Private Student Loans

- Absolutely no fees

- Not-for-profit loan provider

- Low, fixed interest rates

- Impressive customer service

- Not available in every state*

- Only one repayment term

- High minimum credit score

- Hardly any customer reviews

| Rates (APR) | 4.09% – 11.94% |

| Loan amounts | $1,000 – 100% cost of attendance |

| Repayment terms | 10 years |

*Advantage Education Loans aren’t available in Alaska, Delaware, Illinois, Iowa, Nevada, New Jersey, Maine, Maryland, Rhode Island, or Washington

Refinance Student Loans

| Rates (APR) | Starting at 5.95% |

| Loan amounts | $7,500 – $200,000+ |

| Repayment terms | 10, 15, or 20 years |

Advantage is a top choice for budget-conscious borrowers who want no fees and low rates. It’s one of the only not-for-profit lenders that reinvest profits into the loan program. Parents can apply for the Advantage Parent Loan even when their child attends less than half-time—a standout feature that federal loans don’t offer. Students can apply for the Advantage Education Loan or refinance with the Advantage Refinance Loan.

However, loans aren’t available in every state. It’s also hard to qualify for the loans, and there are few reviews about the customer experience. Here’s how to decide whether Advantage is the right lender.

About Advantage Education Loans

Kentucky Higher Education Student Loan Corporation (KHESLC) owns Advantage Loans. It’s a not-for-profit lender, so the company uses profits to support the business instead of shareholders. Advantage’s unique model benefits borrowers by allowing the company to offer no-fee loans with low rates.

You can apply for the following loans from Advantage Education.

- Advantage Parent Loan: Parents can apply for this loan to help cover their kids’ education expenses. The starting rates are lower than the Advantage Education Loan. If students attend less than half-time, you must start repayment immediately.

- Advantage Education Loan: This is the standard student loan you can use for nearly any certified education expense, including tuition, books, and housing. You can apply with or without a cosigner.

- Advantage Refinance Loan: This option allows you to refinance federal or private loans. Rates are slightly higher than the other Advantage loans, but you won’t pay any fees.

Advantage Education Loan rates and terms

Advantage’s rates are quite low—even lower than the current rates for federal loans—and start at 4.09%. Your rate depends on your repayment plan, and you can get a lower rate when you begin making interest-only payments right away.

Advantage also offers a 0.25% autopay rate discount, helping you save even more. The terms, fees, and rates are the same as those of the top private lenders. For example, SoFi®, one of the most competitive lenders with no fees, has nearly identical fixed rates.

| Advantage Education Loan terms | Detail |

| Rates (APR) | 4.09% – 11.94% |

| Loan amounts | $1,000 – 100% cost of attendance |

| Repayment period | 10 years |

| Fees | None |

| Repayment plans | Immediate, interest-only, or deferred |

| Enrollment | Full- or half-time |

Advantage Parent Loans are similar to the Education Loans, but the starting rates are lower, and students can attend less than half-time.

| Advantage Parent Loan terms | Details |

| Rates (APR) | 3.73% – 11.94% |

| Loan amounts | $1,000 – 100% cost of attendance |

| Repayment period | 10 years |

| Fees | None |

| Repayment plans | Immediate, interest-only, or deferred |

| Enrollment | Full-, half-, or part-time |

Eligibility requirements

Some of Advantage Education’s eligibility requirements are standard. You must be at least 18 years old and either a U.S. citizen or a legal resident. But you need a high credit score to qualify, and the company only works with borrowers in 41 states.

| Requirement | Details |

| Citizenship | U.S. citizen or noncitizen with proof of residency card |

| Minimum age | 18 years old |

| State of residence | Not available in Alaska, Delaware, Illinois, Iowa, Nevada, New Jersey, Maine, Maryland, Rhode Island, or Washington |

| Enrollment status | Full- or half-time for Advantage Student Loan; Part-time for Parent Loan |

| Min. credit score | 700 |

| Min. income | $2,500/month |

How does repayment work?

Advantage Education offers three repayment options, but there’s only one repayment term of 10 years.

Here’s how repayment works when you borrow from Advantage Education.

| Terms | Details |

| Repayment options | Immediate, interest-only, or deferred |

| Repayment terms | 10 years |

| Grace period | 6 months |

| Cosigner release? | Yes, after 12 months of consecutive, on-time payments |

How do Advantage Education Loans compare to alternatives?

Advantage Education Loans offer impressive rates, no fees, and multiple repayment options. Even though Advantage is a solid option, it’s not the right fit for everyone.

Let’s take a look at some of the best student loan alternatives.

- MPOWER: This is one of the only lenders for international students without a U.S. cosigner. The rates are higher, but it’s an excellent option for students studying abroad in the United States. You can also take advantage of unique benefits like visa support and connecting with a student mentor. MPOWER charges a 6.5% origination fee, but it’s usually worth it for students who can’t qualify with other lenders.

- College Ave: This lender is the top pick for students who want more flexibility than Advantage Education can offer. College Ave has four terms—five, eight, 10, or 15 years—and multiple repayment options. Graduate students also get an extended grace period of nine months after graduation. The company doesn’t charge any fees, and you can use the Multi-Year Peace of Mind™ offer to get funding for your entire degree.

Check out the best private student loans.

How do you get an Advantage Education Loan?

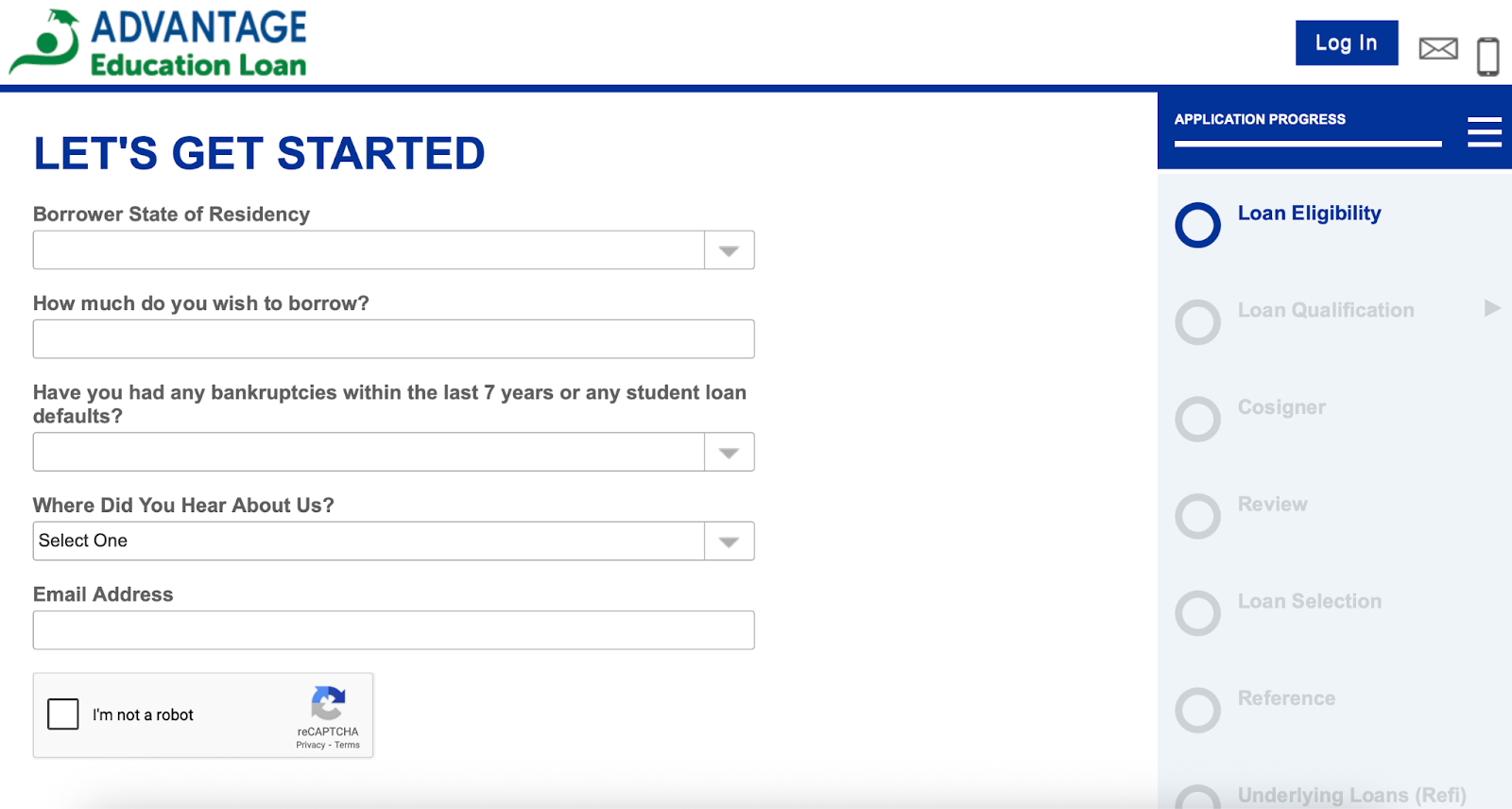

Advantage Education’s student loan application process is similar to other lenders. Here’s how to apply once you’re ready.

- Complete the online application: The digital application is straightforward and takes about 30 minutes to complete. You also need to create an account.

- Submit the loan documents: Provide documents for proof of address and identity. Advantage Education also asks for two references who aren’t your cosigners.

- Review and accept your offer: Your school must certify the loan and confirm enrollment.

- Final disclosure: Read and sign the final disclosure about loan rates, terms, and federal loan alternatives. Once it’s complete, Advantage will send funds to your school.

How does Advantage student loan refinance work?

You can refinance any school-certified loans with Advantage Education, including federal and private loans. You won’t pay any fees, and rates start at 5.95%. The minimum loan amount for refinancing is $7,500—higher than some other lenders but still reasonable.

Advantage’s refinance loan terms are comparable to those of top lenders. But whether it’s worth the hassle depends on your current loan terms and future goals.

| Term | Details |

| Rates (APR) | Starting at 5.95% |

| Loan amounts | $7,500 – $200,000+ |

| Repayment terms | 10, 15, or 20 years |

| Cosigner release? | Yes |

Who is eligible to refinance student loans with Advantage?

The eligibility criteria to refinance student loans with Advantage are similar to the requirements for standard loans from the company. Here’s how to qualify.

| Requirement | Details |

| Min. credit score | 700 |

| Min. income | $2,500/month |

| Citizenship | U.S. citizen or noncitizen with proof of residency card |

| State of residence | Not available in Alaska, Delaware, Illinois, Iowa, Nevada, New Jersey, Maine, Maryland, Rhode Island, or Washington |

| Min. age | 18 years old |

| Graduation status | No degree requirement |

How does Advantage student loan refinance compare to alternatives?

Here are some of the top refinance lenders to consider if Advantage isn’t the right fit.

- SoFi: Advantage and SoFi have strict eligibility requirements, no fees, and low rates. SoFi has more repayment terms than Advantage, so it’s a solid pick if you want more flexibility. You can also take advantage of unique benefits like a free meeting with a financial planner and travel discounts.

- Earnest: As a recent graduate, you can take advantage of the skip-a-payment feature with Earnest, so it’s easier for you to manage your finances. You can also choose from biweekly or monthly payments and select from 180 customization options. But cosigners must reside in the same state as you, so it might be a dealbreaker, depending on where you live.

See our full list of the best student loan refinance lenders.

How to refinance your student loans with Advantage

Refinancing student loans includes basic steps like applying and providing documents. Advantage’s refinance loan application is nearly identical to other lenders. Here’s what to expect.

- Complete the online application

- Submit documents

- Review the offer

- Sign the disclosure

- Advantage sends funds to your school

What do Advantage Education Loan customers say?

It’s nearly impossible to find reviews for Advantage Education Loans online. The company doesn’t have any Google reviews, and Trustpilot only has one, but the reviewer seems to be talking about a different company.

The Better Business Bureau is the only place you can find reviews for Kentucky Higher Education Student Loan Corporation (KHESLC), which owns Advantage. Reviews on the site are overwhelmingly negative. Borrowers have a hard time paying the loan and report frequent miscommunication.

However, there are only six reviews for KHESLC, so it’s hard to know how accurate they are. Other loan companies have thousands of customer reviews, which makes it easier to get a clear picture of the company, good or bad.

| Platform | Rating | Number of reviews |

| Trustpilot | 3.2/5 | 1 |

| BBB | 1/5 | 6 |

Does Advantage have a customer service team?

We found that Advantage’s loan advisors are competent and happy to answer questions about eligibility and applications. You can call 800‐988‐6333, Monday through Thursday, 8:30 a.m. to 5:00 p.m. Eastern time, and Friday, 8:00 a.m. to 4:30 p.m. Eastern. You can also email [email protected].

ARC Servicing handles active loans, including payments and forbearance. ARC answers the phone quickly, but we found the representatives less helpful. You can contact the servicer at 800-693-8220 or 888-599-7768. You can also email [email protected].

About our contributors

-

Written by Taylor Milam-Samuel

Written by Taylor Milam-SamuelTaylor Milam-Samuel is a personal finance writer and credentialed educator who is passionate about helping people take control of their finances and create a life they love. When she's not researching financial terms and conditions, she can be found in the classroom teaching.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.