Housing and meal plans—also known as room and board—are among the biggest college expenses after tuition. For the 2024–25 academic year, the average cost for room and board ranges from $10,390 at public schools to $15,250 at private schools.

This guide focuses specifically on how to cover those housing-related costs, whether you’re living in a dorm, apartment, or Greek housing. If you’re also looking for help with other living expenses—like textbooks, transportation, or personal items—check out our guide to student loans for college living costs.

Below, we break down your best options for paying for college housing and meal plans, including federal aid, scholarships, and grants. Private student loan funds can also be used to pay for college housing costs. Below we’ve listed our top picks for this purpose.

| Company | Rates (APR) | Rating (0-5) |

|---|---|---|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

3.29% – 15.99% fixed-rate APR w/ autopay included |

|

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

Table of Contents

Average student housing costs in 2026

Colleges and universities have discretion in deciding what to charge for room and board or what to allocate for off-campus living expenses. Factors that can influence what you pay include:

- Location

- Choice of school (private or public; two‑year or four‑year)

- Year of enrollment

- Average local housing costs

The average room and board cost for the 2024–25 academic year is:

- $13,310 at public four‑year institutions (on-campus, in‑state students)

- $15,250 at private nonprofit four‑year schools

Newer estimates for public four‑year colleges show that off‑campus room and board costs average about $13,5581—slightly higher than on‑campus room and board, primarily due to separate utility, food, and rent costs.

These average figures provide a helpful benchmark, but actual off‑campus living expenses can vary widely depending on factors like roommates, local rent rates, meal prep habits, transportation, and utilities.

Comparing the cost of on‑campus and off‑campus housing at your prospective school can help you determine which option stretches your financial aid award the farthest. There are cases where cooking and sharing a rental off campus can be cheaper than an all-inclusive dorm and dining package—but not always.

If you don’t complete the FAFSA, you will not be eligible for federal financial aid. You could still pursue scholarships and grants, but those often fall short of covering room and board. And remember: the FAFSA is a prerequisite for many state-backed aid programs as well.

Does FAFSA financial aid cover housing?

Yes, financial aid can be used to cover room and board. How financial aid is applied to housing expenses depends on whether you live on-campus or off-campus.

The Free Application for Federal Student Aid (FAFSA) is what schools use to decide how much aid you’re eligible to receive, which you can use to cover housing. When completing the FAFSA, you must indicate your intended housing plan for each school you list on the application. This step directly affects how the school calculates your financial need.

How to select a housing plan on the FAFSA

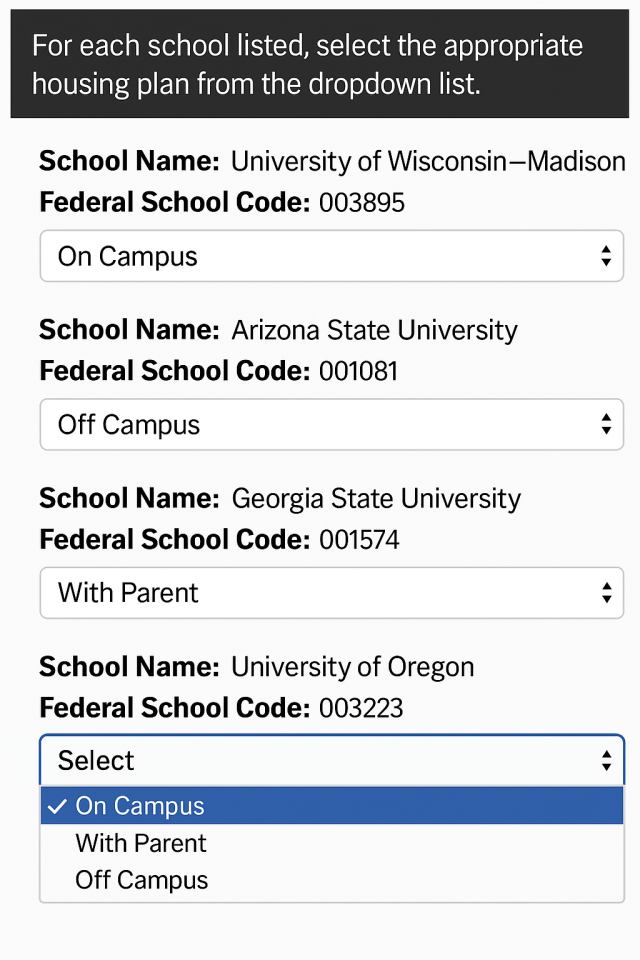

For each school you include on your FAFSA, you’ll be asked to select one of three housing options from a dropdown menu:

- On campus

- With parent

- Off campus (not with parent)

These selections appear in the “School Selection” section of the FAFSA form. Next to each school name, you’ll find a housing option menu where you make your selection based on where you expect to live during the academic year.

Here’s what this section of the FAFSA form looks like in practice:

This information is important because schools use it to calculate your cost of attendance (COA)—a number that helps determine your financial aid eligibility. Here’s how it breaks down:

- On-campus: The COA will include the school’s actual costs for dorms and meal plans.

- Off-campus (not with parent): The COA will include an estimated amount for rent, utilities, food, and other living expenses based on average local housing costs.

- With parent: The COA will include a smaller allocation for living expenses, since room and board at home typically cost less.

Choosing the wrong option—for example, indicating “with parent” when you plan to live in a dorm—could result in a lower financial aid offer, since the COA would be underestimated. Fortunately, you can update your housing plans later by logging back into your FAFSA and making changes or by contacting your school’s financial aid office directly.

Does financial aid cover dorms?

Yes, financial aid can cover room and board costs for students who live on-campus in a dorm. Note that some schools require students to live on campus for the first one to two years of enrollment before allowing them to move off campus.

When you receive financial aid, it’s typically disbursed to your school at the beginning of each term or semester. The school then applies the funds to your costs of attendance. Tuition and fees are paid first, followed by room and board.

On-campus room and board can include:

- Rent for the semester or term

- Utilities, including electric, water, and internet service

- Cable or satellite TV, if the school offers it

- Access to amenities, such as an on-site laundry room

- Parking

Any remaining funds after the school deducts room and board costs are turned over to you. The upside of living in a dorm on campus is that the cost of living is all-inclusive. You don’t need to pay rent or utilities separately; meal plans are often included, as are basic furniture and appliances.

Keep in mind that schools may rate individual dorms and rooms differently. For example, a private, single-occupancy room may cost more than a room you share with two or three other students. Likewise, you might pay more for a premium suite with a full kitchen versus a no-frills dorm room with a standard mini-fridge and microwave.

Does financial aid cover off-campus housing?

Yes, financial aid can cover housing for students who cannot or prefer not to live in a dorm. That includes students who live in private housing by themselves or with roommates. You can use financial aid to pay for:

- Rent

- Utilities, including internet service

- Cellphone service

- Food

- Parking and transportation

- Furnishings

Does financial aid cover renting an apartment?

Yes, if you live off-campus, the school doesn’t deduct money for room and board from your financial aid award.

Instead, it uses your aid to pay tuition and fees and then turns over any remaining funds to you.

You’re then responsible for paying rent, utilities, and other housing expenses from that money.

Does financial aid cover Greek housing? Fraternities and sorority houses

Greek housing works the same way when fraternity and sorority houses are privately owned. The school does not take money from your aid package for room and board; instead, it’s refunded to you, and you pay room and board, along with any other fees or dues, to the sorority or fraternity.

It’s important to research the available housing options at your school. That way, you can be realistic about the costs and understand which housing option is best for you. Always opt for free assistance, such as financial aid, grants, and scholarships, before considering loans. Having roommates and becoming a resident advisor are also excellent ways to reduce your costs. If you’re leaning toward off-campus housing, don’t forget to factor in additional expenses, such as utilities, transportation to and from school, and meals.

How to pay for college room and board: 6 ways

Getting an accurate estimate of your costs can help you decide how to pay for room and board. Your school financial aid office should be able to provide you with an estimated budget for on-campus room and board or off-campus living expenses for the academic year you plan to enroll in.

Once you have that number, you can begin exploring financing avenues. Here are six ways to pay for room and board in college, whether you plan to live on-campus or off.

| Funding option | What is it |

| Free federal financial aid | An application that determines eligibility for federal financial aid |

| Housing assistance grants | State-sponsored grants that don’t need to be repaid |

| Scholarships | Need- or merit-based awards that don’t need to be repaid |

| Resident advisor | Free or discounted room and board in exchange for a work commitment |

| Federal student loans | Fixed-interest-rate loans to pay for college |

| Private student loans | Loans to pay for college from private lenders |

1. Free federal financial aid

As we mentioned, completing the FAFSA is the first step if you’re seeking financial aid for room and board. Your aid package, which may include student loans, grants, and work-study, can pay for:

- Room and board if you live on campus

- Living expenses if you live off-campus

Federal student aid can also be used for tuition, fees, transportation, and other eligible education expenses. You’ll need to be enrolled at an eligible school and meet other basic requirements to qualify for federal aid options.

You can list up to 20 schools when you apply, and you’ll need to choose a housing option for each one. If you need to add more schools after submitting your FAFSA, you can go back and make changes to your application.

Completing the FAFSA as early as possible is important because some federal aid is first-come, first-served. You can submit your FAFSA online and track your application progress through the Department of Education website. If you’re a dependent student, you’ll need financial information for yourself and your parents to fill out the form.

2. Housing assistance grants

Some states offer grants that don’t need to be repaid to help students with housing expenses. The available funding can depend on what programs are offered in your state and where you plan to go to school.

If you’re unsure what housing grants might be available or how to apply, check with your school’s financial aid office. Your state department of higher education can also be a helpful resource.

Here are a few examples of state housing assistance grant programs if you’re interested in using this option to pay for room and board:

- Cal Grant B (California)

- PA Postsecondary Educational Gratuity Program (PEGP) (Pennsylvania)

- MASSGrant and MASSGrant Plus (Massachusetts)

You may be required to complete the FAFSA to apply for state housing assistance grants, even if you don’t plan to accept federal aid. State housing assistance grants may have deadlines or other requirements you need to meet to qualify, so it’s important to read through the details to ensure you’re eligible.

3. Scholarships

Scholarships are similar to grants because they don’t need to be repaid. You can use scholarships to pay for tuition and fees as well as room and board. Some are merit-based, meaning you’ll need a solid GPA and academic background to qualify, while others are awarded based on financial need.

Whether a scholarship permits you to use the funding for room and board can depend on the program. For example, if you get an athletic scholarship for the school, you might be able to use part of the money to pay for room, board, and meals while living on campus.

You can apply for more than one scholarship, assuming you meet each program’s requirements. Our scholarship guide offers a detailed breakdown of where to find scholarships. When considering which ones to apply for, pay close attention to application requirements as well as deadlines to ensure you’re not missing out on any opportunities.

4. Become a resident advisor

If you’re in your second year of college or later, you may consider taking on a resident advisor (RA) position to get free or discounted room and board.

Resident advisors or resident assistants live on campus in a residence hall. They have specific duties, including:

- Overseeing residents in their assigned areas to ensure that students are complying with housing rules

- Planning resident activities, such as game nights or volunteer events

- Helping to build connections between resident students and creating a sense of community

Being an RA is like having a job on top of managing schoolwork. Essentially, you’re on-call 24 hours a day, seven days a week. For that reason, it’s important to understand what’s involved to ensure you can juggle your responsibilities.

How the RA program works to pay for room and board can vary by school. At Northwestern University, for example, resident assistants are not billed for room and board and earn $500 per semester. RAs need to meet certain requirements to qualify for free or discounted room and board, such as maintaining a minimum GPA and satisfactory academic progress each semester.

5. Federal student loans

If you think you might need to borrow to pay for school, federal student loans are the first option to consider. You’ll need to complete the FAFSA to find out which federal loans you qualify for.

Federal student loans can offer low, fixed interest rates and flexible repayment options, including income-driven repayment. Depending on your career plans, you may be able to qualify for federal loan forgiveness, which can help you save on higher education costs.

The types of federal student loans you can use to pay for room and board include:

Federal student loans are disbursed to the school, not the student, to pay for tuition, fees, room, board, and other expenses. The amount you can borrow will depend on what type of loan you’re getting, your year of enrollment, and your dependency status.

6. Private student loans

Private student loans can offer an alternative for paying for room and board if you’ve exhausted federal student loan funding or you’re denied a federal loan for any reason. These loans come from private lenders, so you won’t need the FAFSA to apply. If you qualify, funding is usually disbursed to the school, not the student.

Many private student lenders offer funding you can use to cover up to 100% of the cost of attendance minus any financial aid received. That includes:

- Room and board costs if you plan to live on campus

- Living expenses if you plan to stay off campus

Private student loans can have fixed or variable rates and varying loan terms. Some lenders charge fees for private student loans, but not all do.

Compare the best private student loan lenders to see what rates you might pay and how much you can borrow.

Qualification for private student loans is typically based on credit history and income. Finding a cosigner with a good credit history could increase your chances of being approved and getting the best rates.

When researching private student loans to pay for college housing, we recommend comparing several lenders to find the best rates and terms. Here are our top picks for student loans to pay for college housing.

| Company | Rates (APR) | Rating (0-5) |

|---|---|---|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

|

3.29% – 15.99% fixed-rate APR w/ autopay included |

|

|

|

5.59% – 16.99% |

|

|

5.59% – 16.99% |

|

FAQ

Can a Pell Grant be used for housing?

Yes, Pell Grants can be used to pay for housing costs, including room and board for on-campus living or rent and utilities for off-campus housing. The grant is first applied to tuition and fees, and any remaining funds are refunded to you to use for other expenses, including housing, food, and transportation.

Keep in mind that the total amount you receive depends on your financial need, enrollment status, and cost of attendance at your school—so it may not cover all of your housing expenses.

Does financial aid cover housing for community college?

Yes, financial aid—including federal student loans, Pell Grants, and some state aid—can be used to pay for housing while attending a community college. Even though many community college students live at home or off-campus, the COA still includes an estimated housing allowance.

If you qualify for aid, funds are first applied to tuition and fees, and any leftover amount can be used for rent, utilities, and food. Just make sure to select the correct housing status (e.g., “with parent” or “off campus”) when completing the FAFSA.

Learn more about student loans for community college.

Does tuition include housing?

No, tuition does not include housing. Tuition covers the cost of instruction—your classes and academic services—while housing (room and board) is considered a separate expense. That said, both tuition and housing are included in your school’s COA, which determines how much financial aid you’re eligible to receive.

If you live on campus, your school may bill you for tuition, room, and meal plans together, but they are separate line items and not part of “tuition” itself.

Article sources

- College Board, Trends in College Pricing 2024

- College Tuition Compare, 4-Year Colleges 2025 Average Tuition

- Northwestern University, Resident Assistant (RA) Financial Aid

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.