With recent changes to student loan servicers and forgiveness programs, checking your student loans is more important than ever. We’ll show you how to quickly find out who your loan servicer is and get the details you need, whether your loans are federal, private, or a mix of both.

Table of Contents

How do I view my federal student loans?

Viewing your federal student loans is easy.

You can do this in the following ways:

- Log in to the FSA website

- Make a phone call

- Log in to your loan servicer’s website

- Visit your school’s financial aid office

FSA website

The most common way to view your federal student loans is to log in to the StudentAid website. To do this, you need your FSA ID and password. (It’s easy to retrieve your username or reset your password.)

Follow these steps to check your loan details:

- Visit the StudentAid website, and log in with your FSA ID.

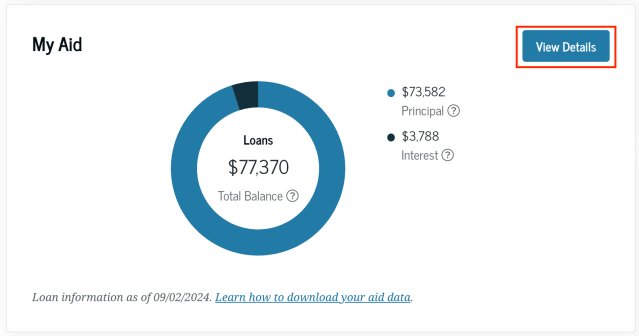

- In your dashboard, view “My Aid.” This shows a snapshot of your federal financial aid.

- See more about each loan by selecting “View Details” to the right of your loan breakdown.

By phone

You can also check your loans by calling the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

Loan servicer’s website

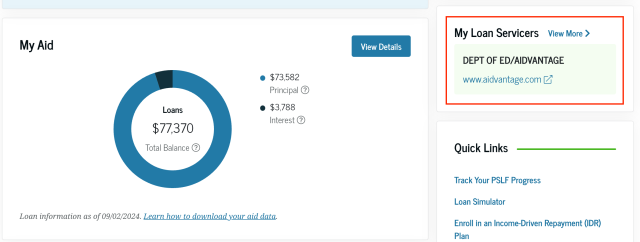

Accessing your student loan servicer’s site depends on your servicer, but StudentAid provides a link to your servicer’s website and contact information alongside your loan details.

School financial aid office

Your school’s financial aid office can also help you check your loan information. It has access to your federal loan servicers, balances, and other details you might need before reaching out to your servicer.

No matter which method you choose, we recommend taking note of the following as you gather your loan details.

Gather this loan information

- Loan servicer

- Monthly payment

- Principal balance

- Current balance

- Interest rate

- Due date

- Loan type

If you have several student loans with different servicers, this can help you budget and ensure you aren’t missing payments.

How to find your federal student loan balance

You can see your total balance, as well as the balances of each individual loan, by checking “My Aid” after logging in on the StudentAid website. You’ll also see how much of your balance is principal and how much is interest.

Click “View Details” to see more about each loan and balance.

What is the status of my federal student loans?

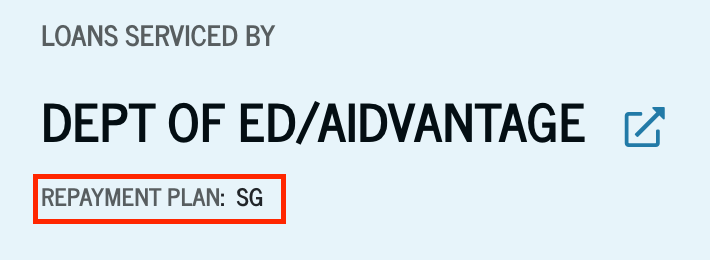

You can see the status of each loan on the StudentAid website by clicking “View Details” from your loan breakdown. If you scroll down on the page, you can view each student loan. A two-letter code indicates its status.

Common statuses include:

| Code | What it means |

| RP | In repayment |

| FB | Forbearance |

| IG | In grace period |

| IA | Loan originated |

| DA | Deferred |

| DU | Defaulted, unresolved |

| IM | In military grace |

| PF | Paid in full |

| SG | Subsidized graduation |

Knowing the status of your federal loans will help ensure none are delinquent or in default. It’s also helpful when determining which loans are in repayment.

How do I view my private student loans?

Private student loans won’t appear on the Federal Student Aid website. To find them, check your credit report or billing statements for the lender’s information.

To view your loan details:

- Log in to your private lender’s website.

- Locate your student loan account under your profile.

- Review loan details like balances, due dates, and monthly payments.

Your school’s financial aid office may also provide information on your private loans.

How do I find my private student loan balances?

No centralized website exists to see your total private student loan balance. If you have private student loans with several lenders, you must get your balance from each lender. You can add up your balances using a spreadsheet or calculator—or use one of several student loan payment and budgeting apps to make it easier.

If you have difficulty managing and tracking your private student loans, consider refinancing them all into one loan.

What is the status of my private student loans?

To find the status of your private loans (e.g., repayment, deferment, forbearance), check your lender’s website, review your latest statement, or contact your lender directly. Online access is the easiest way to keep track of your loans and ensure on-time payments.

Common statuses include:

- Repayment

- Grace period

- Deferment

- Hardship forbearance

- Default

- Delinquent

If your loan is delinquent or in default, contact your lender to explore options for getting back on track.

FAQ

How do I find all my private student loans?

To find all your private student loans, start by checking your credit report, which will list any lenders that have provided loans in your name. You can obtain a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—at AnnualCreditReport.

You can also review any loan statements or bills you’ve received from private lenders. If you’re still unsure, contact your school’s financial aid office; it may have records of any private loans you took out during your time as a student.

What is the difference between federal and private student loans?

The U.S. Department of Education issues federal student loans, while banks, credit unions, or other financial institutions offer private student loans. Federal loans often come with more flexible repayment options and eligibility for forgiveness programs, while private loans typically require a credit check and have fewer repayment protections.

Can I consolidate my federal and private student loans together?

No, you cannot consolidate federal and private student loans together through federal programs. However, you can refinance both types of loans through a private lender, which can combine them into one payment. Keep in mind that refinancing federal loans with a private lender will make you ineligible for federal loan protections, including income-driven repayment and loan forgiveness.

Are there apps to help manage and pay off my student loans?

Yes, several apps can help you manage and pay off your student loans. Popular options include Changed for student loan-specific tracking and YNAB for budgeting. Check out our detailed list of apps that can assist with student loan management.

About our contributors

-

Written by Seychelle Thomas

Written by Seychelle ThomasSeychelle is a financial professional of seven years turned personal finance writer. She's a Nav-certified credit and lending expert who enjoys exploring debt consolidation, budgeting, credit, and lending topics.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.