Our take: Our editorial ratings place Personify below many other personal loan lenders, including Upstart, our top choice for limited to no credit.

However, if your choices are limited to a payday loan and Personify, we think Personify is a clear winner.

Personal Loans

- Accessible with poor credit

- Approves many borrowers who get denied elsewhere

- Offers a prequalification check with a soft credit pull

- Reports payments to the credit bureaus, which can help increase your credit score

- No prepayment penalties

- Fast funding

- Fast approvals

- Not available in every state

- Super high interest rates

- Charges origination fees

- High fees and interest rates make these loans difficult to pay back quickly

| Fixed rates (APR) | 35.00% – 179.99% |

| Loan amounts | $500 – $15,000 |

| Term lengths | 9 – 48 months |

| Min. credit score | None disclosed |

If you’ve been denied a personal loan by several lenders, there is still hope. Personify Financial helps borrowers who have a thin credit history or poor credit. Our editorial ratings place Personify below many other personal loan lenders, including Upstart, our top choice for limited to no credit.

However, if your choices are limited to a payday loan and Personify, we think Personify is a clear winner.

The main drawback of Personify is its sky-high interest rates. But due to its easy application process, it has thousands of positive reviews on Trustpilot. So if you’re in a tight spot and understand the drawbacks, it is one lender that considers multiple factors when approving borrowers, not just your credit score.

About Personify

Personify exists because so many lenders have lost the human touch. Personify is best known for its high-quality customer service. Potential borrowers can call and speak to a loan expert to discuss their needs. Personify explains that its goal is to treat borrowers with respect, regardless of credit score.

Personify is not available in all states, and personal loans are capped at $15,000.

How do Personify personal loans work?

Personify offers a less stressful application process and quick approval. Here’s more information about what makes Personify unique:

Online installment loan

Unlike payday loans, Personify offers installment loans, which means you’ll have a set monthly payment that Personify reports to the credit bureaus. This makes it easier to budget and predict cash flow.

Loan sourcing partners

Personify partners with banks to provide loans. That means, depending on where you live, loan terms may differ.

Personal finance education

Personify offers free access to your FICO score, articles about debt, and other resources to help their customers beyond a personal loan transaction.

Advanced technology loan decisions

Personify believes borrowers are more than their credit score. Personify uses a “decision engine” that helps determine whether to approve a customer based on other factors, like education and work history.

Easy online application process

Borrowers can complete a prequalification and application online. Prequalification results in a soft credit pull, and the full application is a hard pull. Many customers report being approved in minutes and that the application process is straightforward and stress-free.

Pros and cons

Here are the benefits and drawbacks of these personal loans.

Pros

-

Accessible even with poor credit

-

Approves many borrowers who get denied elsewhere

-

Offers a prequalification check with a soft credit pull

-

Reports payments to the credit bureaus, which can help increase your credit score

-

No prepayment penalties

-

Fast funding

-

Fast approvals

Cons

-

-

Sky-high interest rates

-

Origination fees

-

High fees and interest rates make quick repayment challenging

| Source | Customer ratings | Number of reviews |

| Trustpilot | 4.8/5 | 13K |

| Better Business Bureau (BBB) | 4.81/5 | 585 |

| 4.7/5 | 2,887 |

Personify earns excellent customer reviews. Many of them mention how fast and easy the application process is. Some also discuss being repeat customers, and many expressed appreciation for being approved after other lenders turned them down.

Personify is BBB-accredited, and the agency gives it an A+ rating.

In a Reddit thread, a user asked whether Personify was a legitimate company:

One commenter said it was legitimate; however, their Personify loan had a 150% APR. Another Redditor said Personify is for emergencies only due to the high fees and interest rates.

Contact Personify

Contact Personify by filling out a General Inquiry form on its Contact Us page.

You can also call 1-888-578-9546. The hours are Monday through Friday from 8 a.m. to 9 p.m. Central time and Saturday from 8 a.m. to 5 p.m. Central.

Alternatives

If you’re not sure whether Personify Financial is a good fit for you, we maintain a list of the best personal loan companies. Here’s how Personify stacks up against three better-rated options.

Personify vs. Upstart

Upstart uses AI technology that considers more just than your FICO score when making a credit decision, such as your education and employment history. This is particularly helpful for people who are rebuilding their finances or those with a limited credit history.

Upstart’s interest rates are lower than Personify’s, but Personify Financial offers a human-centered customer service approach.

Personify vs. Upgrade

Upgrade offers more competitive interest rates than Personify Financial and would be a better fit for borrowers seeking a larger personal loan or those with fair credit. Upgrade’s origination fee can be as high as 9.99%, but the APRs are much lower than those of Personify.

Personify vs. Prosper

Prosper is a peer-to-peer lending platform where borrowers with a minimum credit score of 560 can apply for loans from individual investors. Prosper charges origination fees of up to 7.99%, but its interest rates are more competitive than those offered by Personify.

If you don’t have a credit score of at least 560, Personify would be the better choice out of these two lending platforms.

Check out our full list of reviewed personal loan companies for more options.

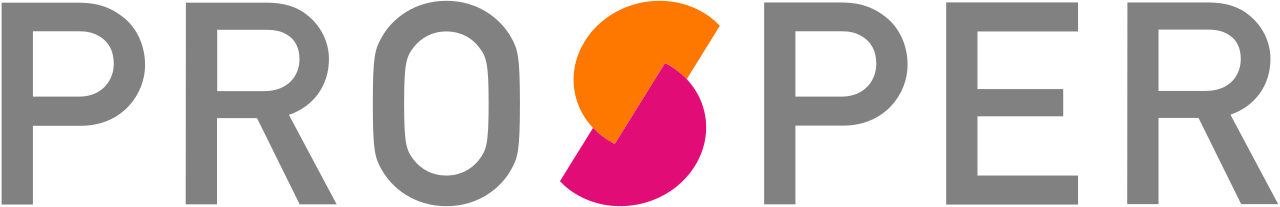

How to apply

Personify allows you to submit a prequalification application online. If you gather your documents ahead of time, you can complete the application in just a few minutes.

To prequalify, follow these steps:

- Go to the Personify Financial homepage

- Hit the “See My Loans Offers” button or the orange “Apply” button in the top right corner

- Enter your zip code

- Add your personal information, including your name

- Let Personify know if you have a prequalification code or invitation code

- Verify your email address

- Complete the application

- Submit

Prequalifying for a personal loan will only trigger a soft pull on your credit. If you prequalify and decide to accept a loan, Personify will do a hard pull on your credit and verify your information prior to making an approval decision.

How we rated Personify Financial

We designed LendEDU’s editorial rating system to help readers find companies that offer the best personal loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Personify to several personal loan lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating, recapped below.

| Company | Rating (0-5) | |

|---|---|---|

|

|

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Personify, Contact Us page

- Trustpilot, Personify Reviews

- Reddit, Loan Sharks subreddit

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.