Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

EarnIn wins LendEDU’s 2025 Best Overall and Best Intro Offer designations in our earned wage access category.

EarnIn Cash Out

- No subscription required

- Works with any compatible external bank account

- Fee-free advances of earned wages arrive in 1-2 business days

- Smooth, modern in-app experience

- 24/7 mobile support

- Doesn’t affect your credit score

- Don’t need full-time employment to qualify

- Capped at $300 per day, which is lower than many advance apps

- Capped at $1,000 per pay period (many advance apps don’t limit this at all)

| Funding | $300/day and up to $1,000/pay period max1 |

| Speed of advance | 1 – 3 business days2 |

| Fees | $3.99 – $5.99 for expedited earned wage access |

Founded in 2014, the EarnIn app was created to help responsibly-employed borrowers with cash flow issues between paychecks.

EarnIn stands out against competitors because it doesn’t charge mandatory fees or interest.

After connecting your bank account with EarnIn, you can borrow up to $300 a day and $1,000 per pay period maximum.

EarnIn is ideal if you occasionally fall short of cash between paychecks but can easily repay the borrowed amount by your next paycheck.

What is EarnIn?

EarnIn is a financial app that offers early access to earned wages through its Cash Out feature.

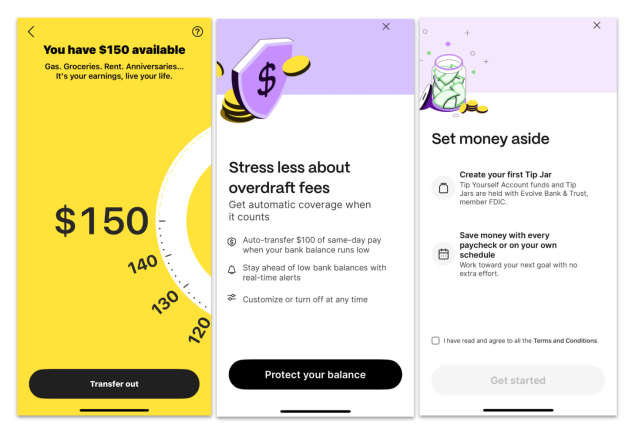

It also provides Balance Shield for overdraft protection, Lightning Speed for funding within minutes, Tip Yourself for savings, and Health Aid for negotiating medical bills, all with secure bank integration.

We’ll cover all of these features and more.

How EarnIn works

Employment verification

The first step (and possible challenge) to using EarnIn is to verify employment and regular income, which can be done in one of three ways:

- Provide a work email address

- Download the app, which uses GPS data to verify where you work physically

- Manually upload your timesheet

Employment is also verified through banking activity. To qualify to advance yourself funds ahead of your next paycheck, you must make at least $320 per pay period. Once you’ve created an account and verified your information, you can request an advance.

EarnIn’s Cash Out feature gives you access to the money you’ve already earned, before your next payday.

Secure connection via Plaid

While you’re signing up and each time you log in, Earnin uses Plaid, a financial services company, to connect your external bank account to your EarnIn account. You can choose your bank and log in through Plaid, which enables EarnIn to confirm your income. You’ll also connect a debit card to receive your money faster.

Your bank account is securely connected through Plaid, which uses 256-bit encryption and is trusted by thousands of financial apps (including virtually all similar money management and money transfer apps).

EarnIn does not store your banking credentials, and all transactions are monitored for security to help ensure your information stays safe.

Cash Out

Once your account is set up and employment is verified, you can start advancing yourself cash.

There’s no interest or mandatory fee, and repayment is automatically deducted from your bank account on payday.

Below is a quick look at the terms and fees. Keep reading for a more in-depth overview of these and more.

| Term | Details |

| Advance amounts | $150 per day; $1,000 per pay period |

| Fees | $3.99 to $5.99 fast funding fee and no fee for standard funding |

| Repayment time | Next paycheck |

| Funding time with a fee | $3.99 – $5.99 |

| Funding time without a fee | 1 – 2 business days |

Standard delivery time

The standard delivery timeline is one to two business days.

Lightning Speed

Lightning Speed is an optional feature that lets you receive your money in minutes. While standard transfers take one to two business days, but Lightning Speed deposits are transfered within minutes for a fee of $3.99 to $5.99 based on the amount transferred.

Daily Max

There are limitations on how much you can advance via Earnin.

In Washington, D.C., Connecticut, Maryland, Massachusetts, and New York, you can only advance yourself $100 per day.

For all other states, you can only advance $150 per day.

Pay Period Max

The pay period max is the total amount you can transfer within a given pay period. This varies by user, based on income and other factors, and can be between $50 to $1,000.

If you forward your direct deposit through EarnIn, you can increase your pay period max by $50 to $300 per pay period (capped at $1,000).

Optional tips

EarnIn lets you leave an optional tip when you use the Cash Out feature. Tipping is voluntary and doesn’t affect your ability to use the app. However, consistent tipping may help increase your maximum advance limit over time because it signals responsible use and community support.

Repayment

As we mentioned, repayment is automatically deducted from your bank account on payday, so it’s an easy process.

Will EarnIn’s advance cause an overdraft fee?

Typically, EarnIn’s Cash Out feature won’t cause an overdraft fee because it monitors your bank account and schedules repayments on your payday, ensuring the funds are available.

However, you should still check your account balance regularly to prevent overdrafts. EarnIn isn’t responsible for fees resulting from an overdraft.

What happens if you don’t pay EarnIn back?

If you fail to repay the advanced funds on your payday, EarnIn will attempt to draw the funds from your account again in a few days. If that fails, it will send a payment reminder.

If you don’t have funds in your account, you may start to see overdraft fees.

EarnIn doesn’t charge late fees or collect debts, but your borrowing limit may be affected, and EarnIn might put your account on hold until you repay the amount in full.

Balance Shield

Balance Shield is EarnIn’s tool for helping you avoid overdraft fees. If your bank account drops below a threshold you set, Balance Shield will either send you an alert or automatically deposit up to $150 from your available cash out balance—whichever option you choose. It’s designed to help you stay on top of your finances without surprises.

Tip Yourself

Tip Yourself is a free savings tool within the EarnIn app that lets you move small amounts of money into a virtual tip jar—like rewarding yourself for good habits or accomplishments. It’s flexible, fee-free, and helps you build savings over time.

Health Aid

Health Aid is EarnIn’s medical bill negotiation service. If you have high or unexpected medical bills, Health Aid can work with providers on your behalf to try to reduce what you owe.

EarnIn for Employers

EarnIn for Employers is a financial wellness benefit that allows companies to offer employees access to Cash Out, Balance Shield, Tip Yourself, Health Aid and all its other featured and benefits. It integrates with payroll systems and doesn’t affect company cash flow, with the primary benefit of reducing employee financial stress and improving employee retention.

Eligibility requirements

EarnIn only has a few criteria borrowers must meet to be eligible for an advance:

- Steadily employed and be able to prove where you work. You can do this by providing an active work email, downloading the app, and granting GPS access, or manually uploading your timesheets.

- Making at least $320 per pay period.

- You must connect your bank account. This allows EarnIn to confirm that you make at least $320 per pay period. That bank account is also used for depositing funds and automatically debiting repayment.

EarnIn’s eligibility requirements are similar to its competitors. However, one aspect that may make EarnIn more appealing is that it’s not a part of any bank, nor does it offer checking or savings accounts that you need to sign up for to use it.

Alternatives: How does EarnIn compare to similar apps?

EarnIn is our top choice if you need a $100 advance right away.

| Company | Best for… | Advance Limits | Rating (0-5) |

|---|---|---|---|

|

Best overall | Up to $300 per day; $1,000 per pay period |

|

|

Best credit-building tools | Up to $400 per advance |

|

|

Best for large advances (up to $500) | Up to $500 per advance |

|

|

Best theft protection | Up to $500 per advance |

|

While the $300 advance limit and $1,000 per pay period limits may seem like a negative in comparison to competitors, we appreciate how this keeps users from advancing more than they can pay later on and ending up deeper the debt cycle. Other similar apps seem to actively invite users to have long-term debt management problems.

EarnIn had the smoothest in-app experience, and the least pushy and salesy user experience, of all the earned wage access apps our team tested firsthand.

EarnIn also allows its users to keep their existing bank accounts. A few apps that you’ll often find in “best cash advance” roundups and in the apps stores are actually full-fledged online banking services that require you to open a new bank account to receive advances (or they will charge you an exorbitant fee to withdraw to your external bank account).

With EarnIn, you don’t need to switch your bank or open a new account to take advantage of its earned wage access feature.

Should you use EarnIn?

EarnIn makes creating an account easy. The most surprising bit about EarnIn is that it doesn’t charge mandatory fees, which is a major advantage when you consider that you can borrow up to $1,000 per pay period.

If you don’t pay for fast funding, which costs anywhere from $3.99 to $5.99, you’ll get your funds transfered within one to two business days. If you pay the fee, you’ll get your money in minutes. Compared to payday loans, these fees are minor and are unlikely to create a cycle of debt for most users.

As long as using EarnIn doesn’t become habitual, it’s a great alternative to other financial products. Just be aware of when EarnIn will deposit your requested money and when it will automatically debit your outstanding balance.

Customer reviews: Is EarnIn reputable?

| Source | Customer rating | Number of reviews |

| iOS App Store | 4.7/5 | 320K |

| Google Play | 4.7/5 | 266K |

| Better Business Bureau (BBB) | 4.19/5 | 577 |

| Trustpilot | 4.5/5 | 594 |

EarnIn has an A+ rating with the BBB, and reviews on Google Play (266,990 reviews with a 4.7/5 aggregate rating) and Apple’s App Store (320,538 reviews with a 4.7/5 aggregate rating) give a positive impression of the app and its various services.

The reviews on the app stores are largely raves about how seamlessly EarnIn works and how much it has helped them in urgent financial situations.

There are complaints related to EarnIn withdrawing money from bank accounts at the wrong time and causing overdrafts, but EarnIn appears to be responsive to customer complaints on review sites.

Customer service

To contact EarnIn’s customer service, you can use live chat in the EarnIn mobile app. Here, you can submit a request or chat live with a support agent. Its customer service is open 24/7, except on major holidays. If you need phone support, call 888-537-9883.

How we rated EarnIn

We designed LendEDU’s editorial rating system to help readers find companies that offer the best access to earned wages. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared EarnIn to several similar earned wage access and money management apps, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. Our editorial team also tested out the app and its features firsthand.

Test run results: Our best experience was with Earnin—the tester was able to advance themselves $100, with no fees, within 8 minutes after downloading the app. (First instant transfer is free for new users.) They were then eligible to advance an additional $150 at a time, and up to $500 total per pay period.

We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Product | Best for | Our rating |

| EarnIn | Best access to earned wages | 4.9/5 |

1. EarnIn is a financial technology company, not a bank. Banking services are provided by our bank partners on certain products other than Cash Out. 1A pay period is the time between your paychecks, such as weekly, biweekly, or monthly. EarnIn determines your daily and pay period limits (“Daily Max” and “Pay Period Max”) based on your income and financial risk factors as outlined in the Cash Out Maxes section of our Cash Out User Agreement. EarnIn reserves the right to adjust the Daily Max and Pay Period Max at its discretion. Your actual Daily Max will be displayed in your EarnIn account before each Cash Out. EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

2. Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

About our contributors

-

Written by Lauren Ward

Written by Lauren WardLauren Ward is a personal finance writer who regularly covers topics like mortgages, real estate, tax relief, home equity, business loans, and investing.