Our take: Filo can be a solid choice for borrowers who want a quick, simple home loan with no lender fees. However, it isn’t available in every state. We always recommend starting with our picks for the best mortgage companies.

Purchase Mortgage

- Fast closing times

- Competitive interest rates

- No lender fees

- Not available in all states

- Limited communication options

| Rates (APR) | Starting at 4.755% |

| Loan amounts | Up to $2 million (for jumbo mortgages) |

| Repayment terms | 15 – 30 years |

Mortgage Refinance

- Interest-reducing potential

- Streamlined online application

- Terms not perfectly clear

| Rates (APR) | Starting at 6.346% |

| Repayment terms | 15, 20, or 30 years |

Filo Mortgage offers affordable home loans and refinancing with no lender fees. It focuses on low rates, a fast, transparent process, and borrower satisfaction. Let’s look into how Filo compares to our top-rated mortgage lenders.

Mortgage highlights

Does Filo Mortgage stand up to its promise of “eliminating unnecessary costs” and “delivering value and satisfaction”?

Low rate guarantee

Filo commits to beating any lower-priced comparable mortgage offer by $500. If another lender gives you a more competitive deal, you can send Filo the offer. Filo will then match it and credit you $500. This applies to new home loans and to refinances.

Fast loan processing

According to Filo’s website, all the steps of closing on a loan take less than two weeks on average. Completing the application should take no more than a few minutes, and Filo approves loans as fast as within a day.

No lender fees

Filo Mortgage states that it charges “No Lender Fees. Ever.” That’s a competitive advantage: Many mortgage providers do charge origination, application, and other loan processing fees, typically equal to 1% or 2% of the loan amount.

Mortgage types

Conventional loans

What to know

| Rates (APR) | Starting at 4.755% |

| Term lengths | 15, 20, or 30 years |

| Loan amounts | Up to $806,500 for conforming loans |

Filo finances 15-year, 20-year, and 30-year fixed mortgages. Of these, the 15-year fixed plan has the lowest rate.

The lender also offers a five-year adjustable-rate loan plan, meaning the interest rate stays fixed during the first five years and then shifts annually depending on the market rate.

FHA loans

What to know

| Rates (APR) | Starting at 5.406% |

| Term lengths | 30 years (fixed) |

| Loan amounts | Up to $524,225 |

Federal Housing Administration (FHA) loans have set limits, currently $524,225 in most of the U.S. and $1,209,750 in some high-cost areas. These loans can be a good option for first-time homeowners because they only require a down payment of 3.5%.

VA loans

What to know

| Rates (APR) | Starting at 5.022% (Current VA Mortgage Rates) |

| Term lengths | 30 years (fixed) |

With full Veterans Affairs department entitlement, the VA will guarantee any loan amount you qualify for based on credit score and income.

With limited entitlement (for example, if you have an active VA loan), the available loan amount will depend on conforming county loan limits, and any amounts above those limits may require a down payment.

Jumbo mortgages

What to know

| Rates (APR) | Not disclosed |

| Term lengths | 15, 20, 30 years |

| Loan amounts | Up to $2 million |

In 2025, a jumbo mortgage is any home loan that exceeds the FHFA’s conforming loan limit ($806,500 in most of the U.S., up to $1,209,750 in some locations). Filo Mortgage states it offers “highly competitive rates” on Jumbo loans, but doesn’t disclose the exact rates on the website.

Mortgage refinancing

Mortgage refinance

What to know

| Rates (APR) | Starting at 6.346% (30-year fixed) |

| Term lengths | 15, 20, or 30 years |

According to Filo, the mortgage refinance process takes two to three weeks, depending on whether your home needs an appraisal.

Filo Mortgage states that it offers “low rates without charging points or lender fees.” At a quick glance, rates are on par with our top-rated mortgage refinance companies.

Cash-out refinance

What to know

| Rates (APR) | Not disclosed |

| Term lengths | 15 or 30 years |

| Loan amounts | $50,000 – $500,000 |

Borrowers who opt for a cash-out refinance with Filo Mortgage may expect rates to be 0.125% to 0.25% higher than with a standard refinance.

The lender also mentions that a cash-out refinance can be an option even for homeowners with lower credit, provided they hold enough equity.

FHA and VA cash-out refinance

What to know

| Rates (APR) | Not disclosed |

| Loan amounts | Not disclosed |

If you initially took out an FHA or VA loan, you may also qualify for an FHA or VA cash-out refinance via Filo Mortgage.

To get an FHA cash-out refinance, you’ll need at least 20% home equity and a minimum credit score of 580. If you’re applying for a VA cash-out refinance, you must live in the home you’re refinancing.

Other loan products

Home equity loan

Filo Mortgage offers home equity loans with up to 90% loan-to-value (LTV), meaning you can borrow against your home’s equity up to 90% of its value. This includes second homes.

- Amounts: $50,000 – $500,000

- Terms: 5 – 30 years

HELOC

Filo’s home equity lines of credit (HELOCs) can combine with a first mortgage. Borrowers may use a HELOC for various purposes, like an 80-10-10 piggyback loan to avoid private mortgage insurance.

Eligibility

Getting approved for a home loan with Filo Mortgages depends on:

- Credit scores: generally 620 for conventional loans and 680 for jumbo loans

- Proof of income and employment

- Specific requirements for some plans, like debt-to-income ratio (DTI) and a down payment

Finally, Filo Mortgage doesn’t operate in all states.

States Filo Mortgage is available in

- Alabama

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maryland

- Michigan

- Minnesota

- Missouri

- New Jersey

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Virginia

- Tennessee

- Texas

- Utah

- Washington

- Wisconsin

Customer reviews

As a fairly new lender (established in 2019), Filo Mortgage has comparatively few ratings and reviews. Still, the available feedback seems overwhelmingly positive: Reviews on Zillow praise the smooth loan approval process and low rates.

| Platform | Rating | Number of reviews |

|---|---|---|

| Better Business Bureau (BBB) | 4.46/5 | 37 |

| Zillow | 4.94/5 | 437 |

Filo is BBB-accredited and earns an A+ rating with the platform.

Our experience

While researching info for this review, we reached out to Filo via email and contact form with the following questions:

- What are the loan amounts you typically issue for mortgage refinancing?

- What is the maximum amount for VA loans?

- What’s the APR for jumbo mortgages? Is it the same as for conforming loans?

- What are the APRs, terms, and loan amounts for FHA and VA cash-out refinance?

- What’s the absolute minimum credit score you’d accept for conventional loans? Jumbo loans?

At the time of writing (six days later), we have yet to hear back from Filo Mortgage. This communication gap, and lack of a live chat option, are serious drawbacks for prospective borrowers who need quick answers.

Application process

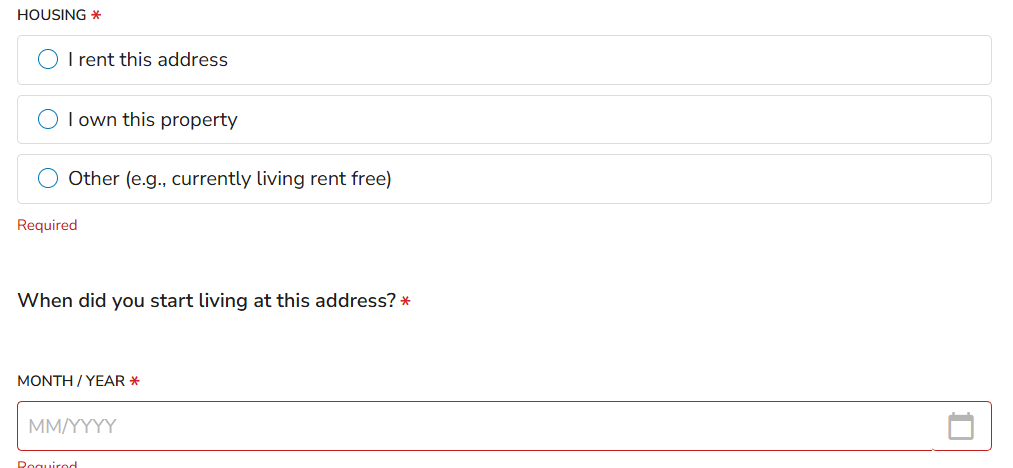

To apply for a mortgage with Filo, you’ll need to create an account and provide certain personal information, such as your legal name, date of birth, address, and Social Security number.

Filo will also ask about your housing status, i.e., whether you own or rent the house you currently live in.

Finally, you’ll need to provide proof of income, such as bank statements and tax returns.

Your preapproval letter will state approximately how much you can borrow. Preapproval remains valid for up to 120 days.

If you need a quick estimate of your monthly mortgage payment, try Filo’s mortgage calculator.

Filo alternatives

Filo vs. SoFi

SoFi, our highest-rated mortgage lender, offers home loans similar to Filo’s: conventional, FHA, VA, and jumbo loans. Like Filo, it charges no lender fees. SoFi finances mortgages in all states.

SoFi is well-known for competitive rates, quick approvals, and a streamlined, online-first experience. Another selling point is the $10,000 Close-on-Time Guarantee: If SoFi causes a delay in closing, it will pay the borrower up to $10,000. SoFi’s jumbo loan limit is $3 million, higher than most lenders’.

Overall, SoFi offers higher loan limits and broader availability than Filo.

Filo vs. Rocket Mortgage

The nationwide home loan giant Rocket Mortgage serves close to 10 million clients. It provides a wide choice of mortgage options, including fixed- and adjustable-rate mortgages, jumbo loans of up to $3 million, FHA and VA loans, mortgage refinancing, and home equity loans. Low-down-payment options are available to eligible borrowers.

One downside is that Rocket Mortgage charges origination fees (0.5% to 1.0% of the total loan amount).

Rocket Mortgage wins over Filo for borrowers who want wide loan options, appreciate the security of working with a high-volume lender, and don’t mind paying typical lender fees.

Filo vs. Quicken Loans

Quicken Loans, the sister company of Rocket Mortgage, isn’t a direct lender but rather a loan marketplace that connects borrowers to mortgage providers.

Loan marketplaces have the advantage of letting you compare terms from multiple lenders at once. However, many prospective borrowers like the predictability of working with a direct lender from the get-go.

Check out our full list of reviewed mortgage lenders.

Do we recommend Filo Mortgage?

If Filo Mortgage is licensed in your state, you may profit from its attractive rates, transparent process, and lack of lender fees.

Still, we always recommend getting preapproved with several of the best mortgage lenders. It’s smart to compare any prospective deal to what other lenders are offering, especially if you’re trying to decide whether right now is a good time to buy a house.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Filo Mortgage, Mortgage Rates

- Filo Mortgage, FAQ

- Filo Mortgage, Disclosures and State Licensing Information

- Filo Mortgage, Refinance Your Mortgage at a Historically Low Rate

- Filo Mortgage, Best VA Loan Rates

- Filo Mortgage, Best Jumbo Loan Rates

- Filo Mortgage, Cash Out Refinance Guide

- FHFA, Conforming Loan Limit Values Map

About our contributors

-

Written by Anna Twitto

Written by Anna TwittoAnna Twitto is a money management writer passionate about financial freedom and security. Anna loves sharing tips and strategies for smart personal finance choices, saving money, and getting and staying out of debt.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.