Personal Finance

See our best personal finance blog content all in one place. Learn about making & saving money, managing debt, and more.

1. Manage Your Money

Money shapes your lifestyle, opportunities, and security. Learn the fundamentals of financial literacy.

Understand the latest trends in savings, debt, and investing with our in-depth financial reports.

We break down the most trusted financial institutions for banking, investing, and credit-building in our roundup of the best personal finance companies in 2025.

2. Manage Your Debt

Debt isn’t always bad, but without a plan, it can spiral out of control. You can take charge of your finances with proven strategies.

Even if you’re broke or just barely making ends meet, this step-by-step guide will help you regain financial stability.

Looking to simplify multiple debts? These are the top-rated options for consolidating loans.

Overwhelmed with debt and not sure where to start? A professional debt relief service may be the way to go.

If you’re not sure if debt relief is the right path forward for you, read more about how it works.

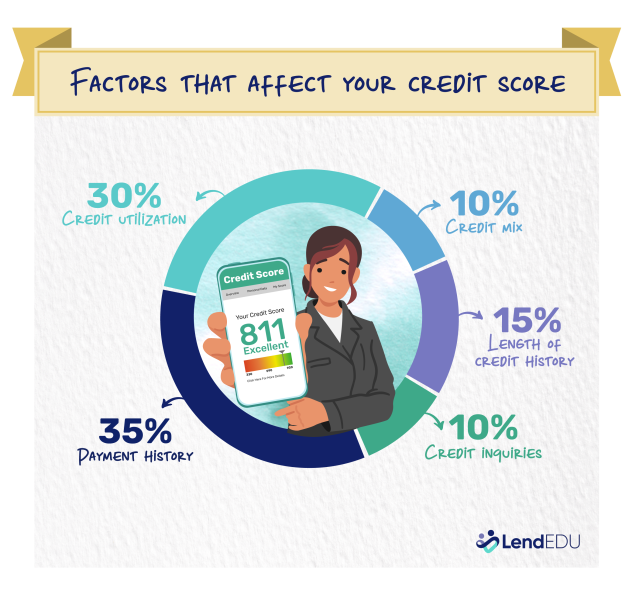

3. Improve Your Credit Score

A strong credit score opens doors to better financial opportunities. Learn how to boost yours.

4. Stay on Top of Your Taxes

Taxes can be complicated, but with the right strategy, you can reduce your liability and avoid issues with the IRS.

If you owe back taxes, we’ll walk you through the five options that can help you resolve your debt without expensive legal fees.

Here’s how to check if you have outstanding tax debt and what steps to take.

If you need professional help with tax debt, these companies offer tried-and-true solutions.

5. Invest and Grow Your Wealth

Investing helps grow your wealth over time. Whether you’re interested in stocks, gold, or real estate, find the right options for your financial goals.

Explore expert analysis on the stability of the U.S. dollar and what it means for investors.

Smart investors spread their risk. Here are the best ways to diversify and protect your investments.

Gold has been a reliable store of value for centuries. Learn how to add it to your portfolio.

All personal finance articles

-

Which States’ Residents Spend the Most on the Lottery & How Do States Spend Their Lottery Revenue?

LendEDU's fourth annual lottery spending report analyzed the most recent U.S. Census data to see what the average American is spending on the lottery, which states spend the most, and…

-

Is Community Tax Legit? 2026 Review of Services, Costs, and Results

Taxes can be complicated, and many people have found themselves in debt to the IRS. Community Tax can help people settle their debts or set up payment plans, reducing their…

-

Anthem Tax Services Review 2026: Costs, Relief Options, and Is It Legit?

Tax debt can be difficult to handle, especially if the IRS is using things like wage garnishment to collect. Anthem Tax Services can help you avoid aggressive collection actions and…

-

Tax Hardship Center Review 2026: Services, Costs, and Complaints

If you're dealing with tax-debt related problems, Tax Hardship Center may be able to help.

-

The Most Budget-Friendly Cities For Renters

LendEDU analyzed the median income and average rent for more than 25,000 U.S. cities to find the most budget-friendly places in the country for renters.

-

How Much Interest Would You Earn on a Million Dollars?

“If only I had a million dollars in the bank.” Who hasn’t pondered that at one time or another? But have you ever wondered how much interest one million dollars…

-

The 50 Best College Financial Literacy Programs for 2020

For the fourth consecutive year, LendEDU has recognized 50 colleges around the country that have the best financial literacy programs for students.

-

These Cities Have the Highest Proportions of College Graduates

LendEDU crunched the data on more than 25,000 U.S. cities to recognize the places that have the highest proportions of residents with bachelor's degrees.

-

Coronavirus’ Impact on College: Nearly Half of Undecided High School Seniors Considering Online Degree or Gap Year

LendEDU surveyed 1,000 current high school seniors and college students and found that 30% of committed high school seniors will consider not enrolling or deferring their admission if learning stays…

-

Coronavirus Survey Round 3: Expenses Keep Climbing But 26% Still Waiting on Stimulus Checks

Since mid-March, LendEDU has been tracking how the coronavirus is impacting personal finances. Our third survey found that retirement concerns have lessened as the market has rebounded and that it…