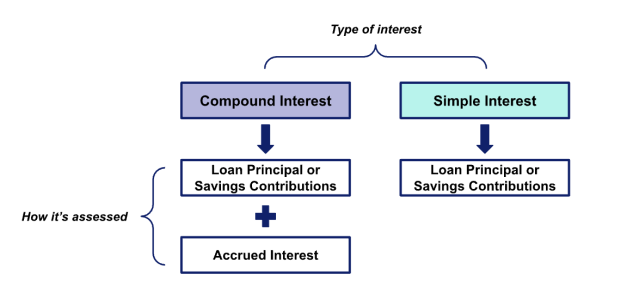

Interest is the fee lenders charge consumers for borrowing money. It also describes the amount consumers earn on their money when saving or investing. Interest is usually represented as a percentage. Simple interest is when lenders charge interest fees only on the principal amount, unlike compound interest, which charges interest on the principal plus any interest accrued.

Car loans, federal student loans, and personal loans use simple interest calculations, whereas credit cards use compound interest calculations. We’ll show you how simple interest works and how easy it is to calculate. This can help you make informed financial decisions about your money in the future.

Table of Contents

What is simple interest?

Simple interest is one way to calculate how much you have to pay your lender in interest fees or how much you will earn in interest when saving. Simple interest, much like the name suggests, is easy to calculate—it’s only based on the original amount you borrow or save, also called the principal.

Many common loans, such as federal student loans and car loans, use simple interest. Because of that, it’s straightforward to calculate how much you owe and how much you’ll pay over time in interest during your term. This can help you determine whether you want to pay off your loan early or search for alternatives with better terms.

How does simple interest work?

To understand how simple interest works, here are common financial terms you might see:

- Principal: This is the original amount of money you borrow, save, or invest.

- Fixed rate: A fixed rate is an interest rate that remains the same during your term, unlike variable interest, which can fluctuate based on the prime rate.

- Term: This is the length of time you will repay a loan. For investing—for example, a savings bond—it’s the length of time until your investment matures, triggering payment.

- Accrual: Accrual refers to the process of earning interest over time. With simple interest, you only earn interest on the principal amount when saving or investing. Similarly, you only pay interest on the principal when borrowing (rather than on the principal plus any accrued interest).

Impact on loans

Here are the types of loans that typically use simple interest:

It’s important to confirm beforehand whether your lender uses simple interest. Some private student loan lenders and some personal loan lenders might use a compound interest formula, though it’s uncommon.

It’s in your best interest as a borrower to choose a loan with a simple interest formula so you know exactly how much interest you’ll pay over your term. This way the negative effects of compound interest won’t affect you and increase your debt in a hurry.

Impact on credit

Because simple interest is so easy to calculate, it’s helpful when you’re trying to decide between lenders or figuring out whether it’s worth it to refinance a loan. Don’t forget that some lenders charge origination and application fees, which you should consider before signing on the dotted line.

Example

If you take out a $15,000 personal loan that’s calculated with simple interest at 9% annually, you will pay $8,100 in interest over a six-year term. The amount of interest you pay equals the principal (how much you borrow) multiplied by the interest rate and the term.

In this case, it would be:

$15,000 x 0.09 x 6 = $8,100

But let’s say you shop around and find a lender offering a $15,000 personal loan at 8.5% interest. It may not seem like such a big difference from 8.5% to 9%, and the monthly payments are similar. However, when you can do a simple interest calculation, you can see just how much you’ll save over your term:

$15,000 x 0.085 x 6 = $7,650

Choosing the loan with an 8.5% interest rate instead would save you $450 in interest over the life of the loan.

Impact on savings

Using an account with simple interest is an easy and straightforward way to build savings, which only 63% of adults have, according to the Federal Reserve’s 2023 Economic Well-Being of U.S. Households report. While it won’t build your savings as fast as an account that uses compound interest, it’s preferable over an account that doesn’t earn interest at all.

Example

If you put $5,000 of savings into a simple interest savings account for three years, earning 4% interest, you would earn $600 in interest at the end of your three-year term. This is helpful when you’re saving for something, such as a home renovation, but you don’t want to worry about losing money in the market.

Most savings accounts are compound interest. I would not recommend choosing a savings account that offers simple interest because it only applies the interest you earn on the initial deposit. I recommend selecting a compound interest savings account since the interest you earn is applied to the amount you deposit and interest that the account has earned over time.

You can find these types of accounts in multiple ways: Ask a representative, view the website, and look for the type of compounding (daily or monthly). A good indicator that a savings account uses compound interest is if the stated annual percentage yield is higher than the stated or nominal interest rate.

Erin Kinkade, CFP®

Is simple interest good or bad?

Whether simple interest is good or bad depends on your financial goals. For example, simple interest is good when you want to borrow money because it’s easy to calculate and makes your monthly payments predictable.

However, compound interest investments are better for long-term goals, including retirement, because you earn interest on the principal and on any other interest you earn. Here is an example of the difference:

| 5-year term | 20-year term | |

| Amount saved | $10,000 | $10,000 |

| Interest rate | 6% | 6% |

| Simple interest ending balance | $13,000 | $22,000 |

| Compound interest ending balance | $13,488 | $33,102 |

As you can see, for short-term savings, a simple interest savings account makes sense because you aren’t subjected to significant market fluctuations. However, compound interest is better for long-term savings goals.

Should I take out a loan with simple interest?

Simple interest is a good choice for loans, especially if you like predictable monthly payments. You can use a simple interest calculation to determine how much you’ll pay in interest over your loan term. Most lenders will also give you this information in your loan paperwork.

Borrowing money based on compound interest, such as carrying a balance on a credit card, can be unpredictable, especially with variable interest rates. It can also increase your debt balance faster, making it harder to pay off. That’s why simple interest is preferable when it comes to borrowing money.

What should I do if I already have a loan with simple interest?

You have a few options if you already have a loan with simple interest. At the end of the third quarter of 2024, Americans had around $1.6 trillion in outstanding car loans and $1.8 trillion in outstanding student loans, according to 2024 Federal Reserve data. These are two of the most common types of loans calculated with simple interest.

If you have a loan with simple interest, you can pay extra on your loan and pay it off early. If your loan has a high interest rate, refinancing it to another simple interest loan with a lower rate can help you save money. However, be sure to compare more than interest rates when evaluating lenders; some charge origination and other fees.

To determine how soon a client can pay off a simple interest loan, I typically use an online calculator or a spreadsheet to outline the basic repayment using the principal amount, the rate, the term, and the monthly payment.

I will use a formula dividing the principal by the monthly payment amount. If they want to make extra payments, I will use a similar formula considering the reduced interest paid due to the extra payments.

Erin Kinkade, CFP®

How to calculate simple interest

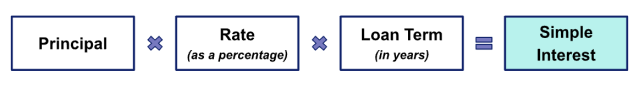

If you want to calculate simple interest, the formula is straightforward.

The simple interest formula is:

Interest = P x r x t

- P represents the principal, which is the amount of money you borrow when you take out a loan.

- r is the interest rate you agreed on with your lender. When using the simple interest formula, write the percentage as a decimal.

- t is your term, typically expressed in years, not months.

This formula is easiest to calculate when you have a fixed interest rate and a set term. Products with these include personal loans, car loans, mortgages, student loans, and home equity loans.

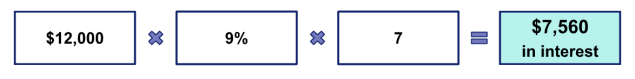

Here is an example of a simple interest calculation:

As the image above shows, if you plan to borrow $12,000 at 9% interest and repay it over seven years and plug these numbers into the formula, you get $7,560.

So you’ll pay $7,560 in interest over the life of your loan, bringing your total borrowing cost to $19,560.

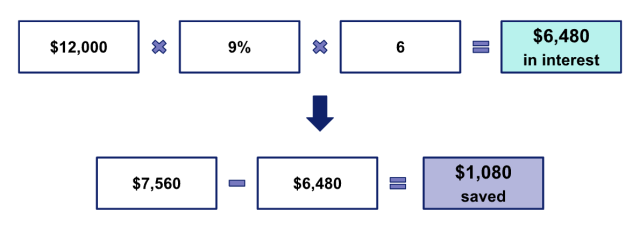

If you accelerate your loan payments, you can take your simple interest calculation a step further and use it to estimate your interest savings. In this example, paying your loan off in six years would result in $6,480 in total interest charges or a potential savings of $1,080.

Try out this calculator to see how simple interest works in real-time.

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.