Struggling to make your student loan payments? You’re not alone—63% of borrowers have had trouble at least once, according to CFPB 2023 – 2024 research. You usually need decent credit to refinance, but if your score isn’t great, you still have options.

Some lenders specialize in working with borrowers with low credit scores, or you can apply with a cosigner to boost your chances of approval and securing a lower rate. A Direct Consolidation Loan might be a better fit if you have federal loans. This guide walks you through how to refinance student loans with bad credit and how to find the best option for you.

Table of Contents

What’s the minimum credit score to refinance student loans?

Typically, private lenders require a minimum credit score of 670 to refinance your student loans. If you want to refinance without a cosigner, you’ll need a stable work history and a debt-to-income ratio (DTI) below 50%.

Some borrowers can’t meet these requirements, but it’s still possible to refinance your student loans. Here are three options to consider based on your situation.

3 options for refinancing student loans with bad credit

Below, we’ve listed the three main options to refinance student loans with a low credit score. Which one is right for you will likely depend on whether you have a cosigner and whether your loans are federal or private.

| Option | Best for |

| Consolidate rather than refinance | More manageable federal student loan payments |

| Refinance with a cosigner | Those with a creditworthy cosigner |

| Apply with a lender with lower credit score requirements | Refinancing with no cosigner |

Option 1: Get a Direct Consolidation Loan

⭐ Best for: More manageable federal student loan payments

How it works: If you have federal student loans and are considering refinancing but don’t have great credit, our first recommendation is to consolidate them instead.

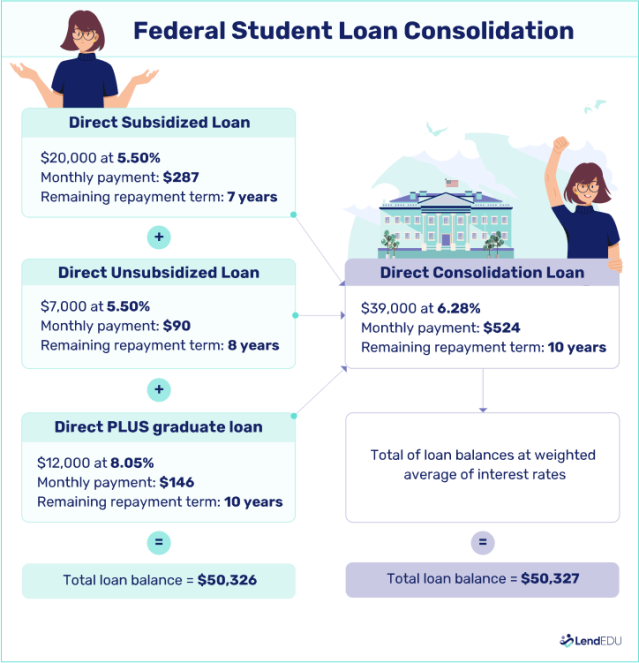

Federal student loan consolidation is different from refinancing. With a Direct Consolidation Loan, you combine your federal student loans into one bigger student loan, and you don’t need a good credit score to do it. This can help you organize your student loans by only having one monthly payment.

If you’re working toward student loan forgiveness, don’t apply for a Direct Consolidation Loan because it will restart your qualifying forgiveness payments. Instead, stay the course and continue paying the federal student loans you have to qualify for forgiveness. If you’re having trouble making payments, contact your servicer to ask about temporary forbearance.

Pros

-

No credit check required

-

Keeps federal loan benefits, such as income-driven repayment and forgiveness options

-

Simplifies repayment with one monthly bill

Cons

-

Doesn’t lower your interest rate

-

Resets the forgiveness timeline if already enrolled in a forgiveness program

Option 2: Refinance with a cosigner

⭐ Best for: Those with a creditworthy cosigner

How it works: If you have a cosigner willing to apply for student loan refinancing with you, you have several more options for lenders. Applying with a cosigner, even if you have bad credit or no credit history, can help you qualify for lower interest rates on your refinance loan.

Eventually, it’s helpful to relieve your cosigner of their obligations, so take the time to research lenders that allow you to release your cosigner after a period. For instance, Citizens Bank offers refinance loans, and you can request cosigner release after 36 months of consecutive, on-time payments. Until then, be sure to make all your payments on time; nonpayment hurts you and harms your cosigner’s credit.

Pros

-

Potential to qualify for much lower interest rates

-

Can help build your credit with on-time payments

-

May qualify for more flexible repayment terms

Cons

-

Cosigner is financially responsible if you miss payments

-

Not all lenders offer cosigner release

-

Requires finding someone willing and eligible to cosign

Sometimes, family members are willing to help by cosigning. But don’t forget—if they cosign, you should be 100% sure you can make your new payments on time. Otherwise, you’ll risk messing with that relationship.

And beyond that, work hard to have your cosigner removed as soon as possible. That may mean taking a side hustle to make every monthly payment. Do what it takes to make your payments on time, remove them as a cosigner, and don’t forget to thank them profusely!

Option 3: Apply with a lender with lower credit score requirements

⭐ Best for: Refinancing with no cosigner

How it works: If you have bad credit, one option is to apply with a lender with a lower credit score requirement. For example, some lenders, like Earnest, accept borrowers with slightly lower credit scores (665 and above).

Using a comparison tool—Credible is our favorite—which features select lenders that accept borrowers with credit scores as low as 580 and allows you to compare credit score requirements from several lenders before applying.

Pros

-

No need for a cosigner

-

Some lenders cater specifically to borrowers with limited or poor credit

-

May still qualify for refinancing and reduce your monthly payment

Cons

-

Interest rates may be higher than average

-

Fewer lenders to choose from

-

May not qualify if income or employment history is weak

If you’re experiencing difficulty making loan payments, the first step I recommend is to reach out directly to the loan servicer. Often it has options for you that may help you proceed through the loan payment hardship period.

If you refinance, I would make sure you understand all your new terms and options. For example, don’t do something that may restart your payments that qualify for loan forgiveness. Do you understand the new terms and the impact on your current cash flow and long-term total interest expense?

Best lenders for refinancing student loans with bad credit

Whether you’re looking for a lender with lenient approval standards or a marketplace that helps you compare multiple offers, these options give you a better shot at qualifying—even with a lower credit score.

Credible

Why we picked it

Credible makes it easy to shop around for student loan refinancing—especially if you have bad credit. Its marketplace lets you compare prequalified rates from multiple lenders with a single form without affecting your credit score. This is especially helpful if you’re unsure whether you qualify or want to avoid applying blindly to multiple lenders.

Credible includes lenders with minimum credit scores as low as 580, giving borrowers with poor or limited credit more options than they might find on their own. The platform is free to use and provides transparent rate and term comparisons, making it one of the most accessible tools for refinancing with bad credit.

- No impact on credit score to compare offers

- Access to lenders with flexible credit requirements

- Quick prequalification process

- Free to use

- Not a direct lender

- Limited control over individual lender terms

| Fixed Rates (APR) | 3.99% – 11.09% |

| Variable Rates (APR) | 4.31% – 12.05% |

| Refinance amounts | Vary by lender |

| Min. credit score | 580 |

| Repayment terms | Vary by lender |

Does refinancing student loans hurt your credit?

Many lenders conduct a soft pull during the prequalification process, which checks to see whether you generally qualify for the loan and won’t hurt your credit score.

However, once you choose a lender and formally apply for a refinance, your lender will conduct a hard pull, which can ding your credit. But it’s temporary because once you make your student loan refinance payments on time, your score can improve.

Is refinancing with bad credit worth it?

Refinancing with bad credit can be worth it, but only in the right circumstances. Refinancing generally works best when it helps you lower your interest rate, reduce your monthly payment, or both. Those benefits can be harder to secure with bad credit, but not impossible.

For example, if you have a cosigner with good credit, refinancing could reduce your rate from 11% to 7%. On a $30,000 loan with a 10-year term, that interest rate drop could save you around $7,400 in total interest and reduce your monthly payment by about $60. Those savings can make a big difference, even if your credit isn’t great.

On the other hand, refinancing with bad credit and no cosigner might lead to a higher interest rate or a longer loan term that stretches out repayment and increases total interest. In those cases, refinancing might only be worth it if you need a lower monthly payment to avoid default or get out of financial distress.

When it might be worth it:

- You have a creditworthy cosigner

- You’re refinancing high-interest private loans

- You qualify for a better rate than what you currently have

- You’re struggling to make payments and need a lower monthly amount

When it might not be worth it:

- You have federal loans and would lose access to income-driven repayment or forgiveness programs

- Your new loan would have a higher rate or unfavorable terms

- You’re close to paying off your current loan

In short: Refinancing with bad credit can be worth it, but make sure it solves a real problem—whether that’s saving on interest or gaining some breathing room in your budget. Always compare offers first and run the numbers before you commit.

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Catherine Valega, CFP®, CAIA®

Reviewed by Catherine Valega, CFP®, CAIA®Catherine Valega, CFP®, CAIA®, founded Green Bee Advisory LLC to help women, philanthropists, investors, and small businesses build, manage, and preserve their financial resources. She's been practicing financial planning for more than 20 years.