If you’ve gotten your first student loan statement, you may feel overwhelmed by all the details.

The format for a student loan statement and the information you’ll find can vary depending on the type of student loans you have and your lender or loan servicer. However, these are the most important sections to focus on to develop a repayment plan and ensure on-time payments.

Table of Contents

What does a student loan statement look like?

Federal loan servicers and private lenders issue student loan statements, so your statement may not be identical to another financial institution’s.

Here are sample statements for federal and private student loans to give you a general idea of what you’ll find in yours and what it can mean.

Federal student loan statement example

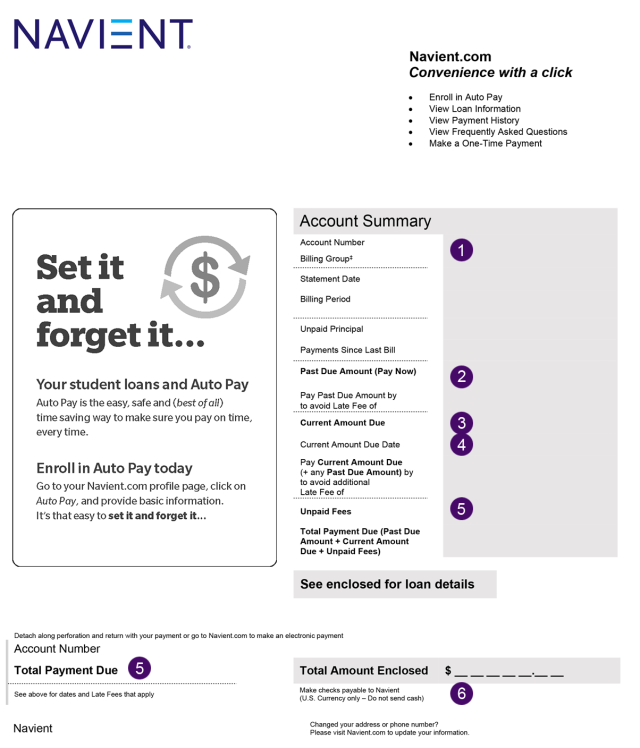

Private student loan statement example

How to read a student loan billing statement

The easiest way to understand your student loan statement is to focus on the main sections. Depending on your lender or loan servicer, these may look different or have different names. But they provide the information you need to manage your student loan debt.

Lender or loan servicer information

In most cases, you’ll find this information at the top of the statement. In addition to a name, you’ll see contact details for the customer service team and instructions to manage your account online.

Account summary

The account summary is often listed toward the top of the first page of your billing statement. It may include the following information:

- Account number: This number is unique to your account and includes all your loans with the same loan servicer or lender.

- Statement date: The date the lender or loan servicer issued the billing statement to you.

- Payments received since the last billing statement: This includes all payments you’ve made since your last statement date. In some cases, the financial institution may break it down into principal, interest, and fees.

- Current principal balance: This is the current amount you owe on your student loans.

- Past-due payments and late fees (if applicable): If you’ve fallen behind on payments, this is where you’ll see how much you owe on top of your current payment.

- Current amount due: This may be your current monthly payment or the total amount you owe, including past-due payments and fees.

- Due date: This is the date by which you’ll need to pay the total amount you owe.

Payment coupon

At the bottom of the first page of your student loan statement, you’ll likely see a payment coupon you can detach and use to make a payment via mail. The coupon will include your account information, the due date, the amount due, and the lender’s or loan servicer’s address.

It may also include a section for special payment instructions, such as paying more than the minimum amount due, making a partial payment, or putting extra payments toward a specific loan.

Making student loan payments online is often best to avoid potential delays. Setting up automatic payments from your bank account could qualify you for a discount on your interest rate while helping you avoid missing payments and late fees.

Loan details

Whether you have one or multiple loans with the same lender or loan servicer, you may get a breakdown of each one with the following details:

- Loan type: If you have federal student loans, this tells you which program your loans are in.

- Original principal balance: The original amount you borrowed.

- Interest rate: The lender uses this interest rate to determine your borrowing cost. With federal student loans, interest rates are fixed for the life of the loan. However, some private student loans have variable rates, which can fluctuate over time.

- Daily interest: The amount of interest that accrues each day on your loan based on the current principal balance and interest rate.

- Current loan details: You can see each loan’s current principal balance, monthly payment, and outstanding fees.

- Payments to date: This section may include a summary of the total amount you’ve paid on each loan, including principal, interest, and late fees. It may also include the payoff date.

Disclosures

Your student loan statement may also include various disclosures to give you more details about your debt. These disclosures may include:

- Past-due disclosure: If you’ve missed a payment, this section will encourage you to make a payment and provide information about potential consequences for remaining delinquent on your account.

- Autopay disclosure: If you’re enrolled in automatic payments, this section will verify that and possibly even provide the next date the lender will pull a payment from your account.

- General disclosures: At the end of your statement, you may find general account disclosures detailing different features and providing instructions to learn more.

Student loan statements can be straightforward if you know what information you’re seeking. Some mistakes I’ve seen clients make involve understanding the amount of interest accruing each month and how that affects the amount of principal you’re paying. For example, a $200 payment doesn’t knock down your balance by $200.

Kyle Ryan, CFP®

Another misunderstanding I’ve seen is when clients confuse the total payment they make with the amount applied to each individual loan. If you have multiple loans from multiple semesters, each requires its own monthly payment for interest charges.

How to get your student loan statement

Depending on the type of student loans you have and your lender or loan servicer, you have several options to access your monthly student loan statement:

- Mail: Unless you’ve opted in to electronic statements, your lender or loan servicer may mail you a copy of your statement each month.

- Email: If you’ve requested electronic statements, you might get an email with a link to your online statement each month on your statement date.

- Online account: Regardless of how you elect to get loan-related documents, you should be able to access current and past statements through your lender or loan servicer’s online account.

- Federal Student Aid website: If you have federal student loans with multiple loan servicers, you can log in to the Federal Student Aid website to get loan information and billing statements from each servicer in one place.

You can call your student loan servicer or lender to request to receive billing statements in your preferred method, whether that’s mail or email.

Kyle Ryan, CFP®

If you’re a recent graduate and are still waiting for information from your loan servicer, you can contact your school’s financial aid office or use the Federal Student Aid website to find out who your servicer is.

About our contributors

-

Written by Ben Luthi

Written by Ben LuthiBen Luthi is a Salt Lake City-based freelance writer who specializes in a variety of personal finance and travel topics. He worked in banking, auto financing, insurance, and financial planning before becoming a full-time writer.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Kyle Ryan, CFP®

Reviewed by Kyle Ryan, CFP®Kyle Ryan, CFP®, ChFC®, is a co-owner and financial planner at Menninger & Associates Financial Planning. He provides his clients with financial products and services, always with his clients' individual needs foremost in his mind.