A home equity line of credit (HELOC) lets you draw on a credit line multiple times, up to a certain limit, while a home equity loan (HELOAN or HEL) lets you borrow a single lump sum.

A HELOC may be better suited for ongoing expenses, such as college tuition or a large renovation project, while a home equity loan may be better for one-time costs.

There are several nuances to consider when looking at a HELOC versus a home equity loan. Find out the details on how each one works, the pros and cons of both, and how to compare your options.

Table of Contents

What is the difference between HELOCs and HELOANs?

Home equity loans and home equity lines of credit both use your home equity as collateral for financing. As a homeowner, you may be able to borrow 85% of your home equity, assuming your income and credit are strong enough for the estimated payments.

Home equity-based financing means lower interest rates than other financing alternatives, such as credit cards or personal loans. But a HELOC and a home equity loan can put your house at risk of foreclosure if you fall behind on your payments.

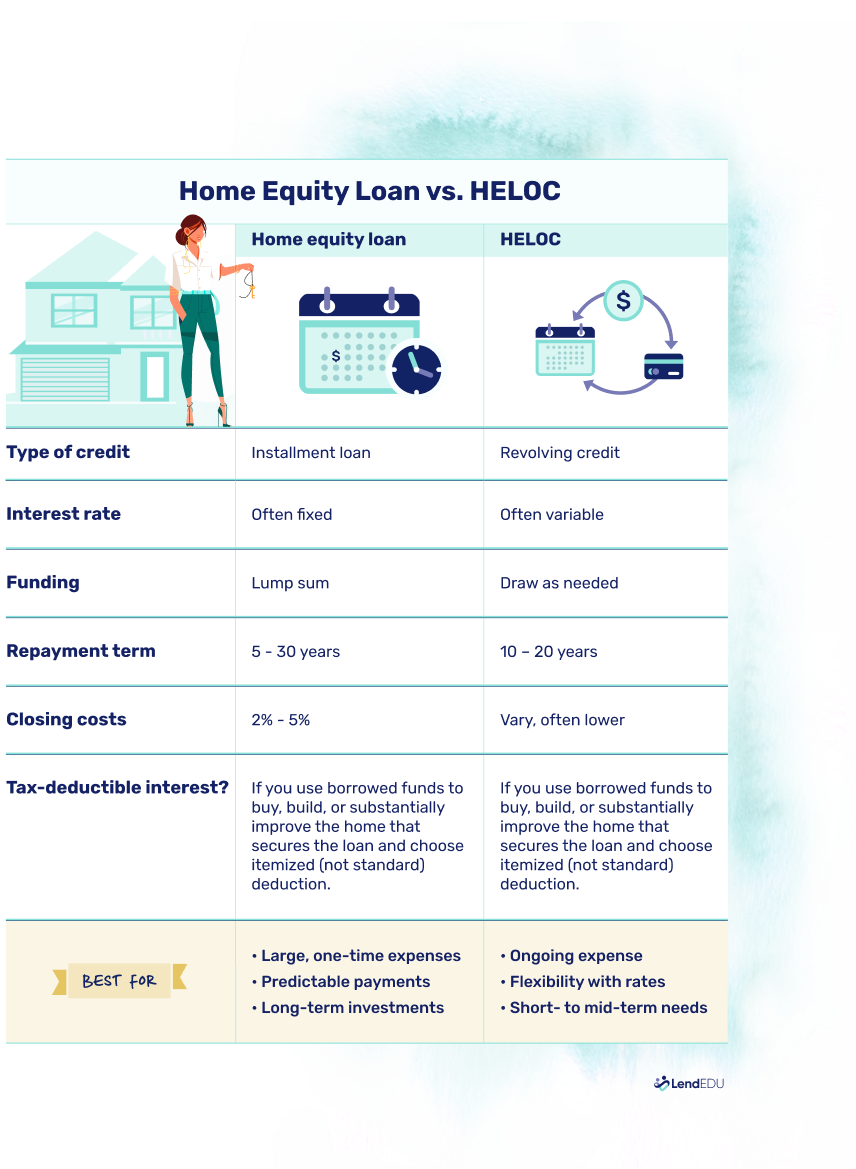

Beyond those similarities, the structure and repayment process vary for home equity loans and HELOCs. Here’s a look at the key differences.

HELOC vs. HELOAN direct lender comparison

View Rates

View Rates

|

View Rates

View Rates

|

|

| Rates (APR) | 5.99% – 18.00% | 8.10% – 18% |

| Rates (APR) | Rates (APR) | |

| 5.99% – 18.00% | 8.10% – 18% | |

| Loan amounts | 5, 10, 20 years | $25,000 – $500,000 |

| Loan amounts | Loan amounts | |

| 5, 10, 20 years | $25,000 – $500,000 | |

| Repayment terms | 5, 10, 20 years | 5 – 30 years |

| Repayment terms | Repayment terms | |

| 5, 10, 20 years | 5 – 30 years | |

| Max. LTV | 85% | 90% |

| Max. LTV | Max. LTV | |

| 85% | 90% | |

What is a HELOC?

A HELOC is a form of revolving credit that allows you to draw on your credit line on your own schedule. Most lenders provide a checkbook or credit card attached to the account. The interest rate is often variable, but only your outstanding balance is charged. Some lenders charge you a fixed rate with each draw.

HELOCs are divided into two stages: the draw period, which typically lasts for 10 years, followed by a repayment period that lasts another 10 to 20 years. Depending on your lender, you may be able to convert your variable rate to a fixed rate during repayment, which can help keep monthly payments more predictable.

While each lender has its own borrower criteria, most home equity loan and HELOC requirements include the following:

- Minimum credit score: Usually between 620 and 640

- Income and debt-to-income ratio (DTI): Helps determine affordability for your monthly payments based on other debt responsibilities; maximum DTI might be around 50%

- Equity: Many lenders require your loan-to-value ratio (LTV) to be at least 15%

Real-life example: Jason’s daughter was starting college, and while he had a general idea of tuition and housing costs, he wasn’t sure what extra expenses would arise each semester. He opened a HELOC with a 10-year draw period, allowing him to pay for books, travel, and fees as needed without taking on unnecessary debt all at once.

What is a HELOAN?

A home equity loan is an installment loan, which means you’ll repay your balance with fixed monthly payments over a certain period. Interest rates are usually fixed, and so is the amount you borrow. These firm numbers can make it easy to plan your budget.

Payments are spread out over five to 30 years, which could keep your payments quite low. The downside is that you’ll be in debt longer with an extended repayment period.

Like a mortgage, a home equity loan usually comes with closing costs paid to the lender. The range is 2% to 5%. For example, based on those percentages, closing costs for a $50,000 home equity loan could total $1,000 to $2,500, due at closing.

Real-life example: Maria wanted to add a full in-law suite to her home to accommodate her aging parents. She estimated the entire renovation would cost $85,000 and preferred to know exactly what her monthly payments would be. With a fixed interest rate and a 20-year term, a home equity loan allowed her to lock in a predictable monthly payment and stick to her renovation budget without surprises.

HELOC vs. home equity loan pros and cons

HELOCs also have pros and cons compared to a home equity loan.

HELOC pros and cons

Pros

-

Flexible funding amounts

Instead of being limited to a one-time amount as you are with a home equity loan, a HELOC allows you to draw up to your credit limit over time. A typical draw period of 10 years can provide a long-term financial cushion.

-

Interest only charged on the balance

Interest only accrues on your outstanding HELOC balance. As you pay off your balance, your credit line replenishes in case you want to borrow more in the future.

-

Lower or no closing costs

Some HELOCs don’t have closing costs, unlike home equity loans. This can save you upfront cash.

Cons

-

Payments could increase

Because most HELOCs have variable interest rates, it can be hard to know what to expect to pay for your future payments.

-

Could overspend

Access to a credit line could tempt you to draw funds for non-emergency or unplanned expenses. It’s smart to have a specific strategy for using your HELOC instead of taking withdrawals on a whim.

-

May pay fees

Some HELOCs charge various fees, including an annual fee to maintain the account, an inactivity fee if you don’t use your account, a cancellation fee if you close your account early, and a conversion fee if you transfer your balance from a variable to a fixed rate.

Here are the pros and cons to consider with a home equity loan compared to a HELOC.

HELOAN pros and cons

Pros

-

Fixed interest rate

Home equity loan rates are usually fixed, so even if rates rise in the future, your payments will remain the same.

-

Predictable payoff period

Set monthly payments make it easy to budget for your home equity loan, which can give you more confidence in its affordability over the long term.

-

Longer repayment term

Repayment terms might last as long as 30 years, which can keep your monthly bill low.

Cons

-

Must borrow a lump sum

Unlike a HELOC, home equity loans aren’t set up to let you borrow more cash in the future without submitting a new loan application.

-

Closing costs could be higher than a HELOC

You could pay as much as 5% of the loan amount at closing, which might add thousands of dollars to the total cost of the loan.

Do both options sound attractive? It’s also possible to have both a home equity loan and a HELOC at the same time if you meet the eligibility requirements.

Which is better: a HELOC or home equity loan?

Home equity loans and HELOCs are structured differently, so the right choice depends on how you plan to use the funds. Here’s a quick overview of when to choose a home equity loan or HELOC, plus more considerations below.

| Choose a home equity loan if… | Choose a HELOC if… |

| You have a large one-time expense | You have an ongoing expense or don’t know how much money you need |

| You’re prone to drawing more than you need | You’re confident in how you plan to withdraw funds |

| You want a set monthly payment | You have flexibility in your repayment budget |

Typically, if the amount is a one-time large expense that they know they need, I recommend that my clients first shop around for the best terms for a home equity loan.

However, due to the higher interest rates we have been experiencing, clients want to avoid locking in a fixed rate and instead choose to shop for a favorable HELOC with a variable rate that meets their funding goals.

Ultimately, it depends on the amount they need, the interest rate environment, the housing market, and their risk tolerance.

Erin Kinkade, CFP®

When to choose a HELOC

- Best for ongoing or unknown expenses: A HELOC is well-suited for major renovations with multiple phases or tuition payments spread out over several years.

- Best for confident budgeters: If you know how you’ll use your HELOC and that you’ll stick to it, having a credit line at your fingertips can be an appropriate choice.

- Best for flexible budgets: It’s difficult to calculate your exact HELOC repayment amount because variable interest and your outstanding balance can change over time. A HELOC may be better for individuals with flexibility in how much they can pay.

When to choose a HELOAN

- Best for a one-time expense: Examples may include major life events, such as a wedding or adoption, or a small renovation with just one or two contractor payments.

- Best for sticking to a budget: A home equity loan doesn’t offer the temptation of drawing additional funds because you only have access to a one-time payment. If you’re unsure how easy it would be to manage a HELOC, this could be a better choice.

- Best for fixed payments: It’s easier to plan your payoff with a home equity loan because you have a clear timeline and monthly payment. If you’re comfortable with those numbers, you can feel confident about staying on top of your payments each month.

Real-life example: Choosing a HELOC over a HELOAN in a rising-rate environment

Lauren considered taking out a $50,000 home equity loan to renovate her kitchen and bathrooms. However, fixed-rate loans had recently jumped to nearly 10%. Instead, she opted for a HELOC with an initial variable rate around 7%, planning to pay off the balance quickly over the next two years. The flexibility helped her save on interest and borrow only what she truly needed.

Recap: HELOC vs. home equity loan

| Detail | HELOC | Home equity loan |

| Rates | Variable | Fixed |

| Amounts | Percentage of your equity | Percentage of your equity |

| Draw period? | 10 years | None |

| Repayment terms | 10 – 20 years | 5 – 30 years |

| Best for | Ongoing expenses | One-time costs |

About our contributors

-

Written by Lauren Ward

Written by Lauren WardLauren Ward is a personal finance writer who regularly covers topics like mortgages, real estate, tax relief, home equity, business loans, and investing.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.