Cash App Borrow is a feature that lets some users take out a short-term loan, typically up to $400, directly in the app. But it’s still in testing and isn’t available to everyone.

Below, we’ll explain how Cash App Borrow works, who qualifies, and what to do if the feature doesn’t appear in your app. We’ll also compare top cash advance apps that let you borrow up to $1,000 and may offer faster access to funds.

Cash App Borrow at a glance:

| Loan amount | $20 – $400 |

| Availability | Select users in eligible states |

| Repayment term | 4 weeks (lump sum or installments) |

| Cost | 5% flat fee (no interest if on time) |

| How to qualify | Based on state, Cash Card usage, direct deposit, and account history |

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Table of Contents

What is Cash App Borrow?

Cash App Borrow is offered to select users through Block’s banking arm, Square Financial Services, which has FDIC approval to issue these loans. However, Cash App Borrow is still in a testing phase, so it’s not available to all users.

Who is eligible for a Cash App loan?

Eligibility for borrowing typically depends on:

- Your state of residence

- Your Cash App activity (e.g., regular direct deposits)

- Your creditworthiness and account history

- Whether you’ve enabled Cash Card and have active usage

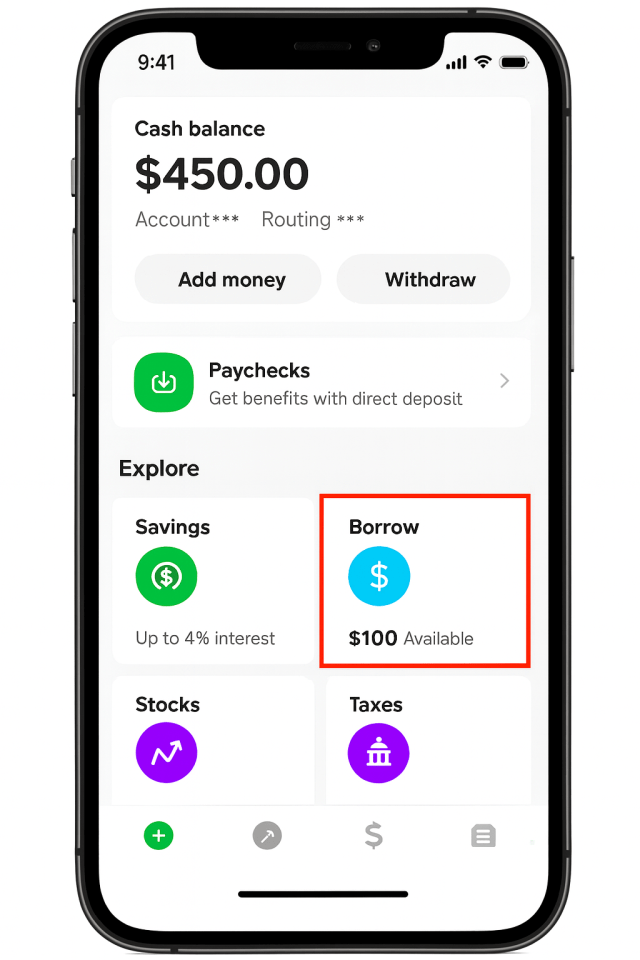

As of now, Cash App has not made Borrow available to all users or in all states. If it is available to you, it will appear as an option on your balance tab of the app and look something like this:

Eligible Cash App Borrow states

Cash App Borrow is currently available in the following states:

- Alabama

- California

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Mississippi

- Missouri

- North Carolina

- Ohio

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

Note: Being in one of these states doesn’t automatically make you eligible. Cash App uses a combination of location and account behavior to determine access. If the feature is not available on your app, make sure your app is updated to the latest version, and check periodically for access. You also must be 18 to borrow from the Cash App.

How to borrow money from Cash App

If you see the Borrow option in your app, here’s how to use it:

- Open Cash App

- Tap the Borrow icon on the balance tab.

- On the Borrow page, review your loan limit and tap “Get Started”

- Choose or enter the amount you want to borrow

- Review the loan details, including loan amount, fee charged, funding method (typically instant into your Cash App balance), and repayment timeline.

- Choose a repayment option

- Enter your Social Security number, PIN, and legal name, address, and date of birth

- Confirm all loan details, including:

- Final loan amount

- Total repayment

- APR and due date

- Tap “Borrow Instantly”

You’ll then receive an overview and ongoing notifications about your loan. Failure to repay on time could result in additional interest or fees beyond the initial 5%.

Watch: How to use Cash App Borrow

To see it in action, check out this quick walkthrough video:

How to borrow from Cash App without direct deposit

Some users have been able to unlock Borrow without setting up direct deposit, but it’s much less common. Direct deposit is one of the main signals Cash App uses to determine eligibility, so skipping it may delay access or limit your borrowing amount.

If you don’t want to set up direct deposit, you can still try using your Cash Card frequently and staying active in the app. Just know that without regular deposits, you may not qualify, or may only qualify for smaller loan amounts.

How to borrow on Cash App (for iPhone or Android)

The steps to borrow money are the same whether you use an iPhone or Android device. Just open the app, go to your balance tab, and look for the Borrow option.

If you don’t see it, that usually means you’re not yet eligible, not that your phone type is the issue. Make sure you’re using the latest version of the app, and check back regularly.

How much can you borrow?

Cash App currently offers borrow amounts between $20 and $400 for most users, though limits may vary based on eligibility. This is a short-term loan, typically due back in four weeks, and comes with a flat 5% fee.

For example:

- Borrow $100 → Repay $105

- Borrow $200 → Repay $210

What’s the max Cash App will let you borrow?

Most users will see a maximum loan limit of $400, though Cash App hasn’t publicly confirmed whether this is the highest possible amount long term. Your individual limit is determined by factors like:

- Your direct deposit history

- Cash Card activity

- How often you use the app

- Your repayment behavior on past loans

Cash App may increase your limit over time if you consistently use the app and repay on time, but there’s no manual way to request a higher loan amount. If you need to borrow more than $400, consider a reputable cash advance app or short-term loan alternative.

How to increase your borrow limit

To increase your borrow limit, Cash App recommends improving your eligibility through:

- Setting up direct deposit to your Cash App account

- Using your Cash Card frequently

- Maintaining a strong account history (no defaults or reversals)

- Staying active within the app

There’s no manual request process. Cash App automatically evaluates your account behavior and adjusts your limit over time.

How to unlock the Borrow feature

If you don’t see the Borrow option in your Cash App, it doesn’t necessarily mean you’re ineligible; it just means you haven’t unlocked it yet. There’s no application or button to request access. Instead, Cash App automatically reviews your account activity and unlocks the feature for qualified users.

To improve your chances of unlocking Borrow:

- Set up direct deposit to your Cash App account

- Use your Cash Card regularly for purchases

- Maintain a clean account history, with no reversals or missed payments

- Keep your app updated to the latest version

- Stay active in the app over time

Even with strong activity, access isn’t guaranteed. Cash App Borrow is still in a limited rollout phase and isn’t available to all users yet.

Common reasons you’re not eligible

If the Borrow option still isn’t showing up after weeks or months of activity, there could be one or more reasons you’re not eligible yet:

- Your state isn’t supported (see the list of eligible states above)

- You haven’t set up direct deposit to your Cash App

- You don’t have an active Cash Card

- Your account history includes late payments or reversals

- You’re under 18 years old

- You recently paid off a previous loan and Cash App hasn’t re-enabled borrowing yet

Cash App’s eligibility criteria aren’t published in full, and access can change over time. If you’ve taken all the right steps but still don’t see the feature, check back periodically—it may show up once your account meets internal benchmarks.

Cash App Borrow is still being tested and rolled out slowly. Even if you meet the typical requirements, the feature isn’t guaranteed to appear. If you want to try other options, check out apps that work with Cash App for short-term loans.

How to repay your Cash App loan

Repayment for Cash App Borrow is typically expected within four weeks, and Cash App gives users flexible options:

- Full repayment in one lump sum

- Weekly installments over four weeks

- “As you get cash,” Cash App automatically sets aside money from incoming funds until the balance is paid

Your loan terms, including repayment due date and schedule options, will be displayed clearly before you confirm the loan. If you don’t repay on time, overdue interest may apply in addition to the flat fee.

If you’re facing a financial emergency and don’t have an emergency fund, or it’s not enough to cover the need, using the Cash App’s borrow feature can be a reasonable short-term financing option. Just be sure to have a clear repayment plan in place, and try to avoid making it a habit.

Alternatives to Cash App Borrow

If you don’t qualify for Cash App Borrow or need more than $400, cash advance apps are the next best option. Some let you borrow up to $1,000 with low or no fees, and many work seamlessly with Cash App.

Want more options? Check out our guide to Cash Advance Apps That Work With Cash App

Best cash advance apps

EarnIn

Why it’s a good alternative

EarnIn is our top pick for a cash advance app because it allows eligible users to access up to $300 from their earned wages with no interest or mandatory fees. First-time users may be eligible for expedited funding at no cost. This option can help many people who may need a short-term loan but don’t want to pay high fees or subscription costs to get it.

If you need to borrow more, EarnIn allows qualified users to borrow up to $300 per day or $1,000 per pay period. If you’re not in a rush to withdraw cash, you won’t pay a fee to get funds within a couple of days. The fee for a Lightning Speed transfer can be up to $5.99.

Dave

Why it’s a good alternative

We like that the Dave app offers more services than cash advances. Dave lists several opportunities that people can use to earn money in the gig economy. Dave also offers a savings account that allows customers to name their savings goals. Because of these features, Dave helps its customers earn more money and save for their futures.

Dave charges fees. For example, a $1 monthly subscription fee applies, and you’ll pay an additional fee if you want to get money right away. If you don’t mind waiting for a deposit, no fee applies, although you’ll still pay the subscription fee.

MoneyLion

Why it’s a good alternative

When you apply for a cash advance from MoneyLion, you don’t need to pay a monthly fee, and MoneyLion doesn’t conduct a credit check. Like other apps, no fee applies if you choose standard delivery, but you’ll pay a fee for instant delivery.

If you have a RoarMoney checking account, you can get up to $1,000, which is more than any other app on this list offers. If you want to improve your finances, build your credit, or access other financial services, MoneyLion offers many other products to regular subscribers.

Current

Why it’s a good alternative

If you have a paycheck and a bank account that shows regular deposits, you may be able to access up to $750 of your paycheck early using Current. Current is unique of the options on this list because it offers bonus features like a high-yield savings account and savings pods.

A fee applies to access your money quickly, but Current doesn’t disclose it until you choose a quick withdrawal option. So I only advise this option if you want to use Current for its unique features, not if you value price transparency when it comes to fees.

When to consider another option

Cash App Borrow can be useful for short-term needs, but it’s not available to everyone. And even when it is, the loan amount may not go far. You may want to consider another option if:

- The Borrow feature doesn’t appear in your app

- You need more than $400

- You want flexible repayment terms or lower fees

- You’re trying to build credit history (Cash App Borrow won’t help)

In these cases, a cash advance app, credit builder app, or even a small personal loan might be a better fit.

FAQ

Can I borrow from Cash App without direct deposit?

It’s possible but less common. Direct deposit is one of the main factors Cash App considers when deciding who qualifies for Borrow. Without it, your chances of unlocking the feature (or accessing higher limits) are much lower.

How soon can I borrow again after repaying a loan?

Some users regain access to Cash App Borrow just a few days after repayment, while others may wait longer. Cash App reviews account behavior on an ongoing basis, so repaying on time and staying active in the app may improve your chances of borrowing again.

Does borrowing money from Cash App help build credit?

No. Cash App Borrow does not report your payments to the credit bureaus, so it won’t help you build credit. If you want to improve your credit score, consider a credit builder loan or a secured credit or debit card (like Chime or Fizz) instead.

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.