People in the United States care a lot about their pets. Whether it be a dog, cat, hamster, turtle, or even a snake, Americans spend quite a bit on their pets.

So much so that total spending on pets increased by $3 billion from 2017 to 2018, with a record-breaking high of $72 billion spent on pets in 2018.

Pet insurance is becoming more popular with pet owners, but many are not sure if it’s worth the cost. Pet insurance policies have been increasing in numbers as well, with 2.1 million pets being insured in 2017, which was up 17% from 2016.

These numbers got LendEDU to thinking. Would people go into debt for their pets, or spend more money on their pets than themselves? We were curious about those questions and many more, so we decided to look into it ourselves.

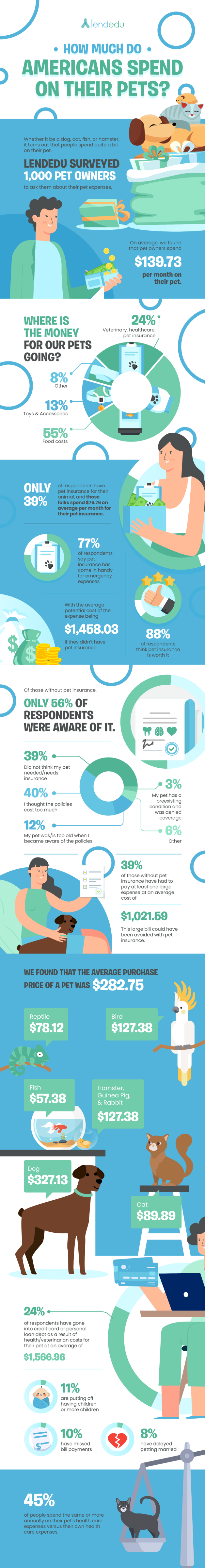

LendEDU ran a survey polling 1,000 adult American pet owners to see just how much people spend on their pets, with or without pet insurance.

Full Survey Results

(All results derive from an online survey of 1,000 adult Americans that currently own a single pet.)

(1) What type of pet do you own?

- 72% of respondents answered “Dog”

- 22% of respondents answered “Cat”

- 1% of respondents answered “Bird”

- 1% of respondents answered “Guinea Pig / Hamster / Rabbit”

- 3% of respondents answered “Fish”

- 1% of respondents answered “Reptile (e.g. turtle, lizard, snake, etc.)

(2) How much do you estimate you spend per month on your pet including things like monthly health care costs, insurance cost, food, toys & accessories, etc.?

- “Reptile” owners answered an average of $56.88

- “Guinea Pig / Hamster / Rabbit” owners answered an average of $63.64

- “Fish” owners answered an average of $53.60

- “Cat” owners answered an average of $95.11

- “Bird” owners answered an averaged of $127.38

- “Dog” owners answered an averaged of $157.39

(3) What percent of your estimated monthly pet expenditure goes to things like veterinary costs, health costs, and pet insurance costs?

- Respondents answered an average of 24%

(4) What percent of your estimated monthly pet expenditure goes to food costs?

- Respondents answered an average of 55%

(5) What percent of your estimated monthly pet expenditure goes to toys & accessories?

- Respondents answered an average of 13%

(6) What percent of your estimated monthly pet expenditure goes to other things for your pet?

- Respondents answered an average of 8%

(7) Do you have pet insurance for your animal?

- 39% of respondents answered “Yes”

- 61% of respondents answered “No”

(8 – Asked only to those who answered “Yes” to Q7) How much do you pay monthly for your pet insurance?

- Respondents answered an average of $76.76

(9 – Asked only to those who answered “Yes” to Q7) Has your pet insurance ever come in handy for emergency expenses like surgery or recurring treatments?

- 77% of respondents answered “Yes”

- 19% of respondents answered “No”

- 4% of respondents answered “I’d rather not say”

(10 – Asked only to those who answered “Yes” to Q7 & “Yes” to Q9) How much would the expense have cost if you did not have a pet insurance policy?

- Respondents answered an average of $1,458.03

(11 – Asked only to those who answered “Yes” to Q7) Do you think pet insurance is worth it?

- 88% of respondents answered “Yes”

- 5% of respondents answered “No”

- 7% of respondents answered “I’m not sure”

(12 – Asked only to those who answered “No” to Q7) Are you aware of pet insurance policies?

- 56% of respondents answered “Yes”

- 44% of respondents answered “No”

(13 – Asked only to those who answered “No” to Q7) Which of the following best describes the reason why you have not purchased pet insurance?

- 12% of respondents answered “My pet was/is too old when I became aware of the policies.”

- 3% of respondents answered “My pet has a preexisting condition and was denied coverage.”

- 40% of respondents answered “I thought the policies cost too much.”

- 39% of respondents answered “Did not think my pet needed/needs insurance.”

- 6% of respondents answered “Other”

(14 – Asked only to those who answered “No” to Q7) Have you ever had to pay a large pet-related expense (like surgery or treatment) out of pocket?

- 39% of respondents answered “Yes”

- 61% of respondents answered “No”

(15 – Asked only to those who answered “Yes” to Q14) How much did you have to pay out of pocket for the large pet-related expense?

- Respondents answered an average of $1,021.59

(16) What was the purchase price of your pet?

- Reptile owners answered with an average of $78.12

- Guinea pig/hamster/rabbit owners answered with an average of $53.58

- Fish owners answered with an average of $57.38

- Cat owners answered with an average of $89.89

- Bird owners answered with an average of $127.38

- Dog owners answered with an average of $327.13

(17) Have you ever gone into, or are currently in, credit card or personal loan debt because of your pet due to health/veterinarian costs that could have come from an emergency surgery or recurring treatments?

- 24% of respondents answered “Yes”

- 72% of respondents answered “No”

- 4% of respondents answered “I’d rather not say”

(18 – Asked only to those who answered “Yes” to Q17) How much credit or personal loan debt did you go into as a result of health/veterinarian costs that could have come from an emergency surgery or recurring treatments?

- Respondents answered an average of $1,566.96

(19) Have you ever had to delay any of the following milestones due to expense from your pet? (Select all that are applicable)

- 11% of respondent answers were “Having children or more children”

- 8% of respondent answers were “Getting married”

- 8% of respondent answers were “Buying or renting a home or apartment”

- 10% of respondent answers were “Missed bill payments”

- 7% of respondent answers were “Made smaller payments to student loan or credit card debt than you would have liked”

- 6% of respondent answers were “Buying or leasing a car”

- 5% of respondent answers were “Getting an insurance policy (life, health, auto, etc.)”

- 2% of respondent answers were “Other”

- 43% of respondent answers were “None of the above”

(20) As an estimate, do you spend more annually on your pet’s health care expenses or own personal health care expenses?

- 24% of respondents answered “I spend more on my pet’s health care than my own.”

- 46% of respondents answered “I spend more on my personal health care expenses than my pet’s.”

- 22% of respondents answered “It is about the same.”

- 8% of respondents answered “Prefer not to say”

Observations & Analysis

Average Monthly Spending Per Pet Type

This data exhibits that no matter the pet type, pet owners probably end up spending a hundred or more dollars a month on their pets. People are willing to spend quite a bit on their pets.

This is not a surprise to many, but some of the more interesting points are how much people spend on their birds and fish. Per animal, fish owners spend $30.48 per month on their fish, while bird owners spend $127.38 per month.

Breakdown of Expenses

By far the most expensive category was food, with healthcare/vet costs not even being half of the total average expenditure.

This is in line with our report on pet ownership cost statistics. Out of the $72 billion spent in 2018 on pets, over $30 billion was spent on food alone. Considering there are almost 184 million dogs and cats in the United States, it makes sense why so much money is spent on food.

Spending on Own Healthcare Versus On Pets

One of the most surprising discoveries was that about 46% of respondents spend the same or more on their pet’s health care than their own. This is incredibly surprising to see, as many Americans might not think about how much they spend on their pet’s healthcare instead of their own.

Some possible explanations for this could include people putting their pet first in the order of who gets health and dental appointments, or being neglectful to their own health to the benefit of their pets.

Reasons Why People Didn’t Buy Pet Insurance

61% of respondents do not have pet insurance for their animals, and the breakdown is illustrated above. Interestingly, 40% of respondents who don’t have pet insurance thought it cost too much. But the biggest surprise was that 39% of this subset of respondents thought that their pet did not need insurance.

Putting Off Expenses or Milestones Because of Pets

43% of respondents answered with none of the above. Some of the more usual answers are expected, like missed bill payments (10%) and smaller payments towards debt (7%). Surprisingly, 11% of respondents have delayed having children, and 8% have delayed getting married. This is unexpected, at least at such a large percentage.

Tips on Pet Insurance

As the above data indicates, owning a pet can be incredibly expensive, especially if unforeseen events require surgery or prolonged veterinary care. For these reasons, pet insurance can be a worthwhile investment.

Below, you will find some general tips that you should know while shopping for pet insurance.

What Does Pet Insurance Cover?

What pet insurance will cover depends on the plan you end up choosing. For example, some pet insurance plans only cover accidents and illnesses, but other plans will cover things like wellness visits.

Ultimately, the best pet insurance plans will offer comprehensive coverage including emergency care, illnesses, and wellness visits.

How Much Does Pet Insurance Cost?

Pet insurance costs range widely, just like with health insurance. Premiums can differ greatly depending on the plethora of variables that impact your specific policy.

In the U.S., the average monthly premium for pet insurance is roughly $22, but some policies can climb as high as $100 per month. It’s important to remember that age plays a big factor in determining price and senior pet insurance can be a lot more expensive.

Check out this LendEDU article for some of the cheapest pet insurance policies.

What Are Some Pet Insurance Companies?

LendEDU listed out six of the best pet insurance companies in an article that you may find helpful if you are in the market for pet insurance. There are also pet insurance companies that have no waiting periods, in addition to highly rated pet insurance companies like ASPCA and Healthy Paws.

Methodology

All of the data that can be found within this report derives from an online survey commissioned by LendEDU and conducted online by online polling company Pollfish.

In total, 1,000 adult Americans aged 18 and up who passed the screener question with the correct answer of “I’m an owner of a single pet,” were surveyed. The screener question was “What describes your situation best?”

Respondents were also screened using Pollfish’s age filtering feature to ensure we surveyed appropriately aged consumers.

All respondents were asked to answer all questions truthfully and to the best of their abilities.

See more of LendEDU’s Research

About our contributors

-

Written by Mike Brown

Written by Mike BrownMike Brown uses data from surveys and publicly available resources to identify emerging personal finance trends and tell unique stories.