If you’re considering debt relief, you’re likely wondering: Does debt relief hurt your credit score?

Yes. Debt relief typically lowers your credit score in the short term, often by 100 points or more. That drop happens because most programs involve missed payments and settling debts for less than you owe.

That said, for people facing overwhelming debt or possible bankruptcy, the long-term benefits can outweigh the temporary damage. This guide explains exactly how debt relief affects your credit, how long the impact lasts, and when choosing debt relief may still be the smartest financial move.

Table of Contents

Does debt relief hurt your credit score?

Yes, debt relief usually hurts your credit score in the short term. Most people see a temporary drop because debt relief programs often involve missed payments and settling debts for less than the full balance.

That said, the credit impact isn’t permanent. For borrowers who are already behind on payments or at risk of bankruptcy, debt relief can still be the most practical path forward. While your score may dip at first, many people are able to rebuild and improve their credit after completing a debt relief program, especially once their debt balances are significantly reduced.

The key is understanding why your score drops, how long the damage lasts, and when the trade-off makes sense.

Why debt relief lowers your credit score

Debt relief doesn’t directly lower your credit score on its own. Instead, it’s the steps involved in the process that affect how credit bureaus view your accounts.

Here’s how that happens.

1. Missed payments and delinquent accounts

Most debt relief programs require you to stop making payments to your creditors while negotiations are underway. Once payments are missed, creditors typically report those accounts as delinquent.

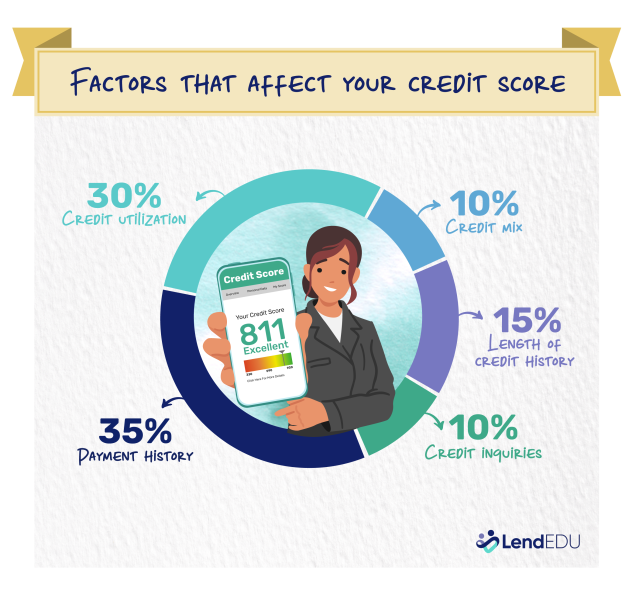

Payment history makes up 35% of your credit score, so missed payments can cause a sharp decline, especially if your credit was in good shape before enrolling. The longer an account goes unpaid, the more damage it can do.

2. Settled accounts vs. paid in full

When a debt is settled through a debt relief program, it’s usually marked as “settled” rather than “paid in full.” From a credit scoring perspective, this signals that the lender didn’t receive the full amount owed.

While settling a debt is better than leaving it unpaid or going to collections, it’s still viewed as a negative event and can weigh on your score until it ages off your credit report.

3. Changes to credit utilization

Credit utilization (the percentage of available credit you’re using) accounts for 30% of your credit score.

In the short term, your utilization can look worse if accounts are closed or credit limits are reduced. However, this is one area where debt relief can eventually help. As balances are settled and eliminated, your utilization ratio often plummets, which can help your credit score recover over time.

4. Account closures and credit age

Some debts resolved through debt relief end up being closed. When older accounts close, your average credit age can decrease, which affects about 15% of your credit score.

This impact is harder to reverse quickly, but it becomes less significant as your remaining open accounts age and you establish a consistent pattern of on-time payments.

How many points does debt relief lower your credit score?

There’s no exact number, but a drop of 100 to 200 points is common, especially early in the process.

How much your score falls depends on:

- Your starting credit score

- How many accounts are involved

- How long payments are missed

- How creditors report settlements

For example:

- Someone starting with a score in the low 700s may see their score dip into the 500s or low 600s during active settlement.

- If your credit score is already low due to missed payments, the impact may be less dramatic since much of the damage has already occurred.

In most cases, your score reaches its lowest point during the first several months and then stabilizes once debts begin settling.

How long does debt relief stay on your credit report?

Negative marks related to debt relief, such as missed payments, collections, or settled accounts, can stay on your credit report for up to seven years from the date of the first delinquency.

That doesn’t mean you’re “stuck” with bad credit for seven years. The impact of these marks fades over time, especially as you reduce your overall debt, make consistent on-time payments, and avoid new delinquencies

Many people see meaningful improvement well before those seven years are up.

Can your credit recover after debt relief?

Yes, credit recovery after debt relief is quite common.

Once you complete a debt relief program, several positive things typically happen:

- Your balances are lower or eliminated

- Your monthly obligations are more manageable

- You’re better positioned to pay bills on time

With consistent on-time payments and responsible credit use, many borrowers see improvement within 12 to 24 months after finishing their program. In some cases, people end up with higher credit scores than they had before starting debt relief, especially if debt was already spiraling out of control.

When debt relief is worth the credit score hit

Debt relief can make sense when the alternatives are to fall further behind or face bankruptcy.

If a client has short- to mid-term credit needs, like qualifying for a job or getting approved for a mortgage, I usually recommend waiting to pursue debt relief until those goals are met.

I also make sure they understand how long debt relief can affect their credit and what realistic steps they can take to rebuild. That said, I do recommend debt relief when someone is unexpectedly unemployed, has no emergency savings, and is facing serious risks such as bankruptcy, foreclosure, or eviction.

Erin Kinkade, CFP®

It may be worth considering if:

- Your debt payments are no longer affordable

- You’re already missing payments or relying on credit to survive

- You’ve exhausted options like budgeting, hardship programs, or direct negotiation

- Bankruptcy feels like a real possibility

If you have short-term goals that require strong credit, such as buying a home soon, it may be better to wait. But if your financial situation is unstable, protecting your long-term financial health often matters more than preserving your current credit score.

Our take: Before enrolling in a debt relief program, it’s worth exploring other options that may have less impact on your credit. Nonprofit debt consolidation or credit counseling (we’re big fans of ACCC’s approach to nonprofit counseling) can help lower interest rates if you’re still able to make payments. A debt consolidation loan may work if your credit is strong enough to qualify. You can also try negotiating hardship programs directly with creditors. If these options aren’t realistic, debt relief may still be the most practical path forward.

How to choose a reputable debt relief company

All debt relief programs can affect your credit, but the company you choose plays a major role in how manageable that process is.

At LendEDU, National Debt Relief is our top-rated debt relief company because it combines transparent pricing, strong customer support, and a long track record of successful debt settlements. Unlike many competitors, it clearly explains timelines, fees, and credit implications upfront, which helps borrowers avoid surprises during the process.

National Debt Relief consistently earns high marks for:

- Clear expectations around credit score impact

- Dedicated account managers and customer support

- A structured settlement process that prioritizes long-term financial recovery

While no debt relief company can prevent a temporary credit score drop, choosing a reputable provider like National Debt Relief can make the process smoother and help you rebuild faster once the program ends. Read our full review of National Debt Relief, and check out our picks for the best debt relief companies.

About our contributors

-

Written by Cassidy Horton, MBA

Written by Cassidy Horton, MBACassidy Horton is a finance writer passionate about helping people find financial freedom. With an MBA and a bachelor's in public relations, her work has been published more than 1,000 times online.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their pack of senior rescue dogs. She has edited and written personal finance content since 2015.

-

Reviewed by Erin Kinkade, CFP®

Reviewed by Erin Kinkade, CFP®Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.