A home equity line of credit (HELOC) lets you borrow against your home’s equity as needed, but before a lender can approve you, it must verify your identity, income, assets, and property details. That means gathering several key documents early in the process.

Understanding exactly what lenders look for can help you prepare your application and avoid delays. Here’s a closer look and complete checklist of. the documents you should be ready to provide.

Advertisement

Best Traditional HELOC

- 12-month introductory rate starting at 6.99%1

- Fixed-rate HELOCs w/ joint applicants

- $0 application, origination, and appraisal fees

- $0 closing costs

- Submit a joint application to see your eligibility

Table of Contents

- What documents are needed a HELOC? A checklist

- When are extra documents needed for a HELOC?

- How do I submit my documents to the lender?

- What documents does the lender provide?

- Should a HELOC co-applicant provide the same documents?

- What do I need to apply for a home equity loan?

- Recap: HELOC document checklist

What documents are needed a HELOC? A checklist

The documents needed for HELOC applications are similar to what most lenders require when applying for a mortgage. Lenders ask for documents to verify your identity, income, assets, and property details.

Personal information documentation

The lender will first want to verify that you’re the person whose name is on the HELOC application. Expect to provide:

- Your name, date of birth, and Social Security number.

- Your current address (and previous address, depending on how long you’ve been in your current home).

- Your employer’s name and address.

- A valid copy of a government-issued photo ID, such as a driver’s license or state identification card.

The lender will use your name and Social Security number to obtain your credit reports, which it will need to approve your HELOC application. Your lender will ask for permission before it checks your credit.

Income and asset documentation

The next set of documents you’ll need for a HELOC application covers your income and assets. The lender uses this and your credit reports to determine your ability to repay what you borrow.

The documentation you’ll need to verify income can depend on whether you’re employed in a traditional job, self-employed, retired, disabled, or receiving domestic support payments.

The income documents you may need to apply for a HELOC include:

- Pay stubs for the previous 30 days.

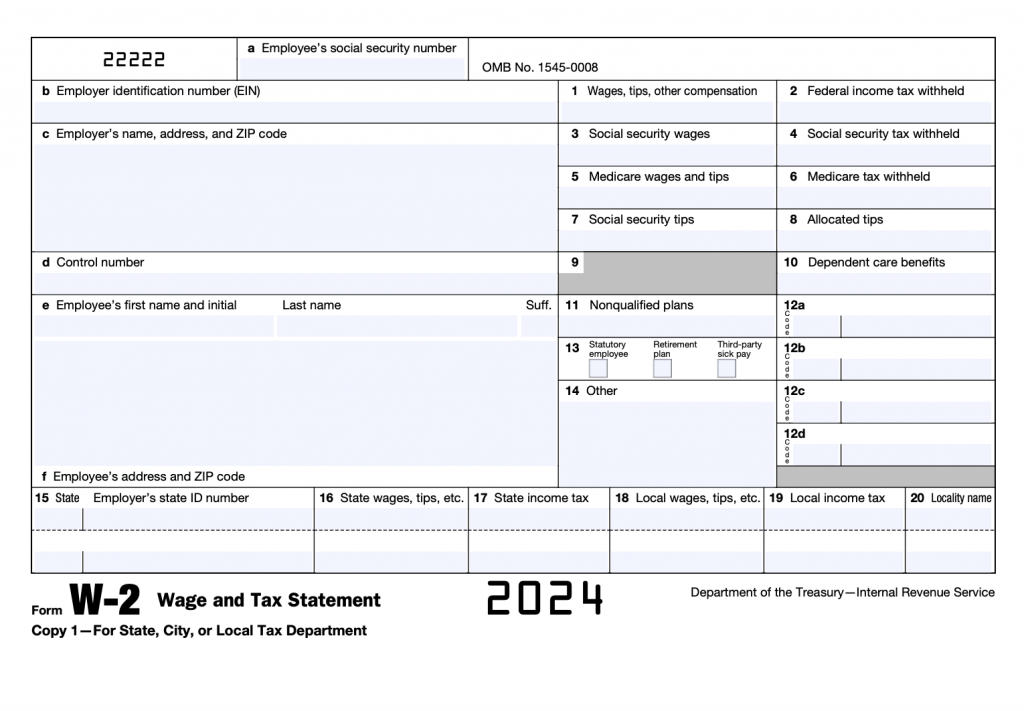

- W-2 forms for the previous two years to verify earnings.

- Current-year profit-and-loss statement (if you’re self-employed).

- Tax returns for the previous two years (if you’re self-employed).

- Disability, Social Security, or pension income award letters. (You may also substitute bank statements or 1099s to show proof of these types of income.)

- Documentation of retirement account distributions, including award letters, bank statements, or tax forms.

- Alimony and child support documentation, which can include a divorce decree, divorce settlement document, court order, or bank statements showing deposits made to your account.

Lenders also consider certain assets to demonstrate your ability to pay. Asset documentation can include:

- Bank account statements for the previous two months.

- Investment and retirement account statements for the previous two months.

This may exclude assets you hold on another’s behalf. For example, if you have custodial bank accounts or 529 college savings accounts set up for your children, the lender may not need to see documentation of these.

Property documentation

The final piece of the puzzle is the home itself. The lender will want to know how much you owe on the mortgage, what the home is worth, and how much insurance you have.

Required documentation often includes:

- A copy of your homeowners insurance declarations page, which you can get from your insurer.

- A copy of your most recent property tax bill.

- Your most recent mortgage statement showing the balance due and escrowed amounts for homeowners insurance, property taxes, private mortgage insurance, or homeowners association fees.

- A copy of your flood insurance declaration if your property is in a flood zone.

Most of the time, you’ll also need an appraisal to apply for a HELOC. Once you submit your application, the lender will schedule the appraisal to determine the home’s value.

When are extra documents needed for a HELOC?

The documentation you’ll need for a HELOC depends on your situation. If you think special circumstances apply to you, it’s helpful to know whether a lender might request any extra documentation to process your application.

Here are several examples of when additional documents might be necessary.

You’re self-employed

Self-employment means you don’t draw a regular paycheck from an employer. As such, lenders may scrutinize your income to ensure you can repay a HELOC.

Instead of pay stubs or W-2s, your lender might ask for:

- Two years’ worth of personal and business tax returns.

- A copy of your profit-and-loss statement for the current year.

- A copy of your business balance sheet.

- Business and personal bank account statements.

- A brief personal statement that explains your financial status and ability to repay a HELOC.

Your lender may also request a letter of verification proving you’re self-employed. For instance, if you’re a freelancer, you may need to provide a letter from one or more clients attesting to your status as an independent contractor.

You’re retired or disabled

Retirement often means you replace your paychecks with pension income, retirement account distributions, Social Security benefits, or some combination of these. If you’re disabled, you might rely on Social Security disability benefits as your primary source of income.

In either case, you might need the following documents to apply for a HELOC:

- Tax returns for the previous two years.

- Social Security retirement benefits or disability benefits award letter.

- Pension award letter.

- Retirement or investment account statements.

- A copy of a lease agreement if you draw rental income from a property you own.

Your lender may permit you to substitute bank statements for other income documentation if you show recurring retirement or disability income deposits.

You live in a flood plain

Living in a flood zone can heighten risk when applying for a HELOC. Lenders may expect to see a declaration of flood insurance to approve you.

If you’re required to provide proof of flood insurance, you’ll provide your:

- Policy term

- Coverage amount

- Premium

Your insurance company should be able to provide you with a declaration or send it to the lender on your behalf.

How do I submit my HELOC documents to the lender?

The process for submitting documents needed for a HELOC can depend on what’s required and the lender.

You can apply for a HELOC one of three ways:

- Online

- By phone

- In person

If you’re applying online, the lender may allow you to upload and submit documents electronically. This can save time, and you may be able to get preapproved to check your rates.

However, you might be more comfortable applying for a HELOC over the phone or in person. In that case, the lender may ask you to provide original or duplicate hard copies or share a link to an online portal where you can submit documents.

What documents does the HELOC lender provide?

There are some documents you don’t have to provide yourself when applying for a HELOC. Instead, the lender collects these documents for you. Note that a fee might apply for that convenience.

The lender is responsible for documents including:

- Your credit reports: The lender uses these to gauge your creditworthiness. Once you consent, the lender pulls your credit reports from the major credit bureaus. You might see a credit report fee of $15 to $75 in your HELOC closing documents.

- The appraisal: An appraisal is necessary for a HELOC to determine what the home is worth. The lender will order the appraisal, and you’ll pay a fee. Appraisal fees total around $350 on average, depending on your location and home size.

Your closing paperwork should include a breakdown of the fees you’ll pay the lender and what they cover. Typical closing costs for a HELOC are 2% to 5% of the loan amount.

Should a HELOC co-applicant provide the same documents?

If you’re completing a joint HELOC application with a spouse or co-homeowner, you’ll both need to provide the required documentation.

These can include:

- Photo ID

- Social Security numbers and birthdates

- Employment information

- Pay stubs, W-2s, and tax returns

- Bank account statements

- Investment account statements

Lenders can look at both your credit histories and debt profiles, as well as your income and assets, when determining whether to approve you for a HELOC. Applying for a joint HELOC could allow you to qualify for a larger credit line if you both have good credit histories.

What do I need to apply for a home equity loan?

You’ll generally need the same documents for a home equity loan as you would for a HELOC, since both products rely on your home equity as collateral. Most lenders verify your identity, income, assets, and property details using the same standard paperwork.

However, there are a few situations where lenders may ask for additional documentation for a home equity loan:

- If you’re consolidating debt: Some lenders require payoff statements for the accounts you plan to pay off. This allows them to send the funds directly to your creditors at closing, which some lenders prefer for accuracy and fraud prevention.

- If you’re borrowing for home improvements: A lender may request contractor bids, renovation plans, or written project estimates, especially if the loan offers different rates or higher maximum loan amounts for improvement-related use cases.

- Because the loan has a fixed monthly payment: A home equity loan works like a traditional installment loan, so a lender might ask for additional income verification such as more recent pay stubs or updated tax documentation to ensure you can comfortably handle a new fixed payment.

Some HELOC lenders may ask for these extra documents too, though it’s generally less common.

Recap: HELOC document checklist

- Name, date of birth, and Social Security number.

- Current address (and possibly previous address)

- Employer’s name and address.

- Valid copy of a government-issued photo ID, such as a driver’s license or state identification card

- Pay stubs for the previous 30 days

- W-2 forms for the previous two years to verify earnings

- Current-year profit-and-loss statement (if you’re self-employed)

- Tax returns for the previous two years (if you’re self-employed)

- Disability, Social Security, or pension income award letters.

- Documentation of retirement account distributions, including award letters, bank statements, or tax forms

- Alimony and child support documentation

- Bank account statements for the previous two months

- Investment and retirement account statements for the previous two months

- Copy of homeowners insurance declarations page

- Copy of most recent property tax bill

- Most recent mortgage statement showing the balance due and escrowed amounts for homeowners insurance, property taxes, private mortgage insurance, or homeowners association fees.

- Copy of flood insurance declaration if your property is in a flood zone

Find out more about how to apply for a HELOC.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.