Mobile Banking with Cash Advance

- Budget, bank, save, and invest all in one app

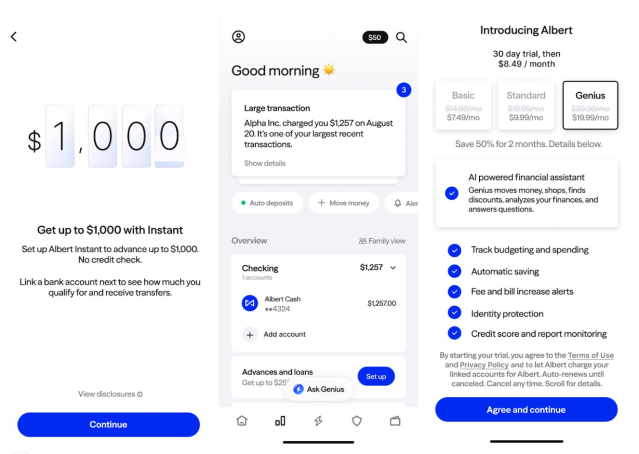

- Cash advances up to $1,000

- Cashback-earning debit card

- Investing support for beginners

- 30-day free trial

- Only available through the mobile app

- Costs $14.99 – $39.99 per month

- Cash advances may be small at first

- Need the premium Genius plan for most features

| Monthly cost | $14.99 – $39.99, depending on plan |

| Services included | Budgeting, banking, automatic savings, cash advances, guided investing, identity protection, credit monitoring, & subscription canceling |

| Cash advance limit | Up to $1,000 |

| Who can use it? | U.S. residents and citizens who are at least 18 years old |

Albert is a solid all-in-one finance app if you’re looking to budget, save, invest, and get cash advances in one place. And it’s 100% legit.

It’s especially appealing for people who want to build better money habits with the help of automation and human guidance.

That said, its features come at a cost. Many tools, including fee-free cash advances, require a monthly Genius subscription.

Need cash, like, right now? EarnIn lets eligible users access up to $300 from their earned wages with no interest or mandatory fees.¹ First-time users may be eligible for expedited funding at no cost.²

EarnIn does not charge interest on Cash Outs or mandatory fees for standard transfers, which usually take 1-2 business days. For faster transfers, you can choose the Lightning Speed option and pay a fee to receive funds within 30 minutes. Lightning Speed may not be available at all times and/or to all customers. Restrictions and terms apply; see the Lightning Speed Fee Table and Cash Out User Agreement for details and eligibility requirements. Tips are optional and do not affect the quality or availability of services.

Lightning Speed is an optional service that allows you to expedite the transfer of funds for a fee. Depending on the product, the fee may be charged by EarnIn or its banking partner. Lightning Speed may not be available in all states and/or to all customers. Restrictions and terms apply. See the Lightning Speed Fee Table for details.

Compared to cash advance apps, Albert offers more financial tools, but it’s not the cheapest option. If you’re just looking for fast cash, there may be simpler (and cheaper) alternatives.

Here’s everything you need to know about Albert.

How to use Albert

It takes less than 15 minutes to start using the Albert app. Here’s how:

- Download the Albert App from the App Store or Google Play.

- Open the app and tap “Get started.”

- Tell Albert your top goals: creating a budget, tracking spending, canceling subscriptions, or saving money.

- Enter your name, email address, and password, and agree to the terms and conditions.

- Connect your bank accounts so Albert can find your subscriptions and help you track your spending.

Depending on your goals, you can take several actions in the Albert app. For instance, you could set up your monthly budget, request an instant cash advance, get help canceling old subscriptions, create goals, and start investing.

How does the Albert app work? Key features

The Albert app aims to simplify personal finance by providing you with all the tools you need to better manage your money.

Instant Advance

With Instant Advance, Albert offers cash advances of $25 to $1,000 with no interest and no credit check. Only a small percentage of users qualify for the full $1,000, since limits are based on your individual account history and activity.

To qualify, you need:

- An Albert Cash account

- Smart Money set to “Automatic”

- An active, linked bank account

- A consistent transaction history

Direct deposit isn’t required, but qualifying direct deposits (employer or benefits payer ACH only) can help raise your limit. Peer-to-peer transfers, tax refunds, mobile check deposits, and 1099 income do not count as qualifying direct deposits.

Here’s how Instant works:

- Once you qualify, you can request a cash advance directly in the app

- Albert will send the money to your Albert Cash account or a linked external bank account

- Typical starting limits are around $25 to $50

- You can repay your advance manually or turn on automatic repayments

You won’t pay any additional fees for standard delivery to your Albert account. You can also select to send your advance to an external account linked to Albert for a fee.

Savings with Albert

Albert automatically moves small amounts of money from your connected bank account into savings based on what it thinks you can safely set aside. You can set custom goals and track progress in the app.

Smart Money

Smart Money is Albert’s automated saving and investing feature. When it’s turned on, Albert regularly moves small, affordable amounts into savings or investments based on your goals and spending patterns. Smart Money must be set to “Automatic” to qualify for Instant Advances.

Albert Genius

Albert Genius is a premium feature that costs $39.99 per month. Genius subscribers can access more comprehensive tools and personalized guidance than regular Albert members. Here’s what you get:

- Albert Savings account. The app analyzes your income and spending to set aside money automatically. You can create multiple savings goals and earn cash bonuses on your savings balance.

- Free ATMs. With the Cash account, you can use over 55,000 Allpoint ATMs without fees. However, a $3.50 fee applies to non-network ATMs.

- Albert Instant Advances. Advance up to $1,000 via a cash advance. It’s free for instant delivery if you have the cash deposited into your Albert Cash Account.

- Investment accounts. Albert offers custom portfolios based on your goals or lets you choose individual stocks and ETFs. You can start investing with as little as $1.

- 24/7 monitoring. The app offers identity protection, credit score monitoring, and real-time alerts to help keep your financial information safe.

Other noteworthy features

Albert Rewards

When you use your Albert Cash card, you can earn automatic cash-back rewards at select merchants. Offers rotate regularly and are applied directly to your account, no coupon clipping required.

Bill Negotiation

Albert’s Bill Negotiation service helps lower your recurring bills like cable, internet, and phone. You upload or connect a bill, and Albert’s team negotiates on your behalf.

Plans and pricing

Albert now offers four subscription tiers, each with different tools and features. All plans come with a 30-day free trial, and you can cancel anytime in the app.

Basic ($14.99/month)

Includes essential money-management tools such as:

- Budget and spending tracking

- Spending trends and insights

- Savings (held at Wells Fargo, Member FDIC)

Standard ($19.99/month)

Includes everything in Basic plus:

- Investing

- Identity protection

- Credit score monitoring

- Cash-back debit card

- Fee-free in-network ATM withdrawals

Genius ($39.99/month)

Includes everything in Basic and Standard plus:

- AI-powered financial assistant that helps you move money, shop, find discounts, and get personalized financial insights

- Full access to all app features with no additional fees

Family ($39.99/month)

Covers you and up to four family members, with access to all features in Basic, Standard, and Genius.

| Feature | Basic | Standard | Genius | Family |

|---|---|---|---|---|

| Budgeting & spending tracking | ✅ | ✅ | ✅ | ✅ |

| Spending insights | ✅ | ✅ | ✅ | ✅ |

| Savings (Wells Fargo, FDIC-insured) | ✅ | ✅ | ✅ | ✅ |

| Investing | ⛔ | ✅ | ✅ | ✅ |

| Identity protection | ⛔ | ✅ | ✅ | ✅ |

| Credit score monitoring | ⛔ | ✅ | ✅ | ✅ |

| Cash-back debit card | ⛔ | ✅ | ✅ | ✅ |

| Fee-free in-network ATMs | ⛔ | ✅ | ✅ | ✅ |

| AI-powered financial assistant | ⛔ | ⛔ | ✅ | ✅ |

| Cash advances (Instant) | ⛔* | ⛔* | Optional** | Optional** |

| Family coverage | ⛔ | ⛔ | ⛔ | ✅ |

**Genius plan is typically needed for most users to qualify for Instant, based on Albert’s guidance.

Who’s eligible to use Albert?

The Albert app can be downloaded from the App Store and Google Play. Generally, anyone who meets these requirements can use it:

| Requirement | Details |

| Citizenship | U.S. resident or citizen |

| State of residence | Anywhere in the U.S. |

| Minimum age | 18 years |

| Minimum credit score | None |

| Minimum income | None |

| Bank requirements | Must have a bank account with a U.S. financial institution |

| Tech requirements | Must have a mobile phone that supports the Albert app and uses a U.S. mobile carrier |

Pros and cons

The Albert app has these benefits and drawbacks:

Pros

-

Can budget and invest all in one app

If you don’t want separate budgeting and investing apps, the Albert app can help you streamline.

-

Offers cash advances up to $1,000

Cash advance apps can be a low-cost way to float you until your next payday.

-

Investing support for beginners

With the Albert money app, you can answer a few questions about your investing goals and build a custom portfolio.

-

Comes with a 30-day free trial

You can take Albert for a test drive for free for 30 days. If you don’t like it, you can cancel before your first billing cycle with no charges.

Cons

-

Subscription fee

Downloading the Albert app is free, but you’ll pay between $14.99 and $39.99 per month for a subscription, depending on what features you want.

-

Other fees apply

Albert charges $3.50 for non-network ATMs and $4.99 to move money from an Albert Cash account to an external bank account within 10 minutes rather than waiting the standard three to six business days.

-

Confusing website

We found that Albert’s website contradicts itself and doesn’t clearly state what’s included with each subscription tier. This can be frustrating when deciding which plan to purchase.

Is Albert legit? Customer reviews

Real-life customers have mixed opinions about the Albert app. But overall, it has positive ratings online, especially from within the app stores:

| Source | Customer rating | Number of reviews |

| Trustpilot | 4.6/5 | 6K |

| Apple App Store | 4.6/5 | 274K |

| Google Play Store | 4.5/5 | 140K |

| Better Business Bureau (BBB) | 4.0/5 | 1.2K |

Albert earns a B rating from the BBB, but it isn’t BBB-accredited.

Many users appreciate the Albert app’s budgeting tools and instant cash advances. They praise its user-friendly interface and helpful customer service. Some customers report that Albert has helped them reach savings goals and avoid overdraft fees.

However, some find the cash advance amounts smaller than expected, which is typical among cash advance apps. Others voice concerns about the subscription fees not being worth the price. Also, some customers report having a difficult time closing their accounts.

Albert alternatives

While Albert offers more than just cash advances, it’s not the only app that combines quick cash with financial tools. Some competitors, like MoneyLion and Brigit, also offer insights, savings features, or even investment options. Here’s how Albert stacks up against a few alternatives. Check out our full rundown of the best cash advance apps here.

Albert vs. EarnIn

EarnIn is best for people who want instant cash advances with no monthly subscription fees. You can borrow up to $1,000 per pay period and tip what you think is fair.

However, EarnIn doesn’t offer the full suite of financial tools Albert does, like budgeting, investing, or savings automation. If you just want quick, low-cost advances, EarnIn may be a better fit. If you’re looking for an all-in-one finance app, Albert offers more value, though at a higher cost.

Albert vs. MoneyLion

MoneyLion offers cash advances up to $500 through its Instacash feature, with no subscription required. It also includes other financial services like credit builder loans and investment tools, putting it in similar territory as Albert.

However, MoneyLion’s interface can feel more focused on credit and investing, while Albert leans more into budgeting and savings. Both are comprehensive, but if you’re mainly looking for credit-building and fast cash, MoneyLion might edge Albert out.

Albert vs. Brigit

Brigit offers up to $500 in cash advances, more than Albert, and its monthly fee is lower ($9.99 for Brigit Plus versus $39.99 for Albert Genius). Brigit also includes automatic overdraft protection and financial insights.

However, it doesn’t include built-in investing or a savings account like Albert does. If budgeting and short-term advances are your main priorities, Brigit may be more affordable. But Albert wins on features if you’re looking for long-term financial tools.

Compatibility

Does it work with Chime?

Yes, Albert works with Chime. You can link your Chime account to Albert to take advantage of its budgeting tools, financial insights, and cash advance features.

Cash App?

Yes, Albert works with Cash App. You can link your Cash App account to Albert to manage your finances, track spending, and use features like cash advances.

Zelle?

Albert does not directly integrate with Zelle. However, you can use Albert with Zelle by linking your Zelle-compatible bank account to Albert for financial tracking and cash advance features.

PayPal?

Albert does not directly integrate with PayPal. You can still use Albert for financial management and PayPal for transactions and transfers.

Varo?

Yes, Albert works with Varo. You can link your Varo account to Albert to use its budgeting tools, financial insights, and cash advance features.

FAQ

Is Albert legit?

Albert is a trustworthy app. It has positive user reviews and offers several security features, including encryption and two-factor authentication, to protect your financial information. However, as with any financial app, it’s important to read the terms and conditions and stay informed about its privacy policies.

Does Albert App really give you $1,000?

Yes, Albert can give eligible users up to $1,000 through its Instant Advance feature.

You don’t need to overdraft to access the money. Instead, you request it in the app, and it can be sent to either your Albert Cash account or a linked external bank account.

Most users start with lower limits, but advance amounts can grow over time based on your activity.

How much does Albert let you borrow the first time?

Albert’s cash advance isn’t considered a loan; it’s an advance from your paycheck.

Albert typically lets new users advance up to $50 the first time. The exact amount depends on factors like your income, spending habits, and banking history. Over time, as you use the app and your financial activity becomes more predictable, Albert may increase your cash advance limit to as much as $1,000.

How do I get my money out of Albert?

To get your money from Albert:

- Use the “Instant” feature in the app to request a cash advance.

- Choose whether you want instant delivery (which may come with a small fee) or standard delivery, which is free but takes a few days.

- Funds will be sent directly to your linked bank account.

If you have money in your Albert Cash account, you can also withdraw it using your Albert debit card, transfer it to another account, or use an ATM.

How fast does Albert pay you?

Albert offers two speed options:

- Instant delivery: Usually arrives within minutes to an hour, but it comes with a small fee (often around $4.99).

- Standard delivery: Takes two to three business days, but it’s free.

Does Albert work with Venmo?

Yes, Albert works with Venmo. You can link your Venmo account to Albert to manage your finances, track spending, and use features such as cash advances.

How we rated Albert

We designed LendEDU’s editorial rating system to help readers find companies that offer the best cash advance apps. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Albert to several cash advance providers, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.