Struggling to make student loan payments? You may have options like forbearance or deferment. Both let you temporarily pause payments, but they work differently—deferment may allow you to avoid interest on certain federal loans, while forbearance always accrues interest.

Understanding forbearance vs. deferment student loans is key to making the right choice based on your financial situation. This guide breaks down the differences, eligibility, and long-term impact of each option to help you decide the best path forward.

Table of Contents

- What’s the difference between forbearance vs. deferment for student loans?

- Forbearance vs. deferment for your student loans: Which is the best?

- How does student loan deferment work?

- How does student loan forbearance work?

- Should you consider income-driven repayment vs. deferment or forbearance?

- Can you get forbearance or deferment on student loans if your loans are in default?

What’s the difference between forbearance vs. deferment for student loans?

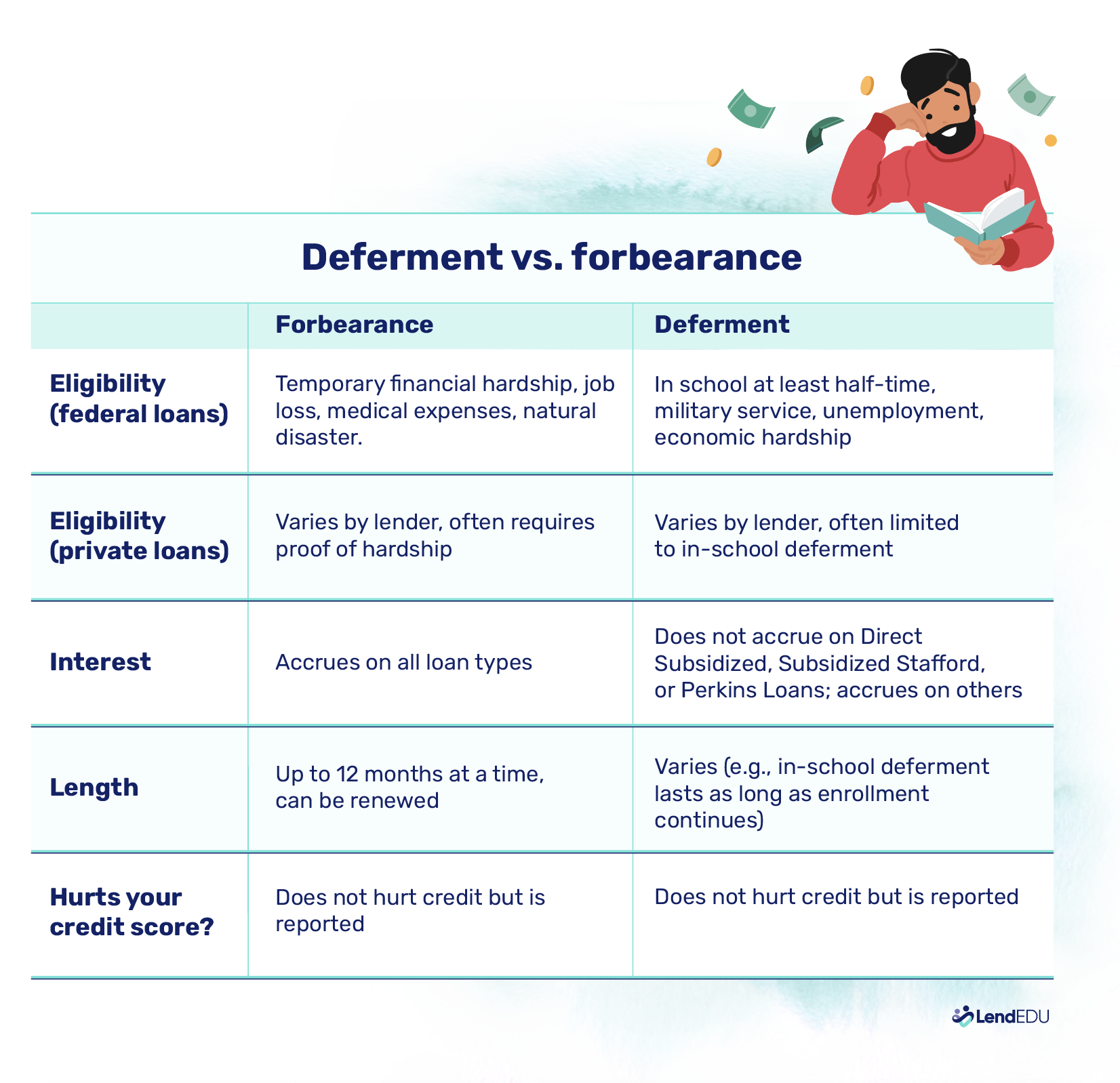

The main difference between deferment and forbearance is how interest accrues. With forbearance, interest accrues on all student loans. With deferment, interest does not accrue on certain federal loans, including Direct Subsidized Loans, Subsidized Federal Stafford Loans, and Perkins Loans. However, interest continues to accrue on Direct Unsubsidized Loans, PLUS Loans, and most private loans during deferment.

Eligibility also varies. For federal student loans, deferment is typically available if you are enrolled at least half-time in school, serving in the military, unemployed, or experiencing economic hardship. Federal forbearance is granted at the servicer’s discretion for short-term financial issues like job loss, medical expenses, or a natural disaster, though some mandatory forbearance options exist.

For private student loans, deferment and forbearance policies vary by lender—some offer limited options, while others may not offer them at all.

Forbearance vs. deferment for your student loans: Which is the best?

Choosing between forbearance and deferment depends on your personal situation and how long you need to pause your payments. Before applying for deferment or forbearance, ask yourself a few questions.

- What type of loans do I have? If I have federal loans, are the loans Direct Subsidized Loans or Direct Unsubsidized Loans?

- How long do I need to pause my student loan payments?

- If I’m experiencing financial hardships, is it a short-term problem or a long-term one?

- Can I handle my student loan balance increasing if my lender pauses my payments?

Below are examples of common scenarios and which choice would be a better option.

| Consider deferment if… | Consider forbearance if… |

| You are actively serving in the military. | You’ve been laid off from your job. |

| You’re experiencing economic hardship. | You are having significant financial trouble. |

| You are enrolled in college or a graduate program. | You’ve been affected by an unplanned emergency or natural disaster. |

| You’re going through cancer treatments. | You have a severe illness. |

Remember: With forbearance or deferment, the debt is not going away, but the payments are being paused until you are in a better financial condition. You should use these options if you meet the eligibility criteria; either way, it’s a benefit put in place because we might all experience bumps in the road.

How does student loan deferment work?

Student loan deferment allows you to pause your student loan payments for a specific period. If you have Direct Subsidized Loans, your loans will not accrue interest during deferment. Deferment doesn’t hurt your credit but is noted on your credit report.

To apply, contact your student loan servicer and submit documentation showing you’re eligible for deferment. This might include military service records or medical records. Once you’ve submitted the documentation and filled out any other necessary forms, continue making your student loan payments until your lender approves you for deferment.

Calculate your new payment

Use our calculator to see how much your loan payment would be before and after deferment. If your loan accrues interest during deferment, your total balance can increase. It’s smart to see your ending balance to help you decide whether deferment is right for you.

For example, if you have a $20,000 student loan with a 10-year term and 7.05% interest rate, here’s how deferment can change your monthly payment and loan balance:

| Description | Before deferment | After deferment |

| Loan amount | $20,000 | $21,410 ⬆️ |

| Interest rate | 7.05% | 7.05% |

| Loan term | 10 years | 10 years |

| Monthly payment | $233 | $249 ⬆️ |

Your total balance might increase by more than $1,400, and you could pay an additional $16 per month.

How does student loan forbearance work?

Forbearance is an option for borrowers who experience financial hardship. If you can’t make your student loan payments, call your provider and ask to apply for forbearance. Some lenders might ask for documentation proving your financial hardship, and your loans still accrue interest during forbearance.

Calculate your new payment

Before applying for forbearance, use our calculator to determine how much your loan balance will grow.

To give an example, here’s what your balance and payment might look like if you defer a $56,000 student loan with an 8% interest rate and a 10-year term:

| Description | Before | After |

| Loan amount | $56,000 | $57,000+ ⬆️ |

| Interest rate | 8% | 8% |

| Loan term | 10 years | 10 years |

| Monthly payment | $679 | $693 ⬆️ |

You might pay more than $1,000 in total for the deferment and an additional $14 per month when you resume payments.

Should you consider income-driven repayment vs. deferment or forbearance?

Before considering deferment or forbearance, first see whether you can convert your loan to an income-driven repayment plan (IDR). IDRs are student loan payment plans that base your payment on your monthly income.

In some cases, your payment can be $0 per month, and the government will forgive your remaining balance by the end of your repayment period, usually 20 or 25 years. However, you might owe income taxes on your forgiven amount.

Pros and cons of income-driven repayment

Pros

-

Payments are based on your income.

-

Certain types of loans qualify for an interest subsidy.

-

No impact on your credit score.

Cons

-

IDR plans can lengthen your loan term.

-

You must recertify your income each year, which involves paperwork.

-

The many types of IDR plans can complicate the process.

Can you get forbearance or deferment on student loans if your loans are in default?

If you don’t make your student loan payment for 270 days, your loan servicer can put your loans into default. Your servicer will report you to the credit bureaus, and it’s possible the government will garnish your wages.

Defaulting on a loan has many repercussions, including the inability to qualify for deferment or forbearance.

Options after a loan default

- Enroll in the Fresh Start program: The Fresh Start program is a temporary program that helps federal student loan borrowers in default. It offers collection relief and stops wage garnishment. Check to see whether your loans are eligible. The program ends on September 30, 2024.

- Debt settlement: Call your lender or collection agency and offer to pay the full amount you owe. Sometimes, you can even negotiate to pay less than that amount.

- Loan consolidation: You can consolidate your federal loans even if you’re in default. A Direct Consolidation Loan rolls your debt into a new loan. You can make payments on your new loan if you’re able or place your loans into deferment or forbearance.

Millions of borrowers use deferment and forbearance

Realizing you can’t pay your student loans is stressful. Calling your student loan provider to ask about your options might feel embarrassing, but being proactive is important.

Millions of federal student loan borrowers are in default or forbearance. Student loan servicers get calls every day about financial hardships. Putting your student loans in deferment or forbearance can help you get on your feet and increase your cash flow for a period of time.

Experiencing a hardship or life experience that leads a borrower to need to elect one of these options is a part of their overall financial plan—a pathway to achieving life and financial goals. Once you’re in a better financial condition, begin with a repayment plan of making the minimum payments, and try to make additional payments when experiencing excess cash-flow months or years. Don’t feel bad or discouraged if you need to use one of these options. Do what’s in your control, keep in communication with your lender, and make an action plan for when payments will begin again.

Importance of early communication

It’s far better to communicate early rather than risk defaulting on your student loans. Federal and most private lenders have options for borrowers who face financial hardships. Make the call and get relief if you need it. Deferment and forbearance aren’t permanent solutions but can be helpful to get you back on your feet.

About our contributors

-

Written by Catherine Collins

Written by Catherine CollinsCatherine Collins is a personal finance writer and author with more than 10 years of experience writing for top personal finance publications. As a mother to boy/girl twins, she is passionate about helping women and children learn about money and entrepreneurship. Cat is also the co-host of the Five Year You podcast.

-

Edited by Amanda Hankel

Edited by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.