Debt consolidation combines high-interest debts, like credit cards and medical bills, into a single, lower-interest loan, simplifying repayment. When managed well—by avoiding new debt and making on-time payments—debt consolidation can boost your credit score. But if you continue using credit cards or miss payments, it may increase your debt and lower your score.

Learn how to consolidate strategically, avoid common traps, and recognize when an alternative might be a smarter choice.

Table of Contents

Debt consolidation methods and their credit impact

Debt consolidation involves taking on new debt to pay off old debt. It sounds counterintuitive, but debt consolidation often simplifies debt repayment. Rather than making multiple monthly payments, you’ll only make one. You might also save money on interest.

You may have several options to consolidate debt. The type of debt you have can influence which you choose and how much you pay. Here are some of the most common debt consolidation methods and their credit impact:

| Method | Best for | Credit impact |

| Debt consolidation loan | High-interest credit card debt > $15,000 | Can lower credit utilization with on-time payments |

| 0% APR balance transfer | High-interest credit card debt < $15,000 | Initial decrease due to hard inquiry but paying balance will increase score |

| Student loan refinance or consolidation | Student loans | Simplifies payment but may reduce score payments missed |

| Home equity loan or HELOC | Multiple unsecured debts | On-time payments may improve score, but missed payments put home at risk |

| Cash-out refinance | Multiple unsecured debts | Timely payments improve score, but may dip initially |

Debt consolidation loan

How it works

Debt consolidation loans function much like personal loans. You apply for a fixed loan amount, often at a fixed rate. Your lender disburses your loan funds in a lump sum, which you then use to settle your debts.

In some cases, your lender may pay off your debts on your behalf. In either case, once your debts are repaid, you’ll make one payment to your debt consolidation loan each month.

Credit impact

Initially, you may see a slight dip in your credit score due to a hard inquiry and increased debt balance. Over time, making consistent on-time payments can help improve your score by reducing credit utilization and establishing positive payment history.

Pros

-

Provides more time to pay off what you owe

-

Can stabilize monthly budget by consolidating variable-rate debts

Cons

-

Some lenders charge origination fees, which reduce the size of your disbursement and increase your borrowed balance

0% balance transfer credit card offer

How it works

Think of balance transfer cards as debt consolidation loans in credit card form. Rather than using a loan to pay off your credit cards, you move the balances from your current card issuers to your new balance transfer card.

Balance transfer cards often come with introductory 0% rates. If you’re eligible for one of these low- to no-interest promotions, you stand to save a considerable sum over time.

Credit impact

Opening a new card may cause a small, temporary drop in your score from the hard inquiry and the new account.

However, if you keep balances low and pay off the debt within the promotional period, you can improve your score by reducing credit utilization. Missing payments, however, can harm your score.

Pros

-

Introductory offers with 0% APR can significantly accelerate debt repayment

-

Potential to quickly reduce debt compared to high-interest rates (e.g., 29.99%)

Cons

-

Promotional 0% APR rates are temporary

-

Risk of losing interest savings if the balance isn’t paid off before the introductory period ends

Using a balance transfer card is sometimes referred to as credit card refinancing. Credit card refinancing and debt consolidation have the same end goal, but the terms aren’t always interchangeable.

Student loan refinance or consolidation

How it works

When you refinance or consolidate student loans, you combine them into one payment, ideally at a lower interest rate. Both processes achieve similar results, but they do so in different ways.

Refinancing most often refers to combining private loans, which you’ll do with a private lender. On the other hand, consolidation is reserved for federal student loans. You apply for federal consolidation loans through the Department of Education.

Credit impact

Consolidating student loans may lower your score temporarily due to a hard inquiry and new account.

Over time, consistent payments on the new loan may positively impact your score, though refinancing federal loans into private loans eliminates federal protections, which could increase financial risk if payments are missed.

Pros

-

Simplifies repayment by reducing multiple student loans to a single payment

-

Potentially lowers your monthly payment amount

Cons

-

Combining federal and private loans into one refinance loan forfeits federal loan protections permanently

Home equity loan or HELOC

How it works

Home equity loans and HELOCs both let you pull cash from your equity. With home equity loans, you get one upfront cash infusion. You’ll pay back that balance in monthly installments, much like you would a debt consolidation loan.

HELOCs are revolving lines of credit. You withdraw funds, repay what you borrowed, and then draw again. You can only pull from your HELOC for a set number of years. Once that time is up, you can’t make further withdrawals.

Credit impact

Using a home equity loan or HELOC for debt consolidation can improve your score by reducing credit utilization.

However, converting unsecured debt into secured debt means missed payments can put your home at risk. On-time payments may lead to a positive impact on your credit score over time.

Pros

-

Provides access to larger loan amounts, especially for homeowners with substantial equity

Cons

-

Converts unsecured debt into secured debt, putting your home at risk as collateral

Cash-out refinance

A cash-out refinance is another way to leverage your equity to pay off debt. In this case, you replace your current mortgage with a new one. The new mortgage is generally larger than what you owe on your home, and you pocket the difference at closing.

When you put those excess funds toward non-home-related debt, you essentially roll that debt into your home payment. Instead of paying multiple creditors each month, you’ll only need to pay on your mortgage.

Credit impact

Cash-out refinancing can initially lower your score due to the hard inquiry and increased mortgage balance.

As you pay down the new mortgage, it may improve your score by reducing high-interest debt. However, restarting your mortgage term may prolong your debt obligations, which could impact long-term financial goals.

Pros

-

Can provide a substantial amount of cash

-

Avoids the need to manage an additional loan payment

Cons

-

Restarts your mortgage term, extending payments over a new 30-year period

-

May not be ideal if you’re close to paying off your current mortgage, potentially adding long-term costs

When does debt consolidation hurt your credit score?

Lenders can perform a hard credit check when you apply for a balance transfer credit card, debt consolidation loan, student loan refinancing, or a home equity loan. Hard inquiries account for 10% of your FICO score, and each can cost you a few points. However, the inquiries only affect your score for 12 months.

Debt consolidation can also hurt your score because you’re taking on new debt. Amounts owed account for 30% of your FICO score. However, the way you consolidate debt can make a difference in how significant the impact on your score is.

FICO score calculations distinguish between revolving credit lines, such as credit cards and installment loans. A debt consolidation loan or home equity loan would fall into the latter category. Revolving credit line utilization tends to carry more weight than installment loans for credit scoring.

When does debt consolidation help your credit score?

You might see initial negative credit score impacts, but debt consolidation could help to raise your score over time. Again, it goes back to the way credit scores are calculated. FICO credit scores give the most weight to payment history and credit utilization.

So what does that mean? If you’re practicing good credit habits, consolidating debt could help you raise your score over time.

FICO doesn’t specify how long it takes to see an improvement in your credit scores after consolidating dates. However, as a general rule, establishing history can take at least six months, so a similar time frame may apply.

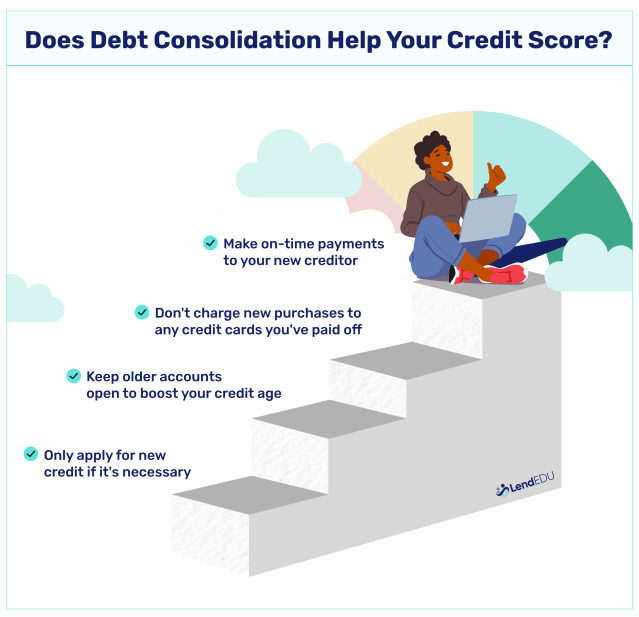

How to consolidate debt without hurting your credit

In most cases, you can’t prevent debt consolidation from affecting your credit. There are several ways to minimize debt consolidation’s negative impact while maximizing its benefits. Here’s what we recommend:

- Don’t close your accounts. Pay off your current debts, yes, but don’t close those accounts completely. Keeping them open maintains your credit history length while increasing your available credit, both of which can boost your score.

- Don’t apply for new credit. While extra credit inquiries won’t plummet your score, they can drop it by a few points. Besides, the objective is to offload debt, not add more.

- Keep your credit card balances low. This is particularly true if you’ve just paid them off. Maxing them out all over again will hurt both your wallet and your credit score, and it can be twice as hard to recover the second time around.

- Pay off your debt consolidation method quickly. The sooner you settle your new debt, the sooner your credit utilization will decrease. You’ll also save on interest, giving you more money to put toward other goals.

- Pay on time, every time. Payment history is the most important scoring factor, so it’s imperative that you pay by your creditors’ due dates without fail. If you must pay late, try to catch up within 30 days to prevent the late payment from hitting your report.

Another indirect way to keep your credit intact as you consolidate is to shop around for the best rates. Lower rates mean a less expensive borrowing cost. That, in turn, enables you to pay down your debts at a faster pace.

Furthermore, prequalifying doesn’t hurt your score. It only requires a soft credit pull. You can evaluate and compare different balance transfer or loan offers without incurring multiple hard inquiries.

Does debt consolidation makes sense for you?

Is debt consolidation a good option? The answer is different for everyone, depending entirely on your finances, goals, and habits.

| Consider debt consolidation if… | Reconsider debt consolidation if… |

| ✅ You want fewer or lower monthly payments | ❌ You’re tempted to continue using your credit cards or take on new loans |

| ✅ You can qualify for better interest rates than your current ones | ❌ Consolidation may lead to accumulating more debt than before |

| ✅ You know how much you can commit to debt repayment each month | ❌ Taking on more debt will stretch your budget too thin |

| ✅ You don’t plan to use your credit cards in the near future | ❌ You lack a solid plan or control over debt spending habits |

| ✅ You’re committed to avoiding new debt while repaying the consolidated amount | ❌ You’re not yet in a healthier financial position or ready for disciplined repayment |

When debt consolidation makes sense

Debt consolidation can be a valuable strategy if it simplifies your payments, reduces interest rates, and fits your financial goals. However, it’s essential to approach it with a commitment to avoid new debt, as consolidation shifts your debt but doesn’t eliminate it.

For those in a stable financial position with a clear repayment plan, consolidation can lead to significant benefits. But if you’re likely to continue using credit or struggle with debt spending habits, consolidating could increase your overall debt and strain your budget.

When debt consolidation doesn’t make sense

Reconsider debt consolidation if you’ll be tempted to swipe your credit cards or apply for additional loans. Debt consolidation doesn’t eliminate your debt—it shifts it around. So if you’re not careful, you could wind up deeper in debt than you were before.

For instance, say you take out a $10,000 personal loan to consolidate your credit cards. But once you pay off the cards, you charge up another $10,000. Now you have double the debt and double the payments.

Not only will this stretch your budget, it’ll also hurt your credit score and undo the benefits you’d have otherwise seen from debt consolidation. And in a worst-case scenario, continuing the same debt patterns could lead you to file bankruptcy.

Alternatives to debt consolidation

Consolidating debt isn’t the only way to pay it off if you’re worried about credit score impacts. Other possibilities you might consider include the following:

| Alternative | Credit impact |

| Debt management plan (DMP) | ✅ Can increase positive payments ❌ Could lower available credit |

| Debt negotiation | ✅ Lowers overall debt obligation ❌ Could reduce approval odds for new credit |

| Borrow from friends and family | ✅ Prevents new inquiries ❌ Doesn’t improve payment history |

With a DMP, you’ll work with a credit or debt counselor to create a payment agreement with your creditors. You make one payment to the DMP, which is split among your creditors. Meanwhile, your creditors may agree to waive certain fees or reduce your interest rates.

A DMP could make sense if you have credit card debt and aren’t behind on your payments, though you may be required to close some or all of your accounts in the process.

On the other hand, you might consider negotiating debts instead if your accounts aren’t current. Negotiating could allow you to settle for less than you owe, but your credit score may take a hit.

The settlement—which will stay on your report for seven years—also indicates to lenders that you didn’t pay your accounts as agreed. You may also owe taxes on the amount of credit that’s forgiven.

To avoid a settlement hitting your report, you might consider asking friends and family for a loan. If you go this route, consider putting together a written agreement to make sure both parties are protected and to prevent any undue strain on your relationships.

About our contributors

-

Written by Sarah Sheehan, MAT

Written by Sarah Sheehan, MATSarah Sheehan is a writer, educator, and analyst who focuses on the impact of health, gender, and geography on financial equity. Her ultimate goal? To live beyond the confines of chasing the next dollar—and to teach everyone else how to do the same.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.