Refinancing student loans can help you lower your interest rate, cut monthly payments, or pay off debt faster. Whether you have private or federal loans, refinancing replaces your current loan with a new one, ideally with better terms. But it’s not always the right move.

In this guide, we’ll walk you through how to refinance in seven clear steps, from checking your eligibility to comparing lenders, applying, and finalizing the transfer—plus tips to help you save more and avoid common pitfalls.

If you can lower your interest rate by at least 0.50% and don’t rely on federal loan benefits like income-driven repayment or forgiveness, refinancing may be a smart move. Compare offers from at least three lenders before applying.”

Table of Contents

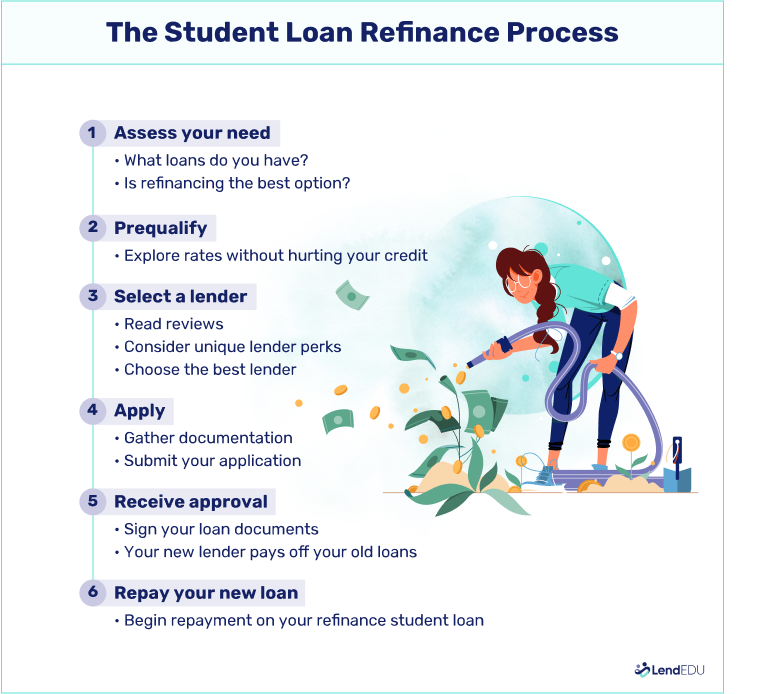

Here’s a quick overview of how student loan refinancing works:

1. Decide whether refinancing is the right move

Student loan refinancing can lower your interest rate, reduce monthly payments, or help you pay off your loans faster. But it’s not the right fit for everyone, especially if you have federal loans, which come with forgiveness and income-driven repayment options.

Before refinancing, ask yourself:

- Do I have private loans, federal loans, or both?

- Am I eligible for any forgiveness programs?

- Will refinancing actually save me money?

- Can I qualify for a better interest rate with my credit and income?

If you have federal loans, refinancing with a private lender means giving up key benefits like Public Service Loan Forgiveness (PSLF), IDR plans, and federal forbearance options. It’s important to weigh the pros and cons.

| Feature | Federal loans | Refinance with private lender |

| Income-driven repayment plans | ✔️ Yes | ❌ No |

| PSLF or forgiveness programs | ✔️ Yes | ❌ No |

| Forbearabce or deferment during hardship | ✔️ Broad coverage | ⚠️ Limited (varies by lender) |

| Interest rate discounts | ❌ | ✔️ Possible (with good credit) |

| Customizable loan terms | ⚠️ Limited | ✔️ Wide range available |

Note: Once you refinance, you can’t go back to federal loan protections.

Use our refinance calculator to estimate how much refinancing might save you over time:

2. Check your eligibility

Refinancing isn’t guaranteed. Most lenders have specific eligibility criteria, and approval depends on your credit profile, income, and loan history. Here’s what you’ll generally need:

- Credit score: Most lenders look for a score of at least 650 to 680. The better your credit, the better your rate.

- Income: You’ll need to show reliable income that supports your new monthly payment.

- Debt-to-income ratio (DTI): Lenders want to see that your total debt, including rent or mortgage, credit cards, and student loans, is manageable.

- Degree type: Some lenders prefer borrowers with a bachelor’s or associate degree from a Title IV school.

- Citizenship: U.S. citizenship or permanent residency is typically required, though a few lenders accept DACA recipients or international borrowers.

- Loan amount: Many lenders set minimum and maximum limits for refinancing (often between $5,000 and $500,000).

Here’s what these requirements look like for several well-known lenders:

| Lender | Min. credit score | Income req. | Degree req. | Citizenship req. | Cosigner req. | Loan amts. |

| ELFI | 680 | $35K | Bachelor’s degree or higher | U.S. citizen or permanent resident | Optional, no cosigner release | $10K min. |

| Earnest | 665 | $35K | Associate or higher | U.S. citizen or permanent resident | Optional, no cosigner release | $5K min. for most borrowers |

| SoFi® | Not disclosed | None; must have disposable income | Associate or higher | U.S. citizen, permanent resident, non-permanent alien, DACA, asylum seeker | Optional, no cosigner release | $5K min. |

| RISLA | None | $40K | Must attend Title IV degree-granting school (no min. degree) | U.S. citizen or permanent resident | Optional, cosigner release after 24 on-time payments | $7.5K min. – $250K max. |

If you meet these criteria, you’re likely a strong candidate for refinancing and ready to move on to rate shopping.

3. Prequalify with several potential lenders

Once you’ve confirmed you’re eligible to refinance, compare rates by prequalifying with three to five lenders. Most let you check your rates online with a soft credit pull, so it won’t hurt your credit score.

When you prequalify, look closely at:

- Interest rate ranges (fixed vs. variable)

- Estimated monthly payments and term length

- Any borrower benefits, like forbearance options or autopay discounts

Tip: If your credit score or income is borderline, applying with a cosigner may help you qualify for better rates.

4. Choose the best student loan refinance lender

After comparing offers, select the lender that best fits your financial goals. Review each offer’s:

- Annual percentage rate (APR)

- Loan term (shorter terms save on interest)

- Monthly payment

- Prepayment or origination fees (if any)

- Flexibility and customer reviews

Refinance federal loans only if you’re confident you won’t need income-driven repayment, deferment, or forgiveness programs.

If any part of a loan offer is unclear, reach out to the lender for clarification before moving forward.

Here are a few top-rated lenders to consider:

| Company | Best for… | Rating (0-5) |

|---|---|---|

|

|

Best for Comparison Shopping |

|

|

Best Online Lender |

|

|

Best Personalized Support |

|

|

Best Skip-a-Payment Benefit |

|

By comparing lenders and researching what each one offers, you can find a lender that best suits your needs.

5. Submit your refinance application

Once you’ve chosen a lender, it’s time to complete the full application. This step usually includes a hard credit inquiry, so be ready to finalize your choice.

You’ll need:

- Government-issued ID (driver’s license or passport)

- Proof of income (pay stubs or tax returns)

- Your most recent student loan statements

- Social Security number

Some lenders allow you to upload documents digitally for faster processing. If you have everything on hand, the entire application process usually takes less than 30 minutes.

How long does it take?

From application to approval and transfer, most refinancing takes two to four weeks. Responding quickly to requests from your lender can speed things up.

6. Review your offer and sign your loan agreement

Once your lender officially approves you, it will send you a final loan offer. Review every detail before signing:

- Interest rate and loan term

- Repayment schedule and first due date

- Fees (if applicable)

- Autopay discounts or other benefits

Even if you’re eager to lock in a lower rate, take time to ensure the offer matches what you expected. If you’re unsure about any terms, ask your lender before signing.

Pro tip: Some lenders offer a 0.25% interest rate discount if you sign up for autopay. Make sure this is included in writing before you commit.

7. Payoff and transfer

Once you sign your new loan agreement, your new lender will pay off your old loans. Your previous servicer will mark your account as paid in full, and your new loan will take its place.

Be sure to:

- Keep making payments on your old loan until the balance shows zero

- Confirm that your old account is fully closed

- Set up your new online account and first payment with the new lender

If your old loan was overpaid during the transfer, your previous lender will issue a refund.

Still unsure?

Reach out to your old and new lenders to confirm timelines and avoid missing payments during the transition.

FAQ

Can I refinance both federal and private student loans?

Yes. You can refinance both types into a single private loan. Just keep in mind that you’ll permanently give up federal benefits if you refinance federal loans.

Does refinancing hurt my credit score?

Checking rates through prequalification won’t hurt your score. A hard credit check is required when you formally apply, which may cause a slight, temporary dip.

How many times can I refinance?

There’s no limit. You can refinance more than once, as long as you qualify. Some borrowers refinance multiple times to get better rates as their credit improves.

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.