Refinancing your student loans can help you save money, lower your interest rate, or simplify your payments—but it’s not the right move for everyone.

Whether refinancing is a smart financial decision depends on your loan type, credit, income, and long-term plans. In this guide, we’ll walk you through six scenarios when refinancing makes sense—and six when it might not—so you can make the best choice for your situation.

Table of Contents

- 1. ✅ You have private student loans

- 2. ✅ You have a stable income

- 3. ✅ You have a good credit score

- 4. ✅ You would save money

- 5. ✅ You have variable interest rates

- 6. ✅ You have multiple loans to consolidate

- 7. ❌ You have federal loans and may need the benefits

- 8. ❌ Your loans are in default or you’ve missed payments

- 9. ❌ You’ve declared bankruptcy

- 10. ❌ You have bad credit

- 11. ❌ You plan on taking out another loan soon

- 12. ❌ You’re focused on forgiveness

1. ✅ You have private student loans

Refinancing private student loans typically comes with fewer trade-offs than refinancing federal loans.

Federal loans come with benefits like income-driven repayment plans and forgiveness programs that you’ll lose if you refinance. But since private loans aren’t eligible for those benefits anyway, refinancing them may help you secure a lower rate and save money over time.

2. ✅ You have a stable income

Lenders want reassurance that you can afford to repay your loan. A stable income—often from full-time work or consistent freelance or part-time gigs—can help you qualify for refinancing. If your job is secure and your income is steady, you likely won’t need the safety net of income-driven repayment plans, making refinancing a safer bet.

| Lender | Min. income requirement |

| Citizens Bank | $12,000 (required for borrower and cosigner) |

| ELFI | $35,000 |

| SoFi® | Must show you have extra funds after monthly expense |

| Earnest | Evidence of a job and steady income. |

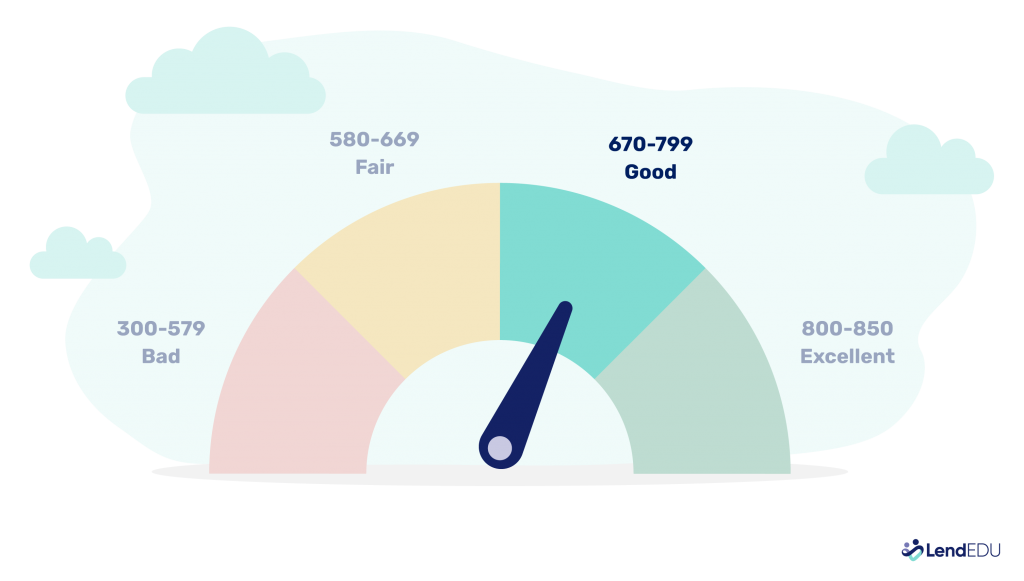

3. ✅ You have a good credit score

Your credit score plays a key role in refinancing eligibility and the rate you’ll qualify for. A score in the high 600s or above may qualify you for a better rate than you currently have.

Better credit usually equals better rates, which means lower monthly payments or long-term savings.

4. ✅ You would save money

The most common reason to refinance is to save money. If the new loan has a lower interest rate than your current one, you’ll pay less over time. Even if your credit score isn’t perfect, refinancing could still be worth it if it reduces your total loan cost.

Use our student loan refinancing calculator to determine your potential savings:

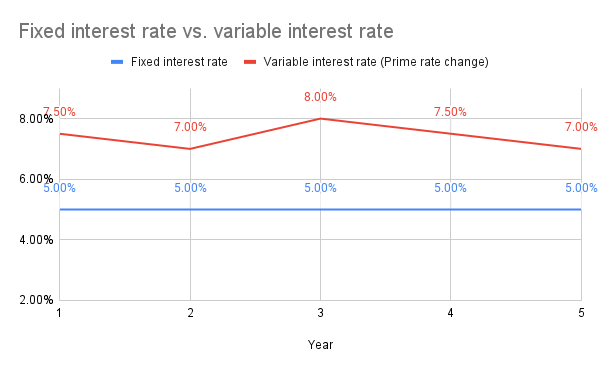

5. ✅ You have variable interest rates

Variable interest rates can rise over time, increasing your monthly payment and overall cost. Refinancing into a fixed-rate loan offers predictability and peace of mind. If market interest rates are climbing—or you’re just tired of rate changes—it may be time to refinance.

6. ✅ You have multiple loans to consolidate

Juggling different lenders, payment due dates, and interest rates can be stressful. Refinancing can consolidate multiple student loans into one new loan, streamlining your repayment. A single loan may be easier to manage and help prevent missed payments.

If you think refinancing is the right decision for you, check out our guide to the best student loan refinance lenders.

Below are six reasons not to refinance—and alternatives to consider instead.

7. ❌ You have federal loans and may need the benefits

Federal loans come with perks you’ll lose if you refinance, including:

- Income-driven repayment (IDR)

- Public Service Loan Forgiveness (PSLF)

- Interest subsidies on Subsidized Loans

If there’s any chance you’ll need those protections, hold off on refinancing.

Alternative: Consider a federal Direct Consolidation Loan to simplify repayment without losing federal benefits.

8. ❌ Your loans are in default or you’ve missed payments

If your loans are in default or you’ve missed payments, refinancing is usually off the table. Most lenders require your loans to be in good standing.

Alternative: Look into deferment, forbearance, or extending your loan term to make repayment more manageable and get back on track.

9. ❌ You’ve declared bankruptcy

Bankruptcy significantly lowers your chances of refinancing approval. Most lenders require that you have no bankruptcies on your record.

Alternative: Apply with a creditworthy cosigner to improve your chances of qualifying.

10. ❌ You have bad credit

A low credit score can block you from refinancing altogether or prevent you from getting a better rate. In this case, refinancing may not make financial sense.

Alternative: Work on improving your credit score and consider applying with a cosigner. Some credit unions may also offer more flexible credit requirements.

11. ❌ You plan on taking out another loan soon

If you’re about to apply for a mortgage or personal loan, refinancing could temporarily hurt your credit score due to a hard credit inquiry. This might affect your ability to qualify for better terms on the new loan.

Alternative: Wait until after you’ve secured your new loan to refinance your student debt.

12. ❌ You’re focused on forgiveness

If you’re working toward loan forgiveness—especially through PSLF or an income-driven repayment plan—don’t refinance. Doing so makes you ineligible for these programs.

The bottom line is that refinancing can be a smart decision if you have private loans, strong credit, and reliable income. But for federal borrowers or those relying on loan forgiveness, refinancing often means giving up valuable protections. Review your loan type, goals, and financial stability before making a decision, and shop around with a marketplace—Credible is our favorite—to compare offers before committing to a lender.

About our contributors

-

Written by Amanda Hankel

Written by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.