add alimony or child support to this number.

- Let AmONE know whether you own or rent your home currently.

- Fill out more of your personal details, including your birthday, address, name, email, and phone number.

- The final step is to agree to AmONE’s terms of use, privacy notice, and consent to get electronic communication. This is also when you’ll authorize AmONE to conduct a soft pull on your credit.

- Click “Agree & See My Results” to see your lender matches.

- Once you choose a lender, you will complete the loan process on that lender’s website. At that point, you’ll need to gather personal loan documentation, like your driver’s license, tax forms, and more, to formally fill out your lender application.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- MarketScreener, QuinStreet, Inc. Acquired AmOne Corp. From Roderick M. Romero for $28.3 million

- AmONE, About AmONE

- Trustpilot, AmONE Reviews

- Better Business Bureau, AmONE Business Profile

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.