Our take: Achieve offers affordable HELOCs with fast approvals for eligible homeowners borrowing against primary residences. It has a lower minimum credit score requirement than many lenders, but may charger higher fees.

Home Equity Line of Credit (HELOC)

- Low rates (for eligible borrowers)

- Fast loan processing

- No prepayment penalties

- Excellent reviews

- Potentially high fees

- Short draw period

- Not available nationwide

| Rates (APR) | 6.24% – 13.25% fixed |

| Draw/repayment terms | 5-year draw/10-, 15-, 20-, and 30-year repayment |

| Loan amounts | $15,000 – $300,000 |

| Fees | $750 – $6,685 |

| Min. credit score | 600; 640 for 20- and 30-year terms |

Achieve, a digital lender with more than 1.5 million customers, offers fixed-rate HELOCs for goals like debt consolidation, home improvement, and major expenses.

To avoid confusion, although Achieve lists a “home equity loan” as a separate option, both its home equity loan and HELOC pages describe the same product: a HELOC.

Achieve HELOCs: What to know

All Achieve HELOC plans come with a comparatively short five-year draw period and repayment periods of 10 to 30 years.

Note that Achieve doesn’t offer lines of credit nationwide, but a list of available states is not available. You’ll have to check with the company whether Achieve HELOCs are available in your state.

Eligibility

To qualify for a HELOC by Achieve, you will need to meet the following requirements:

| Min. credit score | 600; 640 for 20- and 30-year terms |

| Debt-to-income (DTI) ratio | 50% or lower |

| Loan-to-value (LTV) ratio | 80%; 75% for 20- and 30-year terms when HELOC’s purpose is debt consolidation |

When looking at HELOC applications, Achieve will consider a combination of credit score, DTI, and home value. They often estimate property value using an automated valuation model (AVM) rather than using a professional appraiser, which helps them process applications faster. You’ll also need property insurance and possibly flood insurance, depending on the location.

At the time, Achieve only approves HELOCs for primary residences. Achieve provides a calculator to check approximately how much you can borrow.

Eligibility for the lowest rates

While Achieve advertises HELOCs starting at an APR of 6.24%, not all borrowers qualify for this rate. The lowest advertised rate applies to borrowers with:

- Debt-to-income (DTI) of 15% or lower

- Combined LTV of 50% or lower

- FICO score of 780 or higher

- Loan amounts from $15,000 to $150,000

- 10-year repayment term

- Autopay enrollment

Fees

Achieve charges no prepayment penalties, which is a plus if you want to close your line of credit early. However, the closing fees are on the higher end for HELOCs: $750 to $6,685, depending on the line amount and state. This includes origination (up to 3.5% of the line amount) and an underwriting fee ($725).

Using your line of credit

HELOCs by Achieve require you to draw the full line amount upfront. Then, you can pay the balance down and borrow again up to the loan limit throughout the five-year draw period. This structure can make budgeting more predictable, but it also means you’ll pay interest on the full line amount from day one.

Payments cover both principal and interest and are recalculated monthly based on what you still owe.

How to apply

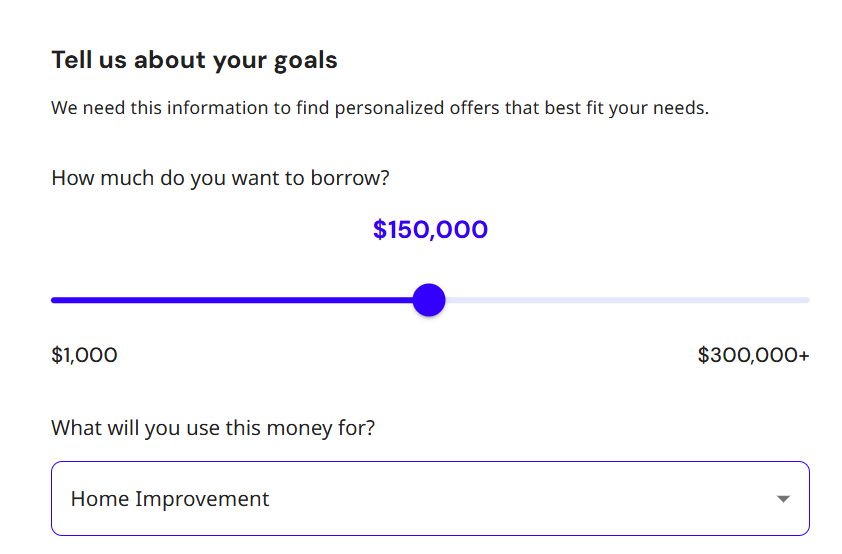

Achieve highlights a fast HELOC approval process, with application-to-funding in as little as 10 days. The “Get Started” button on the site takes you to a quick automated prequalification, during which you’ll need to disclose:

- Your street address

- How much would you like to borrow

- How you plan to use your HELOC funds (debt consolidation, home improvement, major purchase, etc.)

- Your annual income

Ratings and reviews

Achieve boasts excellent reviews, with a 4.8 TrustPilot score based on over 12,000 ratings, as of February 2026. Many customers praise the lender’s exceptional service, transparency, and quick, efficient processes.

For example, Carol writes, “Getting the HELOC was very easy and relieved a lot of stress for me … I was able to consolidate all of my outstanding balances and have extra money for improvements on my home.”

Alternatives

While Achieve offers a high-quality HELOC for borrowers with excellent credit, we always recommend exploring several options, whether for HELOCs or home equity loans. The following companies are among the highest-rated in the home loan product market.

Rates (APR)

6.24% – 13.25% fixed

8.35% – 16.55% fixed

6.99% – 15.49%

Loan amounts

$15,000 – $300,000

$15,000 – $750,000

$5,000 – $400,000

Min. credit score

600; 640 for 20- and 30-year terms

640, but 720+ advised

640, but 720+ advised

Figure

Figure is one of the top-tier HELOC providers, available nationwide except in New York and Hawaii. Its approval process is ultra-fast, sometimes taking just five days from applying to accessing funds. Figure charges no closing costs or annual fees.

Compared to Achieve, Figure offers more credit line flexibility: it approves HELOCs for second homes and investment properties, and issues loans up to $750,000.

Overall, it is among the most competitive options for borrowers with credit scores of 720 and up.

Aven

Aven’s major selling point is a Lowest Rate Guarantee: the lender states it will beat the rate on any competing HELOC product, or give the prospective client $250. Aven partners with Securian in an optional program that can cover HELOC payments for up to six months in case of a job loss.

Aven’s APR starts at 6.99%, with no closing or annual fees. They do, however, charge a 4.9% first-draw fee. The application process is fully digital, and approval can be as quick as 15 minutes. The lender caps its HELOCs at $250,000.

Recap: Achieve HELOC review

Achieve looks like a promising HELOC provider, with great rates for qualifying homeowners, a borrower-friendly application process, and excellent customer service. However, if you start with a lower credit score, prefer a traditional home equity loan, or need to borrow against a secondary home, you might want to look into other lenders.

How we rated Achieve’s HELOC

We designed LendEDU’s editorial rating system to help readers find companies that offer the best HELOCs and home equity loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Achieve to several home equity lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Achieve, Home Equity Line of Credit (HELOC)

- Achieve, Home Equity Loan FAQs

- TrustPilot, Achieve Reviews

Related articles

About our contributors

-

Written by Anna Twitto

Written by Anna TwittoAnna Twitto is a money management writer passionate about financial freedom and security. Anna loves sharing tips and strategies for smart personal finance choices, saving money, and getting and staying out of debt.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.