Defaulting on a private student loan occurs when you miss multiple payments. Though the exact time frame varies, it’s typically 90 days—or three months of missed payments—for most lenders.

While default can result in challenges like damaged credit and collection efforts, it’s important to remember that there are options to recover and get back on track. In this guide, we’ll walk you through what to expect and explore ways to resolve default, helping you regain control of your financial situation.

Advertisement

Finally Take Control of Your Student Loans

- Get your cosigner released by making on-time payments

- Fixed rates only — no surprises

- No credit score required for approval

- Rates not impacted by your credit score

- Skip up to 12 payments, penalty free

Table of Contents

What happens when you default on a private student loan?

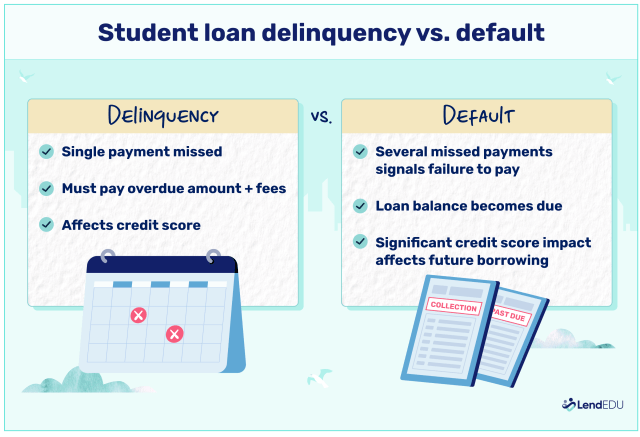

Defaulting on your private student loan, which is more serious than being delinquent, can lead to a range of consequences, from damaged credit to escalating fees and even lawsuits.

Here’s what you can expect if you default:

1. Damage to credit

Most private student loan lenders regularly report borrowers’ payment activity to major credit bureaus. When you stop making payments on your loan, it won’t take long before you see a drop in your credit score.

Payment history is one of the primary determinants of credit score. Once you start missing payments, your credit score will decline as each missed payment is recorded. The more payments you miss, the bigger the impact, with a significant drop occurring when the loan defaults.

In addition to this initial impact, your credit will also be affected long-term. The loan default will remain on your record for up to seven years after it’s first reported. This could make it difficult for you to take out a mortgage or secure new lines of credit in the future.

Even if you are approved for new loans, you’ll likely face higher interest rates and less favorable loan terms due to your low credit score. You may also have issues renting an apartment or getting a new job, as some landlords and employers check your credit report as part of their screening process.

2. Collection agencies and legal action

Once you’ve missed several payments, your lender will likely hire a third-party collection agency. This typically happens after 90 to 180 days of non-payment. The lender may tack on additional fees to cover the cost of collection, depending on your loan agreement and state laws.

The collection agency will then attempt to reach you to collect the debt. Their tactics can sometimes be aggressive, including frequent phone calls, letters, and emails. Thankfully, there are rules put in place to protect you from harassment. Here’s what a collection agency cannot do:

- Call before 8 a.m. or after 9 p.m.

- Use profane language or threaten violence

- Publicly report that you haven’t paid a debt

- Make false statements, such as saying you’ll be arrested

- Contact third parties (family, friends, employer) about your debt

To limit communication from the collection agency, send a letter asking the company to stop contacting you. After receiving this request, the collection agency can only contact you in two cases: to confirm it will cease contact and to notify you of specific actions, like a lawsuit.

If the collection agency is unable to collect your debt, the next step is a lawsuit. This won’t happen immediately—it could take anywhere from six months to several years. A lawsuit will likely add additional legal fees to your balance, as per your loan agreement.

3. Fees and interest accumulation

Collection and legal fees aren’t the only additional expenses you’ll face after defaulting on your private student loan. The interest on your loan also continues to accrue on your outstanding balance, increasing the total amount you owe.

On top of interest, your lender may also add late fees for every payment missed. Plus, there could be additional default penalties or administrative fees charged by the lender, if the loan agreement allows. All these fees add up quickly, increasing your debt burden and making it even harder to manage.

Take time to fully understand your full financial picture. This means taking account of all of your assets like bank accounts, investment accounts, and things like your home and vehicles. Next, look at who and how much you owe. Take note of the minimum payments due, the interest rates, and the total remaining balance due. Once you have this information, now you can begin to make a plan.

If you find your payments are too much based on the amount of income coming in, then that will give you the information you need to take a different approach. This may mean finding additional sources of income or as a last resort, going into bankruptcy.

Crystal Rau, CFP®

4. Cosigner impact

When someone agrees to cosign a loan for you, they take on equal responsibility for repayment. That means if you default on the loan, your cosigner will face the same consequences you do, including damaged credit, collection efforts, and a potential lawsuit.

These consequences won’t just damage the cosigner financially; they can also create a strain on your relationship. If you’re in danger of defaulting on your private student loans, talk to your cosigner to inform them of the situation. By discussing the issue, you may find solutions that protect you both.

Unfortunately, a cosigner release may not be one of the options available. A cosigner release is typically only granted when the primary borrower makes payments on time and can demonstrate financial stability; if you’re struggling to make payments or have missed a few already, you won’t qualify.

5. Private student loan default rates

The most recent data available from the fourth quarter of 2021 showed less than 2% of private student loans entering default. In the past, the default rate for federal student loans was much higher than for private student loans. This was likely due to several factors:

- Students take out more federal student loans than private student loans: more than 92% of all student loans are held by the federal government.

- Private lenders have stricter underwriting standards to ensure borrowers are creditworthy.

- Many private lenders require a cosigner, which improves the odds of repayment.

However, in April of 2022, the federal government rolled out Fresh Start, a new program designed to help borrowers who had defaulted on federal student loans get back on track; this initiative helped drive down default rates on federal student loans.

Recovery options after default

Defaulting on your private student loan can feel overwhelming, but it is possible to recover. Here are four potential solutions to resolve the default and regain control of your finances.

1. Negotiate with your lender

If you’ve defaulted on your private student loan, it’s not too late to work out an agreement with your lender. In fact, they will likely be open to negotiating because they want to collect on the debt without the additional expense of hiring a collections agency or lawyer.

When you negotiate with your lender, there are several things that could occur:

- Loan modification: Your lender might be willing to make changes to your original loan terms, giving you a lower interest rate or more time to repay; this will reduce your monthly payment to make the debt more manageable.

- Forbearance or deferment: Some lenders allow borrowers to put their payments on pause for a while if they’re experiencing financial hardship. Just be aware that interest may continue to accrue even though your payments have stopped.

- Payment plan: Your lender might offer you the option to set up a new payment plan to make payments more affordable without modifying your original loan agreement.

Keep in mind that these options can vary depending on which lender holds your private student loans. Talk directly with your lender to find out which solutions are available to you.

Call each creditor you owe individually and explain your situation. For example, my income is $1,000, and after I pay my housing, food, and transportation, I only have $300 left to pay debt. Will you be willing to work with me to lower my payment or lower my interest rate, or give me more time? When you can explain your situation and an action plan, creditors will be much more willing to work with you. It’s easier for them to work out a plan with you rather than pursue legal action.

Crystal Rau, CFP®

2. Debt settlement

Debt settlement is when you negotiate a deal with the lender to pay off a percentage of what you owe with the remaining balance forgiven. There are several benefits to this approach, for both you and the lender, with the first one being avoiding a lawsuit and legal fees.

It’s also a beneficial route because you end up paying less than the amount owed while the lender recovers at least some of the debt. Typically, lenders will agree to let you pay somewhere between 40% to 70% of the amount you owe.

But remember this option isn’t automatically available just because you default on your loans; you will need to prove your inability to pay to qualify for a settlement. To do this, you’ll likely need to supply information on your income, bank balances, monthly expenses, and other debts.

There are several ways lenders will allow you to settle the debt:

- Make a lump sum payment for the negotiated amount

- Make a large payment up front with the remainder spread over 12 to 18 months

- Set up a payment plan that allows you to pay the negotiated amount over time

Most lenders prefer a lump sum or large deposit to ensure they get paid, so be prepared to offer as much as possible up front. However, lenders may be willing to negotiate a reasonable payment plan if they believe it’s their best option for recovery.

3. Refinance the loan

Refinancing is when you take out a new loan to pay off the loan (or loans) you already have. Refinancing could give you an opportunity to secure lower interest rates and a longer repayment term, which would reduce your monthly payments and put you on firmer ground financially.

To refinance your defaulted student loans, you need to research lenders and compare offers (preferably without a hard credit check) to see what terms they offer. But keep in mind you will need to meet the lender’s eligibility requirements to qualify for a new loan.

Getting approved for a new loan can be tricky since you have already defaulted on your current loan. With multiple missed payments on your record, your credit score will be lower, decreasing the chances of loan approval.

If you are approved, the interest rate and loan terms may not be favorable due to your credit history. Lenders reserve the best rates for borrowers with a strong credit profile so you could end up with larger payments compared to the old loan.

Yrefy is one lender that specializes in refinancing delinquent and defaulted student loans. It offers 100% fixed-rate refinancing with competitive rates, and helps borrowers rebuild credit and avoid collections without needing a cosigner. It’s a good first stop if you’re interested in refinancing your defaulted loan.

Advertisement

Finally Take Control of Your Student Loans

- Get your cosigner released by making on-time payments

- Fixed rates only — no surprises

- No credit score required for approval

- Rates not impacted by your credit score

- Skip up to 12 payments, penalty free

4. Consult a student loan lawyer

If you cannot negotiate with the lender, settle the debt, or refinance your defaulted loan on your own, the best option might be to consult with a lawyer. There are attorneys who specialize in student loans; they can provide insight into the legal options available and help you find a solution.

You can find a student loan lawyer by searching local legal directories or contacting your state’s bar association. Of course, hiring an attorney could get expensive. If you can’t afford to pay for a lawyer, look for low-cost legal help through legal aid organizations, nonprofits, or local law schools.

Before jumping into any of the options, the best thing to do is try negotiating with a lender first and foremost. If it cannot adjust to benefit you, explore different options.

This goes back to fully understanding your situation—what is your income? What are your expenses? How much do you owe? Understanding what is going on can help you make the best decision. Refinancing will be best for somebody who can afford to continue to make payments, but may just need a lower payment. Debt settlement may be best for someone who has too many payments and not enough income coming in.

Crystal Rau, CFP®

Tips to prevent future private student loan default

Here are a few tips to follow to ensure you don’t miss any future student loan payments.

1. Set up automatic payments

When you set up automatic payments, the amount owed is automatically withdrawn from your account on the due date, preventing missed payments since you don’t have to remember to pay your student loan manually. Plus, many lenders offer discounts for enrolling in autopay, which lowers your interest rate and saves you money.

2. Budgeting and income adjustments

Creating a budget will also help you avoid defaulting on your student loans. Start by tracking your expenses to see where you can reduce spending. Also consider ways to increase your income, whether it’s through switching jobs, asking for a raise, starting a side gig, or taking on a part-time job.

Having an emergency fund can also help you keep up with student loan payments. An emergency fund worth three to six months of expenses offers protection when the unexpected occurs, like job loss or a medical emergency. Instead of defaulting on your loan, you can use the fund to make payments.

3 Communicate early with your lender

Communicating with your lender at the first sign of trouble will also help you avoid default. Most lenders are willing to work with you–they do want to receive their money back, after all.

As soon as you start struggling financially, contact your lender to discuss the options available to you. Hopefully, they’ll offer some kind of assistance, like a forbearance, deferment, or payment plan, to help you avoid default.

Legal and financial considerations of student loan default

When dealing with defaulted student loans, there are two additional factors you need to consider: the statute of limitations and bankruptcy.

Statute of limitations

A statute of limitations is a law that determines how long a creditor has to collect a debt. The statute of limitations on private student loans varies depending upon the lender and state laws, but it typically falls between three to 10 years.

It’s important to know what statute of limitations governs your private student loan because the lender can only attempt to collect the debt within this time frame. After the statute of limitations expires, they can no longer legally sue you for the remainder of your loan.

You should also be aware that certain activities, like making a payment, acknowledging the debt, or negotiating a new payment plan could reset the clock on the statute of limitations; read your loan agreement carefully to better understand what rules apply.

Bankruptcy

Discharging private student loans in bankruptcy is a possibility, but it’s not easy to do. While medical bills, credit card balances, and other debts are automatically cleared in a bankruptcy, that’s not the case with student loans; you must prove undue financial hardship to have them removed.

Bankruptcy also has long term consequences; it can cause your credit score to drop anywhere from 130 to 200 points. And your score won’t rebound quickly–bankruptcies stay on your credit report for at least seven years, making it harder to obtain loans, credit cards, or even housing during that time.

For that reason, bankruptcy should be considered a last resort. When you consider the difficulty and financial consequences of discharging your loans in bankruptcy, it’s better to pursue other options.

Recovering from bankruptcy is a long, seven-year journey. It can affect every aspect of your life from the car you drive to the house you live in, and even who your employer is. Having good credit can be a good leveraging tool to help propel you forward in life. Meanwhile, a bankruptcy mark on your credit report will hold you back.

Crystal Rau, CFP®

FAQ

How long does private student loan default stay on my credit report?

Private student loan defaults remain on your credit report for seven years from the date of the first missed payment. This derogatory mark can make it difficult to secure other types of financing, such as credit cards, mortgages, or auto loans. You and your cosigner, if applicable, will experience a drop in credit score. It may take significant time and effort to repair this damage.

Can I go to jail for defaulting on my private student loans?

No, you can’t be sent to jail for defaulting on your private student loans. Defaulting on a student loan is a civil matter, not a criminal one. However, ignoring legal actions related to your default, such as failing to comply with a court order or not appearing in court, could lead to additional legal consequences, including contempt charges

Can I avoid default if I can’t afford my payments?

If you’re unable to make your private student loan payments, you can avoid default by contacting your lender as soon as possible.

Many lenders offer options such as forbearance, deferment, or modified repayment plans to help you pause or reduce your payments. These programs are generally based on financial hardship and can give you time to recover without defaulting.

About our contributors

-

Written by Christi Gorbett

Written by Christi GorbettChristi Gorbett is a finance writer with a master’s degree in English and years of experience. She specializes in creating financial content that simplifies complex topics, making them easier for a wide audience to understand.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.