Our take: CreditFresh offers quick access to cash through a personal line of credit, with same-day funding and flexible repayment tied to your pay schedule. It can be a lifeline for borrowers with fair or poor credit, but the high billing cycle charges make it an expensive option compared to traditional loans.

Personal Line of Credit

- Caters to borrowers with poor or no-credit borrowers

- Repayment schedule based on income frequency

- Build your credit and possibly reduce charges and increase line limit with on-time payments

- No interest is charged, but billing cycle fee could be 10 – 15% of your balance

- You’ll likely find better options with other lenders if you have decent credit

| Interest rates | Doesn’t charge an interest rate, but you’ll pay a billing cycle fee, which can be 10% to 15% of your balance (disclosed in your credit line agreement) |

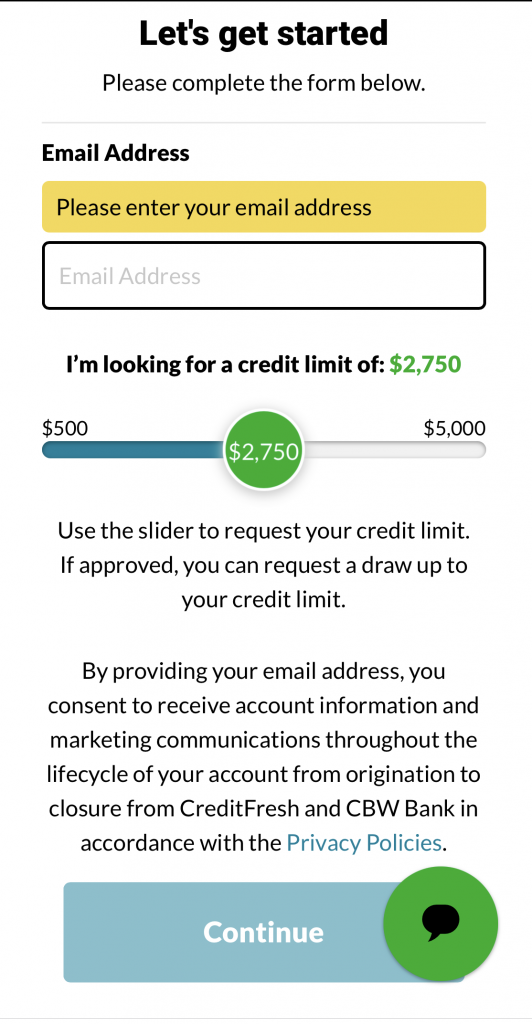

| Loan amounts | $500 – $5,000 |

| Repayment terms | Due biweekly or monthly based on when you get paid |

| Unsecured or secured? | Unsecured |

| Funding time | Same business day if request is made before 3:30 p.m. Eastern, otherwise next business day |

| Fees | None |

Table of Contents

- What is CreditFresh?

- How does a CreditFresh personal line of credit work?

- Does CreditFresh have a minimum credit score requirement?

- How CreditFresh monthly payments and non-monthly repayment works

- Pros and cons of CreditFresh

- Is CreditFresh legit? Customer reviews

- CreditFresh customer service

- How to apply for a CreditFresh personal line of credit

- What if I’m denied a personal line of credit from CreditFresh?

- CreditFresh personal line of credit FAQ

What is CreditFresh?

Founded in 2019, CreditFresh provides personal lines of credit for people who may struggle to qualify with traditional lenders. The online application is quick, with fast approval decisions and the possibility of same-day funding.

CreditFresh doesn’t list a minimum credit score, though it does run a hard inquiry. It’s generally more accessible to borrowers with low to mid-range credit, but the fees are higher than what you’d find with banks or credit unions.

For those who need cash fast, CreditFresh can be a safer option than payday loans. Still, borrowers with stronger credit scores will likely find better terms elsewhere.

How does a CreditFresh personal line of credit work?

A personal line of credit through CreditFresh works like a flexible borrowing account—you’re approved for a set limit, and you can draw money as needed rather than taking a lump sum upfront. You only pay charges on the amount you borrow, making it more like a credit card than a traditional personal loan.

Here’s how the process works.

1. Prequalify online

Start with a quick online request to check your eligibility. This step uses a soft inquiry, so it won’t affect your credit score. You’ll see whether you qualify and get an idea of your potential credit limit.

2. Apply and get approved

If you move forward, CreditFresh will run a hard credit check as part of the full application. If approved, you’ll be assigned a credit limit between $500 and $5,000. The account is originated by one of CreditFresh’s partner banks—CBW Bank or First Electronic Bank—but you’ll manage everything directly through CreditFresh.

3. Request a draw

Once your line is open, you can log in anytime to request a draw from your available credit. Requests made before 3:30 p.m. Eastern on business days may be deposited into your bank account the same day.

CreditFresh doesn’t restrict how the funds are used. You can use the money for various purposes, including emergency expenses, home improvements, and even vacations.

4. Track your balance

The amount you borrow becomes your Outstanding Principal Balance. Your costs are tied to your Average Daily Principal Balance, which reflects how much you’ve borrowed on average during the billing cycle.

5. Review your Periodic Statement

Before each due date, you’ll receive a Periodic Statement (at least 14 days in advance) showing your activity and the Minimum Payment required.

6. Make your Minimum Payment

Every Minimum Payment has two parts:

- a Mandatory Principal Contribution that reduces your balance, and

- a Billing Cycle Charge, which is based on your Average Daily Principal Balance.

Together, these make up your regular payment—often referred to as the CreditFresh monthly payment if you’re on a monthly schedule.

7. Repay on your income schedule

Payments are set to match your income frequency—biweekly, semi-monthly, or monthly. You can pay online, set up ACH transfers, and even pay off your balance early with no penalty.

8. Build credit over time

CreditFresh reports to TransUnion, so on-time payments can help improve your credit score. Responsible repayment may also qualify you for reduced charges or a higher credit limit in the future.

Does CreditFresh have a minimum credit score requirement?

CreditFresh doesn’t list a minimum credit score, which means approval relies more on your income and account standing than on your credit history. To qualify, you’ll need to meet some straightforward requirements.

Here’s a breakdown of the eligibility criteria:

| Requirement | Details |

| Citizenship | U.S. citizen or permanent resident |

| Employment status | Must have a regular, consistent source of income |

| State of residence | Available in 25 states* (listed below) |

| Minimum age | Legal age to contract in your state of residence (18 in most states) |

| Minimum credit score | Not disclosed |

| Minimum income | Must have a regular, consistent source of income |

| Bank account | Must have an active bank account |

States where CreditFresh is available

- Alabama

- Alaska

- Arizona

- Arkansas

- Delaware

- Florida

- Hawaii

- Idaho

- Indiana

- Kentucky

- Kansas

- Louisiana

- Michigan

- Missisippi

- Missouri

- Nebraska

- New Mexico

- Ohio

- Oklahoma

- South Carolina

- Tennessee

- Texas

- Utah

- Washington

- Wisconsin

Because there’s no published credit score requirement, CreditFresh can be a fit for borrowers with low to mid-range credit. Just keep in mind that accessibility comes with higher fees compared to traditional loans.

How CreditFresh monthly payments and non-monthly repayment works

Unlike traditional personal loans, CreditFresh doesn’t use a standard APR. Instead, your costs come from the Mandatory Principal Contribution and Billing Cycle Charge that make up your Minimum Payment.

Because these charges are tied to what you actually borrow, your payments will vary depending on your balance. The higher your balance, the higher your costs. Paying down your balance faster lowers the total you’ll pay.

Examples of CreditFresh payments

To see how this works in practice, here’s what happens if you borrow $1,500 and make only minimum payments, without taking any new draws:

Example 1: Monthly income frequency (each minimum payment is about 30 days apart)

| Billing cycle | 1 | 2 | 3 |

| Balance | $1,500 | $1,470 | $1,440.60 |

| Principal payment | $30 | $29.40 | $28.81 |

| Billing cycle charge | $184 | $184 | $184 |

| Min. payment | $214 | $213.40 | $212.81 |

| New balance | $1,470 | $1,440.60 | $1,411.79 |

Over the first three months, you’d pay $552 in total, but your balance would still be more than $1,400 because of the steep billing cycle charges.

Example 2: Non-monthly income frequency (each minimum payment is about 14 days apart)

With payments every 14 days, each one includes a small principal contribution and an $85 billing cycle charge, so your balance shrinks slowly even after several cycles.

| Billing cycle | Balance | Min. payment | New balance |

| 1 | $1,500 | $100 | $1,485 |

| 2 | $1,485 | $99.85 | $1,470.15 |

| 3 | $1,470 | $99.70 | $1,455.45 |

| 4 | $1,455.45 | $99.55 | $1,440.90 |

| 5 | $1,440.90 | $99.41 | $1,426.49 |

| 6 | $1,426.49 | $99.26 | $1,412.23 |

CreditFresh doesn’t add extra fees on top of these charges, and you can always pay more or pay off your balance early without penalty. But compared with a traditional personal loan—for example, a $1,500 loan at 12% APR with $70.61 monthly payments—the line of credit is much more expensive over time.

Pros and cons of CreditFresh

When considering a CreditFresh personal line of credit, weigh the pros and cons to make a decision.

Pros

-

No hidden fees

CreditFresh doesn’t charge any hidden fees—just the billing cycle charge, which is a percentage of your balance and laid out in your credit line agreement.

-

Fast funding

Access funds on the same business day if you’re approved and make a draw request by 3:30 p.m. Eastern.

-

Pay only for what you use

You’re charged only on the amount you borrow, offering financial flexibility.

-

Positive impact on credit score

CreditFresh reports to credit bureaus, giving you a chance to improve your credit score with on-time payments.

-

Incentives for responsible behavior

On-time payments can result in credit limit increases and lower billing cycle charges.

-

Check eligibility without a hard inquiry

You can check whether you qualify for a loan without affecting your credit score.

Cons

-

High monthly billing cycle charge

This large fee tacked on to each payment you make adds to the overall cost of your loan and makes repayment lengthy.

-

Interest rates unclear

The absence of a standardized APR can make it difficult to gauge the cost of borrowing.

-

Limited information on eligibility

CreditFresh doesn’t fully disclose its eligibility criteria, which can make your application feel uncertain.

-

Lower credit limits

Compared to other lenders, such as Truist, which offers up to a $50,000 limit, CreditFresh has a lower maximum of $5,000.

-

Not available in every state

As of October 2023, CreditFresh personal lines of credit are only available in Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Hawaii, Idaho, Indiana, Kentucky, Kansas, Louisiana, Michigan, Mississippi, Missouri, Nebraska, New Mexico, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Washington and Wisconsin.

CreditFresh can be a solid option for those with limited or bad credit history who need fast funds, but we recommend exploring our best personal lines of credit recommendations and other personal loan companies before making a decision.

We’ve rated several lenders’ personal lines of credit. Check out our top recommendations on our best personal lines of credit page.

Is CreditFresh legit? Customer reviews

| Source | Rating | Number of reviews |

| Trustpilot | 4.5/5.0 | 5,179 |

| Better Business Bureau | 1.0/5 | 1 reviews; 110 complaints closed in last 12 months |

| 4.5/50 | 3,085 |

Customer feedback on CreditFresh is mixed. On Trustpilot and Google, it holds strong 4.5-star ratings, with many borrowers noting fast funding and an easy process.

The BBB profile tells a different story, showing just one customer review at 1 star but more than 100 complaints closed in the past year, many about billing and high costs.

Overall, CreditFresh is a legitimate lender with plenty of positive reviews, but the high fees and complaint history are important to weigh before borrowing.

CreditFresh customer service

CreditFresh’s customer service team assists borrowers throughout their credit experience. Whether you have questions about your application, need clarification on charges, or seek guidance on repayment options, the customer service team is available to help.

The team operates seven days a week, offering an extra layer of convenience for borrowers who might need to reach out during weekends or holidays.

Ways to contact CreditFresh:

- Email: [email protected]

- Call or text CreditFresh phone number: 1-800-766-2007

- Mail: CreditFresh, 200 Continental Drive, Suite 401, Newark, DE 19713

Customer service hours:

- Monday – Friday: 8 a.m. – 9 p.m. Eastern time

- Saturday: 10 a.m. – 6 p.m. Eastern time

- Sunday: 10 a.m. – 6 p.m. Eastern time

- Holiday hours: 10 a.m. – 6 p.m. Eastern time

How to apply for a CreditFresh personal line of credit

CreditFresh offers a streamlined application process that stands out for its simplicity and speed. The lender allows you to check eligibility without affecting your credit score. Here are the steps to apply for a CreditFresh personal line of credit.

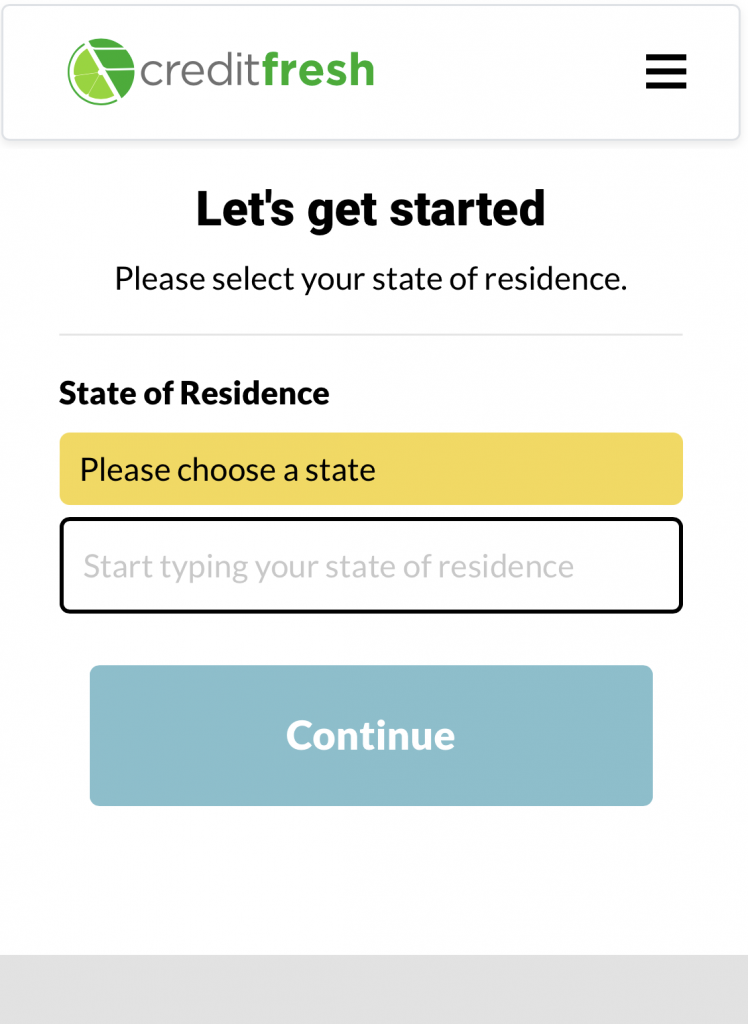

- Visit the website: Navigate to the CreditFresh website to initiate the application process, and click the “Get Started” button.

- Provide details: Fill in required personal information, your state of residence, contact information, including employment status and income source. Be prepared to provide documents that verify your identity and income.

- Get approved: Wait for CreditFresh to review your application, which typically happens within a few hours.

- Request a draw online: Once approved, funding can happen as soon as the same business day, and you can request a draw from your line of credit through your online account.

What if I’m denied a personal line of credit from CreditFresh?

If you find yourself denied a personal line of credit from CreditFresh, it’s crucial to understand why. CreditFresh typically provides reasons for loan denial, offering you insights into what needs improvement.

Common reasons for denial and recommended actions include:

- Low credit score: CreditFresh doesn’t specify a minimum score, but it will check your credit score and history when reviewing your application. Work on improving your credit by paying off debts and maintaining low credit utilization.

- Insufficient income: Consistent income is a main requirement for CreditFresh approval. If you don’t have that, finding additional sources of income is critical.

- High debt-to-income ratio: Work on lowering this ratio by paying off debt or boosting your income.

- Incomplete application: Make sure all fields are completed and accurate when applying.

- Limited employment history: Consider reapplying after you’ve built up a longer, stable employment history.

CreditFresh personal line of credit FAQ

Can you have more than one CreditFresh personal line of credit?

CreditFresh generally limits borrowers to one personal line of credit at a time. The company warns potential borrowers its line of credit is an expensive financial solution, and only one is allowed open at a time.

If you don’t pay CreditFresh back, will it take you to court?

If you fall behind on payments with CreditFresh, your account may be reported to the credit bureaus and could be sent to collections. This can damage your credit score and lead to ongoing collection attempts, including calls or letters.

In serious cases, if the debt remains unpaid and other collection efforts fail, the lender or a collection agency could pursue legal action. That doesn’t happen in every case, but it is a possibility. If a court judgment is entered against you, it may result in wage garnishment or other collection methods depending on your state laws.

The best way to avoid these outcomes is to contact CreditFresh’s customer service as soon as you know you’ll have trouble making a payment. They may be able to work with you on repayment options before the situation escalates.

| Company | Product | |

|---|---|---|

|

Personal line of credit |

|

About our contributors

-

Written by Amanda Hankel

Written by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.