ExtraCash™ Cash Advance

- No interest or late fees

- No credit check required

- Maximum limit of $500

- Reports repayment to the 3 major credit bureaus

- No requests for tips

- An ExtraCash™ account and a $1 monthly subscription fee are required

- Not compatible with PayPal

- FTC complaint for misleading marketing practices

| Funding | Up to $500 |

| Speed of advance | 2 – 3 days; Instant (with fee) |

| Subscription fees | $1/month |

| Instant funding fees | $1.99 – $13.9 |

Dave is a digital banking app that offers cash advances of up to $500 through its headline feature, ExtraCash™—without interest, credit checks, or late fees.

It’s designed to help users cover expenses between paychecks and avoid overdraft charges.

While standard delivery is free, instant funding comes with a fee, and a $1 monthly subscription is required.

How Dave works

| Term | Details |

| Advance amounts | Up to $500 |

| Interest rate | None |

| Fees | $1 monthly sub fee; $3 – $25 optional fast funding fee |

| Repayment time | Varies (often your next payday) |

| Funding time w/ fee | Instant (Dave account) or within 1 hour (external bank account) |

| Funding time w/o fee | Within 3 business days |

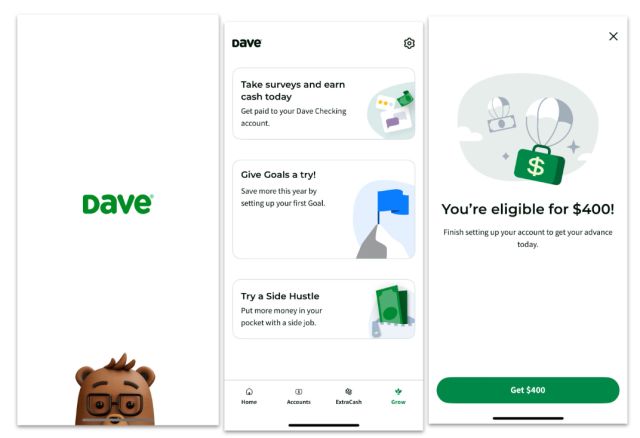

Dave advertises four products on its homepage:

Dave Cash Advance: ExtraCash™

Dave’s ExtraCash™ account lets you borrow up to $500 with no interest or credit check. It’s designed to help cover unexpected expenses between paychecks. While standard delivery is free, you’ll pay a fee if you opt for express funding.

Like many cash advance services, Dave aims to make borrowing money simple. You can get a cash advance without extra fees but must pay a $1 subscription fee. And if you want an instant cash advance, the fees can be higher than what competitors charge.

How to increase your Dave advance

Dave doesn’t just hand out the full $500 to everyone. Your ExtraCash™ limit is personalized, and most users start with a lower amount—typically around $160. But if you want to boost your advance, here’s how to improve your odds:

- Set up recurring deposits. Dave recommends having at least three regular paychecks deposited into your linked bank account. This helps the app predict your income more reliably.

- Maintain consistent income. The higher and more consistent your monthly income, the better. Dave looks for at least $1,000 in total monthly deposits before increasing your advance.

- Build good habits. Your spending patterns matter, too. Staying in the black, avoiding overdrafts, and using the app responsibly can help improve your eligibility over time.

There’s no guaranteed way to unlock the full $500 right away, but meeting these criteria signals to Dave that you’re a reliable borrower. The longer you use the app and demonstrate steady financial behavior, the more likely you are to qualify for higher advances.

Dave Checking Account

Dave’s spending account is a fee-free checking account with no minimum balance. You can get paid up to two days early with direct deposit and manage your money through the Dave app. It’s FDIC-insured and includes access to ExtraCash™.

Dave Side Hustle

The Side Hustle feature connects users to gig opportunities directly through the Dave app. Whether you’re looking for flexible work or a way to boost your income, Dave helps match you with local and remote job listings.

Dave Goals Account

The Goals account is a simple savings tool that lets you set aside money for short- or long-term goals. You can create multiple goals, track your progress, and automate savings to build better financial habits.

Who’s eligible for a Dave cash advance?

To use the Dave mobile app and website, you must meet the following requirements:

- Be a legal resident of the United States

- Be of legal age

- Not prohibited by law from using the mobile app, website, or other services

You must be at least 18 years old to use Dave. This is the minimum legal age required to enter into a financial agreement and use the app’s services.

Dave uses additional factors to determine the cash advance you qualify for through ExtraCash, including:

- Whether you have at least three recurring deposits

- Your income history and spending patterns

- Whether you have total monthly deposits of $1,000 or more to qualify for higher advances

- Whether you have at least a 60-day history and a positive balance on the bank account you link

Most of these requirements are comparable to similar services that extend cash advances without requiring a credit check. Because no credit check is required, these companies use alternative factors to determine eligibility.

What are the costs of a Dave cash advance?

Dave’s ExtraCash™ advances don’t charge interest or late fees. However, there are a couple of required fees, and you can end up paying several optional costs depending on how you use the service:

- Membership Fee

- $1/month — Required to access Dave’s ExtraCash feature.

- Service Fee

- 5% of the advance amount, charged at checkout.

- Minimum: $5

- Maximum: $15

- This applies to all ExtraCash advances, regardless of delivery speed or destination.

- Express Fee

- Standard delivery (1–3 business days): No additional fee

- Express delivery to an external bank account: 1.5% additional fee

- Express delivery to a Dave Spending Account: No additional express fee

- No Optional Tips

- As of mid-2024, Dave discontinued optional tipping following an FTC settlement. The new structure bundles all costs into the fixed fees mentioned above.

While these fees may seem small individually, they can add up—especially with frequent use.

Example 1: Small advance with express delivery

- Advance amount: $75

- Service fee: $5

- Express fee: $1.13

- Membership fee: $1

- Total cost: $7.13

Example 2: Larger advance with no tip and standard delivery

- Advance amount: $200

- Service fee: $10

- Express fee: $0

- Membership fee: $1

- Total cost: $11

These examples show how your costs can vary based on how fast you need the money and whether you choose to tip. While Dave markets itself as a low-cost alternative to overdraft fees, the real cost depends on how you use it.

How do you repay Dave’s cash advance?

Repayment for a Dave ExtraCash™ advance is typically automatic. When you take an advance, you agree to let Dave withdraw the repayment amount from your linked bank account on your next payday or another date you select.

If your account doesn’t have enough funds on the due date, Dave may try again later, but you won’t face late fees or penalties. That said, failed repayments can still cause issues—like overdrafts from your bank or disruptions to your Dave access—so it’s best to plan ahead and make sure the funds are available.

Pros and cons of a Dave cash advance

Consider these benefits and drawbacks before you proceed with Dave.

Pros

-

No interest or late fees

-

Fast funding available (in minutes with express delivery)

-

No credit check required

-

Low minimum eligibility requirements

Cons

-

Express delivery costs extra

-

2024 FTC complaint alleging misleading marketing

-

Optional tips can inflate the cost

-

Only available to Dave members ($1/month fee)

Alternatives to Dave

Here’s how Dave stacks up against four competitors:

| App | Amounts | Fee for fast funds | Our rating |

| EarnIn | Up to $300/day; $1,000/pay period | $3.99 – $5.99 | 5.0 |

| Brigit | $25 – $500 | $9.99/month | 4.6 |

| Tilt | $10 – $250 | $1 – $7 | 4.6 |

| MoneyLion | Up to $100 to external acct.* | $1.99 – $8.99 | 4.5 |

| Dave | Up to $500 | $3 – $25 | 4.3 |

Most competitors have lower maximums for a single advance than Dave. However, Dave charges the highest potential fast funding fees, depending on the account you want to fund and the size of the advance.

👉 Takeaway: With no-fee options and the potential to borrow a large amount each pay period, we think EarnIn cash advance app is the best bang for your buck. Dave may be the better option if you prefer up to $500 in one single advance and you’re able to qualify for this amount.

See more apps like Dave here!

Is Dave legit?

Dave is a legitimate cash advance company. Despite the FTC complaint, it’s making an effort to address the allegations.

Dave app reviews and complaints

Here’s how Dave’s customers rate the app:

| Source | Customer rating | Number of reviews |

| App Store | 4.8/5 | 718K |

| Google Play Store | 4.4/5 | 545K |

| Better Business Bureau | 1.13/5 | 394 |

In the Apple and Google app stores, users rate Dave very highly and frequently comment on its ease of use, early access to paychecks, and its helpfulness during emergencies.

The company has been BBB-accredited since 2019 and has an “A–” rating at the time of writing, but the reviews are less favorable. Many customers report unauthorized charges, difficulty with repayment, and slow response times from customer support. This is an extremely small sample size (394) compared to the App Store ratings (over 1 million across Google Play and App Store).

In 2024, the FTC filed a complaint against the company for misleading marketing practices. The main issues were how they marketed “instant” transfers (which most cash advance apps do similarly) and some emotionally manipulative illustrations to compel people to add optional tips upon transferring cash. Dave responded quickly and reworked its entire business model around this feedback, so we believe it has demonstrated legitimate and moral business practices.

How to get a Dave cash advance

Getting a cash advance through Dave only requires a few steps. If you already have an outside bank account and meet the eligibility requirements, you could sign up for the service in just a few minutes.

- Download the Dave: Fast Cash & Banking app from the App Store or Google Play.

- Link your bank account. It must be active for at least 60 days and receive recurring deposits.

- Submit your application and get approved.

- Choose standard or instant delivery to receive your funds.

Dave starts most users with a small cash advance limit, but you can increase it over time. To qualify for larger advances—up to $500—make sure your linked account receives at least three recurring direct deposits, has total monthly deposits of at least $1,000, and shows consistent income and healthy spending habits.

Dave FAQ

How long does a Dave cash advance take for delivery?

Once approved, you’ll typically get your ExtraCash™ in one to three business days with standard delivery. If you need it sooner, you can pay a small fee to get your advance instantly in your Dave Spending account.

How long do I have to pay back Dave after advance?

After you get the funds, Dave will automatically withdraw repayment from your linked bank account on your next payday—or sooner, if funds become available.

You can pay them sooner if you prefer.

If I don’t have the money in my account, will I pay Dave overdraft fees?

Dave doesn’t charge overdraft fees—but your bank might if a repayment causes your balance to go negative. To avoid this, keep an eye on your account balance and consider setting up low balance alerts. You can also contact Dave’s support if you’re having trouble repaying on time.

Can I take out multiple advances at once?

Nope, you can only take out one advance at a time. You’ll need to repay the first in full before becoming eligible for another.

Why did Dave lower my advance?

Dave reviews your account activity regularly to decide how much you can borrow. If your advance amount dropped, it could be due to:

- Lower or inconsistent direct deposits

- Changes in your spending patterns

- A negative bank balance

- Missed or delayed repayments

To rebuild your limit, try to maintain steady income and avoid overdrafts in your linked account.

Does Dave affect your credit?

No, Dave advances aren’t reported to credit bureaus. Using ExtraCash™ won’t help or hurt your credit score. But consistently paying back your advance on time can help you build good financial habits.

Does Dave work with Cash App?

You can link Dave to the same bank account you use with Cash App, but Dave doesn’t send funds directly to your Cash App balance. To move funds between the two, you’ll need to transfer money from your linked bank account.

How do I get $500 instantly with Dave?

To get up to $500 instantly with Dave, you’ll need to qualify for an ExtraCash™ advance and choose express delivery. Express delivery typically sends the money to your linked bank account within minutes, but you’ll pay a small fee for the faster transfer. Without express delivery, funds usually arrive in one to three business days.

Why am I not eligible for a cash advance on Dave?

You may be ineligible for a cash advance if you haven’t linked a valid checking account, if your income history is inconsistent, or if you recently had insufficient funds. Dave uses your transaction history, deposit frequency, and account activity to determine eligibility. Being a new user may also limit your access at first.

How we rated Dave

Since 2023, LendEDU has evaluated personal finance apps to help readers find the best cash advance solutions. Our latest analysis reviewed 180 data points from 9 apps and financial institutions, with 20 data points collected from each. This information is gathered from company websites, online applications, public disclosures, customer reviews, and direct communication with company representatives.

These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

About our contributors

-

Written by Bob Haegele

Written by Bob HaegeleBob Haegele has been a freelance personal finance writer since 2018. In January 2020, he turned this side hustle into a full-time job. He is passionate about helping people master topics such as investing, credit cards, and student loans.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.