If you’re preparing for college, one of the first actions you should take is to fill out the Free Application for Federal Student Aid (FAFSA). Colleges use your FAFSA to check your eligibility for financial aid, including grants, work-study programs, and federal student loans.

Completing the FAFSA is one of your best shots at accessing “free” money to attend school. Without it, you won’t be eligible for federal financial aid. Keep reading to find out more about the FAFSA, why it’s important to fill one out, and how you can complete yours.

Table of Contents

Why do you need to complete the FAFSA?

The FAFSA is your ticket to financial aid. Not completing the FAFSA every academic year essentially tells your school you intend to cover that year’s tuition on your own. If you want to be among the 85% of students who use financial aid, you must fill out the FAFSA.

When you complete the FAFSA, your school reviews your information to determine whether you qualify for financial aid, including:

- Federal grants, such as Pell Grants and TEACH Grants

- Federal student loans

- Work-study programs

- Institutional scholarships

- State grants

- State scholarships

Exhausting these tuition assistance options before turning to private loans is the key to minimizing your student loan debt and your out-of-pocket costs.

Federal student loans can have lower interest rates than private student loans, even if you’re not eligible for grants or scholarships. They also offer more consumer protections.

The open date for the FAFSA for the 2025 – 2026 school year was November 21, 2024.

FAFSA dates & deadlines to remember

Not only is it important to fill out the FAFSA each year, but you’ll want to begin the submission process as soon as possible. Federal aid is distributed on a first-come, first-served basis, so procrastinating could cause you to miss out on money for school.

Here are a few important dates and deadlines to keep in mind:

| Academic year | FAFSA opens on | FAFSA deadline |

| 2025 – 2026 | November 21, 2024 | June 30, 2026 |

Many states and schools have earlier deadlines, however. Your school’s financial aid website should list its FAFSA deadlines.

But what if you’re not sure where you’ll attend college? The FAFSA website allows you to send your FAFSA to up to 20 schools, so you don’t need to have your college plans solidified just yet.

Instead, check each prospective school’s FAFSA deadline and note the earliest. Complete and send your FAFSA by that date for the best chance at receiving the most no- or low-cost aid.

You’ll get financial aid award letters from schools that received your FAFSA and that offered you admission. Review and compare each one, as well as each school’s cost of attendance (COA), to help determine which college is most affordable.

What if I miss my school’s FAFSA deadline?

If you don’t complete the FAFSA by your school’s priority deadline for any reason, don’t worry. In the worst-case scenario, you might miss out on scholarships, grants, or work-study opportunities for that school year, but you’re not likely to miss out on financial aid altogether.

It’s ideal to submit your FAFSA as early as you can, but you technically have the entire school year to do so, and submitting your FAFSA late is better than not submitting it at all.

FAFSA eligibility criteria

Almost all students are eligible for some form of financial aid. However, students need to meet several requirements. To qualify for federal financial aid, you must:

- Be a U.S. citizen, U.S. national, or eligible non-citizen

- Have a valid Social Security number or A-number

- Have a high school diploma or GED

- Be accepted to or enrolled in an eligible degree or certificate program

- Be enrolled at least half-time, if you’re already in school

- Not be in default on a federal student loan

- Not owe money on a federal student grant

- Make satisfactory academic progress each year

Each school’s definition of satisfactory academic progress may be different. In general, you must maintain a high enough GPA and take enough classes to complete your program of study in a reasonable time frame.

Beginning with the 2021 – 2022 school year, students are no longer required to register for the Selective Service to be eligible for federal financial aid. Students with drug-related convictions are no longer barred from receiving federal financial aid.

You may still be eligible for grants or private student loans if you’re not a U.S. citizen. Check out our resources for DACA recipients and international students to explore your options.

As you complete the FAFSA, you may be required to enter your parents’ financial information.

Your parents aren’t subject to the same qualifying criteria you are, but they must consent to having their federal tax information imported into your FAFSA form. Failure to do so will render you ineligible for federal financial aid.

For your parents to apply for a Direct PLUS loan, they must be U.S. citizens or eligible noncitizens. Neither you nor your parents need to meet income requirements to qualify for financial aid.

How to complete the FAFSA

Once you have ensured that you meet all the student financial aid eligibility criteria and know all the important deadlines, it’s time to start working on the FAFSA form.

Expect the process to take anywhere from 30 minutes to an hour. You don’t have to complete your FAFSA in one sitting, so take a break if you need to. You can pick up where you left off when you’re ready. Here are the steps to take.

Overview of the steps to complete the FAFSA

- Gather your documents

- Enter or create your FSA ID

- Verify your contact information

- Confirm whether you are a student or a parent

- Learn FAFSA basics

- Review your identifying and residency information

- Consent to the retrieval of your tax information

- Answer questions about your personal circumstances

- Enter your demographic information

- Report your financial information

- Select your colleges

- Review, sign, and submit

Step 1: Gather your documents

Before you begin your application, make sure you have all the necessary information and paperwork. This includes your:

- Social Security card

- Driver’s license

- Current bank statements

- Tax return from two years ago

It is crucial to have tax returns from the correct tax year. For instance, the 2025 – 2026 FAFSA uses information from your 2023 return, while the 2024 – 2025 FAFSA used your 2022 return.

If you’re a dependent student, you’ll also need your parents’ tax returns and information about their assets. If you’re married and filed a joint tax return with your spouse, you’ll need their financial information.

Step 2: Enter or create your FSA ID

Every student needs an FSA ID to complete their application. The U.S. Department of Education recommends doing this as soon as possible to avoid any possible delays.

Your FSA ID is the username and password you’ll use to log into the Department of Education website. It will allow you to access information about your federal aid for years.

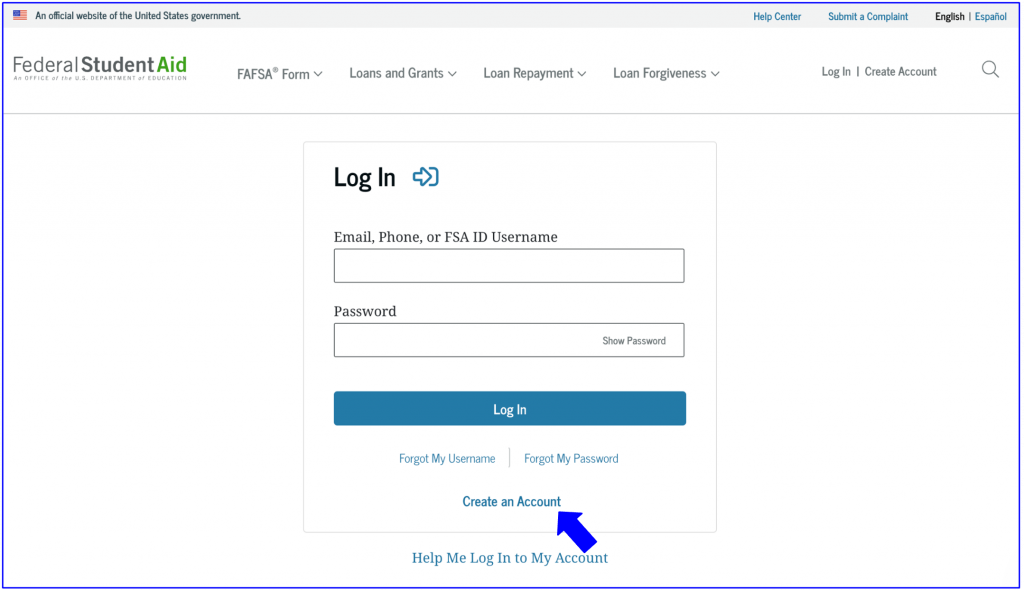

To enter or create your FSA ID, navigate to the FAFSA website and click “Start New Form.”

On the next screen, if you already have an FSA ID and password, go ahead and log in. Then, skip to step three. If you need an FSA ID, click “Create an Account.”

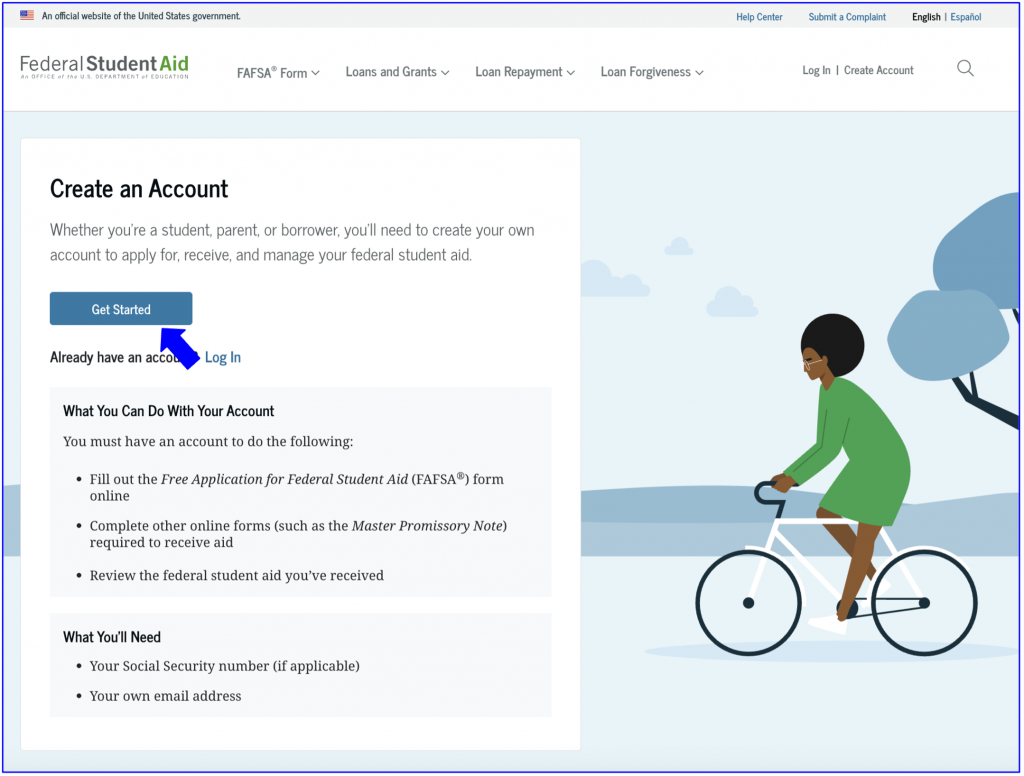

After clicking “Create an Account,” you’ll see a screen that looks like this. Read the provided information, and when you’re ready, click “Get Started.”

Next, you’ll enter your information, beginning with your name, date of birth, and Social Security number. On the following screens, you’ll also register your email address and create a password.

Once that’s complete and you have an FSA ID, you’re ready to fill out the FAFSA.

Step 3: Verify your contact information

When you log in with your FSA ID and password, you may be asked to enter or verify your contact information. Make sure your email address and phone number are up to date.

If you’re ever locked out of your account or need to reset your password, you’ll receive a security code to the email or phone number on file before you can regain access.

Step 4: Confirm whether you’re a student or a parent

The next screen asks whether you’re a student or a parent. If you’re completing the FAFSA as a student, select “Student.” If your parent later logs in to fill in their information, or if they’re completing the FAFSA for you, have them choose “Parent.”

Then, click “Continue.”

Step 5: Learn FAFSA basics

Before you can fill out the FAFSA, you’ll see a few short paragraphs and videos that introduce it. This information will give you a better idea of how to complete it and what to expect after it’s submitted.

After watching the videos and through the preliminary information, click “Start FAFSA Form.”

Step 6: Review your identifying and residency information

Next, you’ll see a list of your personal information, including your name and the last four digits of your Social Security number. Check that your information is correct, and click “Continue.”

On the next screen, enter your state of legal residence and the date you became a resident. Then, proceed to step seven.

Step 7: Consent to the retrieval of your tax information

In this step, you can either give your permission or decline for your tax return information to be retrieved and used for your FAFSA.

You’ll see a quick summary at the top of the page, followed by more detailed information about how your tax information is obtained and a FAQ section at the bottom of the page.

After reading through the information, you can click “Approve” to give your consent and move forward with the FAFSA. If you decline to consent, you won’t be eligible for financial aid.

Step 8: Answer questions about your personal circumstances

Next, you’ll answer a series of questions about your personal circumstances, including:

- Your marital status

- What year you’re entering in school (freshman, sophomore, graduate student, etc.)

- Your veteran status

- Whether you’ve been in foster care

- Whether you’re under the legal guardianship of someone other than a parent

Once you’ve finished this section, you’ll see your dependency status. If you’re declared an independent student, you can complete the rest of the FAFSA by yourself. If you’re a dependent student, you’ll need your parents’ financial information in addition to your own.

Step 9: Enter your demographic information

You’ll now move through a series of questions about your:

- Gender identity

- Race and ethnicity

- Citizenship status

- Parents’ highest level of education

If you’re uncomfortable with reporting your gender or ethnicity, you can decline to answer those questions without affecting your financial aid eligibility.

You’ll also need to provide information about where you earned your high school diploma or GED.

Next, you’ll move on to the financial information portion.

Step 10: Report your financial information

This step is often the longest and most complex. Unlike in years past, the FAFSA no longer uses the IRS data retrieval tool. In theory, the consent you provided in step seven should import income data from your tax return.

However, many FAFSA filers report needing to fill in this information manually. That’s why it’s helpful to have your tax return ready, just in case. If you don’t already have those handy, now is a good time to track them down.

As you move through this section, you’ll share information from your tax return. If you’re a dependent student or you’re married and filed a joint return, you’ll provide information about your parents’ or spouse’s finances too. This information includes:

- Whether you receive public assistance, such as SNAP or Medicaid

- Whether you received the Earned Income Tax Credit (EITC)

- Whether you filed Form 1040 or 1040-NR

- Your family size, which includes the student and the student’s dependents

- Your tax filing status

- Your adjusted gross income (AGI)

You’ll also report whether you received untaxed distributions from a retirement plan, how much you paid in federal income tax, and whether you had any capital gains or losses.

Many of the answers to these questions will come from your tax return. A tool built into the FAFSA tells you exactly where to look on your return to find the information you need. We recommend using it to ensure accuracy.

Step 11: Select your colleges

If you’ve made it to step eleven, hang in there. You’re almost finished with the FAFSA (until next year, anyway).

In the next-to-last step, you’ll designate which schools will receive your FAFSA. You can search by the state where the school is located or by the school’s unique code, which is available on your school’s financial aid website.

Because you can add up to 20 schools, it’s smart to select every school you’re considering attending, even if you’re on the fence and even if you haven’t applied.

You can always add and remove schools after completing your FAFSA, but if you wait to list a school, you could miss out on potential aid.

Once you locate your school, click “+” to add it to your list. When you’ve selected all applicable schools, continue to the next screen, where you’ll confirm your schools of choice.

Step 12: Review, sign, and submit

Now, it’s time to review your FAFSA. Double-check the information you’ve entered. If you catch any errors, correct them before finalizing your form. Otherwise, if everything looks good, click “Continue.”

After clicking “Continue,” read through the terms and disclosures. At the end of these disclosures, you’ll see a button that says you agree to the terms. Once you confirm your agreement, you can finalize and submit your FAFSA.

What happens after you submit the FAFSA?

Immediately after submitting the FAFSA, you’ll see a confirmation message. In addition to your completion date, this message also lists your:

- Data release number (DRN): Think of this as a file number. If you need to call the Federal Student Aid Information Center (FSAIC), you’ll have to confirm your DRN to update information such as your address or phone number.

- Estimated Student Aid Index (SAI): This replaces the Estimated Family Contribution (EFC) from years past. Your SAI doesn’t tell you how much aid you can get. Instead, colleges use it to assess the financial needs of eligible students.

Your confirmation message isn’t the final step in the financial aid process. Your school still needs to process your FAFSA. This can take three to five days. Here’s what you can expect during and after processing, as well as how to finalize your financial aid:

- Your college may contact you to verify your information or request additional paperwork. These communications might come to your personal email address or to your school email if you have one.

- You’ll get financial aid award letters from schools that received your FAFSA and that offered you admission. You can send your FAFSA to any school, whether you’ve applied or not, but you typically won’t receive an award letter until after you’ve been accepted.

- Appeal your financial aid offer, if necessary. If you’re dissatisfied with a school’s aid offer, follow the appeal instructions on your award letter. Your school will reevaluate your financial aid and may restructure your aid package as a result.

- Accept or reject your financial aid. Once you’ve decided where you’ll attend, you then must decide on your financial aid. You can reject all or some of your aid—say, if you’d rather use a payment plan instead of taking out loans—or you can accept your aid package as is.

Read more: How to Edit FAFSA Form After Submitting

Before you accept your financial aid, review your award letters to get an idea of what comprises your financial aid package at each school.

Were you awarded any grants or scholarships? How much of your financial aid consists of student loans? If you appealed your financial aid, how does your new award stack up to your previous offer?

When you’re ready to accept your financial aid, adhere to your school’s acceptance instructions. You may need to sign promissory notes or complete entrance counseling, for example. If you don’t complete all parts of the acceptance process, you may not be awarded aid.

How is the Student Aid Index (SAI) calculated?

The SAI is calculated using one of three formulas. Each formula considers the various income sources and assets available to a student. These could include wages, investments, retirement contributions, and business income.

Once these resources are added together, the formula then deducts certain expenses and allowances to account for how much of a family’s resources can realistically be used for school expenses.

Where the formulas differ is in whose financial information is factored into the equation. Here’s a breakdown of each formula, when each one is used, and whose resources it weighs:

| Formula | Student type | Income used |

| Formula A | Dependent | Student and parent |

| Formula B | Independent without dependent | Student and spouse |

| Formula C | Independent with dependents | Student and spouse |

Another important difference between these formulas is the income protection allowance (IPA).

The IPA reduces a family’s income and resources based on an estimate of their annual basic living expenses. The IPA amount increases or decreases depending on the student’s family size. Students with no dependents (and thus use Formula B) cannot use the IPA.

The table below summarizes which allowances and adjustments each formula takes into account:

| Form. A | Form. B | Form. C | |

| Payroll tax allowance | ✅ | ✅ | ✅ |

| IPA | ✅ | ❌ | ✅ |

| Business / investment farms adjustment | ✅ | ✅ | ✅ |

| Asset protection allowance | ✅ | ✅ | ✅ |

For the 2025 – 2026 school year, the lowest possible SAI is -1500, and there’s no upper limit. The lower your SAI, the greater your financial need.

Having a higher SAI doesn’t mean you won’t receive any financial aid. It just means you may be in a better position to pay for school without need-based aid, such as Pell Grants or work-study. You may still be eligible for other forms of aid, such as federal student loans.

Financial aid & FAFSA resources

Do you have more questions about filling out the FAFSA or financial aid in general? Check out our resources below:

FAQ

Is there a maximum income on the FAFSA to qualify for federal aid?

No, there is no strict income limit on the FAFSA (Free Application for Federal Student Aid) to qualify for federal aid. However, higher-income families may receive less need-based aid, such as Pell Grants, but could still qualify for non-need-based aid like federal student loans. Other factors, including family size, the number of family members in college, and assets, also impact eligibility.

How do you fill out the FAFSA if one of your parents has died?

If one of your parents has passed away, you’ll only include the surviving parent’s financial information on the FAFSA. If your remaining parent has remarried, you’ll also include your stepparent’s financial details. Under the parent section of the FAFSA, you’ll indicate that only one parent is listed.

How do you complete the FAFSA if you are a first-generation student?

First-generation students complete the FAFSA just like any other student. There’s no special section for first-generation status, but being a first-generation college student may qualify you for certain scholarships or additional aid from your school. You will need to provide your family’s financial information, but first-generation status does not impact your FAFSA eligibility.

How do you complete the FAFSA if your parents are married?

If your parents are married, you’ll need to report the financial information for both parents on the FAFSA. This includes income, assets, and any other financial details required for the application. Be sure to enter both parents’ Social Security numbers and contact details.

How do you complete the FAFSA if your parents are same-sex partners?

If your parents are married same-sex partners, you will fill out the FAFSA in the same way as you would for any married couple. You will provide the financial information for both parents, and their marital status should be listed as “married” on the form. I

f your parents are not legally married but live together, the FAFSA still requires you to include financial information for both parents.

What is the average FAFSA aid amount?

The average FAFSA aid amount varies each year and depends on factors like family income, assets, and the number of family members in college. For the 2024-2025 school year, the average financial aid package for undergraduate students was around $16,360, but this amount includes grants, loans, and work-study. The actual amount of aid you receive can be significantly more or less, depending on your specific financial situation.

What is the most FAFSA will pay? Will it cover full tuition?

The most need-based aid you can receive from the FAFSA depends on the type of aid. The maximum Pell Grant for the 2025-2026 academic year is $7,395. Federal student loans and work-study options are also available, but they won’t cover all expenses for most students.

While FAFSA can provide substantial aid, it typically won’t cover full tuition, especially at private or out-of-state schools. You’ll likely need to explore other financial aid options like scholarships, grants, or private loans.

Can my parents make too much money that I won’t qualify for aid?

Technically, there is no income limit that disqualifies you from submitting the FAFSA. However, higher-income families may qualify for less need-based aid, such as Pell Grants.

That said, students from higher-income families can still qualify for non-need-based aid like federal student loans or unsubsidized loans. It’s always a good idea to complete the FAFSA to see what aid you may be eligible for, as factors like family size and the number of family members in college also play a role.

How does FAFSA determine your parents’ income?

FAFSA determines your parents’ income by asking for specific financial details, primarily from their tax returns. This includes their adjusted gross income (AGI), wages, and any untaxed income such as Social Security benefits or child support.

You’ll use information from the most recent tax year available. FAFSA typically allows families to use the IRS Data Retrieval Tool (IRS DRT) to automatically pull tax information, simplifying the process. Additionally, assets like savings, investments, and real estate (other than the family home) are also considered when determining financial need.

Article sources

- National Center for Education Statistics, Table 331.20. Showing Financial Aid Awarded to Undergrads 2000-01 through 2020-21

- NPR, This year’s FAFSA is officially open. Early review says it’s ‘a piece of cake’

- U.S. Department of Education, Federal Student Aid, (GEN-21-04) Early Implementation of the FAFSA Simplification Act’s Removal of Selective Service and Drug Conviction Requirements for Title IV Eligibility

- U.S. Department of Education, Federal Student Aid, Eligibility Requirements

- U.S. Department of Education, Federal Student Aid, Parents’ U.S. Citizenship or Immigration Status

- U.S. Department of Education, Federal Student Aid, Staying Eligible

- What is a Data Release Number?

- University of Cincinnati Financial Aid, Student Aid Index (SAI), How Is SAI Used?

- U.S. Department of Education, Federal Student Aid, (GENERAL-24-17) Details of 2024-25 FAFSA Initial Institutional Student Information Records (ISIR) Delivery and Update on Support for Institutions and Vendors

- U.S. Department of Education, Federal Student Aid, 2024-2025 Federal Student Aid Handbook, Formula A, Formula B, and Formula C for Dependent Students

- U.S. Department of Education, Federal Student Aid, FAFSA® Pell Eligibility and SAI Guide

- College Board, Trends in College Pricing and Student Aid 2024

About our contributors

-

Written by Sarah Sheehan, MAT

Written by Sarah Sheehan, MATSarah Sheehan is a writer, educator, and analyst who focuses on the impact of health, gender, and geography on financial equity. Her ultimate goal? To live beyond the confines of chasing the next dollar—and to teach everyone else how to do the same.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.