If you’re in college or plan to be, you’ll likely use financial aid to cover at least part of your tuition. Grants, loans, and work-study programs are all considered financial aid, and these tools make higher education more affordable for 85.5% of undergraduates.

Financial aid isn’t just for tuition, though. You can use it for any school-related expense: housing, meals, books, transportation, and even electronics.

Besides its uses, there’s much more to learn about how financial aid works. Let’s explore how financial aid can help you pursue an education—and how it can impact your finances after graduating.

Table of Contents

How does financial aid work for college?

The financial aid process starts with the Free Application for Federal Student Aid (FAFSA). The FAFSA is a form you fill out online where you’ll report your economic resources, like your income, assets, and bank account balances.

You’ll also share your citizenship status, age, and Social Security number or A-number (if you’re not a U.S. citizen). If you’re a dependent student, you’ll also report your parents’ Social Security numbers and financial information.

Among other criteria, you are not considered a dependent student if you have dependents of your own or are over age 24, a veteran, married, or under the care of a legal guardian other than your parents.

“The information you report on your FAFSA helps determine your Student Aid Index (SAI).

Schools use your SAI and estimated cost of attendance (COA) to determine your financial aid eligibility. Your SAI could consider your parents’ or your spouses’ available resources or yours alone.”

You can send your FAFSA to up to 20 schools, including community colleges, four-year universities, and trade programs. Each school will then send you a financial aid award letter.

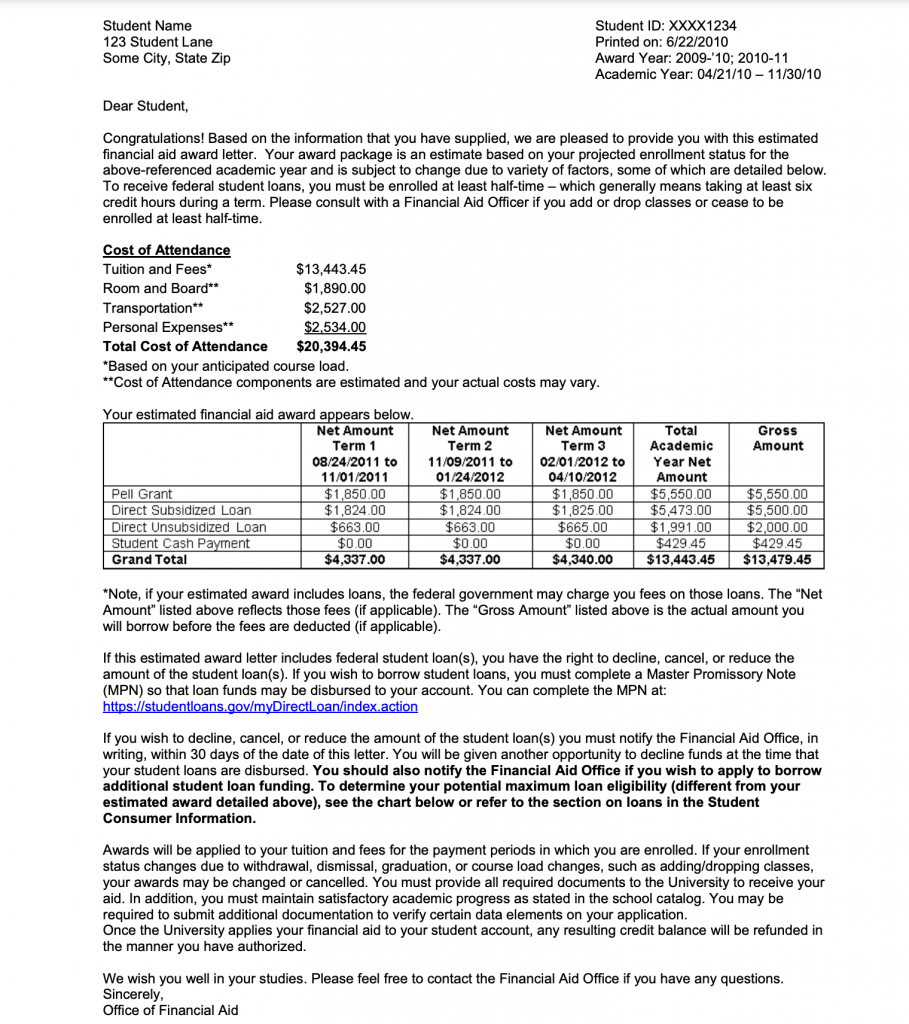

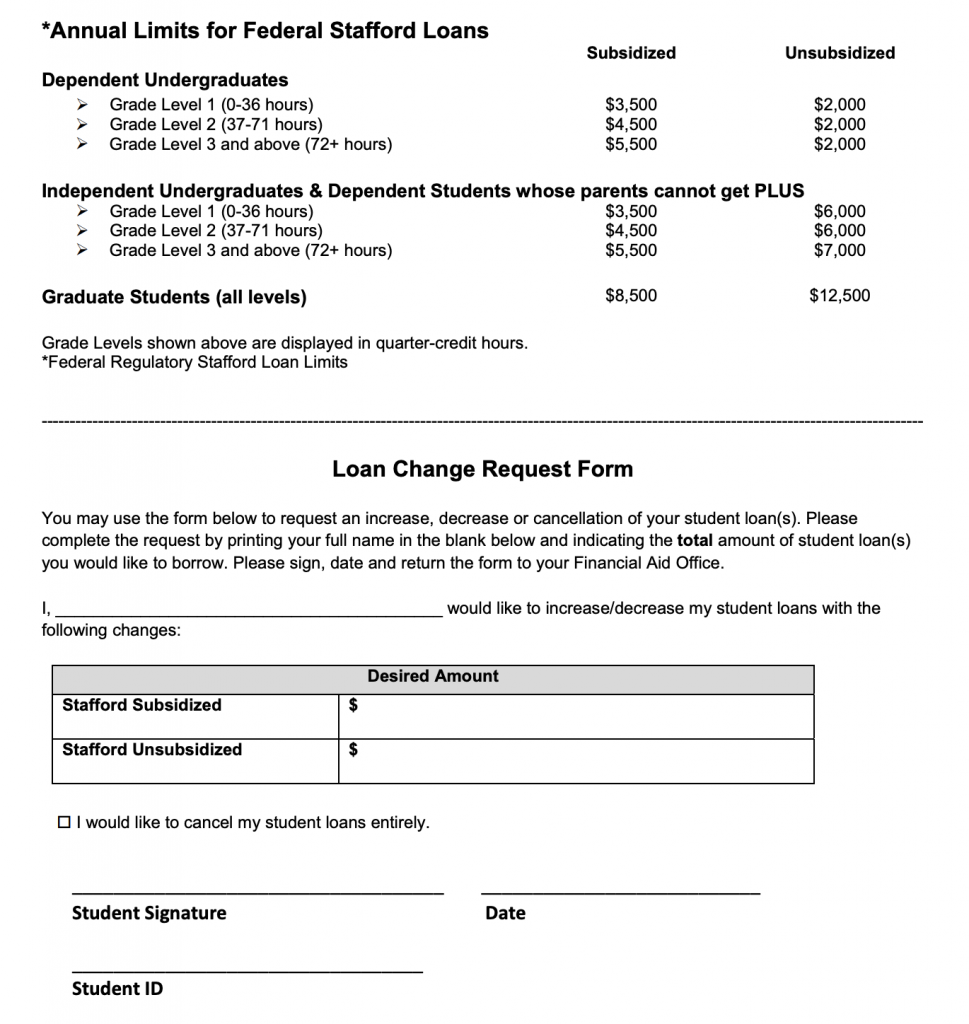

Every institution formats their award letters differently, but it’ll be similar to this sample from the U.S. Department of Education:

Your financial aid award letter will break down your COA into several categories: tuition, room and board, estimated transportation expenses, and estimated personal expenses.

Your award letter will also tell you how much aid you can receive from the following sources:

- Federal student loans: These are loans funded by the federal government. These often come with broader repayment options than private student loans. Note that private student loans won’t be listed on your award letter.

- Grants: In addition to Pell Grants, the federal government offers grants for future teachers, students with severe financial need, and surviving children of servicemembers who died in Iraq or Afghanistan. State governments may offer grants, as well.

- Work-study programs: Federal and state work-study programs connect eligible students with part-time employment to help them pay for education-related expenses.

- School-based scholarships: Many institutions offer scholarships. You may be automatically considered for scholarships when you apply for financial aid, or you may need to submit a separate scholarship application.

In addition to summarizing your aid, your award letter should include instructions on how to decline or adjust all or part of your financial aid package.

A good rule of thumb is to not accept more financial aid than you need, especially if your financial aid award primarily consists of student loans. We’ll discuss this in more depth, but if you take more aid than you need now, you could wind up owing more than you can repay later.

When deciding how much aid to accept, make sure you evaluate all potential costs associated with your planned major including some costs that may not be initially fully detailed (i.e. additional electronics, internships where you can’t work to supplement your income, a potential extra semester of school, etc.). So, in general, you would not want to take out more than you need.

Rand Millwood, CFP®

However, you might want to give yourself a buffer in the expected amount due to these potential unknowns. While you hate to pay back that additional few thousand, it can be better than putting yourself in a financial bind trying to finish your education.

What can I do if I don’t get enough financial aid?

On the other hand, your financial aid award may not be enough to cover your school expenses. If that’s the case, there are several ways to make up the difference. You can:

- Appeal the decision. Ask your institution to take another look at your circumstances. This isn’t guaranteed to increase your aid award, but it’s worth a shot, especially if your financial situation changed since completing your FAFSA.

- Apply for scholarships. Scholarship sources abound. Check with your school, local nonprofits, houses of worship, civic organizations, and professional associations related to your major. If you meet the eligibility criteria, apply as soon as possible.

- Ask your employer about tuition reimbursement. You could save thousands if your employer foots the bill for your education. This may come with caveats, however, like enrolling in a relevant degree program or staying with the company for a certain number of years.

- Set up a payment plan. Your school may offer tuition payment plans. You’ll likely have to pay a one-time setup fee, but you can break down your balance into manageable amounts rather than paying all at once.

- Apply for additional loans. You or a parent may be eligible for the federal Direct Plus Loan or private student loans from a bank, credit union, or online lender. These often come with higher interest rates and fewer protections than federal loans, but they’re worth considering if you can’t cover tuition out of pocket.

As a last resort, you could reduce the number of classes you take. Proceed with caution if you go this route, however. Taking fewer credit hours will lower your tuition bill, but it’ll also extend your time in school. And if you cut back too much, you may forfeit your financial aid altogether if you don’t meet the minimum enrollment requirements.

How do I renew my financial aid?

Financial aid is awarded annually. To renew your aid and continue receiving funding support throughout your education, complete the FAFSA every year, ideally before your state’s or school’s financial aid deadline.

You can still submit the FAFSA after the deadline, but you have the best chance at getting scholarships and grants if you submit early.

If other students complete their FAFSA and accept their financial aid before you, scholarship and grant funds may be depleted by the time your school receives your FAFSA. If you don’t submit the FAFSA, you won’t be eligible for financial aid.

How do I qualify for financial aid?

To qualify for financial aid, you must meet the following basic eligibility requirements:

- Be a U.S. citizen, permanent resident, refugee, or asylee

- Have a valid Social Security number or A-number

- Demonstrate financial need, as determined by your COA and SAI

- Have a high school diploma or GED

- Be enrolled in or accepted to an accredited degree or certificate program (including approved prison education programs for incarcerated students. Note that these students may be eligible for federal grants but not federal student loans.)

- Complete the FAFSA ahead of every academic year

You must also make satisfactory academic progress to maintain your financial aid eligibility. While each school defines this differently, you need to earn a high enough GPA and be on track to complete your program within a reasonable timeframe.

Some forms of financial aid (usually grants and scholarships) may have additional qualifications, like requiring you to declare a specific major.

If at any point you become ineligible for financial aid, reach out to your school’s financial aid office as soon as possible. They can guide how to regain eligibility and help you chart a path forward.

If you don’t meet citizenship requirements, you still have options. Many states offer discounted tuition for DACA recipients. You could also look into student loans for international students.

Depending on your level of need, you may be able to find sufficient help from free online resources or your financial advisors. If you have more detailed or nuanced questions due to your particular financial situation, you may need to hire a consultant to walk you through the document to ensure you can receive as much aid as necessary.

Rand Millwood, CFP®

The relatively small cost of this could be beneficial if it needs you the necessary aid, especially if they can assist in getting additional grants/scholarships that do not need repayment.

Does all financial aid need to be repaid?

Whether you need to pay back your financial aid depends on the type of aid you receive. Student loans usually must be repaid, while grants and scholarships typically don’t.

The exception is if you qualify for student loan forgiveness that erases all or part of your federal student loan balance. Similarly, if you fail to meet a grant’s conditions, you may have to repay those funds.

The federal TEACH Grant, for example, requires recipients to teach a high-need subject for four years in a low-income school. If you don’t fulfill this requirement within eight years of graduating, your grant will be converted into a student loan, with interest applied retroactively.

Here’s a quick summary of the types of financial aid you may receive and whether they need to be repaid:

| Type of aid | What it is | Must be repaid? |

| Federal student loans | Loan issued by the federal government | ✅ |

| Private student loans | Loan issued by banks, credit unions, or other private lenders | ✅ |

| Grants | Need-based financial aid | 🤔 |

| Scholarships | Merit-based financial aid | ❌ |

| Work-study programs | State or federal programs that match students with part-time jobs while in school | ❌ |

Repayment timelines vary, as well. When and how you repay private student loans depends on your lender. You’re generally not required to pay toward federal student loans while you’re enrolled at least half-time or within the first six months after you graduate.

However, your loans will still accrue interest during that time. Even if you’re not actively in repayment, you’ll save money—and potentially get a student loan interest tax deduction—if you pay down your balances while you’re in school.

What is the best form of financial aid?

The best forms of financial aid are those that don’t accrue interest and don’t require repayment. Here’s how you should prioritize the financial aid you accept, from least expensive to most expensive:

- Grants and scholarships

- Federal student loans

- Private student loans

Grants and scholarships won’t cost you anything if you maintain eligibility before and after graduating, effectively reducing or eliminating your education expenses.

If you must take out loans, exhaust your federal loan options before applying for private loans. Here are some of the most important differences between federal and private student loans:

| Federal student loans | Private student loans | |

| Eligible for forgiveness programs | ✅ | ❌ |

| Eligible for repayment programs | ✅ | 🤔 (only if the lender offers a repayment program) |

| Payments required while you’re in school | ❌ | 🤔 (depends on the lender) |

| Requires a credit check | ❌ | ✅ |

| Fixed interest rates | ✅ | 🤔 (depends on the lender) |

| Lower or higher interest rates? | ⬇️ | 🤔 (depends) |

However you fund your education, make sure you understand the terms and conditions and the long-term ramifications of the financial aid you accept.

The impact of student loans, in particular, warrants careful consideration. Student loans can impair your ability to qualify for other financing (like getting a mortgage). They can also eat up a significant portion of your disposable income when you enter repayment.

Still, the reality is that many students can’t attend school without student loans—and there’s no shame in that. If you borrow responsibly and proactively approach repayment, you can preserve your financial health without compromising your education.

About our contributors

-

Written by Sarah Sheehan, MAT

Written by Sarah Sheehan, MATSarah Sheehan is a writer, educator, and analyst who focuses on the impact of health, gender, and geography on financial equity. Her ultimate goal? To live beyond the confines of chasing the next dollar—and to teach everyone else how to do the same.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Rand Millwood, CFP®

Reviewed by Rand Millwood, CFP®Rand Millwood, CFP®, CIMA®, AIF®, is a partner at Guardian Wealth Partners in Raleigh, North Carolina. His firm assists clients of all ages and areas of life (with a strong background in the medical and legal fields) in planning, investing, and preparing for retirement and other financial goals.