Getting a zero-interest student loan might sound like a fairytale or flat-out scam, but it’s not as far-fetched as student borrowers may think.

Zero-interest student loans aren’t very common, but they’re out there, and they’re typically available to U.S. citizens or permanent residents who have exceptional academic history, and can demonstrate financial need.

In case you’ve exhausted your federal financial aid, school aid package, and scholarship opportunities, and are currently in need of funding for school, here’s our list of top-rated private student loan lenders: Best Private Student Loans in 2026: Reviewed and Ranked.

Below, you’ll learn how zero-interest student loans work, where to find them, and how to apply.

| Company | Rates (APR) | Rating (0-5) |

|---|---|---|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

3.29% – 15.99% fixed-rate APR w/ autopay included |

|

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

Table of Contents

What are zero-interest student loans?

Zero-interest student loans do not charge interest—and they’re few and far between. Because this money is borrowed as an interest-free loan, the amount a student borrows is the same amount they will repay. As you might imagine, these loans are in high demand.

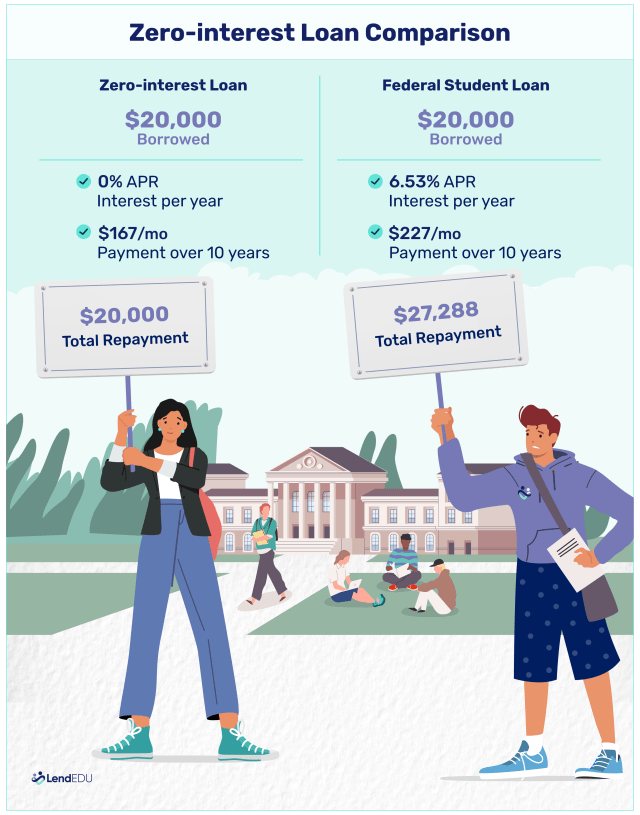

Although federal student loans are some of the most popular ways students finance post-secondary education, the interest on these loans can be expensive, often because of the decade-plus repayment periods. But a no-interest student loan can save a student borrower thousands over the life of the loan.

Take a look at current student loan interest rates and how much they’re costing student borrowers. As of January 2025, a college student would pay 6.53% interest for a federal Unsubsidized Loan.

With a zero-interest student loan that has a 10-year repayment term, you could save more than $7,200.

How do interest-free student loans work?

When a lender provides student borrowers with an interest-free student loan, no interest—or extra fee—accrues over the life of the loan. So whether the repayment term is five, 10, or 20 years or more, the amount originally borrowed is evenly divided over the term.

Nonprofit organizations, foundations, and institutions, such as state-run programs, often offer interest-free student loans in an effort to make higher education more accessible and affordable, encourage diversity, or boost their philanthropic footprint, image, or reputation.

Students hoping to get interest-free student loans typically must meet certain criteria, such as graduating high school, enrolling in a post-secondary program full-time, and being in good academic standing at the institution they’re attending.

Some lenders may also require potential borrowers to:

- Complete the Free Application for Federal Student Aid (FAFSA)

- Provide financial statements

- Obtain letters of recommendation

- Reside in the issuing lender’s state

- Not be in default on other student loans

- Apply with a cosigner

The process of applying for interest-free student loans is often more like an application process for a grant or scholarship. These loans may require more time, such as showing proof of residency, enrolling in a specific program—e.g., nursing or medical—submitting an essay and participating in an interview.

Since some interest-free student loans rely on information from the FAFSA, it’s usually best to seek financial aid by first completing the FAFSA, even if you don’t intend to get traditional student loans.

Once you’re approved for the zero-interest student loan, prepare to review an agreement letter from your lender explaining the repayment terms and other important information. After your loan is disbursed, you can use the funds you receive to pay for your education-related costs.

Where to find zero-interest student loans

If you want to find zero-interest student loans, start by researching “interest-free loans” and “scholarship loans.” You should also tap into your high school or college guidance counselors or financial aid office advisors, as well as local nonprofit organizations, fraternities and sororities, religious groups, and state government.

2 nonprofit organizations and charities

1. Central Scholarship

Important dates and requirements:

- Apply by the FAFSA deadline

- Be a Maryland resident

- Have a 2.8 GPA or higher

- Attend an accredited college, university, or community college

- Be a U.S. citizen or permanent resident

2. Lancaster Dollars for Higher Learning

Important dates & requirements:

- Application period is February 1 – April 30, 2025

- Must be a legal resident of Lancaster County, PA

- Must be enrolled in an eligible program at a selected institution

- A co-borrower must sign the loan agreement

2 state-sponsored programs

1. Massachusetts No Interest Loan Program

Important dates and requirements:

- Application period depends on financial aid office

- Must live in Massachusetts for at least one year and plan to remain in state

- Apply for financial aid through the FAFSA or an equivalent application

2. Abe and Annie Seibel Foundation [Texas]

Important dates and requirements:

- Application period is January 1 – February 28

- Must be a Texas resident who graduated from a Texas high school

- Enroll full-time at a Texas college or university accredited by the Southern Association of Colleges and Schools

- Top 10% of high school class, a minimum SAT score of 1100, or a minimum ACT score of 23

- Enroll full-time and maintain a 3.0 college GPA

3 religious organizations

1. Jewish Educational Loan Fund

Important dates and requirements:

- Application period is January 1 – April 30

- Must identify as Jewish

- U.S.-based cosigner

- Must be a U.S. citizen or have lawful status

- Apply for aid through FAFSA

- Legal resident of Florida, Georgia, North Carolina, South Carolina, or Virginia (not metro D.C.)

2. Riba-Free (interest-free) Educational Loans

Important dates and requirements:

- Application period is January 15 – February 28

- Must be a U.S. citizen, permanent resident, or DACA recipient

- Maintain satisfactory academic progress in college or career school

3. JFLA Zero-Interest, Zero-Fee Loan

Important dates and requirements:

- Application is currently open (for nursing and medical students); opens April 1, 2025 for all other students

- Must be at least 18 years old with a state-issued California ID

- Live in Los Angeles, Ventura, or Santa Barbara County

- Steady source of income or full-time student

- At least one qualified guarantor

How to apply for no-interest student loans

In general, here are the steps you should take when applying for no-interest student loans:

- Complete the FAFSA online: Even if you don’t want federal student loans, several lenders—including some listed above—rely on the information collected from the FAFSA to award funds. Be sure to apply for the FAFSA each year you need the loan or other financial aid.

- Research zero-interest student loans: Use state, local, and nonprofit databases, such as College Board and the Department of Education’s state webpage.

- Once you locate and decide on the interest-free loan program, check the eligibility requirements.

- If you qualify, follow the instructions to apply before the deadline.

If you don’t qualify for a zero-interest student loan, I always recommend filling out the FAFSA to see what kind of financial aid you may qualify for outside federal student loans. Schools have different scholarships or grants available—either based on merit or need-based—and you never know what you may qualify for.

Additionally, when you receive federal aid, do your best to keep spending at a minimum. Instead, look into work-study programs or even working part-time so you can use those funds to contribute to the cost of school. Search for outside scholarship opportunities through local businesses and foundations. There are several scholarships out there that are out there that people never pursue.

Alternatives to zero-interest student loans

If you don’t get anywhere in your search for zero-interest student loans, or if you don’t receive funds from any of the programs you applied to, all is not lost. You can still get financial aid via other means:

Scholarships and grants

Look up scholarships and grants, which serve as funds you don’t need to repay. Some are program-specific or based on merit. Others require you to submit an essay or run on a first-come, first-served basis.

Employer-funded continuing education

Ask your employer whether it will pay for you to go to school. Many companies cover their employees’ education, especially if it relates to their current role within the company.

Work-study programs

You can check with your college or university about working a part-time job while you attend school. If you demonstrate financial need, work-study can help you earn money to help pay for your education.

Tuition installment plans

Some colleges and universities allow their students to pay the cost of tuition and other education-related expenses during a semester in equal installments.

Tuition installment plans are typically interest-free but may include fees for setup and enrollment. Nevertheless, this can be a significant money-saving alternative to interest-bearing loans.

Federal student loans

Apply for federal loans through Federal Student Aid for four-year college, graduate, trade, career or technical school, or community college.

You could qualify for:

- Direct Subsidized Loans: Interest is covered while you’re attending school and up to six months afterward

- Direct Unsubsidized Loans: Interest accrues from the moment you get the loan.

Apply for Direct Subsidized Loans over Direct Unsubsidized Loans whenever possible, so you pay less interest over time.

Private student loans

Several private lenders offer private student loans if you’re in need of more funding. However, private student loans can come with higher interest rates, especially if you have less-than-perfect credit—and even if you qualify for competitive rates, private loans don’t come with the benefit of potential loan forgiveness.

So make sure you exhaust all other practical options before applying for any private student loans. Should you decide to explore these loans, we recommend starting with Credible. It’s our go-to marketplace when shopping for private student loans. You can get rate quotes from several lenders without affecting your credit—at no cost to you.

Funding

You can ask family and friends for help—or even strangers. Peer-to-peer (P2P) lending is one way to raise funds for school. Basically, a group of investors pools money on crowdfunding platforms to loan you the money you need, and you then pay the loan back over time with interest.

Crowdfunding or similar ways to borrow money are relatively new, and some platforms may be better than others. Should you choose to go down this route, do your due diligence by verifying the legitimacy of the platform you’re interested in with the Securities and Exchange Commission and state regulators.

FAQ

Do student loans have interest?

Yes, most student loans, including federal and private options, accrue interest. Interest is the cost of borrowing and is added to the loan balance over time, increasing the total amount you’ll repay.

Can I get student loans with no interest until after graduation?

Yes, certain loans, such as federal Direct Subsidized Loans, don’t accrue interest while you’re enrolled at least half-time, during the grace period after graduation, or while in deferment.

However, private loans typically start accruing interest immediately, even if you defer payments. Zero-interest student loans never accrue interest, but these programs are less common and often have strict eligibility criteria, such as financial need or institutional ties.

Are zero-interest student loans better than scholarships?

Interest-free student loans are a solid way to minimize debt costs because they allow you to borrow without the added expense of interest. However, scholarships are generally a better option because they don’t require repayment at all.

While zero-interest loans are helpful for covering gaps in funding, scholarships, and grants should be your first choice to reduce your overall financial burden. Combining both options can help you manage education costs.

About our contributors

-

Written by Melody Stampley, CEPF®

Written by Melody Stampley, CEPF®Melody Stampley is a personal finance writer and Certified Educator in Personal Finance® with 10-plus years of combined experience in writing, editing, and finance. She specializes in credit, loans, budgeting, saving, and insurance. Melody is a mother who enjoys helping others become free and empowered to show younger generations good stewardship practices.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Crystal Rau, CFP®, CRPC®, AAMS®

Reviewed by Crystal Rau, CFP®, CRPC®, AAMS®Crystal Rau, CFP®, CRPC®, AAMS®, is a Certified Financial Planner based in Midland, Texas. She is the founder of Beyond Balanced Financial Planning, a fee-only registered investment advisor that helps young professionals and families balance living their ideal lives with being good stewards of their finances.