Home Equity

Compare our top picks for the best home equity loans & HELOCS and learn more about how home equity works & how you can use it.

Ways to access the equity in your home

If you have sufficient equity in your home, you can use it to access cash. Your home acts as collateral for these loans or agreements.

- How to Take Equity Out of Your Home

- Best Home Equity Loans

- Best Home Equity Lines of Credit

- Best Home Equity Agreements

- Best Home Sale-Leasebacks

Home equity reviews

Several companies allow you to access the equity in your home. Before moving forward with any company, it’s important that you review what it offers to ensure it offers you the best terms.

- Figure HELOC Review

- Hometap Review

- Spring EQ Home Equity Loan Review

- Point Home Equity Review

- Unison Home Equity Review

- EasyKnock Home Equity Review

- List of Home Equity Companies

Other home equity resources

All home equity articles

-

What Is the Best Way to Pay Off a HELOC?

A home equity line of credit, or HELOC, is a flexible tool that allows you to borrow against your home’s equity. But if you have a balance, paying it off…

-

CELOCs Explained: The Smart Way to Tap Commercial Property Equity

A commercial equity line of credit (CELOC) allows business owners and property investors to tap into the equity of their commercial real estate. While traditional HELOCs for residential properties are…

-

Can You Get a HELOC on a Co-op? How It Works and Your Best Options

Getting a HELOC as a co-op owner may seem challenging, but it’s entirely possible with the right approach. By borrowing against the value of your co-op shares, you can access…

-

Best HELOCs for Home Repairs With Fast Funding in 2026

Nothing is as stressful as an unexpected home repair. Whether it’s a broken HVAC system, flooded basement, or mold remediation, you often need to make home repairs fast for the…

-

Complete Guide to All-in-One HELOCs: Benefits, Drawbacks, and Alternatives

An all-in-one HELOC is a unique financial product that combines a home equity line of credit with a checking account. Instead of managing separate accounts, you can use one account…

-

Best HELOCs for Excellent Credit

If your FICO score is between 740 and 850, give yourself a pat on the back: You have excellent credit. This tells lenders you manage your money—and your debts—responsibly. Because…

-

Best HELOCs and Home Equity Loans for Veterans: Top Lenders and Rates in 2026

Accessing your home equity can be an effective way for veterans to fund home improvements, consolidate debt, or cover major expenses. The Department of Veterans Affairs (VA) doesn’t offer HELOCs…

-

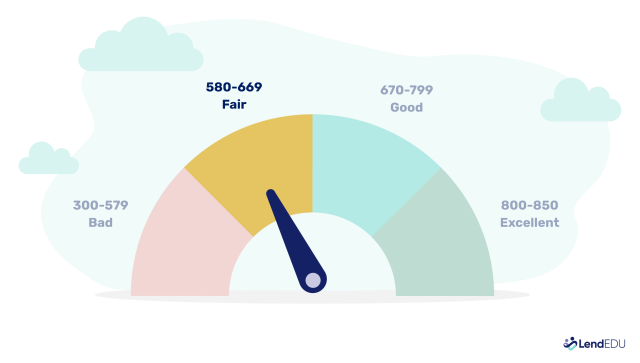

580 – 669 Credit Score? Here Are the Best HELOCs for Fair Credit

We’ve observed that, despite having minimum credit scores around 640 to 680, HELOC lenders very rarely approve fair credit applications. They mainly approve applications with scores of 720+. If you…

-

Best Online HELOC Lenders

Home equity lines of credit (HELOCs) aren’t just available through traditional banks and credit unions. With the rise of online lenders comes online HELOCs—and added convenience and efficiency. Online HELOCs…

-

Newfi EquityChoice: Mortgage-Based Home Equity Agreement With Clear Terms

This Newfi review explores the EquityChoice home equity agreement, a unique financing option for homeowners looking to access their equity without taking on monthly payments. Unlike traditional loans, EquityChoice is…