College can be expensive, and if you’re hesitant to take out student loans, you might consider an income-share agreement (ISA) instead. Income-share agreements allow you to get funds to pay for school today, in exchange for a portion of your future income. It’s a novel, but not new, concept; the idea behind ISAs dates back to the 1950s.

So is this a legit way to pay for school? And who should consider an income-share agreement?

In case you’ve exhausted your federal financial aid, school aid package, and scholarship opportunities, and are currently in need of funding for school, here’s our list of top-rated private student loan lenders: Best Private Student Loans in 2026: Reviewed and Ranked.

Read on to learn more about what ISAs are, how they work, and the pros and cons of income-share agreements for students.

| Company | Rates (APR) | Rating (0-5) |

|---|---|---|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

3.29% – 15.99% fixed-rate APR w/ autopay included |

|

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

Table of Contents

What is an income-share agreement?

An income-share agreement is a financing arrangement in which a provider gives a student money to pay for school, and the student agrees to pay back a percentage of their future earnings. You make a certain number of payments after you graduate, but only when your earnings are above a set threshold.

Yale was the first university to experiment with ISAs for students, according to RAND. Today, ISAs can be found at:

- Title IV schools that participate in federal student aid programs

- Non-Title IV institutions, including bootcamps and skills training programs

Income-share agreements are less regulated than federal and private student loans. In 2022, the Consumer Financial Protection Bureau (CFPB) took action against Better Future Forward Inc., charging that the company misled borrowers about the nature of ISAs. Shortly afterward, the Department of Education took the stance that ISAs are private loans.

Since then, the CFPB has said that ISAs are “generally subject to consumer financial laws,” but no specific law exists to regulate them. The ISA Student Protection Act of 2023 was introduced in Congress to protect borrowers, but after being referred to committee, there hasn’t been any further movement on the bill.

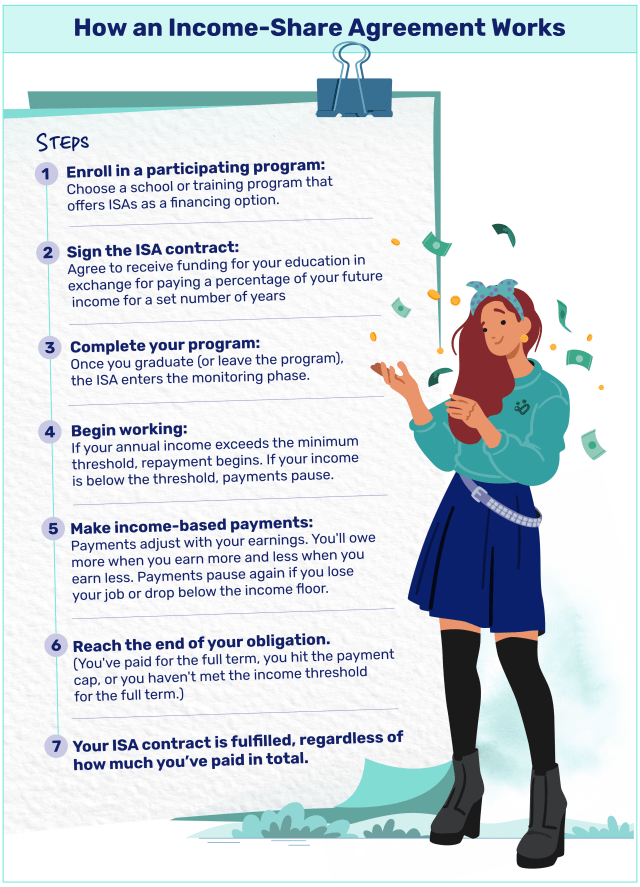

How ISAs work

ISAs may be described as private loans by the federal government, but they’re unique in several ways. Here are the terms to know that can help you understand how ISAs work.

- Income percentage. Income percentage is the amount of your income that goes toward repaying the ISA. According to RAND, a typical percentage is anywhere from 1.4% to 30%.

- Payment cap. The payment cap is the maximum amount you’re expected to repay to the lender. For example, you might be expected to repay no more than twice the amount of funding you received.

- Payment term. The payment term represents how long you’re expected to make payments to the ISA provider. This may also be described as the maximum number of payments in your agreement.

- Minimum income threshold. Your minimum income threshold is the minimum amount you need to earn to owe a payment. If your earnings are below that amount for any given month, you won’t need to make a payment for that month.

Here’s an example to help you pull it all together.

Say you get $10,000 to pay for school through an ISA. You’re expected to commit 7% of your future income to repayment, and your payment cap is twice the amount you received. You’re required to make 60 payments or repay $20,000, whichever comes first.

The minimum income threshold is $2,000 per month or $24,000 per year. Here’s what you could expect to pay at different income levels.

| Annual salary | Total repaid | Interest | APR |

| $40,000 | $14,000 | $4,000 | 8% |

| $50,000 | $17,5000 | $7,500 | 15% |

| $60,000 | $20,000 | $10,000 | 20% |

Pros and cons of ISAs

Income-share agreements offer advantages and disadvantages. Before you commit, weigh the pros and cons.

Pros

-

Manageable payments

ISAs match your payment to your income; if your earnings drop below a certain threshold, you won’t need to worry about a payment for that month.

-

Easier to qualify

Income-share agreements don’t have credit score requirements. That could make them more accessible than private student loans, which factor in credit for approval.

-

No cosigner needed

You won’t need a cosigner to get an ISA, which is another difference from private student loans.

-

Capped repayment

Income-share agreements end when you make the required number of payments, or hit your payment cap, whichever comes first.

Cons

-

Lack of regulation

ISAs are technically subject to consumer financial laws, but a lack of regulation can open the door for predatory providers.

-

No federal loan benefits

Federal student loans offer benefits like income-driven repayment plans, forbearance periods, deferments, and the option to qualify for public service loan forgiveness. You won’t get any of that with an ISA.

-

Prepayment penalties

Paying an ISA off ahead of schedule could trigger a hefty prepayment penalty.

-

Limited availability

ISAs are not widespread, so it may be difficult to find a provider for your program or school.

How do ISAs compare to federal and private student loans?

| ISA | Federal student loan | Private student loan | |

| Interest | No set rate | Low, fixed rates | Fixed or variable rates |

| Lifetime funding limit | Varies by provider | $31,000 for undergraduates; $57,500 for graduate students | Up to the cost of attendance, less other financial aid received |

| Benefits and protections | Some providers may offer deferment or grace periods | Forbearance and deferment programs, income-driven repayment, and rate discounts | Rate discounts, deferments, and grace periods are offered by some lenders |

| Credit check | No | No | Yes |

| Cosigner | No | No | Recommended |

I generally would not recommend an ISA over federal or private student loans unless the student has extenuating circumstances that disqualify them from obtaining a loan and lacks support from friends or family.

However, an ISA might make sense in specific situations, such as when the student cannot qualify for federal or private loans, is entering a field with low or unpredictable starting income, and is attending an alternative education program that offers a well-structured and reputable ISA.

Where can you get an ISA?

If you’re interested in an income-share agreement, you may have to do some digging to find one. To save you time, we’ve profiled two options you might consider to fund your education. (One, Edly, is an ISA, and the other, Ascent, is an alternative to a traditional loan—but it isn’t exactly an ISA.)

Edly

What to know about Edly’s income-based repayment

Edly offers income-based repayment private loans for students attending two- and four-year colleges and universities, or pursuing certificates through career training schools and bootcamps. Borrowers pay a percentage of their income, above a minimum income threshold of $30,000.

You can get an IBR loan from Edly with or without a cosigner. No-cosigner loans don’t require payment while in school; cosigned loans do. If your annual income drops below $30,000 while in repayment, your loan is put in temporary forbearance.

Cosigned loans are available for students enrolled at a broader range of schools, with the option to apply for cosigner release after one year. You must be a U.S. citizen or permanent resident to apply and be enrolled in a supported school or eligible program.

| When payments begin | 4 months after graduation |

| Percentage of income | Not disclosed |

| Loan amounts | $20,000 lifetime limit for non-cosigned loans; $25,000 lifetime limit for cosigned loans |

| Repayment terms | 84-month term limit |

| Min. credit score | None for students; not disclosed for cosigners |

Ascent

What to know about Ascent’s outcomes-based loan

Ascent’s outcomes-based loan is designed for college juniors and seniors who don’t have a credit history or cosigner. Ascent’s product isn’t an ISA, but we included it because it might appeal to borrowers seeking an ISA due to concerns about being approved without a cosigner.

Unlike traditional private loans that rely on your income or credit score, this loan considers your future potential. Ascent evaluates your school, major, GPA, and expected graduation date to determine eligibility—betting on your ability to earn and repay after college, not your financial background today.

The loan is available to U.S. citizens, permanent residents, and DACA recipients with a valid Social Security number. You must be at least 18 years old and enrolled full-time or half-time within nine months of graduation. Payments can be deferred for up to nine months after you finish school, giving you time to find a job before repayment begins.

| Rates (APR) | 12.72% – 14.67% variable; 12.86% – 14.85% fixed* |

| Loan amounts | $2,001 – $200,000 (maximum aggregate) |

| Repayment terms | 10 or 15 years |

| Min. credit score | None |

| When payments begin | Nine months after graduation |

If you’re interested in an ISA, talk to your school or program’s financial aid department to see whether any programs are offered in-house.

Is an income-share agreement worth it? What students think

We were curious how students who use ISAs feel about them, so we searched the web for feedback. One place we checked was on Reddit via r/StudentLoans.

Reddit users express significant frustration with ISAs, mainly due to their financial burden and lack of flexibility.

One user described being required to pay 10% of their income despite struggling to cover basic expenses:

Another pointed out that ISAs penalize both high and low earners and criticized the hefty prepayment penalties that sometimes result in borrowers paying far more than they borrowed:

I am a student working on an income share agreement startup, ask me anything

byu/CaptDraco inStudentLoans

A thread on r/Professors found some educators arguing that ISAs could open up degree programs to a wider range of students. Others compared income sharing to indentured servitude:

Can we talk about Income Share Agreements?

byu/trunkNotNose inProfessors

Whether an ISA is worth it to you comes down to the numbers. If you could pay less for an ISA than you would for a student loan, the math is on your side. However, given the lower funding limits, it may not be possible to avoid student loans altogether if you’re entering a pricier program.

Should you choose to use student loans to fund your education, start with federal loans first. Federal loans give you benefits you won’t find elsewhere, including low, fixed interest rates. Complete the FAFSA to see what kind of aid you qualify for, then explore the best private student loan lenders.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.